The visionary Unchained Capital co-founder excitedly details his thoughts on why bitcoin is so inspirational.

This interview with Dhruv Bansal was conducted by myself in an effort to obtain valuable insight into a rather visionary Bitcoiners mind, and I believe my mission was accomplished. Bansal’s answers are profound and thought-provoking, giving us a glimpse into his thoughts on Bitcoin at large. Be sure to check out his talk at Bitcoin 2021 here after reading the edited transcript of our interview below.

Casey Carrillo: Hi everyone, I have here Dhruv Bansal, co-founder and CSO at Unchained Capital.

I was lucky enough to have an email Q and A with Mr. Bansal, and we agreed to sit down here at Bitcoin 2021, where I’ve had the pleasure to finally meet him in person. First of all, welcome to Bitcoin 2021, and I hope you are enjoying your time here.

Dhruv Bansal: Thanks Casey, it looks like I’m going to be a little overwhelmed, it looks like a huge conference.

Carrillo: Absolutely. So, jumping right in: in your previous article you mentioned that you’re excited to see the Bitcoin-inspired discoveries other scientists make within their respective fields. What, in your opinion, gives Bitcoin this capacity to inspire different ways of thinking about things?

Bansal: I think anytime humanity discovers a new principle of organization, governance, construction or material science, it affects everything. I think that’s true for ideas of evolution and for ideas of computation. I think we’re seeing that with Bitcoin. Bitcoin is interdisciplinary. One of the things it does is that it distributes decision-making, order matching, reality and truth in a way that we’ve never seen happen before, which gives Bitcoin a lot of its strength and resilience and is what makes it unique. I would love to see scientists and researchers of all stripes apply those kinds of thoughts and methods to other kinds of systems. My talk with Ryan is attempting to apply some of this thinking to things like the internet, other networks and civilization. But I think Bitcoin can go beyond that: it can teach us how to deal with systems that don’t have any definite state in a given moment in time but that eventually become consistent. We know this from databases quite intimately, but to see it not only affect a database in an esoteric programming context but to see normal people talking about notions of forks and eventual consistency is really powerful. I love to see that learning wash over humanity as a whole and allow us to be more informed of the trade-offs and rules of distributed systems.

Carrillo: I find your business, Unchained Capital, extremely interesting. What is your personal interpretation of the macroeconomic conditions surrounding the surge in bitcoins price, and do you believe the conditions we’re in currently are set to continue?

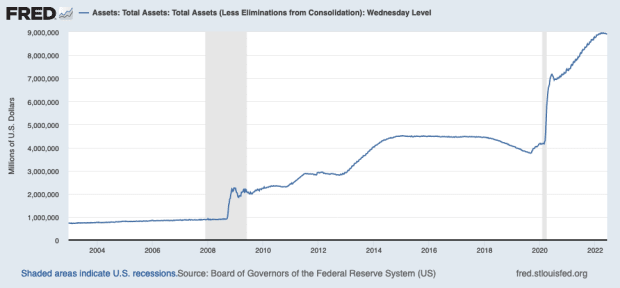

Bansal: That’s an interesting question—and I’m certainly not an economist or anybody you should look to for macroeconomic commentary—but what I’ll mention is that like a lot of Bitcoiners I expected the price to increase in 2021 tremendously. Why? History, stock-to-flow, four-year cycles. It feels a little bit silly to say that just because it happened four years ago it’s going to happen again, but I have admitted to myself that that’s kind of what I believe. And here we are: it’s happening again and it’s been happening. Now, truthfully, it’s not happening merely because it’s four years from the last time. It’s happening for real reasons. Most people who are buying bitcoin probably don’t care that four years ago was the halvening or that last year we had a halvening. It’s so curious to me, believing that the price would increase, to watch things like the COVID pandemic happen, to watch things like money printing go crazy over the last year, and to watch people pay attention to that and connect it to bitcoin. And lo and behold, the price started to increase. And as much as I expected it would, I was still shocked to understand why it did. Obviously nobody expected the COVID pandemic. There are probably other reasons too, which if I was more of a macroeconomic thinker I would be able to draw out. To me that’s been the most interesting part of this whole process, knowing that it would happen but not really knowing why and then seeing the why and understanding thesense behind why it happened.

Carrillo: Going off that, I suppose it may be believed that these conditions drive the price in the short term. Are you of the personal belief that in the long term these things are irrelevant to bitcoin and we’re experiencing a sort of water flowing down a mountain, a sort of inevitability?

Bansal: I think that’s a nice way to put it. I mean yes, this is something Ryan and I were talking about: Bitcoin has already won. And I’m not saying there’s no risk or no concern and we should all just be chill and not try to work hard to make this asset class better, richer, stronger and more robust. We should be doing those things. But essentially I believe it’s already won. That, in your words, it’s kind of like we’re just going to be going downhill in the next fifty years as Bitcoin takes over every aspect of society and affects it in some meaningful way. Nevertheless, even water going downhill has to contend with things in its way like obstacles, boulders, whatever you like. And there are a lot of those. So I think when we see the price retrace by 50%, that affects my business very strongly, it affects so many people here [Bitcoin 2021], and so when I see that happen I kinda think “well, we’re still just rolling down hill, aren’t we?” Like, we’ll be right back at $60,000 in a couple months, we’ll maybe cross $100,000 after that. I still tend to be extremely optimistic. Of course I could be wrong and it won’t work out this way, but hopefully it continues to do, on the largest scale, the thing I think it’s going to do, which is increase in price tremendously over the next few decades.

Carrillo: Having conducted this interview at Bitcoin 2021, I want to ask you what you’re most looking forward to at the conference.

Bansal: Oh that’s an easy answer. There are so many people here that part of me is worried that, while walking through the conference and all the events, there’s gonna be so much noise and chaos. But the excitement is that there are so many people here, so many of my friends and colleagues, people I’ve been reading the last few years and admiring from a distance. And I’m getting to meet them, have drinks, go on walks with them. You know, the chance to really dig in and have that kind of conversation you can only have in person is what’s so great about conferences in general, and in particular that’s what’s going to be so great about this one for me.

I really appreciate Mr. Bansal taking the time to answer my questions at Bitcoin 2021. Thanks for reading, and be sure to check out his talk at the conference on YouTube.