Digital Asset Tech Provider Metaco Secures Partnership With Liechtenstein Private Bank

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

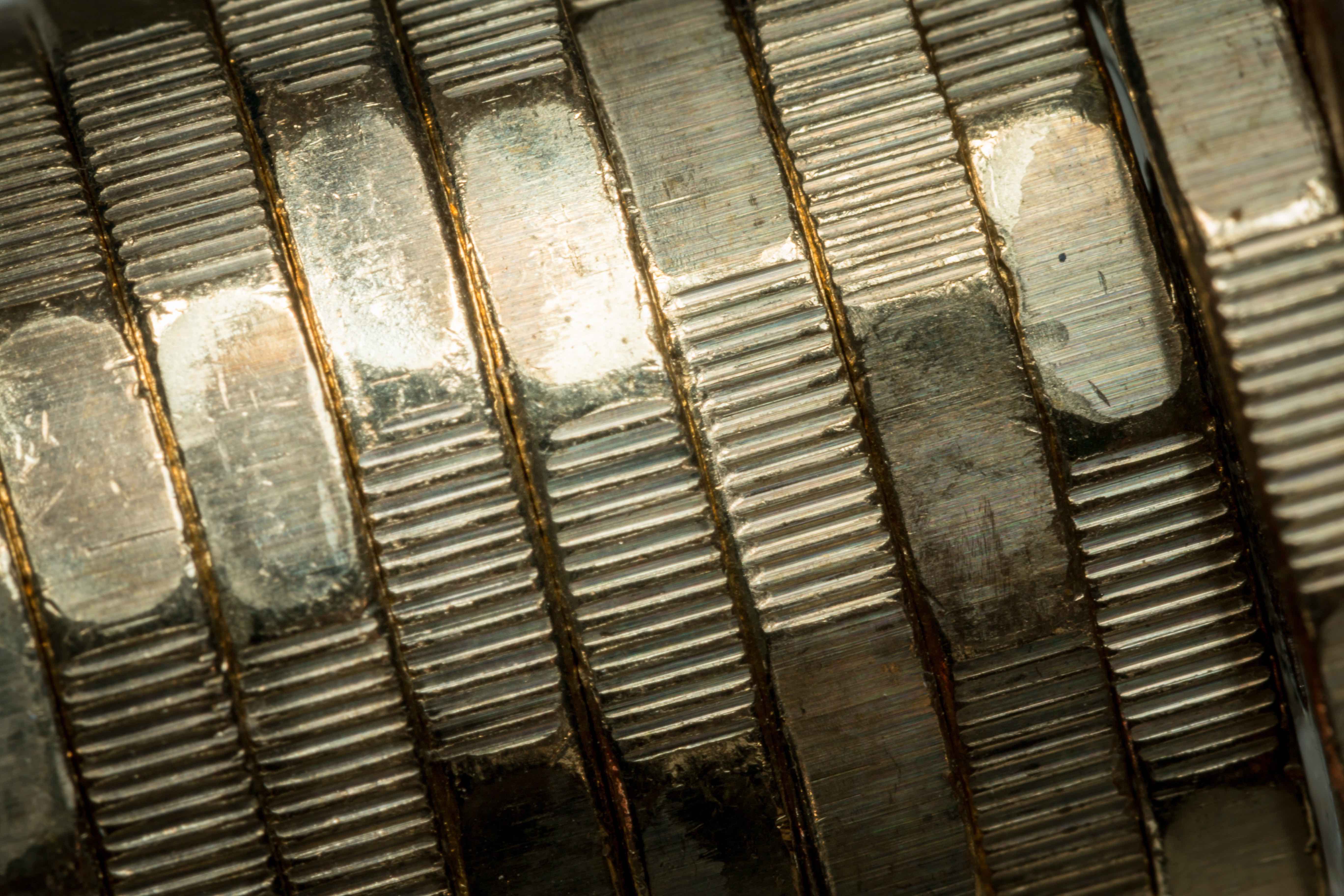

Swiss digital asset technology provider Metaco has secured its fifth partnership with a major financial institution in the last nine months, this time with Liechtenstein private bank VP Bank (VPBN), according to an emailed announcement on Tuesday.

VP Bank has tapped Metaco for its Harmonize platform, which it will use to expand its digital asset custody and tokenization services. The lender commenced its digital asset strategy in 2021, envisioning tokenization and custody of physical assets like jewels or paintings. Now it wishes to expand into supporting tokenized financial assets, as well as minting, burning and storing tokens.

VP Banks follows Citibank (C), Societe Generale (GLE), DekaBank and DZ Bank in selecting Metaco to assist with the development of their digital asset services.

Following the collapse of prominent crypto-friendly banks Silvergate and Signature last month, the emergence of traditional finance (TradFi) firms offering similar services with the help of companies like Metaco could provide an alternative.

“The bank-grade orchestration capabilities of the Harmonize platform enables the secure management of a range of digital asset use cases, allowing banks and financial institutions to satisfy demand for new asset classes and expand their business model in any direction,” Metaco chief growth officer Seamus Donoghue said.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.