Despite Stock Markets’ Crash, Gold Declined For Similar Reasons As Bitcoin: Here Is Why

All financial markets went through a severe downfall last week. The most popular indexes – S&P 500, the Dow Jones, Nasdaq, etc. – dropped with more than 10% in what history says it’s one of the worst trading weeks ever.

In times of uncertainty, investors generally turn to safer options. Gold is considered to be one of them. Yet, the precious metal, despite reaching its 7-year-high on Monday, also plunged later.

It raised the question if gold can be truly trusted in similar conditions. Ed van der Walt, Bloomberg reporter, and market analyst, recently offered his views on the matter.

What Happened With Gold?

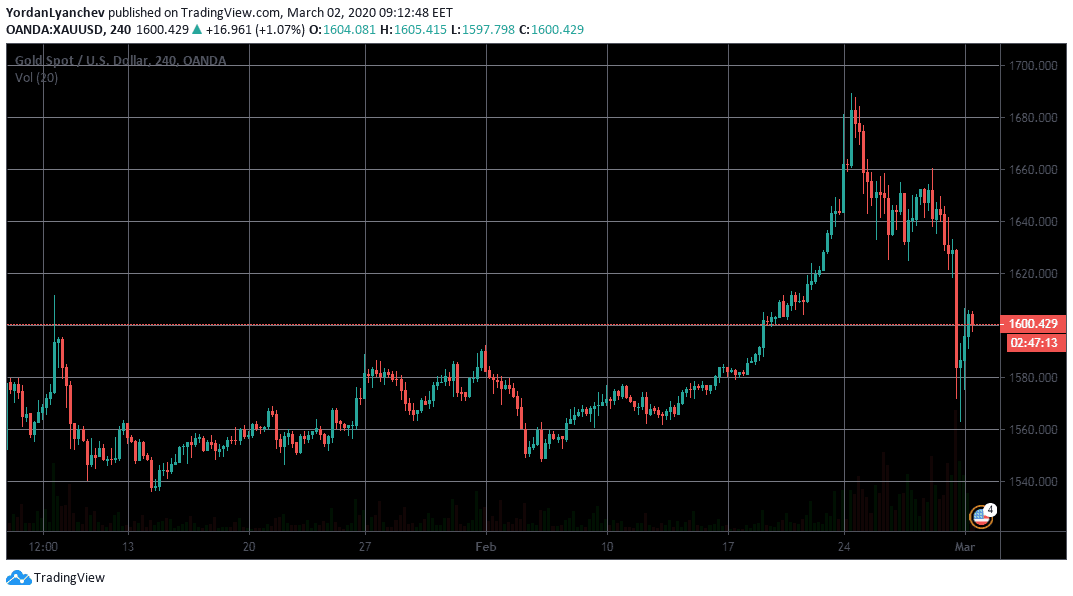

As Cryptopotato reported, gold reached its highest point since January 2013 last Monday at $1,690/oz. As the stock market continued plummeting due to the coronavirus pressure, some investors assumed that the precious metal would keep surging. A few days later, though, it dropped with 7.5% to $1,563.

In a series of tweets, van der Walt’s explanation first examined institutions that were not selling gold. He referred to global ETF investors. Not only they didn’t sell, but “they added eight tons to the biggest stockpile in history.”

Similarly, off-exchange retail investors didn’t sell, according to him. One popular exchange even had “their busiest week since Trump was elected, with most action on the buy-side.”

Hedge funds managers were “well-behaved” as well, or at least until Tuesday. He said that there’s no data for the rest of the week.

Who Sold Gold?

For starters, he noted that some sales came from the recycling market. Meaning that individuals owning gold jewelry were selling. Van der Walt, however, believes that this market is too insignificant to cause a massive drop.

And, finally, the most substantial action came from the futures market, he revealed. Van der Walt believes that margin calls are the real reason why gold plunged as well. More specifically, people selling whatever assets they have to receive cash:

“Basically, the idea is they need to get their hands on cash to prevent their leveraged positions being stopped out and sell anything to get hold of cash. (This is also why correlations across asset classes rise during a crash.)”

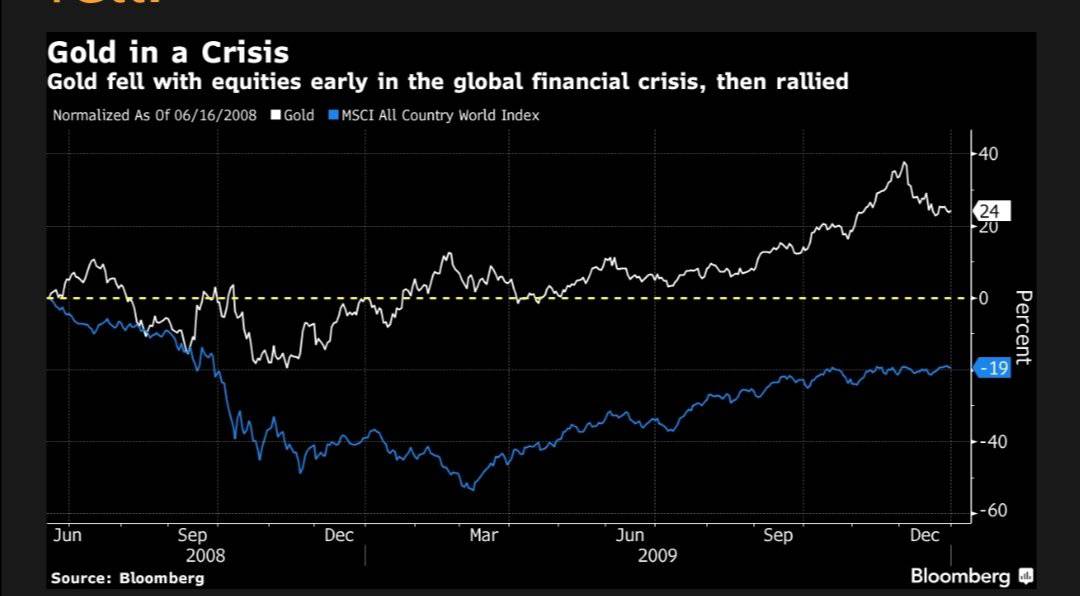

He also referred to the last notable financial crisis in 2008. From March through October, gold was selling off at the rates of most index funds. However, when central banks started quantitative easing, the precious metal “really comes into its own. That’s what drove it to more than $1,900 post-2008.”

He believes that something somewhat similar could happen this year as well. That’s why he predicted that gold could even reach $1,800 by the end of 2020.

Could It Be True For Bitcoin?

Bitcoin has been previously compared to gold in terms of serving as a safe-haven in tough political and economic times. Recent examples came during the peak of the U.S. – China trade war and the tension between Iran and the U.S. Both times, stocks plunged while BTC and gold increased their value.

Last week the largest cryptocurrency recorded a serious drop of approximately $1,500, causing many to question its negative correlation to financial markets.

However, could the same explanation apply for Bitcoin? If investors are selling off their assets to get cash quickly, are they selling off BTC too? More importantly, does that invalidate the argument that the largest digital asset cannot serve as a hedge? According to Mike Novogratz, that’s precisely what happened.

In any case, it would be interesting to follow the coming months to see how gold, and Bitcoin, will react if the stock market drops worsen.

The post Despite Stock Markets’ Crash, Gold Declined For Similar Reasons As Bitcoin: Here Is Why appeared first on CryptoPotato.