Discussing The Bitcoin Energy Revolution

A group of Bitcoin experts come together to explore the energy revolution that is being ushered in by the Bitcoin standard.

Watch This Episode on YouTube

Listen To This Episode:

- Spotify

- Apple

- Libsyn

- Overcast

But they put out this duck curve grid that was a snapshot of a spring day in California and it is a direct correlation of solar energy being produced during a sunny day and then in line with the demand of energy for offices and homes. This sort of concept was when energy is really cheap and solar is making really cheap energy, the demand is actually much lower for energy during the day, a lot of people are at the offices, there’s no need to have lights on. They use a spring day, in particular, to show more of an extreme variant between the day and the night, because there’s no need for air conditioning or no need for heat.

As you can see, as the sun comes up, and as tons of cheap energy comes and flows to the grid, there’s not much of a demand. But unfortunately, right around like, six, five o’clock, five o’clock, six o’clock, seven o’clock, everyone drives home, they turn on their lights, they turn on their television sets, they turn on their computers, maybe they turn on their heat, but we see this huge ramp-up of demand, the actual like the neck of the duck curve. As soon as I kind of stop introducing this, I’ll put some tweets in the nest that has the duck curve picture on it, so we can all see it.

But we see this big ramp up that’s like the duck’s neck. Basically, we have to ramp up coal usage to meet the demand of everyone coming home and turning on their lights. Right as solar becomes ineffective and stops producing really cheap energy is right when we’re met with an increased demand for energy. I was sort of wanting to use, literally, California government-provided data to sort of write a thesis of how Bitcoin can sort of mediate the dynamic discrepancies of demand and energy production and actually caused deflationary technological price effects to be given to the consumers of the energy grid.

Using Bitcoin as the buyer and seller of energy of last resort, we can sort of take these moments of low demand, we can extend the energy grid, extend the solar grid, and use that cheap energy and if it’s not in high demand, we can use that to mine Bitcoin and monetize this energy that would be just wasted. Not wasted, energy can’t really be wasted, it’s another part of the article that’s sort of really banging down the idea of the law of thermodynamics and this concept of renewable and wasted energy is that they’re kind of both just misnomers.

But stranded energy, not captured energy. But we can use Bitcoin as a buyer of this stranded energy during the day when demand is lower, and we can monetize it and when the grid and when people at home start to turn on their things in demand more energy, we can turn off the Bitcoin miners and we can send that energy relatively quickly, like much faster than you would be able to traditionally turn off stranded energy monetization processing, such as like aluminum.

Aluminum is one of the bigger components of the energy market because it’s something like 80 plus percent of the cost of processing aluminum is the electrical cost of processing it. But there’s a lot of like very real sunken costs there. You need a staff, you need a building, you need lights, you can’t just turn it off and send people home. Aluminum processing plant, if the demand goes up on the grid, whereas a Bitcoin miner, you can power it down relatively quickly. Obviously, depending on what level you’re doing and how much your wattage is, I mean, it’s not necessarily as simple as just turning off a switch. But it’s much, much easier than any other technology that we have.

[5:38] CK: Mark. [5:39] Mark: Yes? [5:40] CK: Yes, I was going to say that I think this is a good part to place to jump in. I think that’s a really, really good primer and I am now ready to co-host this bad boy with you. Thank you so much for your patience and for buying me some time. [5:53] Mark: I’m happy to stall, CK, always, I’m going to send some tweets and stuff to you so feel free. [5:59] CK: You not only stalled, but you actually just started, that was fantastic. I do want to do a little bit of housekeeping. I want to tell all the Bitcoiners in the audience about Bitcoin Black Friday, which starts tomorrow, I got that tweet pinned to the nest, so you can check that out. We have a lot of awesome, kind of exclusive opportunities to buy really cool activations with Bitcoin and support a great cause, which is the Built with Bitcoin effort that Paxful and Ray Youssef have started. Taking Bitcoin and using that Bitcoin to build schools.We are currently working with them to build schools in El Salvador, bitcoinblackfriday.com, check it out, all for a great cause. Great opportunities to get some really cool collectibles and activations and gear there and also support the Built with Bitcoin Foundation. Get your Bitcoin Magazine. The print edition is here, the new El Salvador Edition is absolutely beautiful, so get your annual subscription to the next four, including the El Salvador Edition, a beautiful collectible. Then lastly, if you’re a beginner, we have a Bitcoin 101 course, that is called “21 Days,” check that out. All of those are pinned to the top.

Lastly, on the top pinned is the article from Mark Goodwin, which is absolutely fantastic. He just kind of described the basic idea here, I want to start teasing out some of these ideas because I think a lot of people in the “crypto,” as well as like in the no coiner world, the fiat world think that more energy usage equals bad, and that “proof of work” is this thing that we need to continue to innovate beyond.

Personally, I think that could not be further from the truth. I think a lot of these people have an inherent bearish position on Bitcoin because of that kind of a misconception. How would you kind of address that perspective? That like proof of work is something that is wasteful and that we have to go beyond that, we have to find a way to come up with distributed consensus without proof of work?

[8:25] Mark: Well, I mean, yes, there’s a lot there. It’s a very near and dear concept for me because we don’t have another solution to the Byzantine General’s problem. The idea of how can we send truth in a decentralized system? How can we send out immutable truth that can be validated by everyone in a distributed system without any leaders?It’s a really hard thing to do. It’s a computer science problem. Like at its core, it literally is sort of a scientific problem. This idea of this argument about proof of work being a waste, first off, again, thermodynamics, no energy is wasted, it’s not possible.

You could have a bias about the usage of the energy being not as prudent as other usages, but you can’t waste energy. That’s also part of the misnomer of renewable, right? It’s like there isn’t renewable energy. There’s cheap stranded energy and naturally occurring energy that can be captured, but there isn’t renewable, right? I mean, nothing is renewable in the grand scheme of this energy equation, right?

If we look at proof of work as solving this computer science problem, there’s really no other solution to it. Proof of stake is not a solution to the Byzantine General’s problem at all. I would actually argue that every proof of stake system wastes more energy than proof of work. Because it’s not solving those things. It’s pretending to. It’s saying that it’s decentralized, it’s saying that it’s doing this, but it’s really not. The core reason why it’s not, it’s because of a function in proof of work that is the universal forgetful function of block discovery.

That is not how proof of stake works. Proof of stake works by you getting a certain amount of shares based on the stake that you own and there’s a random lottery that’s based on a centralized clock, and it randomly distributes authority to people, and they’re able to choose, invalidate transactions. It’s not solving any of these problems, it’s not solving the Byzantine General’s problem.

Proof of stake is arguably much more so a waste of energy than proof of work. It’s a really, really big deal to create a decentralized, immutable, digitally scarce bear asset, I mean, it’s a really important tool for humanity to have sound money, and to be able to make transactions and know that it’s beyond just speech being protected by the Bill of Rights. It’s literally being enforced technologically and cryptographically. It’s a really big deal, and there’s no energy that’s being wasted that’s being put into the Bitcoin system. It’s all just additional security.

