Discussing Bitcoin Information Theory

Aaron Segal dissects Bitcoin using the laws of thermodynamics and the concept of monetary entropy.

Watch This Episode on YouTube

Watch/Listen To This Episode:

- BitcoinTV

- Rumble

- Spotify

- Apple

- Libsyn

- Overcast

In this episode of Bitcoin Spaces Live, host Christian Keroles (@ck_snarks) is joined by Aaron Segal (@LudiMagistr) to discuss his article for Bitcoin Magazine titled “Bitcoin Information Theory: B.I.T.”. Aaron explains how entropy is closely related to money and how Bitcoin as information is ultimately a reduction of entropy. This is an extremely enlightening discussion, as Aaron applies the laws of thermodynamics to explain the monetary phenomenon that is Bitcoin. Other speakers include Guy Swann (@TheGuySwann), Mark Goodwin(@markgoodw_in), and Bitcoin TINA @BitcoinTINA

Full Transcript:

[00:00:07] CK: I’m really excited for this conversation. I’m going to ping Mr. Aaron Segal quickly to get him to join. We’re going to be talking about a really interesting subject, Bitcoin information theory. People like to refer to Bitcoin as digital gold. In my mind, that is a very limiting way to think about Bitcoin, just because gold was sound money in the past, does not limit Bitcoin to just being the digital incarnation of gold. It is far more than that. It is actually the removal monetary uncertainty. Aaron calls it entropy in his article. We are going to be spending the next hour or so, talking to Aaron about the article.

Before we get into that though, I want to tell you about Bitcoin 2022. I’m pretty sure, Aaron’s going to be there. Almost everyone that you’ve been seeing speak on Bitcoin Magazine Spaces will be at Bitcoin 2022. It’s going to be the biggest Bitcoin event in history. Bitcoin ’21 was the biggest Bitcoin and crypto event in history. We are going for a three X on that. We’re really trying to take the Bitcoin event space to the very next level, and it is going to be an absolute blast. There’s going to be something for institutional investors, to core developers, to Bitcoin plebs. We have a four-day event, including a full-day music festival to celebrate the Bitcoin culture.

Extremely excited. You can use promo code Satoshi, or HSFP, Have Fun Staying Poor. They both give you 10%. If you pay with Bitcoin, you can save an additional $100. You can stack those. Pay with Bitcoin and you use one of those promo codes to save the maximum amount and do not wait to get your ticket. It’s going to be an absolute blast. All right. That’s enough for me. Aaron, what is up my man? Welcome back to Bitcoin Magazine Spaces And really excited to talk about your first article for Bitcoin Magazine. You’ve now contributed three, but this was your first one back in May.

[00:02:00] AS: Yeah. Thanks, CK. Nice hearing your voice again. Nice talking to you guys. Thanks for everyone for joining. Yeah, it’s an interesting topic. Like CK just said, one of the genesis of this was my thinking about gold, and thinking about the whole digital gold narrative that was becoming a lot more pervasive last year. We’ll call it during the first and second quarter of the year. Some point down the road, we can get into my background, but real quick, I’ve been on the buy side. I’ve been in the hedge fund industry for 17 years.

I’ve approached this, my background, of course, as an investor, as an asset allocator. I’ve been involved in macro equity credit derivatives, traded all through the great financial crisis and saw the insanity that was occurring back then and have only seen it actually increase since then. You would have thought that that would have been the pinnacle of the insanity, but it was really just the beginning. For a lot of us, of course, Satoshi included, that was an eye-opening era. For me, I’ve been involved in so many different asset classes. Most recently, I work in a hedge fund. That’s more involved in the credit industry and that’s how I’ve gotten speaking with guys like Greg Foss, and has gotten closer to him, because we have some shared experience there and shared experience in the insanity of the credit market where real yields, they’re now negative.

Essentially, I’ve started to see the world in which I operate become more and more administered, more and more manipulated over the years. That has just disturbed me more and more, as I’ve started to see the consequences, both socially, economically from a market perspective, from the ability of prices to actually make sense in a coherent fashion and the ability to model. My initial mentor, this guy named Marty Zweig, he was a legend in Wall Street in the 1980s-1990s. He was famous for actually predicting the bond crash in 1987, literally. That was on a – they call it Black Monday. He was on this television show, like the predecessor to CNBC the day before, he predicted it literally that Sunday morning.

His mantra was always don’t fight the Fed. That’s because he grew up in this era where Greenspan had introduced this concept of moral hazard. They used to call it the Greenspan put. Now, Alan Greenspan, for those who don’t know, was a central bank in the 1990. That was the lens in which I formulated my views. I also have always had this little tinkering interest in physics and theoretical physics and quantum theory and all this stuff I can nerd out on as a lay person.

When I started thinking about, this is before really, you had guys like Saylor talking about Bitcoin as what do they call it? Digital electricity. I had come across some of the work of Buckminster Fuller. Now, a lot of people also quote him too, but his theory of the kilowatt dollar. That got me thinking about the second law of thermodynamics.

Basically, just to frame this whole article is it’s a amalgamation of the second law of thermodynamics, information theory, which was a theory that took thermodynamics in an entropy and applied it to networking and information and telecommunications in the 1950s-1960s. A guy named Claude Shannon was the grand master, the founder of that school of science. Then just my own economic background, my own tinkering as an investor. I think, honestly, that’s the best way of learning the real merit of things is by tinkering in them. That’s why I’ve always had a mistrust for economists. I really would implore it. This is nothing against economists. That’s my background too, before I got into the field of investing.

If you ever come across somebody, who’s giving you investing advice and they don’t have any

money invested, I would be very weary of those people. I’m buying all of these concepts and this background to formulate this equation. I’m going to use the term equation loosely, here because it’s really just a thought experiment. It’s not an equation that can necessarily be applied empirically for practical purposes. I think, it really helps frame, as CK was getting to and alluding to at the beginning, it helps frame why this is so much more than just digital. Because digital gold is just a store of value. It’s not a transmission mechanism.

Just big picture. I don’t want to get too deep into the weeds of the article itself, just regurgitating the actual article. I’d like to do a brief run through of what I’m getting at and the basic concepts, and then some of the implications, which are things that I didn’t talk about in the article. I kept everything pretty abstract in the article. That way we can run with it and have hopefully, a more fun conversation. It’s talks a bit more about some of the pragmatic applications of these ideas.

Yeah. Basically, for those who aren’t familiar, the second law of thermodynamics is basically saying, hot things always cool down, unless you do something to stop them. Another way of expressing that is that disorder, which is characterized quantitatively as entropy always increases over time. There’s a really great quip by this astrophysicist that I came across when I was doing research for this article. I think, this can be applied to anything in the shitcoin, altcoin space.

If your theory is found to be against the second law of thermodynamics, I can give you no hope. There is nothing for it, but to collapse in deepest humiliation. He wrote that in 1915, but I think that applies pretty well to a lot of things that are going on right now. That’s thermodynamics in a real simple nutshell. Information theory, like I mentioned is pioneered by this guy named Claude Shannon, mid-20th century. He was a computer scientist. He applied it to, how can a signal that’s going across a telecommunications network be transmitted with a minimal loss of information?

When you start to ask that question as an engineer, you then need to start defining what information means. We were just at the precipice of this information revolution at this time. It might seem like a thought that we all think about a little more frequently now. I don’t think it’s necessarily what the everyday person thinks about, but I think a lot of people probably in this room tend to have these kinds of big idea thoughts. Back then, it was really a very esoteric concept, because digital information was just non-existing.

The way he defined it, that I thought really was succinct and valuable is “if information equals resolved uncertainty, entropy must be the uncertainty needing resolving.” What you can deduct from that is that information equals resolved uncertainty. Uncertainty is entropy. Therefore, information equals reduced entropy, right? That’s the first big step in trying to connect thermodynamic entropy to informational entropy. You end up with an equation where the more that you increase thermodynamic entropy, which is the more that you’re expending real-world physical energy, the more you can reduce informational entropy, which is another way of saying, the more you can create structured, utilizable data.

