Dogecoin Futures Set Record After Twitter Adopts Shiba Inu Logo

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Dogecoin’s derivatives market have become busier than ever as prices rose sharply following Twitter’s decision to replace its popular blue bird logo with a picture of a Shiba Inu dog earlier this week.

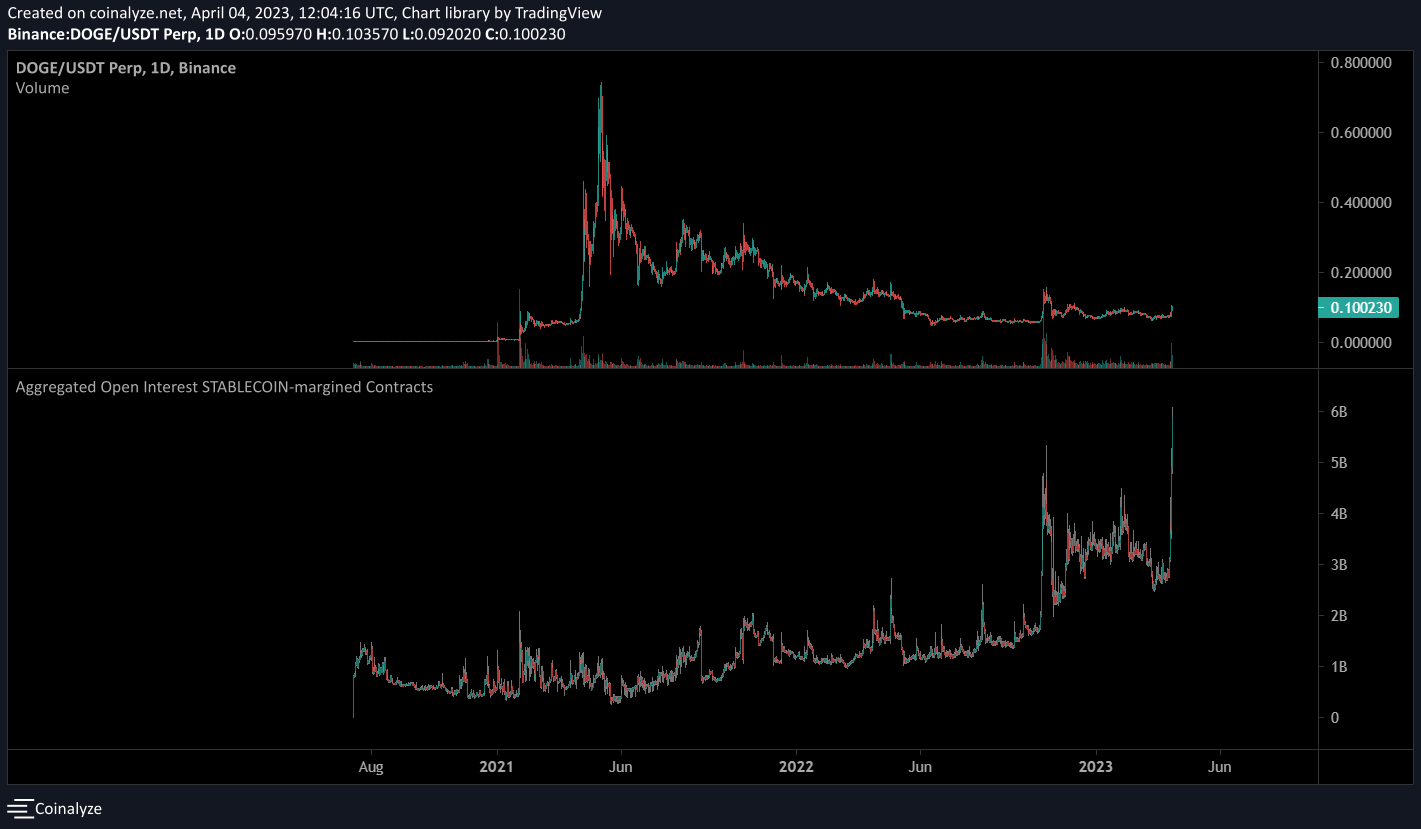

Open interest (OI) in stablecoin-margined dogecoin (DOGE) futures contracts surged to nearly 6 billion DOGE tokens as of Tuesday night, data from Coinanlyze shows, setting a record lifetime peak. This represents $600 million worth of dogecoin in unsettled futures positions as of Wednesday.

The previous peak for stablecoin-margined contracts was five billion DOGE tokens in November 2021, valued at over $1 billion at the time. Stablecoin-margined contracts are settled in tokens such as tether (USDT).

Meanwhile, coin-margined contracts on dogecoin – which settled in other assets, such as bitcoin, instead of stablecoins – saw over $55 million in total open interest as of Wednesday.

Stablecoin or fiat-margined futures offer linear payoff as the value of the collateral remains steady irrespective of the broader market trend. Meanwhile, coin-margined contracts offer a non-linear payoff and are more prone to liquidations, as the trader takes a loss on both the collateral and futures contract when the market goes against his/her bet.

Thus, stablecoin-margined contracts are better suited to risk averse traders and for hedging while coin-margined contracts are preferred by aggressive traders, particularly during bull runs.

Stablecoin-margined contracts on dogecoin have set record highs. (Coinalyze)

What does OI really mean?

OI refers to the number of unsettled contracts, or the net amount of positions opened by traders, on financial derivatives that track an underlying asset. This can be used to determine market strength behind a recent price trend – suggesting market volatility ahead instead of prices remaining flat.

Data shows funding rates, or a fee paid by leverage traders to remain in a futures position, is an average of +0.01% on cryptocurrency exchange Binance, which has the highest open interest among counterparts, and a similar fee on Bybit. Rates on OKX are fluctuating between -0.04% and +0.02%. Positive rates imply leverage is skewed on the bullish side.

Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets. Depending on their open positions, traders will either pay or receive funding. The payments ensure there are always participants on both sides of the trade.

Participants utilize sophisticated strategies to collect funding rates while hedging losses due to token movements.

Meanwhile, Coinalyze analysts told CoinDesk that current open interest levels suggested high amounts of leveraged bets on dogecoin.

“Very likely we will see even more liquidators,” the firm said, suggesting the dogecoin market could see steep volatility in the short term.

As such, some say the current move is unlikely to be sustained.

“Memecoin pumps may generally suggest bullishness amongst retailers. However, this is not indicative of a long-term trend as we can see by the huge DOGE spike of 2021 and the massive slump soon afterward,” François Cluzeau, Head of Trading at Flowdesk, told CoinDesk in a Telegram message.

“Bitcoin’s stable upwards momentum also correlates with this. There is a certain trickle-down effect that follows the no. 1 cryptocurrency. This is also in part because many leverage their memecoin bets with bitcoin,” Cluzeau added.

Edited by Oliver Knight and Omkar Godbole.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.