Again, another problem with proof of stake is that they’ve removed token issuance and governance from the token distribution. It’s sort of a fallacy of a decentralized system of like being sound money that we remove the mining process and the token distribution process from the governance and the security process. I think–

[12:23] CK: The incentives there, especially with Ethereum, do seem wonky, right? [12:29] Mark: Yes. [12:30] CK: We pre-mined 70% then we fair mined and distributed 30%. Now, we can turn off distribution and the system is great. [12:39] Mark: It’s ridiculous. [12:40] CK: Yes. [12:40] Mark: Yes, and over time, right? It compounds governance, not only wealth. Like, obviously, the foundation is getting wealthier with staking or whatever or will get wealthier. But also the stake is related to the governance. Over time, there’s actually a compounding governance stake that’s gaining for these quintillionaires that started this thing. I really don’t necessarily have a comment on whether or not they’re good-faith actors or not, it doesn’t really matter to me. But the incentives of the protocol are incentivizing you to get more weight and you get more chances to win this validation lottery to solve the digital double spend, which is digital scarcity is completely meaningless without solving the digital double spend. [13:33] CK: I want to jump in here, Mark. I found that really interesting that you kind of went straight for proof of stake, because I kind of would go more for, if I were to like steel man disposition, I would say, “Hey, all the proof of stakers, they actually have the underlying problem and completely incorrect.” They think that “Oh, we need to use less energy to save the planet.” But the reality is that our energy infrastructure is under attack and our energy infrastructure is extremely inefficient and centrally planned. That the only way to solve that is with a distributed proof of work system to one, fortify energy production, and two, to incentivize the build-up of a distributed and market-based energy grid.If we do not do that, one, we’re going to be poor with no energy because of centralized planners, but two, we will destroy the planet because of the massive misallocation of resources and pretty much everything the Fiat standard has brought us. Like the proof of stakers, like they’re not coming to at-first principles, and they’re not looking at the real problem, which is that our energy infrastructure is absolutely and utterly fucked. That’s what your article kind of talks about is like, there’s this duck curve where we can produce the right amount of energy at the right time with the right resources and put in Bitcoin, and that really flattens out the curve and makes it a lot more sustainable, dependable, and predictable.

[15:07] Mark: Yes, perfect. Totally. I hate to give more talking time to proof of stake than necessary. But I think it’s important just to talk about exactly to give a base layer of the difference of what Bitcoin incentivizes. It’s monetizing energy and allowing citizens of the world like us to store our life essence in an energy remittance market that’s actually a free market. That’s never happened before.Citizens aren’t able to monetize unless you were a Rockefeller at the start of the country or whatever and you found oil and bought it up or whatever, it’s really hard for citizens to monetize energy and to be able to participate in the global energy market. In fact, something that I talked about a lot in the article is the subsidization of inefficient energy by governments to sort of perpetuate this profit guarantee in this sort of energy… Yes, it’s kind of a racket.

There’s a lot of talking in the Bitcoin space about a lot of the ESG stuff. I think fossil fuels are incredibly important, and oil and coal are incredibly important, and we’re going to need them to be able to get to a truly next level, very, very modern energy grid, but we’re just not there yet. In order to get there, we need to invest in batteries, better lines, then solar technology, and then in nuclear capacity. There are so many things that we can do to increase the utility-scale of our power grid.

Because it’s not a free market, the winners and losers aren’t being appropriately divvied up. We’re having a lot of inefficient, like what you said, just a lot of inefficient energy grid providers that are continuing to carry on because the government subsidizes. Whereas if we let the free market work, we will hopefully see the deflationary effects, and the price decreases of energy with a fair kilowatt per hour price go and be distributed amongst everybody.

We should see really, really cheap energy if we monetize it right and create a free market for it. We’re seeing so much stuff right now, strategically releasing oil reserves, and then we’re seeing other countries like seeing us release three days worth of oil or whatever, and then they’re “Okay, well, we’re going to stop production and we’re gonna ramp down.”

Like, we’re seeing this game theory of this market kind of play out in between nation-states, and the people that are energy independent, and the people that are energy-dependent, that’s going to be the conflict moving forward and we’re seeing it in so many ways, whether it’s pipelines being shut down or the petrodollar system, and us kind of removing some of our military presence in the Middle East.

We’re seeing it everywhere. It’s definitely an important tool and I think, honestly, sort of the way that we are sort of boxed in and controlled by some of our leaders. I think a free market for energy is really only possible if we fairly monetize energy and I think Bitcoin is the best chance that we have, and it is doing it. I’m really excited to see even like, well within sort of like the Californian energy grid data, there’s an absolute mathematical thesis for how Bitcoin is in fact not going to be perpetuating a waste of energy. But is in fact going to be efficiently utilizing every watt of energy, whether it be for Bitcoin mining or made available to go to the grid when the time comes.

Proof of work is so misunderstood and the idea that any type of calculations that are made to show how much energy is being used per transaction is really disingenuous. Energy is used to secure the network, and we have layer twos. We have lightning that can scale infinite transactions on top of two transactions on the mainchain.

[20:01] CK: 100%. I think the proof of stake argument, again, is it’s not rooted in what’s the first principle’s problem. Then like the waste of energy argument, it just doesn’t. Like if you put into context of anything, it doesn’t make sense, it starts to fall apart. Actually, yesterday night, we’re supposed to go live with Hass McCook, he actually had to cancel last minute, but we’re going to bring it back on, I believe, Saturday night. He is one of the best people at comparing Bitcoin energy usage to stuff and putting it into context.We have Justin, Mike, and Troy on stage, I invite you guys to come up. Feel free to jump in with your thoughts on this conversation. Again, we are discussing Mark’s awesome article about “Forget the Bears, Bitcoin Takes on the Duck Curve.” Really, it’s about how Bitcoin is this energy revolution and something that’s, I don’t think it’s pressing quite yet.

[21:04] Mark: No, definitely not. I want to give a lot of credit to, I went to the Texas Blockchain Summit in Austin. Hearing so many of the miners talk about what they’re doing and what they’re building. Nick Carter did an awesome speech and even Ted Cruz. This is why I really wanted to use the California data and stuff, certainly, a liberal-leaning person and I have been my entire life, and then seeing Ted Cruz come out and completely explain perfectly how they’re going to use flared, stranded natural gas to secure the energy grid of Texas.It was pretty mind-blowing to see all the stuff that was happening there and the way people were talking about it. I got a lot of ideas for the article in the way that these mining panels and politicians were talking about, the real-life ways that, obviously, Texas has an independent grid, and they had a pretty big public display of what that means. But again, if using Bitcoin as sort of this protocol that can absorb cheap stranded energy and then also very quickly shut down and send that demand back to the grid. It’s going to allow us to have so much more monetization and exploration into batteries and into better wires and into better infrastructure.

It is a green movement, it is all of these things that I think a lot of the traditional leftist like to sort of poop on Bitcoin for, Elizabeth Warren and stuff that I think is just sort of misguided and are really not understanding. Proof of work is not wasting anything, there is no waste in discovering blocks. The actual net energy usage of the Bitcoin network is very insignificant compared to so many other infrastructures that we take for granted, so many other things that we don’t ever attack publicly.