Before I move on away from information theory, just another side that I came across in my research was, since Claude Shannon’s original theory, in his original white paper, there have been a lot of subcategories of information theory, and they’ve been applied to many different fields. One of them is actually behavioral science. It’s interesting from that perspective, because I think a lot of Bitcoiners really geek out on some of the behavioral science aspects.

It’s becoming a bigger part of economic theory, too. There’s behavioral economics now that has become more invoked, since guys like Daniel Kahneman came about in the 1970s, 1980s, and started to popularize it then. From the behavioral science perspective, they were trying to solve for what consciousness is.

That’s just pernicious difficult thing, amorphous thing that we’ve tried to define as humans for many centuries now, and from a neurological and behavioral science background, they decided to bunch up consciousness into two key categories, which is our ability as humans to differentiate, which is to break down the whole into its constituent parts, and then integration, which is understanding the connection of these parts and reintegrating them.

Really, you can’t have consciousness without both of them. You can have intelligence with one or the other, but you can’t have consciousness without both of them, at least by this theory. I’m bringing this back to the relevance of this conversation is that when I was reading about that, it turn on a light bulb for me when it comes to praxeology. Praxeology, it’s a concept, it’s a philosophical concept, I guess you can say, regarding human action. You only really find it used within Austrian economics.

Again, there’s probably a number of Bitconers in here who might be familiar with the term, who might be familiar with Austrian economics. For those who aren’t, it’s essentially a term that was corn by Ludwig von Mises, or Misses, I never know how to pronounce it. Essentially, it’s the first principles of Austrian economics, which is that it assumes that humans act out of their own set of goals. Those goals are always base conscious desire, conscious belief system.

When I started to think about how to integrate this with information theory, so if consciousness is a form, of course, a form of information, and it’s a form of reduced entropy, which is structured information, then if you have a system where that information is being manipulated, where that information is losing its signal, then you have a huge problem in terms of our ability to base our human behavior in a efficient way regarding our economic goals.

Basically, consciousness is reduced to entropy and if economics is the application of human actions towards goals and values. If the input to that belief system arise at goals that are flawed, because of the way our monetary system is structured, then the whole system devolves in error, because we are all making decisions based on what we believe to be rational, but the information that we’re using to come to those conclusions is wrong. Our first principles are wrong.

What’s scary about that is you can go a long time in such a manner without realizing how bad it is, because we’re all suffering from the same input problem. We’re all receiving flawed information simultaneously together. That’s how I tried to tie together – I know this is all mouthful here. By the way, CK, just I can ramble. Pause, ask questions, whatever you want to do anytime. I’m getting I’m going off the deep end here.

[00:12:22] CK: I thought that was great, by the way. Maybe you even want to just, the last part, maybe just to repeat that one more time. Because I think, that’s where we are right now. That’s what you just described.

[00:12:33] AS: Yeah. Basically, a very fundamental concept in economics is to boil down like CK is saying, a fundamental concept in economics is that we base our decisions, whether or not to consume, whether or not to defer consumption, whether or not how and where to allocate resources based on a belief system. That belief system is based on our personal motives and goals. If that is based essentially, from our conscious state where we are taking differentiation and integration of our world around us, and if that world is being obfuscated by bad money, then our rational, or seemingly rational decisions will not be actually rational. They will seem that way, and they will seem that way for a very long time.

This is why I think Bitcoiners love the whole matrix analogy, because it’s exactly what that is. It’s a world that is internally accurate, but not real. I guess, you can go down a real deep rabbit hole and say then, what is reality? Reality is what we make of it or whatever. I’m not even trying to get philosophical here. You just have inputs that are manifested from an outside source, like they’re manifested, not from our own actual action and behavior that is bootstrapping it. There’s this external input that’s driving it.

That, we in turn are reacting and basing our behavior off of that information. We are doing so, and it’s creating flawed allocation of resources. Where does that leave us? I think, this is why this concept is only going to become more interesting actually, as we, I think, become more tuned to the interplay between energy, in real-world energy and money.

Of course, that will become much more apparent when we start to see how, for example, mining, which is a completely different rabbit hole. I don’t think we have time to get into that. How mining can bootstrap as a first and last resort buyer. Always, a number of you in this chat are familiar with some of those ideas. There are people who are far better than I am at explaining them, so I’m just going to leave it at that. I do think as we become as a society, much more aware of the interplay here and how energy and money are just inextricably linked, because I don’t think that’s a given. I don’t think people realize that. That’s going to be key.

If the 21st century is really the century that we’re going to see information as the scarce resource, information is what we need to harness. That’s in comparison maybe to the 20th century, where carbon energy was really what bootstrapped society and bootstrapped human productivity. If that’s the case, then we need to ensure that the economic activity is not wasting the energy itself. That’s exactly the problem with monetary entropy, which is really, the crux of this equation.

When there’s monetary entropy, you have a system that starts to leak. A system that leaks, thermodynamically speaking, is on sustainable. What is the equation? It sounds a lot more complicated than it is, honestly. Again, think of it more as a mental model. On one side, you have thermodynamic energy. I’m going to get into some aspects of the equation, because we only partially defined some of it so far, but I’ll just give you the full equation first.

You have thermodynamic energy raised to the power of, in this case, you’ll see X, and X stands for human innovation, or productivity. What I mean by that is that’s essentially just technology. It’s an input of technology, a variable for technology. The reason you raise it via power law is because that’s how humanity scales. We take thermodynamic entropy. We basically take resources, we utilize them. Then we leverage our innovation to utilize those resources to a greater degree without needing further input. For any given input, if you have a greater power law, that means you have greater innovation associated with that.

You take thermodynamic energy, you raise it to the power of innovation, and that equals the negative of informational entropy. What I mean by that is that on the other side of that coin, the more energy you’re utilizing and the more productivity you’re scaling with that energy, you have negative entropy, which is on the informational side, which is what I’m saying without it is that you’re taking information and you’re making it more structured.

You’re creating something out of it. What are humans? Humans are just little pockets of reduced entropy within a world that’s constantly scaling up with greater entropy. There’s this physicist, Brian Greene, who has a great quote. I’m just going to paraphrase it here. He basically calls it the entropy dance, which is the universe is essentially, on this timeline of greater entropy. Actually, that’s how a lot of physicists defined time. Of course, Bitcoiners also have this weird association with how there’s this intuitive association with Bitcoin in time.

Entropy is actually from a physicist standpoint, the only way that we can define what time even is. The only way you can actually determine time, other than just – as a human concept, is there’s an era of time that’s based on entropy going from a lower level to a higher level over time. That doesn’t mean there’s not pockets of reduced entropy that form around that. That’s all of what human progress is. That’s all of what geological progress is. That’s what a planet is. That’s what the solar system is. We can do that on our small scale, too. That’s what I mean on the right side of that equation when I refer to negative informational entropy.

That’s what we are creating with physics on the other side of that. Now, there’s one little variable that I haven’t mentioned here, which is that when you raise thermodynamic entropy to the power of human and innovation, there’s another variable in that human innovation. Exponent, which is monetary entropy. This is really what the crux of the whole problem is. Because money is a transmission mechanism, but it’s also a technology. A technology, that if it’s allowed to function at design, will allow information to scale. That’s why you have to raise thermodynamic entropy to the power of that as well, because it’s just like any other technology. It’s something that can either increase productivity, or inhibit it.

