DLT Platform Hedera Hashgraph Raises $100 Million

Decentralized ledger startup Hedera Hashgraph has raised $100 million to build out its platform and launch its network, the firm said Wednesday.

Related Posts

The Protocol: Restaking Tokens Are Exploding, and Restaking Isn’t Even Live

Those of us who follow the blockchain space closely know how quickly things can change, including hot stories like this week's not-so-smooth airdrop of the new STRK tokens from the Ethereum layer-2 network Starknet.But occasionally a big trend comes along. That seems to be happening now, with "liquid restaking protocols" and their "liquid restaking tokens"

Chinese Insurance Giant Ping An’s Blockchain Arm Reveals Terms for $468M IPO

Dec 4, 2019 at 14:45 UTCUpdated Dec 4, 2019 at 14:46 UTCChinese Insurance Giant Ping An’s Blockchain Arm Reveals Terms for $468M IPOOneConnect Financial Technology, the blockchain and AI subsidiary of China’s top insurance company Ping An Insurance, has set the terms for its previously announced initial public offering (IPO).According to an updated F-1 filing…

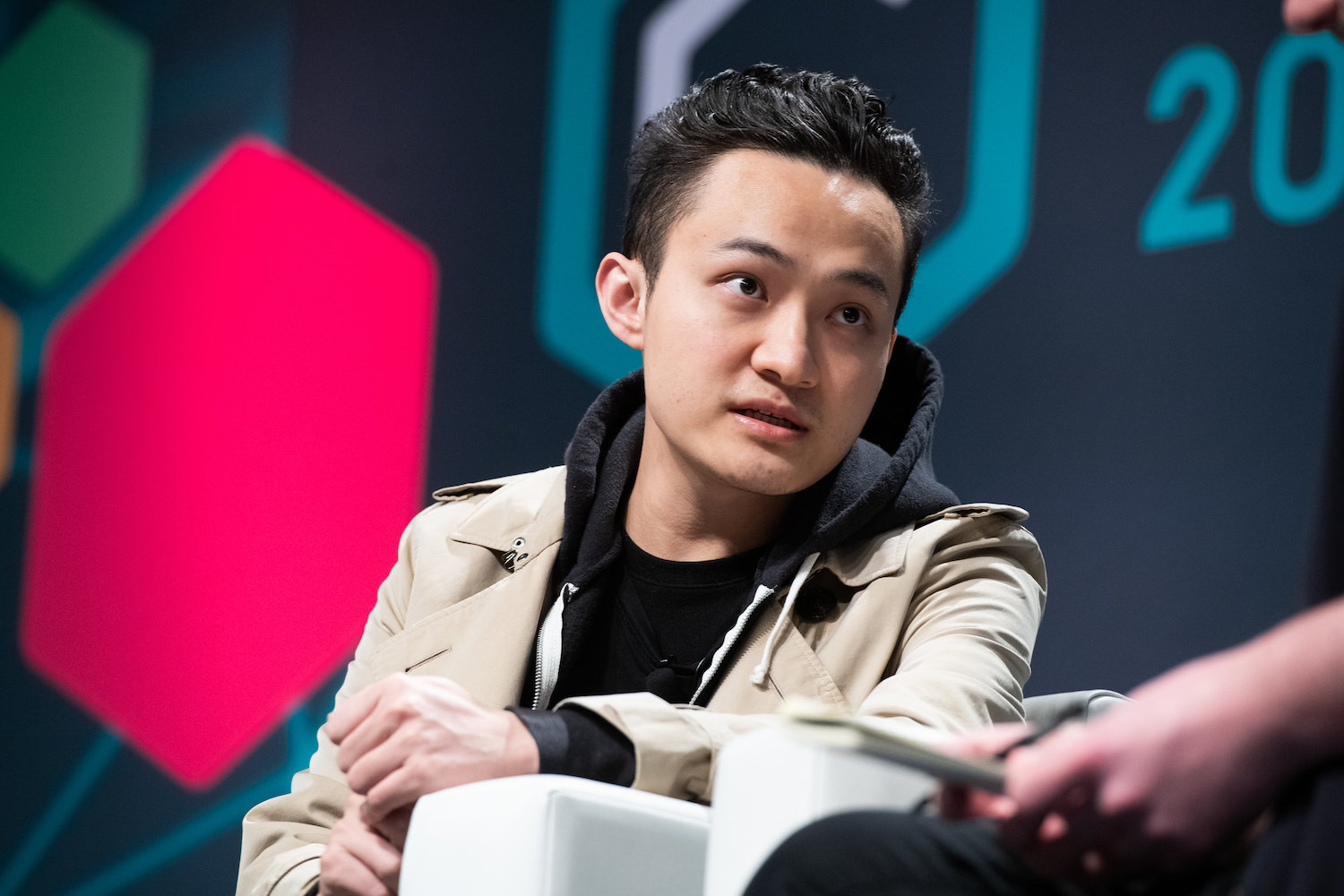

Tron Arbitration Challenged in Hostile Work Environment Lawsuit

Jul 9, 2020 at 17:56 UTCUpdated Jul 9, 2020 at 18:50 UTCJustin Sun (CoinDesk archives)Two technology developers are trying to keep their workplace harassment lawsuit against the Tron Foundation on the path to trial. A legal challenge is calling on a court to overturn an order allowing the central organization developing the Tron cryptocurrency to…

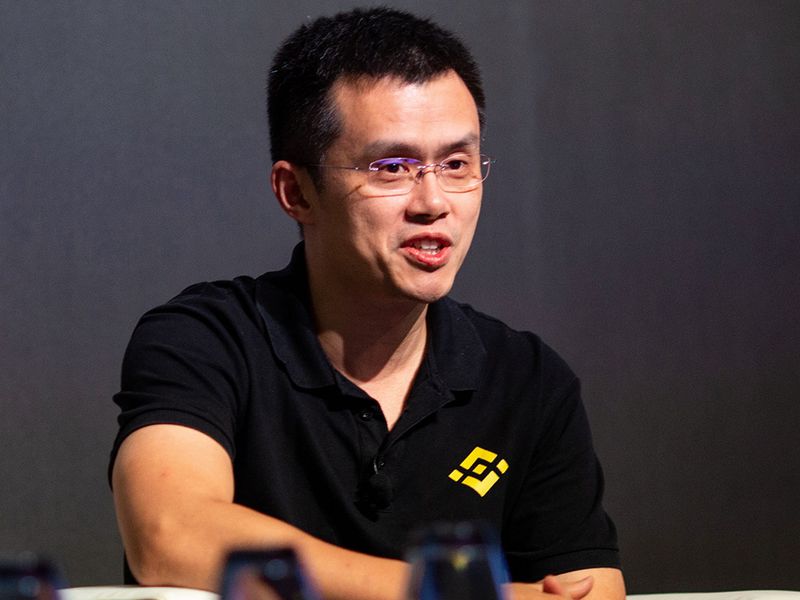

Can Binance Survive the SEC’s Charges?

After news broke that the U.S. Securities and Exchange Commission (SEC) is suing Binance, the Chief Executive of the world’s largest crypto exchange, Changpeng Zhao (aka CZ), took to a familiar strategy: tweeting. CZ’s first Twitter communiqué was just the number “4,” posted around the same time SEC Chair Gary Gensler was likely cleaning up…