Again, I think I use proof of stake as my first thing to sort of compare because it’s the thing that people always propose as well. Proof of work is wasteful, but proof of stake is great and it’s like, “No, proof of stake is actually literally a waste in terms of monetary policy,” Bitcoin is not, proof of work is not. It is transmuting stranded energy and turning it into credit on this unbelievable distributed ledger that is permissionless and it allows every single citizen on the earth to participate in an energy market, a remittance market for the first time.

Like a free energy market is so important for the advancement of the species on an individual and on much bigger levels. Bitcoin really is the tool that can do that for us, it can liquidate a lot of these controllers of our energy grids and it allows us to store our life essence in something that really can’t be fucked with. It’s super near and dear thing to me because I want humans to have a free market and be able not to have to be worried about all the things we love Bitcoin for. Not having to be worried about their saving power going away, purchasing power going away.

The energy component of Bitcoin can not be separated from the monetary policy because they’re innately connected. The whole point of the article is really just to sort of show how it actually is the tool that will actualize a lot of these, not necessarily super well-thought-out ideas like the Green New Deal or things like that, it’s like they’re well-intentioned maybe but the incentives of the actual proposals are not necessarily going to get to where we actually need to get to.

I think Bitcoin actually is sort of the solution to a lot of those problems, the monetization of energy is such an unbelievable advancement in technology. It’s just so important, I think, that all of us sort of push back and use the language and the lingo and the data from a lot of these energy usage opponents of Bitcoin to show, it’s like, “No, actually, you’re incorrect. Bitcoin doesn’t use that much energy, it doesn’t waste any energy, and every single watt that goes into the Bitcoin network is establishing beauty and harmony and a free market for everyone. It’s just so completely worth it in every way and it’s going to bring deflationary effects to the energy grid that will help us all, it will help everyone.”

You don’t need to be a Bitcoin miner. But if your power company starts incorporating Bitcoin mining into their grid, you will see those effects if it’s set up right. If it’s done in a way where those profits get distributed across the line and that is what Bitcoin incentivizes. It’s worth writing articles about it and worth having discussions like this because it’s really our only chance of modernizing our energy grid and establishing a free market for energy, which I think are two of the most important things that America and humanity really need to deal with now. Mike, I know you got your hand up.

[26:47] Mike: Well, I agree, Mark. Again, I’ve said this before, but this article you wrote… beautiful. If I was more intelligent and understood the energy sector better, I would hope to have produced something remotely close to this quality. It’s frustrating dealing with the ESG narratives right now because if you just look through, you don’t even have to look through the history of energy usage by the human species, but you can just look at what we use now and we still very much use prior main energy sources throughout our history.As you said, coal, oil, and natural gas, it’s not like when our species discovers a new source of energy, we just stop using it. It all contributes to the Kardashev scale. The more energy that we figure out a way to utilize, we contribute to the overall expenditure of our species and our society to push ourselves forward.

One way that I like to kind of describe the exact problem that Bitcoin has a solution for is when we get into these conversations where like, I’m sure everybody on the panel has had conversations over our lifetime where we’re discussing with friends or family about as a society or like even as a species, technologically, we should be much farther.

Then the conversation goes to “Well, why aren’t we much farther?” It’s like, “Oh, well, the technology is expensive.” Well, why is technology expensive? Because it costs a lot of energy to produce that technology or to get the resources to produce it. Why is energy expensive? Well, we don’t have a great way to monetize that energy. Bitcoin gives us a great way to monetize that energy.

Again, like you said, I’m very excited about what a free market dynamic and a true monetization of the energy sector is going to do. Like it’s going to skew the supply and demand dynamics so far to the supply side, which is the first article I wrote for Bitcoin Magazine. I think that what we’re going to see is that Bitcoin causes the demand. Well, it’s funny because there’s a demand for energy, and Bitcoin causes the demand to go up, so it’s going to produce or it’s going to result in a dramatically increased supply of energy for just grids, in general, across the world.

Then the way that should work in my mind, and I’m sure, Mark, you agree, is that when that supply goes up, the cost to produce goes down, and then ultimately, eventually cost of living and cost of production are just wildly cheap.

[29:38] Mark: Yes, you nailed it. Absolutely. [ads] [31:40] Mark: Why haven’t we had these progressions? They haven’t been held back because we haven’t had the human ingenuity or even really the technology. It’s just we’ve been subsidizing inefficient parts of our energy grid literally with printed money. I think it’s something in the article [crosstalk] . [32:00] CK: That’s a great point. [32:02] Mark: Like I think I said, let’s see. $41 of US printed money per megawatt of coal like that’s how much is subsidized. And again, I’m not shitting in the coal industry. It needs to happen. We need coal, we need fossil fuels to create solar panels. There’s certainly a lot of inefficiencies in that market as well. Just to be very clear not to piss off Marty Bent or anything. I’m not against any of those things.I agree, but I think a lot of these companies have not been really honest intellectually, financially with the advancement of technology and in a lot of technology that we should be further along with has been held back because of the fact that we don’t have a free energy market. And if we had a free energy market, it would be decided by the fucking free market and we don’t. So that’s why we’re like playing catch up.

And it’s a shame that we have to play catch up when we’ve so much of this technology for so long but we’re starting to see it now. I think 72% of last year of new energy capacity came from “renewables” and the majority of that is solar because solar is actually becoming a much cheaper way. It’s dropped about 90% of cost per watt in the last 10 years. We’re starting to see these efficiencies of a free market. People can buy solar panels, put them on their house, offset the cost of their energy. We’re starting to see a little bit. No one has nuclear generators in their backyards but people do have solar panels.

[34:00] CK: Not yet. [34:03] Mark: Not yet, but there were talks about it. That was something that people were talking about when the nuclear sort of thing was coming out. Everyone will have little nuclear generators in their backyards. That was actually literally a talking point but would take so much control away from the powers that be that they use the energy markets as a way to control the monetary expansion and control cost of industrialization and what things citizens can do. So efficient solar panels are a way for people to sort of gain and claw back control from these huge government-subsidized power companies.And then Bitcoin is a way to then take those solar panels and monetize them when you’re not using them to offset the cost of installation and construction of these panels and without it, it would be a lot harder for the majority of folks. Bitcoin basically will monetize all of your solar energy that you have and allow you to not lose money on having it up there. And so, you can store that energy and then say you go away for three weeks and you leave your solar panels on and you save three weeks worth of Bitcoin that you’ve mined during those three weeks, then you can come home, take that money and use it to purchase energy from the grid that you need.

So this whole free market of energy is just it’s never happened and Bitcoin is a way to digitize analog energy and to allow you to, not only just store your energy in a monetary way over time, but also over space. So a big part of the inefficiency of our electrical grid is that you can only send AC circuits like so far, only a certain amount of miles over wires. And then if you wanted to store it in a battery and ship the battery, your battery is going to be leaking entropy. It’s really, really hard to store energy in any sort of long-term way and it’s super hard to move energy in any sort of way.

