Digital Currency Group Pushes Back Against NYAG Lawsuit

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Digital Currency Group, a venture capital firm, has filed a motion to dismiss a criminal suit filed against them by the New York Attorney General’s office.

The legal battle between DCG and the NYAG has been ongoing for several months, and is directly entangled with a dispute between two other prominent crypto firms: Genesis, a now-defunct brokerage firm, and Gemini, exchange and bank. These groups have been entangled in a series of disputes that trace back years, involving dramatic relationship changes and serious fraud accusations. A particularly relevant twist in the whole situation is the fact that the bankrupt Genesis is and has been a subsidiary of the substantially powerful DCG, which holds billions’ worth of assets under management and counts ETF issuer Grayscale as another subsidiary.

In other words, untangling the background for all the different players involved here is a fairly significant undertaking, especially considering the fraught environment that currently exists. Not only is the attorney general’s suit directed against DCG, Genesis and Gemini in equal measure, but Genesis and Gemini have also faced off in civil suits independent of this. The NYAG accused these firms in October 2023 of collectively defrauding investors out of more than $1 billion, and the mutual recriminations involved have created a messy atmosphere. To begin, as good a place as any is a recent revelation found in court filings surrounding this dismissal. Specifically, court documents this March have made it public knowledge that Genesis and Gemini considered a merger in 2022.

In 2022, DCG CEO Barry Silbert conducted a meeting with Gemini co-founder Cameron Winklevoss over lunch, to discuss some of the motivations and logistical issues with merging the two corporate entities together. At the time, Genesis was in serious danger of bankruptcy, and its substantial partnerships with Gemini meant that the fallout would likely damage the other company’s business. Gemini had lent substantial funds to Genesis as part of the Gemini Earn program, which Genesis had proceeded to lose. The hedge fund Three Arrows Capital was in charge of this money when it went belly-up in the aftermath of the FTX collapse, and Genesis was faced with a $1 billion dilemma. As for the original source of these lost funds, the NYAG has accused the firms of defrauding this money from investors.

At the meeting, Silbert made the sales pitch that the two firms should combine, and that they “would be a juggernaut and would be competitive with Coinbase and FTX”. He added that, even if Genesis and Gemini couldn’t reach an agreement on these terms, “there is a ton more Gemini and Genesis can do together and the two companies should be leaning in together, not pulling apart”. Although Winklevoss was allegedly “intrigued” by the proposed deal, it did not happen. Frictions, alongside Genesis’ declaration of bankruptcy, arose in the immediate aftermath.

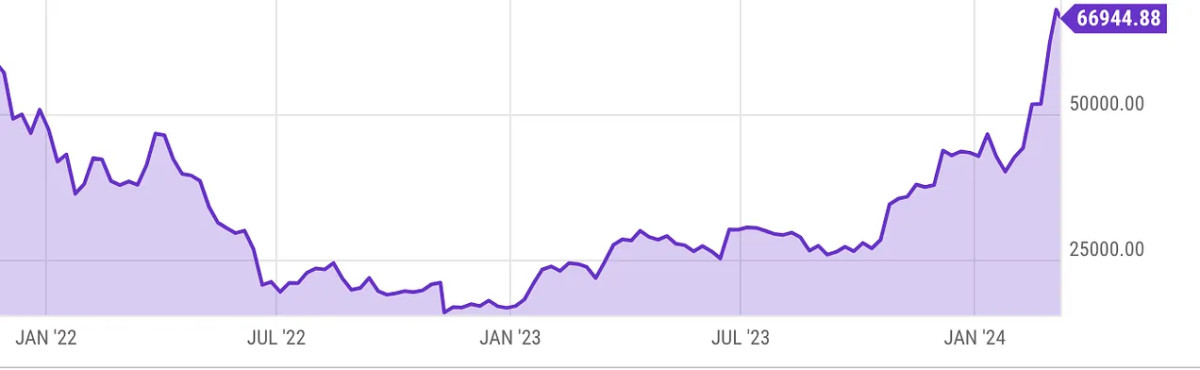

A particular point of friction is found in the aforementioned Gemini Earn partnership, which made headlines this February when Genesis won a court ruling against Gemini. Essentially, Genesis owned a tranche of Grayscale Bitcoin Trust (GBTC) shares that were promised to Gemini as collateral for an exchange of money between the two companies, but Genesis declared bankruptcy before the shares could actually change hands. Since GBTC is unique among the Bitcoin spot ETFs as a pre-existing fund that was converted into an ETF, this tranche of shares had ballooned by early 2024 to be worth more than $1.2B. DCG’s ownership of both Grayscale and Genesis put an extra complication over the issue. Gemini objected to Genesis’ legal right to sell the shares it was promised years prior, and this began a lengthy civil suit.