We will define just for simple purposes, and what I did in this article is defined monetary entropy as a long-term inflation rate of that money, of whatever money system in question that you’re talking with. In this case, let’s say, we’re talking about the dollar. Now, and it’s a tricky definition, because then you have to define what inflation is. I think, a lot of us in here understand how slippery slope that can be. There’s some arbitrary metrics, like CPI. None of them are perfect. They all have imperfect ability to actually assess inflation, because inflation is something that’s subjective. It’s something that is not based on an aggregate level of data. It’s based on a fluid system, where prices are constantly fluctuating.

Just for simplicity purposes, just think of it as an inflation rate of money, whether that be the growth of a money supply, whether that be some aggregate inflation mechanism, but it’s some form of leakage to the system. If you have thermodynamic entropy, and you have a lot of innovation, that’s great. You’re creating a lot of negative informational entropy. That means you’re creating a lot of information that can be utilized. It’s good for society. It’s good for productivity. It’s how humanity scales.

If all of that is being obfuscated by monetary entropy, which we’re subtracting from that power law, you end up missing out on so much of that human potential. In some ways, you could completely negate it. That’s something, guys like Jeff Booth are really amazing at articulating is how technology is deflationary, but monetary inflation is basically this hamster wheel that we’re on that’s basically, we ended up spinning our wheels, because we don’t allow that innovation to flourish. We don’t allow it to do what it would otherwise do.

Maybe it does what it wants to do in certain fields. Maybe certain areas, we see massive technological innovation, massive deflation, but that ends up getting counterbalanced by some massive inflation in some other part of the world. A great example of that would be Moore’s law, reducing the cost curve of semiconductors, but simultaneously, healthcare costs and education costs have gone through the roof, and real estate and all sorts of other things that have completely negated the benefit to humanity that may have otherwise caused.

Basically, you have this leakage in the system. When there’s no leakage, when you have a pristine money that has zero entropy, everything can transmit from one side of the equation to the other fluidly, without anything obfuscating, without anything, getting in the way. That is really the aha. That’s the crux of this. That’s why I think money that can scale in this way, and it can scale not just as a store of value, but as a medium of transmission and as a medium of specialization, which we can get into in a little bit what I mean by that. That’s really the crux of why this is so different from just digital gold. Before we go on, I’ll pause there.

[00:21:47] GS: Aaron, first off incredible. Super, super smart. Do you think that inequation or inefficiency is like a purposeful, tactical thing? Or just a literal inefficiency of a money market?

[00:21:58] AS: Yeah, that’s a good question. I tend to believe that – I think, everyone in the system – Not everyone, but I think, there’s a lot of people in the system that generally genuinely think that the system we’re in is good, is righteous, that everyone’s just doing the best they can. I tend to think that these mistakes occur at the margin and over time and they compound. Because a great example of that, you can put together a system where you say, okay, “We need more money because we need to fund this or that thing.”

Then of course, a lot of that is war and bad things, of course. There’s also good things. There’s social welfare. There’s actual goals that are ideologically valid. What happens is people don’t see the long-term compounding effect of that one little policy, right? Then that puts you in a path dependent system, Because that involves creating more debt. Then when you create more debt, you reduce the money velocity. When you were just the money velocity, you need to print more money to create more GDP. When you do that, you need more debt and then you end up in a debt trap. Then everything else becomes even more path dependent, because you can’t go back. You can’t stop.

You have all these well-meaning people who maybe made decisions along the way that were incremental, or incrementally detrimental, but they’re well-intentioned, but they put us down this path. Now we’re on this path that we can’t get out of. That’s actually a big theme of another article I wrote, where I really talk about, it’s called Revenge of the Nodes. It’s one of the more recent pieces I did, which really talks about the deterministic path that we’re on. There’s really no way out. The only way out is Bitcoin. Honestly, I’m not saying that just to talk our own book here. I genuinely haven’t come across any alternative from an economic, from a societal standpoint.

I think that’s why we’re all here. I think, we all know that. I don’t think it’s purposeful. I think, it’s just the nature of the system. There certainly are negative actors involved, but I don’t think it’s purposeful.

[00:23:46] GS: If I can actually add to that real quick, is that humans, particularly on a long enough time scale, humans are a product of their environment. The incentive structure of the legacy system is just bad. It’s just a horrible incentive structure that leads to certain outcomes. What’s funny is that, when we debate, or talk about whether or not these actors are malicious, or if they’re just incompetent, or they’re just responding, they’re naïvely responding to the incentives without any judgment. I’m just a good banker. These are the policies that make a bank survive in this environment. It just so happens that I’m leveraged 40 to one. That’s a terrible outcome, but they responded properly to the incentives to become a successful bank.

There’s a degree of whether or not they’re malicious or good from an intentions perspective. If the results are the same, does it really – I think, we’re in an environment of terrible incentives. It’s more likely that will even create bad intention to actors, people who are simply there to abuse the system. Now, bad people, almost never think they’re bad people. That’s why “evil” is so dangerous. It’s almost done almost always done righteously. I agree, this is fundamentally an incentive problem. It’s a structural problem.

Our economic system is just fucked six ways from sideways. The only way to fix it is systemic incentives correction. The only way to do that is to start with the money. Without Bitcoin, there’s no fixing the incentives. You’re just wiping clean and starting from scratch on a bad incentive system, because you’ve led to the end result, which is destruction. Otherwise, we just go down this whole path all over again, and we have enormous amounts of pain in the short-term, just to kick the can for a whole another century-long, or 70-year cycle or whatever it is. Or we fix the incentives. We fix the money. Obviously, that is what Bitcoin is, and that’s why it’s such a profound innovation when you look at it from that context.

[00:25:49] AS: Yeah. I think that’s spot on. At some point, if you start talking about, if you bring morality into this conversation, or ethics, you allow people to hide behind things. You allowed people to have a high-time preference with that, because you can say, “Oh, that might all be well and good, but in the short run, we need to do this. In the short run, we need to solve for this.” We see that with what’s going on in the ESG movement. Then, of course, there are valid concerns about the environment, but then people misuse them, people misread them.

Again, it gets back to what Guy was just talking about with incentives. I’ll read something from the article itself to touch on this a little bit. The crucial realization is it concerns the important paradigm shift inherent to Bitcoin is as follows. Fiat money involves a net increase in entropy. This cannot be overstated as it is imperative to the articles thesis, such a conclusion is reached despite money theoretically being a form of information that should reduce entropy when applied as intended. However, fiat unfortunately is not money as money was intended. Inflation, centralized, and this is the key part that gets to motives in the incentive structure.

Inflation, centralized, and thus arbitrary control of the rules of supply and attempts – also controlling demand via administered risk-free rates, via global exchange rate volatility and competitive devaluations, mercantilism subsidies, free debt supporting zombie industries, opaque and uneven taxation enforcement, and many other behaviors, all conspire to create an aggregate equation of massive entropy and fiat money of economies.

Again, none of those things that I listed, they’re all horrible. None of them are like, because of one bad actor, or one bad intention. They’re all just a result. They’re all a consequence of that, of a bad system. I think, another thing that’s key about this too is, and this is something CK and I have talked about. I think we did another space is on this at one point. Obviously, there’s a lot of crazy signs about inflation. Now that’s a whole different conversation I’d love to have some point. Putting that aside, even if we were dealing with 2% annual inflation a year indefinitely, not only is the math of that extremely deleterious on just from compounding perspective, right?

Even if you lose your value 2% a year for 20 years, that’s a horrible situation to be in. From a thermodynamic system, taking this back to the equation, of the article, there’s actually, I think it was a Robert Breedlove, Michael Saylor interview, where Saylor gets into – because he’s got his engineering background. He likened it to an adaptive control system. I’m not an engineer. I have no engineering background, but he basically said, that’s a common engineering term. It’s a structural way that engineers go about trying to solve a problem. Adaptive control system requires a few things in order to be effective. It needs negative feedback.