So Bitcoin isn’t a battery. It doesn’t literally directly allow you to take that energy out and use it to power your home but it does let you store the monetization of your energy and allow you to take that amount that you stored in Bitcoin over time and over space. You can go and wait 2 years and go all the way across the other side of the globe and use the money that you mine from your solar panels at your citadel and use it to purchase something that cost energy to produce like an iPhone or pay your electricity bill at your summer home across the globe.

So there’s so many things that Bitcoin can do as a protocol to break down so many of the walled gardens of the energy grid to really empower, no pun intended, the citizens and the average day-to-day people. It’s super important monetarily but from an energy standpoint, you can’t really remove the two. And the reason why we’re able to store our energy in this monetary policy that we know is going to be secure is because a lot of the Game Theory effects of the energy market coalescing with the monetary policy. And so over time when you invest in Bitcoin or you mine a Bitcoin, your credit for the real debit, the real cost of mining Bitcoin, the real energy cost will extrapolate overtime on the ledger and will gain you more purchasing power as time goes on.

And that’s really important like a little fulcrum in this buyer and seller of last resort is that if you can reliably store your energy in Bitcoin and we can look at KGAR and see that it’s appreciating at like a couple 100% a year on average. And there’s no other energy storage solution from an entropic standpoint that can even remotely come close to, not only just storing it, but actually appreciating value. There’s just nothing that does that and Bitcoin is very different. It isn’t an energy revolution, free energy market now. Let’s go, baby. Troy, what’s going on, man?

[38:54] Troy Cross: This has been awesome. I just read the piece. I hadn’t read it before somehow. So I read it quickly while you were talking and it was like two separate clinics being put on at the same time. Awesome. And I had a few thoughts. One is just when people talk about how Bitcoin mining is a waste, they mean different things by that, and like this economist guy, Alex de Vries, Dutch Central banker and hater of Bitcoin, like the way he puts it is every computer that doesn’t find a block is a waste and every cycle of every computer that’s not finding a block is a waste.And to those folks, they don’t understand the function of mining as securing the network. All that energy, not a watt is wasted because it increases the price to attack the network. It increases the price of 51% attack. So I like to use the analogy of insurance like health insurance. When you buy health insurance, if you don’t get sick, was it a waste or if you buy a safe and nobody breaks into it, was that a waste or a military or a police force or anything like that. Is the military budget a waste when you don’t have a war? Well, not that it prevents a war, right? So, anyways, one little piece of just kind of rhetoric.

Another thought I had was you mentioned the Texas Blockchain Summit. I wasn’t there unfortunately but that was an eye-opener for me too because I found out about it through Nick Carter, Sean Connery, and Lancium and just wanted to say, people should follow Sean. He’s in the industry and he’s doing the thing that we’re talking about theoretically. And recently, a CNBC piece which all sent to CK, maybe you can put it in the Nest. Finally, CNBC is like starting to get it, the boomers are like starting to get it, describes this controlled load role that Bitcoin mining can play in the production of energy and describes how essentially old machines like S9s can run only when there’s excess power production and the newer machines provide a baseload but they can also be turned down by the power company to precisely tune the frequency of the grid.

And basically, nothing else in history has been able to do this. What we’re doing is balancing the grid as Nick Carter puts it in the article, fiddling with the demand-dial rather than fiddling with the supply dial, and no such fiddling has ever been possible before on the demand side. And when the people get this, the energy flood is just going to go away if they can really get it because not only does it make renewables finally make sense but the other thing is that they’re building our renewables in places where they don’t yet have transmission built.

And it finances building out renewable infrastructure like wind and solar prior to the existence of transmission which is otherwise just not possible unless you are going to do something like build an aluminum smelter right where the power plant is. You would have no way to monetize it until the transmission all got built. And then what would you do with your aluminum smelter once it is built.

So Bitcoin mining because it’s so portable and tunable can play this role of basically like okay, supposed the infrastructure does get built and you need fewer Bitcoin miners than before the transmission infrastructure is built. where do you do with that access Bitcoin mining capacity? Well, you move it to the next spot where there’s renewable energy and you want to build out more infrastructure there, right? So you just kind of move those miners. And this is like this will monetize the build-out of energy and this is just what you were saying but it’s a concrete case of it actually happening. And if you follow Sean, he’s posting like how much excess energy to have in West Texas where the sunbelt and the wind belt meet, there’s not a lot of population there, there’s not a lot of transmissions.

So it’s like an extreme case of overproduction of energy. And the kind of recent news just in the past few days is that they’re financing a lot more build-out of energy like 150 million is the start but it’s going to be many times that precisely because Bitcoin is making this possible. And as somebody says in the article, Bitcoin mining and renewable energy is a perfect match. All right. I’ll shut up. Awesome, awesome presentation, Mark. I’ve got more to say but I’ll step back.

[43:53] CK: Troy, thanks for bringing that. I actually went and I found the article that Nick and Sean wrote for Bitcoin Magazine and pinned it into the Nest. So for anyone interested in following Sean, it’s @seanenergy and you can just go to the Nest and grab that and definitely go read through that article. That one is epic and all great points and completely agree. I actually thought Alex Petrov who’s from Bitfury in the audience, I pulled him up on stage.So as part of the duck curve thesis and part of my assumptions is kind of like this idea of energy producers maybe on the day-to-day, week-to-week, season-to-season, will be able to kind of like allocate hash rate in order to flatten out the demand curve and maintain profitability. That was kind of an assumption in the article and I saw that in the comments on Twitter, Alex, kind of a season miner, called out how realistic that assumption is. I guess I’m kind of curious, Alex, if you want to chime in to the conversation in general and maybe even talk about that point. Like about operating in a facility, how easy is it to turn on and off after? Like how long does that take?

[45:20] Alex Petrov: If you’re talking about these huge volumes, it can take hours just to switch off and turn off the big [inaudible] . It’s not a light bulb. So if we’re talking about the megawatts, if we’re talking about like 100 megawatts, you cannot just switch all 100 megawatts here. This will just blow up all the transformers for road rewires because there will be a huge peak on the load. And if they’ll be storing up the equipment, it can harm or impact the powerline.Normally else it should be poor because there is like a network of different transformers, we’re using different route of connections. If we are placing the loads, you should inform the network. Normally, they are monitoring the network for like houses or cities and automatically they balance everything. But in the huge facilities, for example, in Georgia than the taking electricity from the electrical forward stations from dam. So we are practically calling them and right now, we are starting for switching gradually step by step increasing the load on the network.

Let’s talk and compare. Here is also the point, turning the equipment on and off, the life cycle of the equipment is also degrading. The light bulb that they are using in your house, it’s normally breaking or failing exactly when you’re switching the light on. And it happens because it’s like cold, in the cold safe, remember physics, electricity get the lower resistance if it’s cold wires. And this superconductivity, it’s exactly didn’t do like 0 degrees of the current lead and then the resistance is lower. And the equipment also like then is warming up and then it’s cooling down. There is small cracks on the boards. There is also small cracks on icy chips on the crystal structure and they degrade with time. Then if you run importance…

[47:41] CK: Yeah, I mean, I think all of that makes sense effectively when you’re saying is like your light bulb is probably would break less often if you never turn them off and E6 is a lot more of a complex things. So turning them off and on actually puts wear and tear into the E6 itself along with other kinds of complications associated with that. So it’s not just a straight like, hey, any energy could produce or can just turn on and off like a light switch their energy consumption with Bitcoin.But, I mean, I think Troy’s example of what Sean does which is like monetized energy production and then take portable demand and move it from place to place depending on the life cycle of the project definitely so fits into what’s reasonable. I’m curious like I feel like the objections on turning off and on the E6 is something that could be solved or mitigated or made less expensive through engineering and design resources towards that problem. I’m kind of curious, Alex, like how very sure are you on that proposition into the future?

