DOGE Clones Like SHIB Attracting ‘Dumb Money’ is Why Bitcoin Goes Down: Analyst

Despite Bitcoin’s strong fundamentals, its price has been struggling for weeks. A popular crypto analyst argued that this might be because of the ongoing craze around meme coins, which are seeing massive inflows of fresh funds.

However, he believes the trend could be changing soon, and tokens with actual intrinsic value, like BTC, will resume their bull runs.

Where Are the Attention and Money Going in Now?

Although it started as a joke eight years ago, Dogecoin took center stage in 2021 and hasn’t vacated its spot yet. The craze that started with Elon Musk and was supported by names like Mark Cuban and Snoop Dogg attracted the masses, and it became arguably the most widely discussed topic in and outside the crypto community.

Somewhat expectedly, others wanted to take advantage of the ongoing mania, and numerous copycats emerged. Coins that seemingly have no value or product, despite advertising future services, garner people’s attention due to massive fluctuations and promises for multi-digit returns.

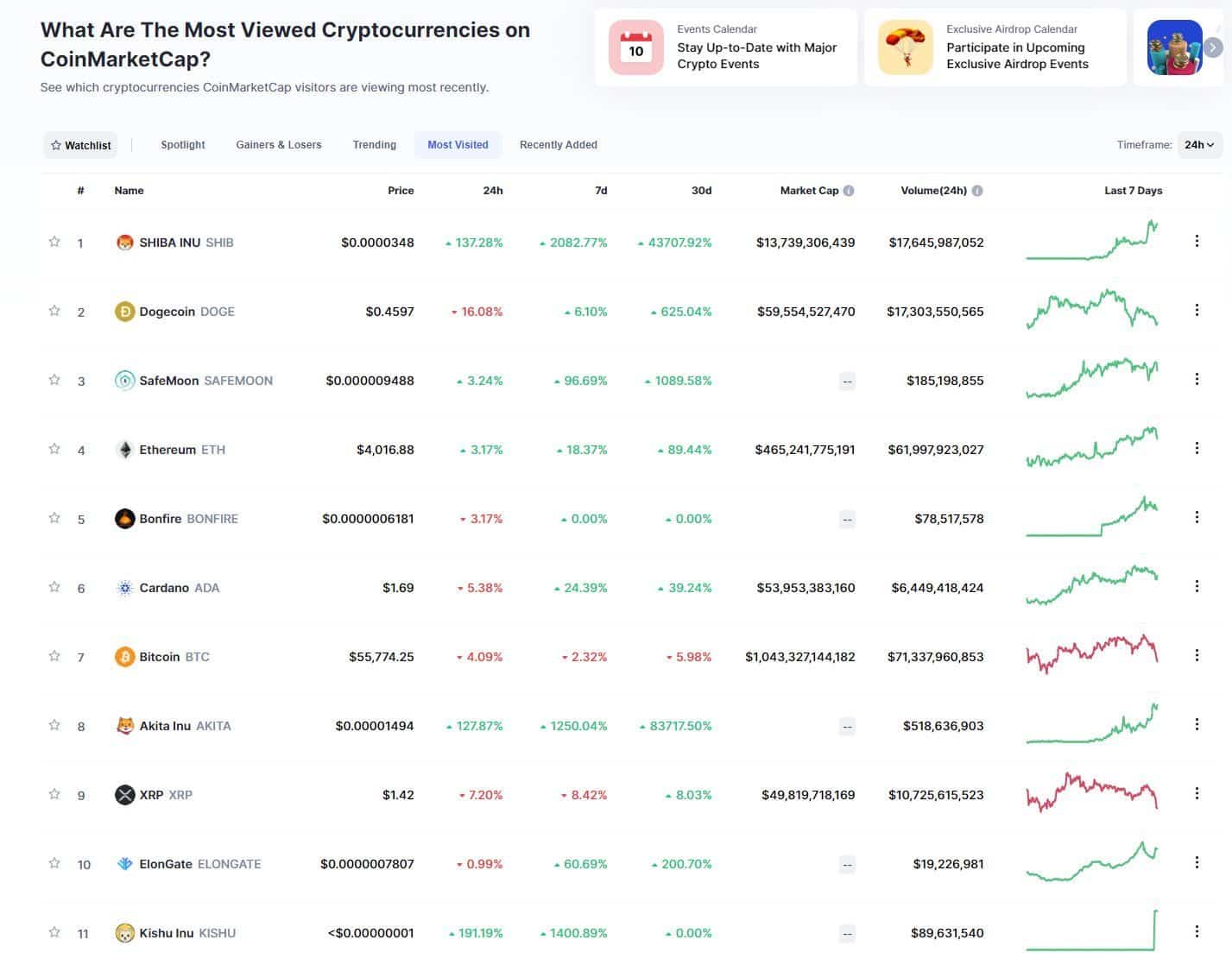

Yet, the formula is working as quite of few of them have skyrocketed lately. The most recent example is a token called Shiba Inu (SHIB) which is up tenfold in the past few days alone.

This further enhances the snowball effect, and some of them became the most searched and viewed digital assets.

Apart from the mind-blowing returns, the following chart from CoinMarketCap confirms this.

Smart Money to Go in Bitcoin Soon

In light of the apparent trend showing which are the hottest cryptocurrencies in the market now, CryptoQuant’s CEO argued that this is the primary reason why bitcoin’s price has been struggling.

He believes that the asset’s fundamentals are still “strong,” and on-chain data support this narrative. As reported before, institutional investors continue accumulating, miners refuse to sell, smaller hodlers withdraw their coins from exchanges, etc.

The hash rate also recovered after the mid-April brief declines and is back at record-high levels as well.

However, the asset’s price has struggled in the past month. After registering an ATH at $65,000, bitcoin slid hard and even dipped below $50,000 for a few days. Despite bouncing off, it has failed to overcome $60,000 and currently trades about $10,000 from its ATH.

At the same time, many altcoins see frequent new records, including the aforementioned massive surges by the meme coins. Nevertheless, CryptoQuant’s CEO, Ki Young Ju, believes that this trend is about to change soon.

“The market will become smart money soon, and the funds will go to major coins that have intrinsic value.” – he concluded.