Although the issue was resolved through a series of settlements that allowed Genesis to make the sale and kept both it and Gemini from admitting culpability, the NYAG still filed a complaint alleging that the parties involved were all jointly guilty of substantial fraud. There were more than a billion dollars missing, and the attorney general’s office was growing tired of the mutual recriminations between the relevant parties. Even if Genesis could make enough money from their sale to recoup their investors, that still doesn’t address the issue of criminal activity. A particular illustration of the hostile environment came up when DCG, Genesis’ parent company, disputed Genesis’ own settlement with the NYAG.

So, this brings us to the present day. On March 7, Silbert and DCG filed a motion to dismiss the attorney general’s suit, claiming that the allegations against these companies were entirely baseless. In the motion, DCG’s legal team claimed that “The allegations against DCG in this case are a thin web of baseless innuendo, blatant mischaracterizations and unsupported conclusory statements. In search of a headline-worthy scapegoat for losses caused by others, the OAG [Office of the Attorney General] wrongfully seeks to portray DCG’s good-faith support of a subsidiary as participating in fraud”. They specifically claim that DCG acted in good faith by funneling money towards Genesis after the Three Arrows collapse, investing “hundreds of millions of dollars of additional capital into its subsidiary during the months leading up to its bankruptcy, even though DCG had no obligation to do so”. The attorney general took a different view, that DCG’s net contributions conceal a large drain of Genesis’ money at one crucial moment: DCG took their money back, Genesis declared a “liquidity crunch” and did not allow users to withdraw their crypto, Genesis went bankrupt immediately. The burden of proof is on them, however, to demonstrate that this was a deliberate fraud tactic.

As of yet, there is no way of knowing what a judge will think of DCG’s proposed defense or motion to dismiss, or if a settlement is feasible in the event that the motion to dismiss is denied. However, one unambiguously good sign has come out of the morass: Gemini announced its plans to fully reimburse the allegedly defrauded users of the Gemini Earn partnership with assets in kind. In other words, these users had Bitcoin stolen from them in 2022, and Gemini has made commitments to pay them back, accounting for Bitcoin’s price jump since then. This has tacked on another $700M to the price tag of reimbursing over $1B in assets, and is a clear sign of confidence from the company.

If nothing else, this decision to reimburse users like this is an impressive display of sincerity and good intentions from Gemini. Gemini is named as a co-defendant on all the legal documents submitted by Silbert’s legal team about the NYAG suit, and would also benefit greatly from seeing the suit dismissed. This gesture of good faith might not be enough to clear the air for DCG and Genesis, but it certainly couldn’t hurt anyone’s chances of escaping the whole fiasco without a criminal conviction. Although Gemini failed to halt Genesis’ attempt at getting the money from GBTC sales, Gemini is still a successful and prominent exchange. Apparently, it was able to float a compensation of this size without relying on the GBTC tranche.

It’s anyone’s guess as to how the suit will proceed in the coming months. When the NYAG first filed a complaint after the first round of settlements, it seemed clear that the prosecutors were quite fed up with the acerbic attitude of these former business partners. Nevertheless, Gemini’s restitution plan will surely go a long way in proving their intention to do right by their users. If nothing else, it shows that they’re proactive in taking the issue seriously. We’ll have to observe the situation carefully as it develops, but it does seem clear that the mutual loathing and underhandedness displayed so far has not been rewarded. The broader digital asset space has periodically been filled with shaky businesses and outright scams, but eventually they all fall apart. Bitcoin, on the other hand, has come by its success legitimately. When the dust settles, the biggest winners might actually be the defrauded users, who collectively will see their expected payout nearly double thanks to Bitcoin’s own strength. Compared to those kinds of gains, it’s hard to imagine a scam working much better.