[48:53] Alex: It may work and even like US mentioned the Bitcoins like transition then you don’t have wires. We have an example, then the customer is using the mining facility just to lower these costs of electricity or steel production. The case was very, very simple. The customer was only this steel factory and steel factory is located like 600 km away from the location of the solar panel and the grid station. The government there is promising they will build new wires, they will build new like anything to put the grid back because it’s 600 km and the cost is very, very high. The customer cannot over or build wires by themselves. And the result of the promise stayed like a promise.What the money’s equipment, can you install the money’s equipment near to the solar grid and just mining Bitcoin is covering and lowering the cost of electricity working style with himself on the steel factory. And this is a great example, Bitcoin is worth it like in transition. No wires is transiting exactly the excessive electricity and allow you to lower the increase the wire it consumed at least. The wires and all the grids, it’s not like transition without losses. It’s always losses. I mean, the United States in transition, there’s approximately from ATT have increased this loss only in transition. It’s like average numbers. In Europe, they are losing approximately 16%, 17% of electricity because in a shorter distance and no more than great.

It’s a little bit more efficient but you always losing something in position [inaudible] because it’s resistance because it’s self-leakage, we can see also need to higher voltage then you upscale the voltage, it’s the transformer. And transformer is not working like one-to-one. We are losing approximately 10%, 15%, 25% then you downscale the electricity of the entire voltages. We are losing again, some percentage and this is making all the network. In Greenport, they are using also efficient. Normally, the cities use them also for because it’s much simpler and much easier to build the coal electrical station in your city but more efficient is Hibra electricity. It could be electricity and efficiency is approximately 90%.

The solar panel normal efficiency is 70% but you need also downscale it and then upscale it, you’re losing approximately 25% on conversion. The wind generation is also not very efficient, normally it’s 25% and definitely whatever wind generation you are building, you’re spending more electricity for fossil fuel what the wind generation, you’ll be able to generate through all the life. Solar panel and wind generation is also creating that pool and that pool is called because normally, the wind is not blowing all the time and the sun is not else lighting all the time. So the heat is very in the middle of the day then the consumption network is not the slowest one.

The higher load of consumption is every morning and in the evening time in the network and result then you can actually the solar panels and wind generation to normal grids. This may take the regular fossil fuel station and Hibra station is less efficient. They did not sell the constant electricity that they are generating. They need to decrease the production and then decrease the production. And this is making all their business less efficient and that’s real work but I think they can use the excessive power and using the mining, yes. We can utilize that excessive power in this field like energy-based civilization essentially one is all dependent from electricity, from energy and consumption like electricity consumption is always increasing but the time it’s never was decreasing.

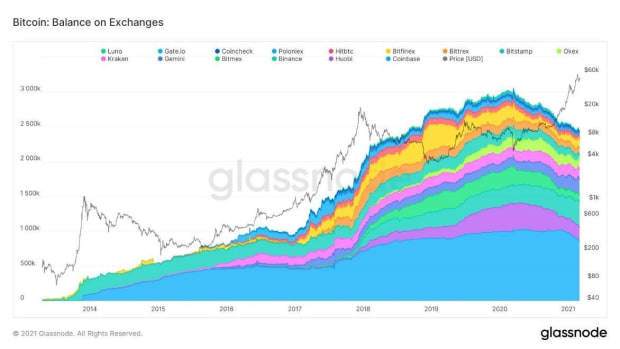

[54:00] CK: Thanks a lot. Yeah, I think you brought a lot of really good points there and it’s interesting to think that adding in and hyper-allocating to green resources when they’re not like consistent energy production can actually destabilize the consistent energy production from a business perspective. That’s really interesting too. [ads] [56:22] CK: Mark, I want to pass it back to you. Alex is talking about the duck curve and again, I think we added a lot of new people to this room, meeting people are cycling out but the impetus for this art, for this conversation is an article about how Bitcoin can help with the duck curve. You’ve also posted some images. If people go to the second tweet inside the Nest, you can pull up a chart that Mark has put together with the duck curve. Mark, do you want to explain what the duck curve is and maybe like walk through one of these charts with the audience? [56:57] Mark: Yes, totally. And thanks, Alex, so much. I want to give a big love and shout out to Alex for after the article was posted, he reached out to me and talked to me about a lot of some of the lesser talk about things in the mining space and he’s super supportive and really loving and just really sharing of this information. So it was a little bit hard to hear some of it Alex unfortunately but just follow him. He really knows what he’s talking about and he’s really giving with information which is awesome and so true of the Bitcoin space. So I just wanted to thank you Alex for teaching me so much.So, the idea of the duck curve, it’s a snapshot of a day, of a spring day in California. And so again, I wanted to use government data. I wanted to use California government data to make this mathematical thesis as part of getting more ammunition to fight some of these narratives about proof of work being wasteful and really just show using their data how Bitcoin can monetize stranded and inefficient energy production. So the duck curve is this like colloquial term for this California company, CAISO. They’re a nonprofit that does a lot of the overside of the grid of California and they made this grid of, I think, it’s March 31st. Yes, it is. So a spring day when people don’t need to use heat, they don’t need to use air conditioning, and it shows the demand of the energy grid of the cost.

So during the night, when there is no solar being produced, there’s very little demand for energy and little production. And then, as you know, the workday starts and as the sun comes up, we have this really big belly of the duck. And we can see every year, the amount of wattage being produced by solar is increasing dramatically. And we can see that the duck’s belly is getting bigger and bigger which is great. Solar is cheap. There’s a lot of issues with it. We need to make it more efficient, we need to store it better. But it is really cheap energy. There’s a lot of bullshit in the green energy space but the idea of cheap energy is like anything but a narrative. It’s a reality. And so again, using California data as a way to sort of disprove some of this anti-proof of work stuff.

You can see right about four o’clock, five o’clock when the sun maybe is starting to go down and not as high up in the sky and everyone’s leaving work and coming home, we see this big ramp of demand of energy. And it’s unfortunately happens right as the sun is going down. So we have to sort of ramp up. Part of coal production, energy production is you need to start and ramp up the energy production. So there’s actually a greater cost to start a plant to increase and ramp up its demand, whereas solar, it is getting what the sun is providing.