Basically, it needs a system that has volatility, right? It needs to be able to receive volatile responses in order to react and adapt to them and adjust. That gets back to anti-fragility, which we’ll get into in a little bit. You need that and you need a variable to control. You need to actually define what you’re trying to control. In this case, Saylor absolutely noticed, that’s a correct ledger, right? That’s what the blockchain is. The variable you’re trying to control is the correctness of the ledger.

Then the third variable that you need is a low error rate. This is what’s key to the purpose of this conversation specifically, an error rate is just, when you have a system and you want it to have a long-term degree of integrity, from a thermodynamic perspective, you can’t have just a leakage of energy, because that compounds over time.

Imagine if you’re an engineer and you’re trying to take an internal combustion engine and you’re trying to make it more efficient. You’re trying to make the same amount of energy input create a greater amount of horsepower as an output. Meanwhile, your tank is leaking 2% oil per day, and this is, I’m basically paraphrasing Saylor’s analogy here. This is not my own. I thought that was just so perfect, and it’s so related to the whole crux of this article, which is so even if you don’t have hyperinflation, or some high level of inflation, if you’re losing even 1% of the system’s energy input per day, it’s just not going to last.

Not only will you not increase productivity, which by the way, just so the point on productivity and I talked about that scaling function, right? You need to raise thermodynamic energy to the power of something. That power is human innovation, which is basically another way of saying, productivity. Productivity, we actually just got our third quarter of 2021 productivity numbers yesterday. I believe, it was the lowest level since 1981. We have workers working in more hours and producing the same or less output.

By the way, productivity, this is not just a one-quarter phenomenon. This has been a consistent, long-term, structural decline that’s really been confounding economists for decades. I remember having this debate in 2007 with people trying to figure out why is productivity declining? We’re in this golden era of the digital information technology, so why is productivity so weak? Productivity is weak because of the incentive structure that I was just talking about. The incentive structure is bad, because you have a high error rate. You have energy leaking out of the system.

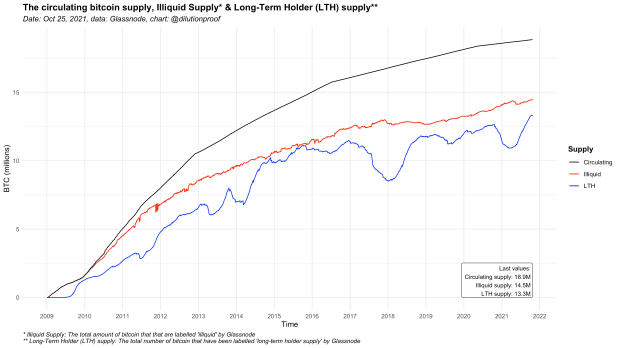

Yeah. The bottom line here is that fiat money always has a monetary entropy above zero and Bitcoin always has a monetary entropy of zero, period. That’s it. It never goes. We’ve never had that in any monetary system ever. Therefore, this equation can scale indefinitely.

[SPONSOR MESSAGE][00:31:27] ANNOUNCER: Yo. What is going on, plebs? We’re going to take a break from our programming to tell you about the resurrection of our print magazine, starting with the El Salvador issue. Starting this fall, Bitcoin Magazine will be available on newsstands nationwide, and at retail stores, such as Barnes & Noble.

Don’t want to get off your couch though? No problem. You can also go to store.bitcoinmagazine.com. Skip the line and get each issue shipped directly to your front door with our annual subscription. I’m talking four issues a year that contain exclusive interviews and profiles with leading Bitcoiners, actionable insights on the state of the market, breaking news and cultural trends, along with powerful photos and artwork from the best artists in the world.

Subscribe today and get 21% off using code PODCAST at checkout. That’s P-O-D-C-A-S-T. PODCAST at checkout.

[EPISODE CONTINUED][00:32:22] CK: You talked about all the pitfalls of monetary entropy. Now you said, okay, Bitcoin fixes this effectively. That enables human productivity and to scale indefinitely. I feel like, we need to dig into that a little bit more.

[00:32:38] AS: What I meant by that is that, the only thing stopping you at that point from a societal perspective is your own innovation. There’s nothing getting in the way. There’s nothing obfuscating it at that point. There’s nothing to say that this can’t continue to scale. This actually gets into what I was just about – the second little rabbit hole I was going to go into, which is that an implication from this equation is that the systems inputs, which are that thermodynamic energy on the left side of the equation, exhibit greater scarcity over time.

That’s where people talk about resource scarcity. The whole concept of why resources are even scarce to begin with is because there’s entropy. If there was no entropy, if the law of physics didn’t entail the second law of thermodynamics, we wouldn’t have a problem with resource scarcity. Entropy means that energy can only move in one way. We use energy and we create order out of disorder. We can’t then go back. There are systems that we can create. That’s part of what innovation is. You break an egg, you can’t put the egg back together again. There’s only a limited amount of resources as a result of that ever increasing degree of entropy.

Why does this matter? If the money is supposed to be a shock absorber to all of this, right? As we use more resources, in order to make ma make it so that humanity uses resources intelligently and applies them non-wasteful way, you need something to absorb the scarcity of all of that entropy. As I say in the article, if money is not permitted its intrinsic capacity to absorb this scarcity, other resources will need to fill that void. This increases the cost of information production, because there are fewer and fewer sources of increasing thermodynamic entropy from which to convert into decreasing informational entropy.

What I mean by that is you start to lose the price of all of those inputs, the price of all that thermo – The Bloomberg commodity index is up 50%. Oil is up 43%. Gasoline prices are up 50%. This is versus pre-COVID levels. Not on a year-over-year basis. Natural gas prices in the US are up a 160%. UN food price index is up 40%. Base money supply is up 35%. Housing prices are up 20%. Rent prices, I believe, are up 18% though. They obfuscate with the owner equivalent to rent and the CPI number, which is a bullshit number. All of these things, all of these finite resources are what starts to absorb the monetary entropy that sound money should be absorbing instead. As a result, getting back to your question, CK, you can’t scale as well because things become cost prohibitive.

The innovation becomes throttled by that. Resources that are meant to be utility goods, that are meant to actually be used end up being stores of value. Real estate is a utility good. Yes, it’s an income producing property, but it is meant to be a dwelling. It is meant to be an object of utility. That’s a whole different conversation. The point is that even when there’s innovation occurring, it’s done in a really centralized and lopsided way, where because – Yeah, please go ahead.

[00:35:45] MG: I wanted to interject right here, because Saife talked about this and he’s got a whole section in his new book, Fiat Standard. One of the things is that when you’re talking about, when you see nominal values of things increase, the level of monetary entropy that is resulting from this is not merely in, like you’re saying, it’s not just in the fact that you’re losing the savings in the communication of any value over a period of time, but it’s also giving the appearance of profitability to things that aren’t profitable.

A house is actually a maintenance heavy thing that is purely for utility. The idea of holding it as a store of value is actually a terrible idea. A house is a liability. It is not an asset. Unless, you are renting it out, unless it’s an apartment building or something that is generating income, it is just a consumption good. Just like having a sandwich, or a car. That’s all it is. Yet, the appearance of it having a nominal return, where the number is going up, even though its real value return is not positive, leads to so much misallocation of resources and to stuff that is not innovative.

Buying and sitting on a bunch of houses does nothing for the economy. It does nothing for progressing humanity forward. It’s not actually producing a return. It’s just producing nominal gain. Your number count is just going up with the amount of money and new debt being created in the system. The sheer amount of capital time and labor that could go to an innovative purpose, to something that has real gain, that’s actually a productive company producing some positive good for humanity is completely being bastardized. It’s being soaked up by all of these nominal returns in just holding stuff, in wasting commodities, just to sit on them. People talk about, oh, inflation – not inflation, but deflationary currency that goes up in value means people are just going to hoard it.

That’s a great thing, because money is not a productive asset. Of course, you want somebody to hoard money and not a tractor, a house, something that people actually need. If the value of the money is going up, that means everybody’s income is going up. It’s just a tally. You’re actually not getting in the way of allocation of real resources and consumption goods that people desperately need to better their lives.

