Developers Deploy Uniswap Contracts on Bitcoin as BRC20-Based SHIB, PEPE Gain Popularity

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

A group of developers have deployed Uniswap’s smart contracts onto the Bitcoin network to capitalize on the rise of BRC-20 tokens and develop the decentralized finance (DeFi) ecosystem.

Called Trustless Market, the protocol has racked up daily volumes of $500,000, attracted over 2,000 users, and lets liquidity providers earn a 2% cut on all swaps conducted on the network.

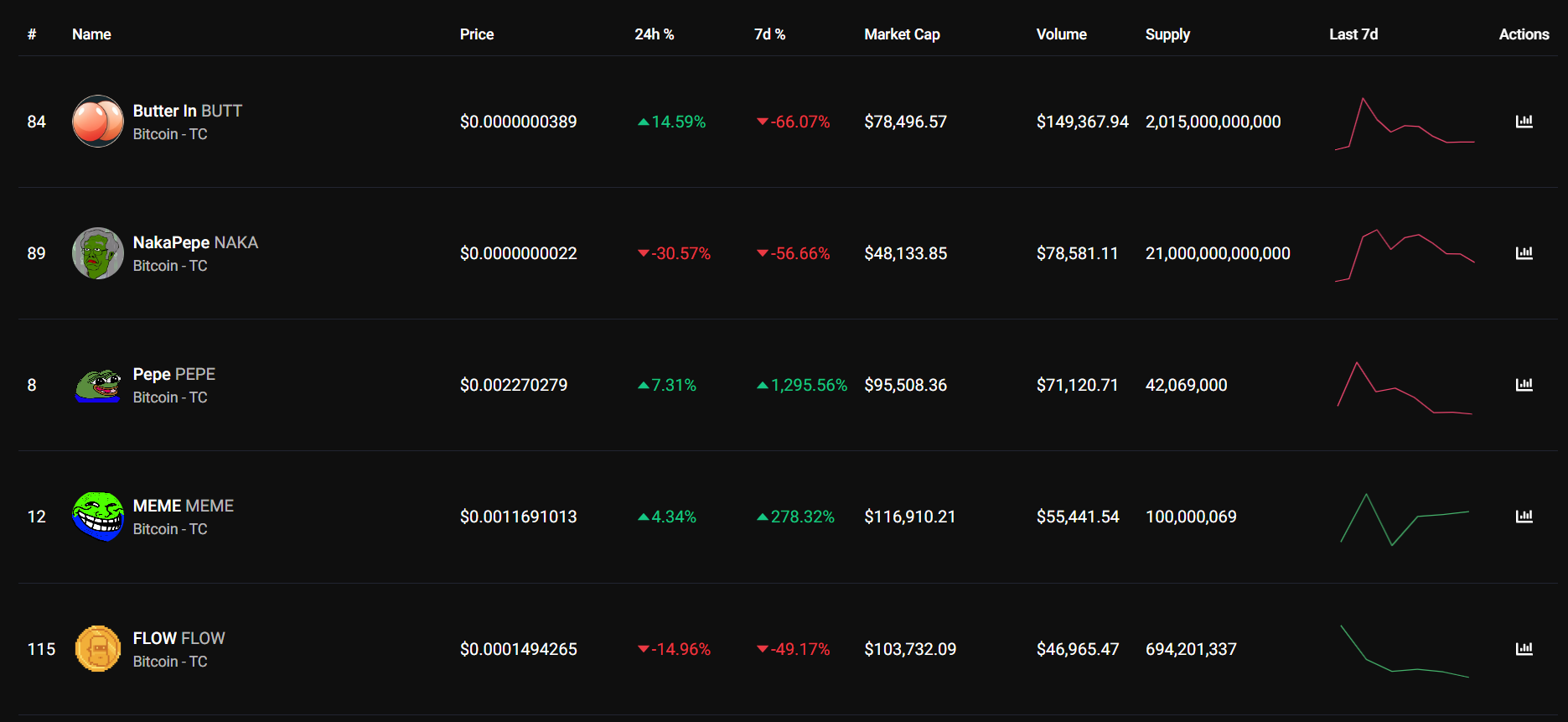

DeFi on Bitcoin is seeing steady, albeit muted, growth. (Trustless Markets)

Although most of these tokens are meme coins, instead of tokens that may be used in a sophisticated DeFi application built on Bitcoin, it still counts as a start.

“We want to make Bitcoin as generalized as possible — usable for far more than just a currency,” said @punk3700, one of the developers at Trustless Market, in a Twitter message. “We started first with Art, then AI, and DeFi is the natural next area to add.”

“It’s still super early. Feels like Uniswap in 2018. But it’s fun,” @punk3700 said.

DeFi relies on automated smart contracts to provide financial services, such as lending and borrowing, to users. Nearly $47 billion worth of tokens are locked on such protocols, DefiLlama data shows.

Bitcoin’s usage in DeFi applications was so far limited to tokenized representations of bitcoin on other chains, such as Ethereum or Solana. However, the recent introduction of “Bitcoin Recent for Comment” token standards allows developers to issue tokens – and DeFi applications – natively on Bitcoin – which has spurred a collection of digital artwork and meme tokens built on Bitcoin in recent weeks.

Data from OrdSpace, which tracks BRC-20 data, shows over 11,000 tokens issued on Bitcoin are available on the open market as of Monday with a cumulative market capitalization of $500 million, down from a $1.5 billion figure earlier this week.

So far, tokens of Ordinals marketplace Ordi (ORDI) are the most valued BRC-20 tokens with a market capitalization of $400 million and 8,300 unique ordi token holders. Ordi is said to be the first BRC-20 token deployed on Bitcoin, which may also be aiding its value proposition among holders.

Pepe tokens (PEPE) on Bitcoin – different from the ones issued on Ethereum – are the third-largest BRC-20 issuance, albeit with a relatively tinier $17 million market capitalization. There’s also Bitcoin’s own shiba inu (SHIB) iteration at a $3.7 million capitalization – a mere smidge compared to the original SHIB on Ethereum, which boasts a $5.5 billion capitalization.

As such, Trustless Market is one of the few protocols in a rising cohort that seeks to develop the Bitcoin ecosystem – a move that has sent transactional fees spiking.

Bitcoin users paid over $17.42 million in fees over the past 24 hours, marking the second highest day ever in gas fees, analytics tool DefiLlama tweeted Thursday.

But the likes of @punk3700 say that the fee problem is a stepping stone to fuel adoption in the long term.

“I think that’s a good problem to have actually!” @punk3700 said. “Always think the use cases/utilities are going to come first. The infrastructure upgrade will then follow.”

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.