Despite the Correction: Bitcoin’s Hash Rate and Mining Difficulty at ATH

Despite the sudden price correction, bitcoin’s fundamentals continue to reach new highs. The asset’s hash rate has recovered its recent declines and marked a new ATH. Accordingly, the network’s mining difficulty saw its most significant increase in nearly seven years to a new record level as well.

Hash Rate and Mining Difficulty to New Records

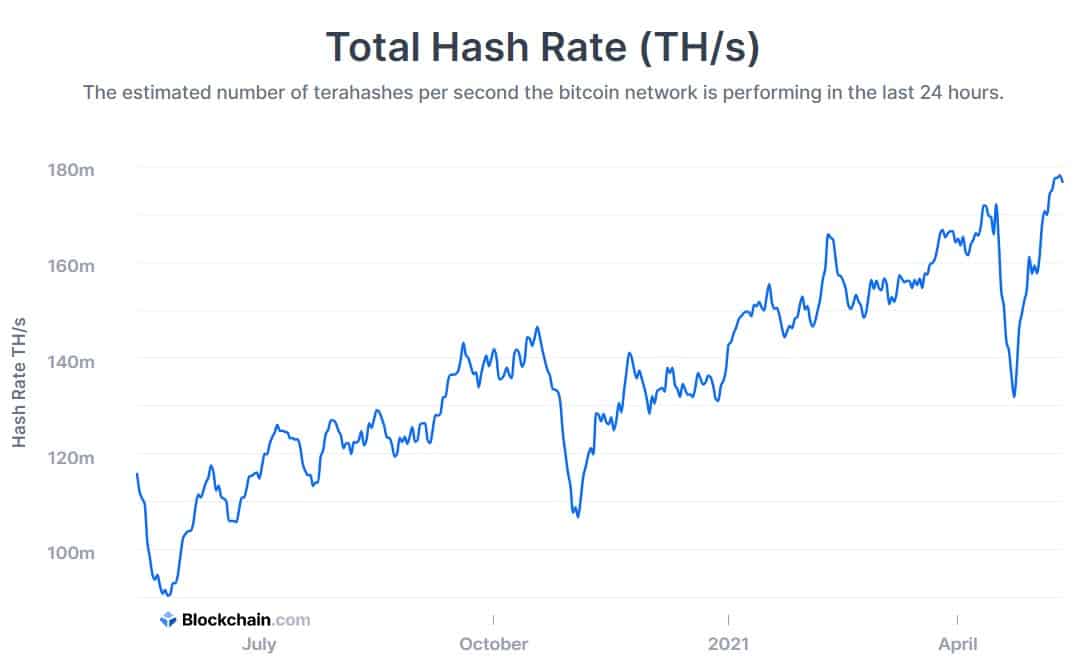

Bitcoin’s hash rate is the measuring unit of the processing power on the asset’s blockchain. The general rule of thumb suggests that when there’re more miners who put their computational devices to work on the network, the metric increases, and vice-versa. Naturally, the higher the hash rate is, the more secure and robust the network is.

Overall, the hash rate has been increasing gradually in the past few years with a few brief dips, primarily caused by miners from China. The latest one came in mid-April when reports informed about massive power outages in Xinjiang province – one of the dominant regions for BTC mining operations.

According to Blockchain.com, the metric indeed fell hard from over 170M TH/s to around 130M TH/s in days. Since then, though, the hash rate not only bounced back but went for another all-time high record at just shy of 180M TH/s.

The mining difficulty is a self-correcting feature embedded in bitcoin’s blockchain that either increases or decreases depending on the number of active miners. In other words, when there’re many miners and the hash rate increases, the difficulty goes up and vice-versa. This process takes place at every 2,016 blocks (roughly two weeks).

As the hash rate reached a new ATH just recently after a substantial decline in mid-April, the mining difficulty had to act accordingly. In fact, it underwent the largest increase in almost seven years (21.5%), as Glassnode informed. As a result, this metric also registered a new all-time high record.