You’re not you’re not screwing up the price system by buying something that you actually don’t have any demand for. You don’t need another house. You’re just parking value. Whereas, the flip side of it is it’s oh, if the money is inflationary, oh, we’re going to invest it. No, they’re not. They’re just going to hoard assets. They’re just going to take things that people need off of the market. The rich are just going to hoard it, so that they don’t lose money. The distortion of that is in trillions and trillions of dollars. Stuff that in a matter of five years, allocated in the right direction could have huge societal benefit and is instead, is just buying up real estate.

It’s incredible the amount damage, that even a seemingly minor monetary entropy, or disincentive can cause, because there are second and third order effects that make things appear profitable that just aren’t, that have no actual value or use in society, because you’ve destroyed the function of money. You‘ve destroyed the means of communicating that value. Everybody’s just spending all of their time and energy on the business of translation, which is solved by money. Now, it’s a new problem in society again that’s not there, unless you put unnecessary entropy in the money.

Anyway, I just wanted to add that I actually have – I’m at 13% battery and I’m at TabConf right now, just sitting in the corner. I thought I would have my battery pack with me and I’m stupid. I’m going to have to shut down my phone, so that I have enough battery power to get an Uber out of here at the end of it. I’m sorry, I was only in here for –

[00:39:44] CK: Thanks for joining, Guy.

[00:39:45] GS: 15 minutes to hang out.

[00:39:46] AS: Thanks, Guy.

[00:39:47] GS: Thanks, guys. Take it easy, you all.

[00:39:49] AS: Just to add, by the way Guy does a reading of this article. If you guys are like I am, prefer to listen to your words. On Bitcoin Audible, he has a reading of it and he has his Guy’s Takes, which are awesome. Yeah, everything he said is spot on. I actually see someone wrote in here, they were shocked at my statistic that I gave about productivity being down.

I think, this is a really misunderstood concept. This is why even some of the smartest economists out there really get confused by this concept of why productivity is declining over the long run. Just to be clear, it is a very volatile statistic when used, because the way that it’s defined is like I said, it’s hours worked relative to output. All of these things are so abstract, so let’s break it down for a second here. It’s like, why is productivity problematic with a highly entropic money? Why is it so important for productivity to scale, to have a money where the ability to save it is pristine and why its transmission mechanism being completely transparent is so important.

Let’s talk first principles here for a second. There’s really only – when you really break it down to its bare bones, there’s only two sources of human prosperity. Two arrows that can cast this forward, from caveman into wherever we want to go. One is savings, which is another way. Economists call excess consumption. The other is specialization, and they’re inextricably linked. The reason that they’re so linked is savings is necessary. It’s your pool for investment. It’s your belief in the future. Up until agriculture and I guess, our ability to create surplus through agriculture and animal husbandry or the domestication of animals, we didn’t really have extra savings, right?

We were just hunter gatherers living hand-to-mouth and going through in this cyclical process. There’s a really interesting study I came across from NIH actually, which got into – there’s a lot of debate as to how the agricultural evolution route evolved, like what caused it and why it evolved basically throughout these disparate parts of the world and all of these completely different societies simultaneously.

It’s amazing when you think about it. These are all people that never interacted once and yet, they came across the same conclusion on a scale of hundreds of years from one another, which, in the timescale of humanity is basically, no time at all. One of the conclusions they reached from this article, whether you believe it or not, I just found it to be interesting was that we thought that – I think there’s a pre-existing belief that agriculture was a result of societies that were struggling and that needed to innovate their way out of that problem.

What they found, actually, it was that societies that moved from hunting and gathering into agriculture, were actually prosperous societies. What they did was they were basically, trying to solve for robustness against uncertainty. That’s what storing value was. The reason I’m bringing this back to specialization and savings is that when you have excess savings, when you have that cushion against uncertainty, which of course, we’ve take for granted now, but all societal collapse is previously were a result of lots of exogenous outcomes occurring that really blew up these the societies. They were very sensitive to volatility. They had that negative feedback in their system that told them, “Oh, it’s important to save. It’s important to have this.”

Then once you can do that, and once you have those excess savings, you suddenly have the ability to start specializing. There’s that parable of the primordial fishing island, where you have this – just this tiny little economy of two fishermen fishing. Only when you have excess fish that you’re no longer consuming, can one of them invent some new skill. Then, that new skill creates more surplus. Then that creates new innovation, and so on and so forth. It’s something we just take for granted at this point.

Actually, there’s a lot of great work from a lot of Austrian economists that talk about how a lot of new Keynesians and monetarists have really changed the narrative, that savings is usury, right? The saving is bad and consumption. That’s such a classic example of a bad system, where we’re punishing savers. Is that if we save too much and there’s no money velocity, money can’t scale. I see people, there’s this big altcoin economist on Twitter. I forgot her name, but she got all these PhD credentials. I don’t think she’s ever worked a day in her life, actually investing or anything. She’s always talking about how Bitcoin is horrible for society, because it’s never going to scale and there’s going to be no money velocity.

Guess what? Our current system right now is horrible money – I wrote down the stats here. By the way, money velocity is when $1 produces more output. If you have a dollar in the system and you have money velocity of two, that means for every dollar you put in the system, it creates $2 worth of GDP, right? When you have declining money velocity, you need more and more dollars to create the same amount of GDP. That’s how you really get bad inflation. It’s also how you get bad productivity. More importantly, it’s how you get into a debt trap. A debt trap is what we’re in.

Unequivocally, I don’t think anyone who really knows anything about economics would say differently. When you come across anyone who tells you that Bitcoin is going to decrease money velocity, because it’s just going to make everyone hoard and save as if that’s a bad thing, point to what’s going on. What’s going on is that you have money velocity plummeting from, I believe, the pre GFC, pre great financial crisis range was around 1.8 times to two times. Now in the US, we’re at 1.1 times. We’re basically getting close to breaking that one-to-one ratio, which would be horrible.

Japan, in comparison, their money velocity is at 0.4 terms. That started at around 1.6 times back in the late 1960s, early 1970s. Europe it’s even worse. They’re also below one time. 0.8 times and they were back 1.8 times in 1995. China’s even bad. China’s at 0.5 times versus 0.8 times in 1998. The only reason that US velocity is better than all of those is because we’re the reserve currency. We have more avenues for global lending, despite these trends.

If you think about Bitcoin in comparison, why would the opposite system to this also have a low velocity? We have a system that is requiring more and more debt and more and more money printing for each dollar of output that we want to produce. We need more of those dollars of output to basically, fund that debt. It becomes this really bad, vicious cycle. The question to ask is, why would it not be the opposite? Wouldn’t it be more intuitive that the opposite of a debt trap would actually involve an increase in money velocity over the long run? Once Bitcoin is monetized, once we’re actually in a system where the Bitcoin is the unit of account.

Trying to take this back to what Guy was saying, and really bringing it into something that’s tangible, let’s talk about the current problem that we’re in and why productivity in this particular quarter was so bad. Like I said, you had more hours worked for the same amount of output, and that’s why productivity plummeted. We all know, we’ve all been reading all the headlines about this labor shortage. I’m actually working on a piece all about this. I have lot of views about why this labor shortage is structural, but that’s a whole different rabbit hole.

Let’s just take it as a given for the moment, that at least we have a labor shortage right now, and that’s affecting our ability to be productive. How could Bitcoin help this? How could Bitcoin help this? First of all, like I just said, when you have more debt, you have less productivity. It’s just a classic outcome of the production function, which is you have labor, capital as your inputs. If you have too much capital, you crowd out labor. You crowd out labor’s ability to be productive.