A big part of the upkeep in the capacity potential of coal is based on the coal being supplied to it and the people working there. And so when we see this demand happen in the evening, that’s when solar becomes inefficient and isn’t there. And so how can we monetize this lowered demand but higher megawatt production as a way to incorporate and distribute the deflationary effects of cheaper energy across the energy grid and towards people, citizens of California. How can we do that? And so again, using California data, using all literally government-provided data, I wanted to sort of talk about capacity and showing that Bitcoin as sort of this buyer of energy remittance can create a free market where the price per watt is being subsidized by profits during the day.

So when there’s a big, big solar overgeneration, if you will, potential overgeneration, the local grid can use that and monetize it, store it in Bitcoin, let it extrapolate credit and purchasing power on the ledger over time. And then when more energy needs to be purchased, the energy company can use that overgeneration that was normally would just be wasted or rather just inefficiently used, can now be directly monetized and stored in a digitized version of energy that it’s not a battery, but it is a monetization preservation technology. And it is a way for you to preserve your purchasing power again, over time and space.

So that’s a huge problem with the energy grid is distributing energy over time and space. And Bitcoin allows us to monetize wattage and store it and then be able to get on a plane and fly somewhere and take your Bitcoin in your head, your seed phrase in your head that you mined on solar in the middle of Death Valley and go fly to England and use that money to purchase something that takes industrial energy to produce or use it to literally purchase energy.

So again, it’s not a battery. It isn’t but what it can do is preserve purchasing power. And if we create an energy grid that is incentivizing cheap energy and is monetizing cheap energy, we can break this sort of energy conglomerate use of control over citizens and we can kind of break this market and turn it really into a free market with a decentralized energy bearer asset that increases in purchasing power over time historically. And we can take those effects and spread them over the grid and subsidize instead of paying $41 per megawatt, you know of coal we can take the Satoshis, spread them across the grid, invest in the phishing technologies. Invest in better transmissions, invest in better batteries. And I think Alex is completely correct and he’s very much so talking about what’s happening right now. And I think that’s important to realize that some of this is a little bit of a future hope of what this can do. And the actual realities are a little tougher. And I’m really thankful for Alex for his perspective on that because it’s grounded in reality. But the if you look at that duck curve and we see how short is the belly was in 2013 and if we look at it now in 2020, that’s a humongous percentage of megawatt production.

Solar will get more and more efficient. That the sun puts out enough energy, in 2 hours to power the entire global energy usage for an entire year, right? Now, solar is not the only thing. There’s a humongous component of nuclear in my argument here and article I think that they’re both incredibly important and going to work super well together where we have a super high-capacity, nuclear capacity meaning it’s constantly putting out a base load that is super high into a capacity for nuclear.

Just like in the 90s, whereas the capacity of solar is like in the 20s, right? But we need this, I think to be able to take the monetization of wind-solar is available and when it’s cheap and monetizing it. And then also, being real into the actual demands of the energy grid and know that we can’t just switch to a solar standard, it’s not possible. The inefficiencies of making turbines, the amount of energy it costs to make a turbine will never, where we are right now, produce enough energy to offset the energy cost of making it. Which is that’s where we are, technologically.

But if we have an incentive, and the protocol of Bitcoin to incentivize, investing in these technologies and so that they scale, and if we continue to see an unbelievable efficiency of solar capacity, if we continue to see effects like that in the next 2, 5, 8, 10, 20 years, we’re going to be able to have them modernized energy grid. If we distribute that, this deflationary effects of technology, of this profits amongst everybody, I think that’s the huge part of Jeff Booth’s book “The Price of Tomorrow”. I highly recommend everyone to read it. It’s one of the couples of books that I buy my friends and family when I’m trying to always tell them. I think technology should be making energy cheaper. It should be making us able to do more things. And there’s so much inefficiency in our market because of subsidization and because of conglomerate big bucks realtors and people having and been invested into this old system and their profits are guaranteed based on this old system. Bitcoin is a way to sort of break free. A lot of the energy controls and create a global remittance energy market where we can monetize Geo independence stranded energy and take those effects and distribute them amongst the society for the net good rather than just for us select people of profit holders.

I think it’s going to be interesting to see which power companies become Bitcoin mining companies which Bitcoin mining companies become power companies? Because I mean, I don’t think, it’s only a matter of time before we have true pricing of energy in Satoshis. And when we do have that, it’s going to have profound effects on society because we’ve never had a free energy market. And yeah, I mean it’s a pretty important thing and it’s cool that we as citizens, can participate in it. And we can put up, we can plug into the energy grid and make a speculative attack on PG&E by mining. If it makes sense for you and if your wattages are low enough your price for wattages, below five cents whenever and you can do it, great. If you can build a solar array, great. And if you can use flared natural gas and monetize, that’s all so good.

It empowers individuals and citizens to be able to take that, invested in themselves they can store their life value in this energy remittance per asset protocol that is designed to continue to appreciate over time. And if we take that, as soon as we continue appreciation and distribute it amongst everyone, I mean how could not be in that positive for society. And so, again a lot of these narratives of Bitcoin being wasteful and all this, it’s not even close to using up this much energy as so many other things that we do that we don’t even think about. Especially, when considering the petrodollar system and the military system that’s needed to enforce this fiat like why does anyone talk about the amount of electricity it cost to run the air-conditioning for the soldiers in the Middle East? Or to keep the tanks running, or to keep the helicopters going, right?

We don’t talk about that stuff. It’s really easy for a Senator to come out and just say something about you know…

[69:31] Sovereign: The military is not going green, you know? [69:34] CK: I mean not yet, but what does the incentive, what is the protocol of Bitcoin incentivize? [ADS] [71:17] CK: Who wants to jump in? Sovereign, welcome. And yeah I mean I agree, speaking of Sovereign, Sovereign Individual really talks about this. And moving value into the digital space and how that definitely protects the people or it changes the return on violence is the way that they phrase it. And the book is Sovereign Individual. Sovereign Stoic, what’s up I know you’re a miner. I know this is something that you think about and talk about all the time. Why don’t you jump in at the convo? [71:51] Sovereign: Hey guys, how’s it going in that great conversation? Honestly, I agree with everything that’s been said even though we are just in our little echo chamber here, right? But one thing that Alex brought upon, that’s hard on the machines when you’re cycling the modern office a little bounce-in mechanism. I feel like immersion cooling technology might be able to mitigate that.A lot of the big guys are moving to immersion in a large way. I mean, a right house I think. A hundred, maybe lots of out there, three to four hundred maybe got an operation right now, running on the immersions. So not just a lot of users on the boards when you’re cycling was on and off as well. In terms of Fluor gas mining, utilizing those standard resources, standard energy resources to bring the market right to the molecule, right?

It’s a total game-changer. And I think everyone knows also about our favorite space force guy Jason Lowery. He’s doing his whole thesis on how Bitcoin mining access a defensive mechanism so that we actually don’t need the petrodollar system to project all that power for nation-states. We’re so early but we are on the point of the edge of being out of this sword. And it’s wonderful to see.