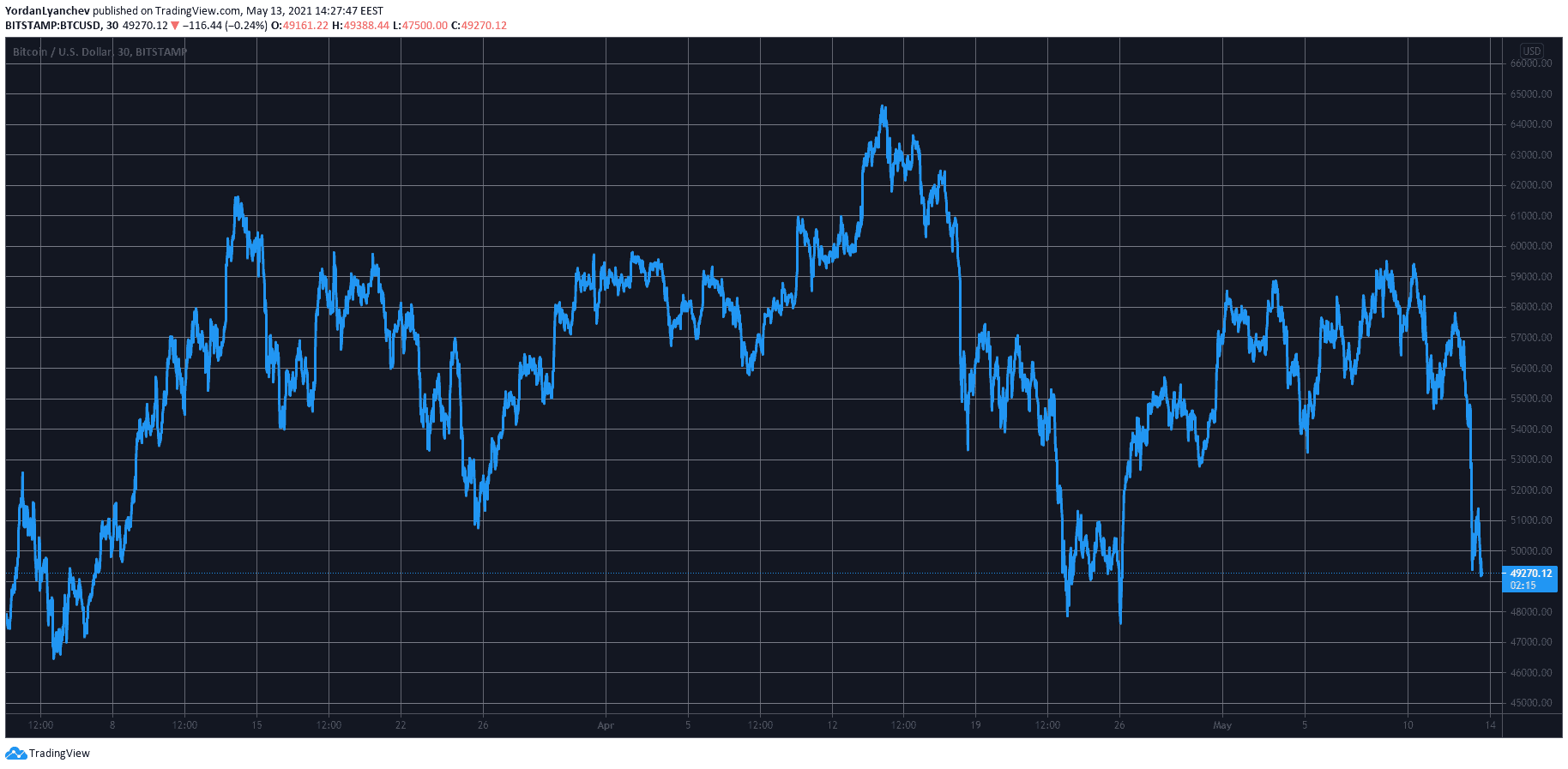

Bitcoin’s Price Slides Hard

While the network becomes more and more robust, one tweet initiated by Tesla’s Elon Musk drove the cryptocurrency’s price south. As reported yesterday, the electric vehicle maker decided to cease using BTC as a payment method.

The asset tumbled immediately and lost more than $12,000 in a day. Despite recovering initially and jumping above $50,000, BTC has dipped once more and currently sits below this coveted price line.

Bitcoin’s market capitalization also fell below an important milestone and is well beneath $1 trillion as of writing these lines.