When you don’t have savings, then people don’t have the ability to specialize into new avenues. People don’t have the ability to say, “I’ve saved what the Wright brothers did.” I think, Guy was talking about Saifedean. Saifedean, I heard a recent thing where he was talking about the history of avionics and the history of the airplane industry and how we saw so much innovation for so many years. Then I just stopped in the early 1970s. One of the Wright brothers do, he used them as this classic example. They had this excess savings from this little business that they had, and they started tinkering.

I think, they were bike mechanics or something and they started tinkering and that’s how they developed the first planes. That’s just a silly example, but savings are absolutely necessary for people to specialize into new avenues of innovation. We take it for granted, but it is absolutely vital. If you don’t have that, then you end up just using more and more debt, but more and more debt actually inhibits productivity in the long run.

It may increase productivity from the borrower, but it’s stealing it from somebody. On a net basis, it’s decreasing it. Okay. you need lower debt. You need more savings. Okay, Bitcoin, done. Number three. When you don’t have as much savings, you need to go further on the risk curve. This is what Guy was also talking about, is what I was talking about too, about how other stores of value, like utility goods starts to take over. People have to go further on the risk curve. I think, we all intuitively understand now that equities are now the store value. Equities are people savings.

People don’t save. They don’t buy bonds. They don’t save in their time deposit accounts. They buy equities. That’s the only way that you can keep up with the money printing that’s going on. The problem with that, and not just from a risk perspective and a systemic perspective, the other problem with that is that’s time consuming. Because now you’re saving in a risky asset. In order to not get wrecked, you basically have to know what the hell you’re doing. That’s time-consuming.

I’m a professional investor. I do this every day. If I don’t have time to do other things, right? If I want to go out the risk curve and save all of my money in more risky assets, that’s time that could be spent doing something else. It must now be spent in portfolio management, just your everyday average person. The next problem is price discovery. When you have a monetary system, this gets back to the whole equation. When you have a monetary system that mis-allocates the pricing signal and that transmission mechanism for pricing that is flawed, then people can’t make appropriate decisions as to where to allocate their capital. That of course, has a horribly detrimental impact on productivity.

Another weird thing is healthcare. You wouldn’t think that healthcare plays in as well. Healthcare is this weird thing where we’ve seen – Essentially, we’ve seen hyperinflation in healthcare and actually, in my business and my industry, this is all we invest. We invest in corporate debt of healthcare companies. These are horribly run companies that haven’t innovated or done anything good. All they do is take advantage of a system that is incentivized to extract value from just raising prices, through our healthcare system.

That’s something called – it’s a very well-known problem. It’s called Baumol’s cost disease, actually, which is when – it’s like a free rider on inflation. You ha you have something that’s not actually innovating. Because all of the innovation occurring elsewhere, they’re able to raise prices, because they can’t hire talent otherwise. No one’s going to go work in the healthcare system, unless they earn the better wage, even if they’re not actually being more productive.

What does this have to do with our ability to specialize further? If healthcare inflation is so dramatic, then everybody needs to attach themselves to an employer who can provide healthcare coverage for them. As a result, you end up working maybe in a job or a role that you otherwise could grow out of, but you’re afraid to, because you have a family, you have two or three kids and you got to make sure that your healthcare costs are covered.

You ended up having to work for someone you can’t be as entrepreneurial. You also are probably stuck in a job where you’re working 9, 10 hours a day and doing one particular task. When you could be spending that time doing two or three or four tasks. You could be have a micro job. You’d be doing multiple jobs, but you’re stuck in this one little pigeonhole of a situation. What’s interesting is I think, working from home is creating along with a digitally scarce money that can scale and allow us to specialize.

I think, even stuff work from home from a cultural perspective is going to improve our ability to specialize further. For example, I have a job and I’m on this call right now, doing this. Because I’m working from home. Education is another problem, too. Education is also experienced Baumol’s cost problem. It’s hyper-inflated there over the last 30 years. If education is too expensive, people can’t learn new skills, new skills that they otherwise would learn to innovate and create new productive skill sets for society. It’s a mouthful, but I just wanted to put some concrete specifics into why this matters.

Because I know this is all – can sound academic, or can sound highfalutin or whatever, but there’s real world applications as to why this is a problem and why Bitcoin can actually fix it. I’ll take that as another opportunity to stop and if anyone wants to jump in, or chime in about anything.

[SPONSOR MESSAGE][00:52:42] ANNOUNCER: My fellow plebs, the Bitcoin Conference is back. Bitcoin 2022, April 6th through the 9th is the ultimate pilgrimage for the Bitcoin ecosystem. The Bitcoin Conference is the biggest event in all of Bitcoin and cryptocurrencies. We’re leveling up and making this bigger and better than ever. I’m talking straight to the moon with a four-day long festival in the heart of Miami at the Miami Beach Convention Center.

This has something for everyone. Whether you’re a high-powered Bitcoin entrepreneur, a core developer, or a Bitcoin newbie, Bitcoin 2022 is the ultimate place for you to be with your people and celebrate and learn about the Bitcoin culture.

Make sure to go to b.tc/conference to lock in your official tickets, and use promo code Satoshi for 10% off. Want more off? Pay in Bitcoin and you’ll receive a $100 off general admission and a $1,000 off whale pass. Those are stackable, so go to b.tc/conference and attend the best conference in Bitcoin history.

[00:53:48] ANNOUNCER: Yo, my fellow Bitcoin lovers. I’ve got something specifically curated for you. The Deep Dive is Bitcoin Magazine’s premium markets intelligence newsletter. This isn’t some paid group shilling by and sell signals. No. This is a premium Bitcoin analysis led by Dylan LeClair and his team of analysts.

They break down in easy divestible way what is happening on-chain, in the derivatives markets and in the greater macro backdrop context for Bitcoin. These loosely returns volatility into a joke. Hit up members.bitcoinmagazine.com and use promo code podcast for 30% off The Deep Dive. That’s members.bitcoinmagazine.com, promo code podcast for 30% off. Divorce your pay group and learn why Bitcoin is the strongest asset by Dylan LeClair and his team.

[EPISODE CONTINUED][00:54:38] CK: P, Mark, [inaudible 00:54:39]. One of you guys want to jump in?

[00:54:41] M: Yeah, I just wanted to say, we had a spaces last night and Dina and Tina were talking about the being careful about tying inflationary or hyperinflationary, using these trigger words to talk about Bitcoin’s success and how it’s really not necessary. I think, you nailed it earlier where you’re like, “2% is enough entropy leaking from the system to cause these physical outflows.” I really love your analogy of money having an inertia system and a physical system. Now that we’re at the third halvening, we’re inflating at sub 2%, 1.79% against supply issuance. Your theory is playing out exactly and we’re seeing it. I just wanted to say, yeah, I think you’re exactly on it.

[00:55:21] AS: Thanks, man. Yeah. I actually wrote an article called The Pitfalls of the Inflation Narrative, earlier in the spring, I think, or spring or summer. I’m totally with you there. It’s weird, because I think that there’s all these deflationary forces at play right now, in terms of – for example, we’re just talking about this labor shortage. Shortage of something that’s a supply on the supply side creates inflation. Right now, this labor shortage issue is creating this mismatch between demand. Eventually, over the long run, when you have a declining fertility rate, when you have a decreasing population size in a declining labor force participation rate, you’re going to have – that’s deflationary, and deflationary, not in a good, innovative way, but deflationary in a bad way. Especially for a world that’s not set up for that. We’re in a world that needs inflation to succeed.

You have these structural things that will create demand destruction over the long run and are deflationary. Our debt trap is deflationary, unless we just print. Eventually, we probably will need to just print our way out of it to an even greater – it will make what we did last year look like nothing. I think of it as if you think of a bell curve, as an investor, the reason equities did so well in the 2010 to the 2019 period, and from the last – and basically, our entire life. I was born in the early 80s. This entire era as an equity investor has been magnificent from a historical perspective.