[73:16] CK: Awesome. Hey, Troy, I want to give you the stage but I just want to shout out, for everyone requesting if I don’t know who you are, you’re going to have to DM me with something coherent otherwise you cannot get on. With that being said, Reggie, I welcome him onto the stage because he definitely sounds like he could add to the conversation. Troy, you have the mic. [73:38] Troy: Well, since we are in our little echo chamber here, I thought I would say something. One audience is like thinking economically about energy and even about decentralization. Some of the cool stuff that the market is saying is that you can decentralize energy and disrupt a centralized conglomerate with solar panels on your roofs and now monetize. That is just awesome and it’s going to more kill to some of us who are into decentralization generally. And we’re like, okay that’s decentralized energy. And we can decentralize energy via decentralizing money and tying it to energy. I mean that is an amazingly powerful idea. And there’s another crowd that they’re not interested in this at all, they’re just interested in what’s the effect on the number measured in Hawaii on the CO2 concentration of the atmosphere.And that crowd is going to include a lot of Bitcoins’ most staunch critics. Sovereign’s here, I should say nothing too in other. Greenhouse gases, right? And I think that Mark’s thesis has got implications for both crowds like the hardcore Bitcoiners and economic people thinking about how do we dance in civilization? But also the people who are thinking, in beyond what happens to carbon concentration? And I just think you know, it’s thanksgiving a lot of people talking about how do you talk to your relatives? It’s like, figure out who your audience is first. And this is going to enable growth is going to appear appealing to one audience? And other audiences want to know what’s the net effect on energy over time? And I think Mark’s thesis and the thesis of Nick and Sean is that over time, the percentage of renewables is going to grow tremendously faster with Bitcoin. And one way to think about it simply is just that with non-renewable energy whatever that means because its chief vice is compensated for.

Bitcoin mining helps to monetize the previously unmonetized portion of its output and that is those excess portions. And that makes it more cost-competitive overall than it is. So, it’s going to accelerate the adoption of renewable. And to the audience that cares about concentrations of greenhouse gasses, that’s the pitch, right? It incentivizes that build-out even before we had transmission to it, it makes renewable cost-competitive. And they’re just, I think they’re not cannot be moved by other stuff. And in particular, I guess I want to call out one thing that I hear a lot in a Bitcoin community which is the card of shifts scale stuff. There are different ways of putting it. They’re slightly different, one I agree with and one I strongly disagree with. The form I agree is we’re knocking to advance while turning down the energy dial. We’re not going to kind of get way up. The version I don’t like and it’s going to fall absolutely flat on the environmentalist friends that you have around the Thanksgiving table, is that merely consuming more energy advances civilization. You know it does it. And here are some examples. You could just light all the force on fire, burn everything underground that’s vulnerable and have a massive nuclear war, like all those things would consume a shit ton of energy. They would not advance civilization one bit. And another way to think about it is you’re looking at two refrigerators at Best Buy which one should I get. You know get the less efficient one because it’ll burn more energy and that’s just stupid. I mean, what matters is the work that has been done with the energy. Nothing energy is consumed.

If you can do more work with less energy, that’s called good engineering. And you advanced between two civilizations, one of which uses more energy and one of which uses less but which produce the same amount of work? The more advanced one is the more efficient one. Not the one using the more work. So there’s just that you make accuracy in the way we pitch the card of shifts thing. And just be careful of that because there’s a truth to it, which is energy uses required for civilizational advance. And then there’s the bogus thing that anybody is going to snip out as bogus and knows anything about energy which sometimes gets confused with it. So there are the two points, I don’t know that anything is controversial here. One is like, just know your audience and pitch to your audience. One audience cares about monetizing energy and advancing concern about decarbonizing the grid in the long run. And pitch accordingly.

[78:46] Sovereign: Yeah, Troy. That’s just this is the fact that Bitcoin mining incentivizes efficient use of all energy resources whereas the fiat system is completely incentivized as a misallocation of resources which increases waste. Which going to it obviously and that inefficient use of all energy can’t move civilization forward, all right? [79:09] Troy: Yes, I would say 100% to that. Yes. Like a lot of times if you talk to someone who’s energy concerned it’s pretty easy that kind of like it and agrees with the fact that, hey, our current energy grid is not doing it, right? It’s the decrepit PG&E in Northern California that has started massive forest fires every single year. And they blame it on climate change. And like our energy grid is a massive issue. I think it’s pretty easy when you get people to agree to that. And then, you can talk about basic economics that’s the book by Thomas Sowell who’s an OG economist but you know a big point in basic economics is that in defy of communism versus capitalism what became very apparent is that communism is not efficient like capitalism is just a much more efficient way to allocate resources and ultimately that’s why the US crashed. It’s obvious. Because it was so much more efficient to run a capitalistic society while a communistic society just wasted resources.So people generally, who can’t accept that history, some from old pushback, so if it says that “Hey, our energy system’s fucked and capitalism is more efficient that’s why you know capitalism won.” You know the next set is like pointing out that our energy grid is centralized and effectively communist. And I point out that a lot of the issues that we’re facing right now in terms of the wasteful energy grids and environmental issues that are caused by that are coming from a communist-based energy allocation strategy. And that’s where Bitcoin comes as a market-driven way to do that.

And then, that’s I think where you can bring up research like Nick and Sean’s. You can bring up research like Mark’s. You can bring up research like Hass McCook’s to kind of fortify your argument. But that’s how generally I like to pitch it because I think we need to take the offensive. Like fiat is destroying the planet, fiat is missing out on hitting cup though, not Bitcoin. Bitcoin is .001% of energy usage or something like that. It’s marginal. Fiat is what is the 99% of energy usage today and that fucking sucks. I think everyone agrees to that.

[81:40] CK: Yes. There’s a really awesome, I highly recommend to everyone to check it out, Leonard E. Read essay called “I, Pencil”, which very often gets associated with Friedman because it talked about it a lot. But sort of this idea of, look at the pencil, how many people to come together, how many resources have to come together to make just a very simple pencil? And the concept is not one person can make a pencil, right? Where does it all come from? And what are the mechanisms?There are no centralized figures sitting there sending out letters to people saying, “Hey you in the Pacific Northwest, you cut down this tree.” “Hey you, in Malaysia, you cut down this rubber tree to make the eraser.” “Hey, you’re fabricating the brass bit.” There’s no one person is coming out and saying all of these things. What is the meshy network between all of these industries happening and coming together to produce a pencil? And so the concept is the free market, the price of the labor that it costs you make all of those things, the freer that market is, the freer that energy market, that distribution, that industrialization market is, the more efficient that our pricing will be. And the more efficient our industry will be.

And so, I agree, yes. Like, truly capitalism, people always question capitalism, it’s kleptocracy, it’s oligarchy. Like that’s the shit that we should yell at. It’s not fucking capitalism. Capitalism is fantastic. It’s a biological thing to risk capital and to make it gain. Stop rejecting our biology. But this idea of needing a free market of price to have a fair labor market and a fair energy market. Right now, we just simply don’t have it and fiat is crap. And I agree, CK, with everything you’ve said that’s you until we have a free energy market, we don’t have a free world. Until we have a Bitcoin standard for energy, we don’t have a free energy market. It’s really, really important for going forward for like all industries, for all societies, for individuals, for group collectives we need a free market for energy and we need it now, we needed that yesterday.

