Does Technical Analysis (TA) Work For Bitcoin & Crypto Price Forecasting?

Many individuals in the cryptocurrency trading and investing space often utilize technical analysis (TA) in one form or another. But does technical analysis (TA) truely work in crypto?

Technical analysis (TA) can be used for a multitude of applications. An investor might simply use TA to check price’s location relative to its history, while more in-depth traders might look to the charts to develop trading systems, for example.

Questioning whether or not TA works in crypto, on the whole, is a difficult one to answer. Trading and investing, via TA, significantly depends on who is applying it, as well as their goals. What might work for one person, may not work for the next due to individual biases, interpretations, tendencies, targets, etc.

TA – For Determining Probabilities

Distinguishing TA from trading, Crypto Nerd on Reddit said:

“Technical analysis is about determining probabilities. Trading is about implementing that analysis within a wider, more dynamic set of rules (trading plan) in order to reliability and consistently extract profit from a market.”

In this video referencing some of his chart work and an associated tweet, popular crypto YouTuber Sunny Decree said, “Yes, I do believe that technical analysis does work. It cannot tell you exactly when and how high or how low the price goes, but, it can definitely increase the probability for a good trade.”

In a general sense, utilizing charts can be broadly useful in looking at an asset’s history, allowing the spectator to gauge if the price is relatively high or low, thus, adding information for more well-rounded trading or investing decision.

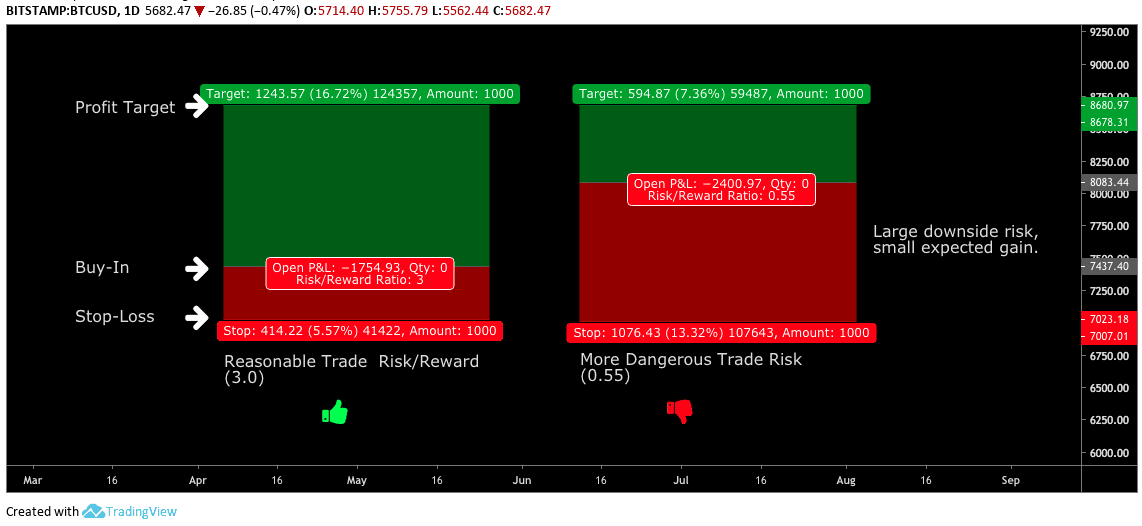

TA in crypto can be useful for risk management, giving a visual representation of what levels might be appropriate to reach for in a trade, as well as what percentage of loss any given trade can withstand, comparative to the desirable payout. If a trade has too much downside risk without enough potential gain, the trade may not be a strong one from a risk management perspective.

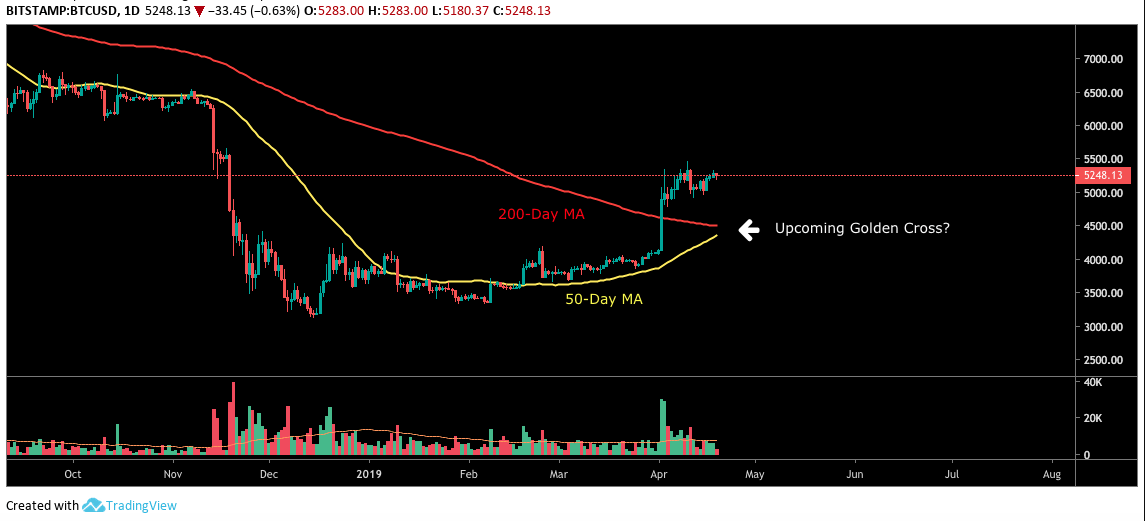

Many traders also use TA in the crypto space to make specific trade decisions, looking to the charts for an idea on where the Bitcoin price might lead, as well as current or future price trends. Technical analysis can be important in the crypto world as the space, in general, does not have as many factors driving price, as do traditional markets.

Things Happen a Lot Faster in Crypto

Traditional market stocks, for example, can see trading based on fundamental analysis, such as price movement in relation to dividends, earnings reports, and other data. Crypto, in many regards, is not quite at that stage yet, possibly requiring a heavier emphasis on technical analysis by itself.

In a December 14, 2017, Twitter post, John Bollinger, technical analyst and creator of the Bollinger Bands indicator, said crypto markets move more quickly than traditional markets. “It is not that technical analysis doesn’t work in crypto-currencies; it is that things happen faster,” he said.

In response, Twitter user Dr. Cryptohead tweeted an opinion that crypto markets operate too much on emotion for TA to be effective.

“TA is useless in a greed/fear//FOMO/FUD controlled market that just opened the door to mass adoption, and it’s going exponential. Try again when we hit 10 trillion,” the user tweeted. Alternatively, Bollinger then noted, “The market conditions you describe are perfect conditions for TA. The literature is full of examples.”

Bollinger has a long history and a vast amount of experience in traditional markets and technical analysis. It would make sense that Bollinger knows the markets and technical analysis well, having enough expertise to fuel such a comment.

Additionally, technical analysis success and effectiveness can depend on where the market sits on the whole, as TheChartGuys explained in a July 2018 tweet.

#Crypto The current market does not favor technical analysis and trading. It is possible but more difficult. Only the bears are getting by with some consistency. BUT this market cycle will pass, just a question of when. In the last 14 months we have seen 3 cycles…

— TheChartGuys (@ChartGuys) July 12, 2018

The post Does Technical Analysis (TA) Work For Bitcoin & Crypto Price Forecasting? appeared first on CryptoPotato.