The reason is because you had these pressures on inflation that kept inflation at bay. We were in this Goldilocks zone, from an economic standpoint, where we could get away with all this stuff. We could get away and we could hide it, but it was creating all of these imbalances in plain sight. My belief is that these imbalances still, even now, I think COVID accelerated them, but these imbalances still are not greater than for us to take our medicine. We’re only going to take the medicine when carrying these imbalances becomes worse than the alternative. The alternative is to correct them. The alternative is it is a Jubilee of sorts. The alternative is inflating our way on an even larger scale out of this.

In the interim, we’re in this weird, like I said, think of it like a bell curve and we were in this Goldilocks zone. The tail, the fat tails as they say, which were the black swan events. On the left side, that’s deflationary. On the right-side tail, that’s inflation. Those tails were really low probability outcomes, right? There was just a very low chance of any of those things happening. Asset prices did it inordinately. Now, I think the bell curve is changing its shape, and we have these fatter tails. The margin for error for Goldilocks has become so narrow.

The misstep that will take us into either extreme inflation, or extreme deflation, and that’s why I love, I think I think it’s Luke Roman had a great little quip about the Fed, which is that they think they have a dial, but they just have an on and off switch. I think, we’re saying the same thing. I’m just using this bell curve analogy. Basically, they will find that our ability to tweak policy, so as to maintain Goldilocks is becoming harder. That they will tighten it too much and they’ll create a deflationary burst and asset prices will start to crater, and that’s really completely unacceptable now. Our system cannot handle that.

Then, they’ll turn it off and they’ll turn it back on in the other direction, and then we create the hyperinflation. I hate that term, hyperinflation. When I think of hyperinflation, the way I like to define hyperinflation, especially for a reserve currency is inflation that once turned on cannot be turned off. To your point, even if that’s 2% or 3%, like it’s been, that’s still really damaging. Imagine if it’s 5%, 6%, 7%. Imagine if people start to realize that and realize that there’s a real 3%, 4% figure that’s being quoted in the financial press. It’s more like 5, 6, 7, 8, even maybe double-digit percentage.

When that mentality starts to shift in people, that’s when real problems. I think, you’re absolutely right, which is that it’s not necessary for Bitcoin doesn’t need Y Maher, Germany for Bitcoin to work. Bitcoin works for all the things I just said. It is a system. It’s a better system for a system that’s been broken for at least 50 years.

I agree with you that I hate it when some Bitcoiners tie the narrative too much to that scenario, because I’m not sure that’s the scenario that’s going to play out. It would be a shame if too many people believe that was Bitcoin’s only merit.

[00:59:31] CK: I completely agree, especially because I just find it dubious that the inflation narrative is being embraced. Versus all the other very logical explanations for why things are looking really bad right now. Let alone, criticizing their own policies. I’m very dubious of that and I think it’s definitely could be a pitfall. Like you said, the whole point of Bitcoin information theory is that Bitcoin is better information. Bitcoin is a monetary system that doesn’t leak. Bitcoin is the system that will enable people to perfectly communicate their desires without manipulation. That is going to enable a Cambrian explosion of innovation and productivity.

Aaron has done a really good job of explaining how our current system is destroying the indicators of the healthy system. Productivity is down. Money velocity is down, all of these things.

[01:00:22] AS: Yeah. Thanks, man. Yeah, I don’t know what our time level is, but there’s one last topic that we could end on, if we want to just go down and take this to its next logical conclusion.

[01:00:31] CK: Yeah, let’s close out the top of the hour. We got about 15 minutes here.

[01:00:36] AS: Cool. Like you said, one of the things too, that is implicit by the problems that you’re talking about, or that we’re all sitting here talking about is, that as a result of all of these imbalances, we’re in a system that is required to keep the time value of money in this completely distorted state. That’s through interest rates. It’s through interest rates setting, interest rate manipulation. I was listening to a really interesting podcast the other day with, I think it was John Vallis and Preston Pysh. They were going down the whole, where does this all lead rabbit hole, right?

Hyper-Bitcoinization and all this stuff. I don’t think they gave Nik Bhatia the credit, but I believe they were talking about his theory of a risk-free rate based on Lightning node fees and things like that. That he started talking about it presently back in 2018, and how that could be your risk-free rate. Absolutely, no disrespect to Preston Pysh. He’s awesome and he speaks right. I actually found it a little interesting that when Valis was pushing him on this idea about deflation being on the other side of this, how when you had finally a unit of account that was in Bitcoin down the road, that basically, he wasn’t applying this, but this has been my theory all along, which is that when you’re in a Bitcoin denominated world, the risk-free rate is just the rate of productivity in the society. Because the money in that system, in this case, Bitcoin is the one accruing all of the value of that deflation, right?

As productivity creates more for less, you end up having all of that excess monetary premium crew to the money itself. Let’s say, productivity is increasing at a rate of 2% per year. You end up having only having the incentive and this gets back to why savings are so important. You only have the incentive not to save, if the rate of return is greater than 2%. Because otherwise, you’re better off saving, especially – this is why I don’t even like using the term risk-free rate when we’re talking about Bitcoin universal interest rate. Because a risk-free rate implies counterparty risk. We all know that one of the amazing attributes about Bitcoin is that there is no counterparty risk, especially if you’re self-custody.

Of course, there are going to be various services along the way and various layers that adds, a counterparty and adds some degree of centralization. As a savings vehicle in and of itself, there is no counterparty. There’s no national entity. There’s no nation state. There’s no bank. As a result, the term risk-free rate loses its meaning. Just so that we’re all on the same page, when I refer to risk-free rate, historically what people mean by that is a steady state nominal rate of GDP growth over time. Being earned or being lent an asset, where there’s very negligible counterparty risk, or the lowest level of county party risk in that system. If we’re talking about the US government bonds, of course, we’re saying, okay the US government is perceived by the whole world to have virtually no counterparty risk, or at least up until recently.

Basically, the long-term risk-free rate should over time equal the steady state nominal rate of GDP growth. What is nominal GDP growth? It’s just your rate of inflation times productivity. If you take away inflation, getting back to the whole point of this conversation, if you have zero monetary entropy, and you have zero counterparty risk, then the only thing left in that equation to get your risk-free rate is productivity. If productivity is increasing at 2% per year, that means if you hold 10,000 units of Bitcoin, those 10,000 units will get you 2% more next year than they did the previous year. The only incentive you have to not save and instead invest, which is another way of saying consume that savings, consume it as an investor, as a lender, is if that hurdle rate is somewhere above 2% in that instance.

Because then you are introducing credit risk and counterparty risk, and you’re dealing with having to make a determination about the quality of the investment. This gets into the whole crux of why this is how capitalism is supposed to work, because if you’re that person deciding, do I consume? Do I invest? Do I save? That minimum threshold is the information. That’s the informational entropy that’s declining that you need to know to make that decision. That natural risk-free rate is your benchmark, and it should oscillate in real time. That should be moving in real time. It’s not set by the government. It’s not set by some central entity. It’s set by the aggregate information available to all members of that society.

When you have that information and when everyone has access to it, they can make much more well-informed decisions. As a result, they invest in things that are actually adding productivity to the system. This is where I get back to money velocity. Then, you start to see money velocity increase, because as long as there are opportunities to invest in, and as long as there’s people who are discovering ways of doing things that are going to create more abundance beyond that preexisting 2% rate of productivity that I use in this example, then there’ll be people willing to invest in them.

That’s what Vallis and Pysh were talking about. When the Bitcoiners stopped owning Bitcoin and start buying equities, for example. They’ll do that in that world, when there are equities that can provide adequate excess return over that rate of productivity. They will provide that rate of return and people will want to invest in them, because they’re adding productivity beyond that 2% of society. Then it becomes a virtuous system, rather than a negative feedback loop.