Hydrogen Technology Execs Jailed for HYDRO Price Manipulation

Hydrogen Technology executives Michael Kane and Shane Hampton were jailed for fraud and securities manipulation. For the first time, a jury in a federal criminal trial found that a cryptocurrency was a security and that manipulating cryptocurrency prices was securities fraud, the U.S. DOJ said. Two Hydrogen Technology executives were sentenced to jail for defrauding

Crypto Markets ‘Highly Dependent’ on Stablecoins Lacking Transparency, TUSD Poses Risk: Kaiko

Centralized stablecoins dominate cryptocurrency trading, but recent turbulence has showcased that markets heavily rely on stablecoins that lack transparency of their reserves with TrueUSD posing the biggest risk, digital asset market research firm Kaiko said in a report.As of Thursday, 74% of all transactions on centralized crypto exchanges involved stablecoins, while only 23% incorporated fiat…

First Mover Americas: Bitcoin Extends Decline for a Fifth Day, Touches $26.6K

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.Latest PricesTop StoriesBitcoin extended its losing run to a fifth consecutive day, dropping below $27,000. The cryptocurrency fell 2% on Thursday to around $26,600 after starting to drop

New York State Sees First Conviction for Crypto Money Laundering

news A case involving millions of dollars in bitcoin and Western Union payments has resulted in New York State’s first conviction for cryptocurrency money laundering. The Manhattan District Attorney’s Office announced Wednesday that defendants Callaway Crain and Mark Sanchez, both 35, laundered $2.8 million earned through sales of controlled substances carried out over the internet. Between…