And proof of work as a universal forgetful function is the fairest way to create that free-market dynamic that we truly need to efficiently industrialize and produce what we need to like fucking move on and progress as a society. That’s why I wrote the article like this using California government data because I want to use their own fucking data to be like, no you guys have subsidized the energy grid, you’re fucking it all up. It’s terrible. We need a free energy market and Bitcoin is going to take it from you. It’s going to take it right from you when they least expect it. And I am super volition on Bitcoin mining. I’m super stoked Adam’s here. I’d love to hear what he has to say about this because he’s a great fellow. He’s super, super, super smart.

[85:04] Denver Bitcoin: Yes, man. Thanks for having me here. It’s been a good talk. All I want to add to that and what pops in my mind is, I mean you’re absolutely right for everything. That’s what Bitcoin mining really does. And I talked about this a little bit in Kansas City is what it does is for the first time ever we’re going to have a properly priced kilowatt-hour globally. Like the world, we were fluidly the entire global will be able to know what the kilowatt-hour is. And it’ll be arbitrage constantly on the global scale because we have this immutable market that we can sell energy to notice the Bitcoin network. And it’ll pay a truly free market price, it’s unbastardized kind of a market.So, I agree with you. I think Bitcoin is going to shatter all the regulatory nonsense like goes on in energy markets because every producer feels that they’re getting screwed until they start exporting that energy to the Bitcoin network until they’ve stopped being screwed. And so, it’s a really simple kind of a function but has very massive implications.

[86:05] Reggie: They tempt to step back in a terrible connection a couple of minutes ago. But anyway, Mark’s expect to fill in the space. I used to work with utilities all around the world implementing network solutions. Things like demand response which is the way the utility world refers to, in control I mean the demand side of the grid resources. I’m going to make an argument that back again some of the things that we’ve said earlier and that is the first real opportunity the utility isn’t had to actually play with the demand side of the grid. And that sectioning is not entirely true. Demand response programs have been around for like 25 or 30 years. And it sort of started with the customers that had the highest control of a load source. So folks I’d talk a little bit about aluminum smelters is an example of manufactures that can plug into the grid and then have some program incentives from the utilities in order to have some control of a load in who demand advanced to share that load.These demand response programs has evolved significantly over the last several decades and there’s more and more diverse types of plugin plate assets that can be controlled on advanced side of the grid. The problem is serving what I was alluding to, I hope I was able to communicate earlier, is that these programs are affected through government-controlled energy efficiency portfolio mandates. That’s the vast majority of the electricity market in the US. And the few commenting, these programs through regulations. So, what I’m excited about is that Bitcoin is basically plugged into the system that is entirely ready for these new types of high load controllable resources that can really do a lot to balance and also monetize due to the demand side of the grid. It’s not like it hasn’t been done, it’s just a massive resource that has an extraordinary monetary incentive. And the grid is immediately ready for this. It’s got already their protocols, one called OpenADr which effectively allows anybody to plugin and control both demand-side assets into the utility system. So this is kind of what we’ve probably waited for. It’s really exciting to see this happening and thanks for organizing this discussion. I’m surprised, honestly that there isn’t more of this discussion of the Bitcoin community today.

[88:53] CK: That’s really cool Reggie. And yes, that is totally true. I don’t think anyone is benign that those things exist. But I think to your point that there are still government-subsidized programs that are still using government fiat as a way to offset the demand of energy productions. So I think kind of more to the honest point of creating a global kilowatt price that is arbitraged constantly and by citizens and not by just by nation-states is the main difference. But I agree, I mean, the technology is there, there are people talking about it. But until it is priced in digitally scarce decentralize bearer asset, it’s not really solving a lot of the issues. It’s not actually an open market, there’s still a wall to guard in it, still disclosed. [89:54] Alex: It’s not scalable as it is because you know, we talked about the example of aluminum smelters. How many aluminum smelters are there around any segments of the grid? If you look on the consumer end of things, the assets that they’re controlling, obviously we volt it to a smart thermostat you can do actually quite a bit in controlling the AC load from residential. But the highest-value asset in the utilities that are controlling are things like pool pumps. Come on, let’s get real, how many of us have pool pumps? And take note in a Venn diagram of people that have pool pumps and are aware that utility efficiency standards exist for those pool pumps to be incentivized to be turned on and off in an ADR program. You know, the stuff existed there but what Bitcoin brings to the table is immediate scalability and extraordinary monetary opportunity to gather in one type of asset. So that’s what makes what I’m talking about it. [90:56] CK: Hey, Alex. You also sent me an interesting point in regards to the modernization of the grid. You know the huge problem with solar is when they become inefficient. We have to get rid of them and recycling solar panels is one of the worst parts of solar, right? Well, we can recycle them and connect them to S9s. Say you use them to, use inefficient A6 to monetize instead of trying to recycle these old solar panels. So there’s a lot of ways that Bitcoin can actually subsidize the transition into a modernized grid very directly. But I don’t know. Has anyone on stage wanted to say something? [91:43] Sovereign: S9s will live forever, boys. They’ll live forever. But it’s true that Bitcoin mining will incentivize and I hate that word subsidy but the fact is like the fiat subsidies are just taxes stolen from the citizens to triumph build-out and push this renewable energy forward. But Bitcoin mining subsidizes or incentivizes the sustainable and efficient build-out of that energy resource which again it has everything to do with the similarity of Bitcoin mining merging with energy grids and energy systems is like Mark says that’s one we start pricing, our civilization sucks. [92:25] Troy: Sovereign, actually you just made a point that gave me a miniature brain blast. But you know a lot of times it’s my co-host, you better watch, we say that Bitcoin is creating a productive ecosystem and market. And the existing system if you look at across every metric, it’s actually unproductive. And volatility and pretty much metric of like economic health it’s just been trending down for a long time. And when you talk about energy subsidies and fiat system as being parasitic to the system in the citizens whereas the Bitcoin “subsidy” is creating value, adding that alliance to perfectly with like this idea like Bitcoin is a parallel system where growth is actually possible. And again, nothing that ties a little bit to the like card of shifts scale like in moving us forward us to society, evolving us as a society. It’s like Bitcoin is going to enable that productivity to come back to the world then we’re going to start advancing again. Whereas the old system is just so parasitic at this point that we’re just declining day after day. [93:42] Mark: And not just productive but also being steward and an asset that will appreciate over time. It will allow the monetization and the modernization of the grid to happen so much faster and so much more sustainably, and I don’t mean sustainably in terms of the green ways but investing in Satoshis, is in storing your power in Satoshis is going to get you more purchasing power over time. It’s how Bitcoin was designed. And to connect that, instead of constantly having a depreciation of your surplus of money, you’re having an appreciation. And if we’re going to set up a grid where that appreciation can be distributed and self-subsidizing the energy market to give lower energy costs to the people directly, rather than being a rocket that’s used as a way that sort of control us, it’s going to do huge things for us. It’s going to be such a net positive for the globe. This is not just an American thing, this is not just a California thing, a really true global remittance energy market where we can truly price a kilowatt per hour would never have the technology to be able to do that. So it’s going to be really fascinating to see it developed. I’m really curious to see when that will start to happen.