I thought it was really interesting that even a guy like Preston Pysh, didn’t want to go down that. This is nothing against them. I’m using this as an example to say, just how pervasive this idea of deflation is, even with Bitcoiners who spent five years down this rabbit hole. It’s so counterintuitive to imagine a system that’s actually deflationary, but that it’s actually adding productivity, but that’s exactly in my opinion, how capitalism is meant to work. That’s how zero monetary entropy money can accomplish that. I’ll end with that, then we can maybe take some questions, or however you want to end it.

[01:06:40] CK: Yeah. We don’t have much time. I did send a Bitcoin Tina a quick invite, just because I was on a Twitter Spaces with Preston and Tina and him were having a very similar conversation. I would be curious if Tina –

[01:06:55] AS: I heard that. I was on that conversation. I heard Tina. I want to hear Tina’s thoughts on this, because I actually agreed with a lot of what he was saying, and he was getting a lot of pushback on that call. But I do agree with it. Where I disagree is that I do think there will be – I think, I don’t want to speak for you, Tina, but I believe you were saying that there only be equity rate of returns and there won’t be a risk-free rate. Like I said, I think there will be an implicit risk-free rate. That’s a hurdle rate for everybody. I think, we were getting at the same thing. Yeah. I’d love to hear what you have to say.

[01:07:22] CK: We’ll see if he accepts the invite. He might be listening on a computer. Yeah. I don’t know. I guess, if you want to ask a question, please request. We probably can take one or two. Then we got to close this one out. All right. Wicked. What’s up?

[01:07:38] W: Hey, guys. Thanks for having me up here. Awesome conversation. Aaron, man, tons of a truth bombs you’re laying down and I’m learning a lot just listening from you right here. I had a question and honestly, I don’t even know where the answer would go, or if it’d be good or bad, or anything like that. I was wondering on a Bitcoin standard, what happens when productivity gets too hot, because of that positive feedback loop and rates get too high?

[01:08:04] AS: Wow, That’s an interesting question. I don’t think I’ve even really given that much thought, because it’s just – we’re so far from there that it’s hard to fathom. I think, if there’s a lot of productivity, that means there’s a large willingness to lend, actually. The savings rate should decline and you’re right, that will lead to higher rates. That’s how a naturally balancing system is supposed to operate. Essentially, if there’s not enough savings in the system to accommodate that and make it sustainable, I think that’s all it is you need to solve for robustness. You need to resolve for something that’s sustainable.

Again, getting back to Saylor’s analogy from an engineering perspective, a system that can’t just be maintained in perpetuity is not a system worth having. In your example, I think, if you have so much willingness to lend and such a belief in the future that people are willing to lend for that theoretical productivity, that seems to be increasing at an ever higher rate, then eventually, there won’t be enough savings in the system.

Then, the hurdle rate as a producer, as that innovator becomes, inordinately high, and you can’t really innovate beyond that rate. That’s the whole point is that the rate will actually just set to the point that innovation starts to go back to a more sustainable level. Or not even necessarily innovation, but the desire to innovate, the desire to try to produce something that may not be possible. Now, I’m thinking out loud here. I don’t know if there’s other ways around that. I don’t know if there is. It’s a really interesting question. If there’s just some inherent cap on rate of productivity. I don’t think there is. As long as there’s a system that can accommodate it. I think, Bitcoin can, just be by its nature of being perpetual.

[01:09:48] BT: Aaron, there won’t be lending in a Bitcoin world, there’ll be no lending. Everything will be equity-based. Your rate of productivity will be so high, your implied rates will be way too high. You’ll only want to invest where you can own something. You’re not going to be willing to sacrifice you before lending. You’re going to demand higher return, which you’re going to get from ownership. It’ll be an entirely equity-based world. I agree with you on productivity. I think, your estimates of 2% are way too low.

[01:10:15] AS: That was just a little – yeah, using that as an example.

[01:10:17] BT: Yeah. You’re going to have shockingly high – I don’t know if I’ll live to see that, but you’re going to have shockingly high productivity and shockingly high effective cost of capital, which will be very well directed in that economy.

I think, people think about this wrong. I think that the questions the Preston had raised in another room when I made the statement and said, what about entrepreneurs who demand to borrow in Bitcoin? I think, people will come to learn that you don’t want to borrow in Bitcoin, even in that world. That will be solved through pricing. It can easily be solved through pricing the value of the business. It doesn’t have to be solved, and pricing dividends and other types of things. I don’t think it has to be solved with that. I think, debt roads as a solution to a problem, I don’t think debt is necessarily inherently natural.

I think, it was a working solution. Just as I think, banking was a working solution. I think with a different money and a different money technology, you will see other things evolve. I think, this is a radical notion that people have a hard time swallowing. I love listening to what you had to say. I think, you and I are on the same page across the board. You express it very well and I’d love to actually talk to you. We’re in a high degree of agreement here. I only caught – I came in the middle and I’m anxious to listen to your paper. I’m a lazy reader, so I’ll listen to Guy Swann’s presentation of it. I think, that you and I agree a shocking amount. I really enjoyed listening to you and I’m anxious to see the piece you produced for Bitcoin Magazine.

[01:11:43] AS: Thanks, man. No, that means a lot coming from you. I appreciate all the things you’ve done in this space. You’ve been around here longer than I have, so I value your opinion.

Yeah. I think, you’re bringing up an interesting point that really ties into, I think Wicked asked that question too, about what happens when productivity reaches this really high cost of capital pace. We can both be right maybe here, which is that, the system is going to error correct. If there’s innovation occurring in that high of a degree and which very well, I think we all hope will happen, I do think things are naturally cyclical. Even in a Bitcoin standard world, there will be cycles of innovation. I think that’s just the nature of technology throughout human history is that there are cycles of innovation.

That’s why when people say that deflation, not to detour too much here, but when people say, “Oh, deflation will re-exert itself right here. Because technology is creating so much deflation that we’re just never going to have high rates ever again, even in our current system.” I’m like, yeah, maybe in a 20-year horizon, 30-year horizon. Over the next two or three years, the supply shocks and things like that, we can have some real problems. Maybe that will lead to innovation. Innovation is what the mother of all necessity. There’s that.

Even in a Bitcoin standard world, I think some of that will still be the case. I do think incentives will be aligned so much better, that we will see so much more innovation, so much more productivity. I think, especially at first, there will be this way, this Renaissance, hopefully. Though, we are speculating. Now, what I can say for sure though, is that there will be these hurdle rates. That is innate of financial decisions. It’s innate to the concept of time preference. In that sense, debt is intrinsic to human progress, because that’s what helps us determine that time preference.

[01:13:27] CK: Hey, Tina. Before you jump in, we’re going to have another conversation. We have a hard stop.

[01:13:31] AS: Yeah, let’s do this again.

[01:13:32] CK: I do want to give just a moment for a last word. I guess, Tina maybe you can jump in, two-minute last word you give us a two-minute last word and we can close it out.

[01:13:42] AS: Tina, go ahead, man.

[01:13:43] BT: No, go ahead. I don’t have a last word to give. I really enjoyed what you had to say, and I’m anxious to read what you had. I’d love to talk to you. I think, you and I agree on so much. I didn’t catch the whole thing. I’m really happy to hear you actually delve into a lot of this, in a way that I actually can’t explain it well, but you’ve done, I think, a really interesting job and I’m really actually interested in exploring it, because you’re touching on the issues that I think a lot of people don’t well understand. I’m very excited to learn more about the work that you’ve done. I’ve been very impressed what you had to say in the brief time that I heard today.

[01:14:20] AS: Thanks a lot, man. I appreciate that. Yeah, I’ll just really end quickly by saying, I totally agree. That’s the whole genesis of these space, is because I think the article is a starting point. The article gives us a, like I said, it’s a mental model. Once you have that mental model in place, you can use that to ask all of these other questions. I do agree with you that a lot of these other questions are not actually theoretical. These are real world issues that we’re trying to solve right here now.