Blockchain services firm Diginex could be a publicly traded company by Sept. 23.

The firm’s backdoor listing on Nasdaq is happening more quickly than a regular initial public offering (IPO), but the company – which is behind the EQUOS.io crypto exchange – is cautiously making sure it’s flush with capital before it lists.

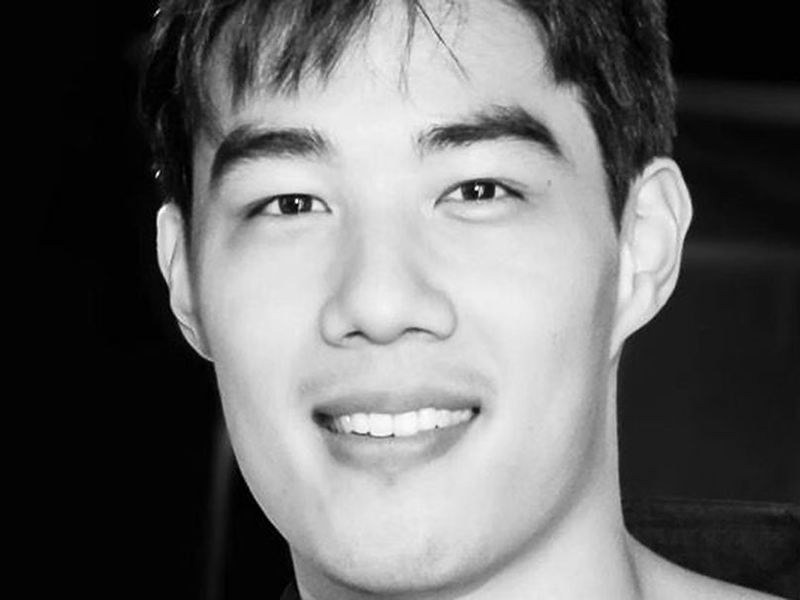

Diginex CEO Richard Byworth said the firm’s public listing will give it more transparency than other exchange operators that mistreat customers with poorly structured liquidations and exorbitant fees.

“Some of these guys are offering a ridiculous 250-times levered product,” Byworth said. “At that point it’s quite easy to be able to map where liquidiations can happen if the price of bitcoin gets to that level.”

The exchange will still be relying on other private exchanges as references for pricing data on levered products, but Byworth said public filings will give non-crypto traders more confidence to enter the market.

Diginex is not the only crypto exchange company to be rushing into the public markets. INX has already launched its own initial public offering on the Ethereum blockchain, which retail and institutional investors can follow on Etherscan.

Hong-Kong based Diginex’s path to the Nasdaq involves plans to merge with publicly traded 8i Enterprises Acquisition Corp., a British Virgin Islands-based “blank check” company, after a final shareholder vote later this month.

If all goes as planned, Diginex should bypass many of the usual regulatory barriers associated with an IPO and list on Nasdaq around Sept. 23, said Byworth, a former investment banker.

Earlier this week Diginex announced $20 million in funding from four family offices and one hedge fund in Asia and Europe. As part of the acquisition deal, i8 agreed to redeem at least $15 million to add to the private raise, giving Diginex a reserve of $35 million.

One of the firm’s private equity investors introduced the firm to a number of special-purpose acquisition company (SPAC) managers before Diginex found i8 in May of last year, Byworth said.

“Obviously it did take some time for the SEC to get their heads around it,” he told CoinDesk in an interview, referring to the Securities and Exchange Commission.

Byworth said i8 expects to exceed $15 million easily. “That round goes all the way to this weekend … when we’ll know how many investors redeemed and how much cash is coming to us,” he added.

While Diginex’s EQUOS.io is certainly not a “top-tier” exchange, going public is noticeable; the Nasdaq listing would raise its profile among investors and potential customers, said George Zarya, CEO of digital asset services firm Bequant. (Diginex competes with Bequant, which offers crypto custody, multi-venue trading and an investment banking advisory arm based in the U.K.)

While private equity will likely continue to be the main source of funding for crypto startups, the main reason for using SPACs is the speed, and there will likely be more cases of it, Zarya said.

From now until the company lists, Diginex will be focused on making sure investors understand the company’s business model.

“This is a really important inflection point for us,” Byworth told CoinDesk, adding:

“It’s really important that we make sure investors understand the value proposition of Diginex and ways we’ve been designed to produce best outcomes for the industry.”

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.