Despite Ripple ETF Optimism, XRP Options Market Leans Bearish

TL;DR

- Following the supposed conclusion of the lawsuit against the SEC, all eyes in the XRP army are now focused on the potential approval of a Ripple ETF in the States.

- Nevertheless, certain traders are still leaning bearish toward the asset, at least according to data from Kaiko.

ETF Hopes on the Rise

The approval of Bitcoin and later Ethereum ETFs in the States last year opened the door for other altcoins to hope for such financial vehicles. The massive change in the regulatory regime in the country following the inauguration of Trump only strengthened the sentiment that smaller cryptocurrencies would also be legitimized in front of institutional investors.

Being the third-largest non-stablecoin cryptocurrency by market cap, XRP is positioned among the leaders in terms of ‘who’s next?’ Currently, there are around ten different applications from financial companies to launch such products in the United States.

The US SEC has acknowledged the majority of them, while the chances for an approval in 2025 stand at 77% according to data from Polymarket (but the odds drop to 29% when the deadline is July 31).

Crypto analysts are adamant that the closure of the legal case against the SEC, which is still not entirely official, would fully open the door for an XRP ETF. While others believe the potential approval of these financial vehicles could be the next catalyst for major gains, a more in-depth analysis shows that there are several warnings investors should not ignore.

Options Market Is Bearish

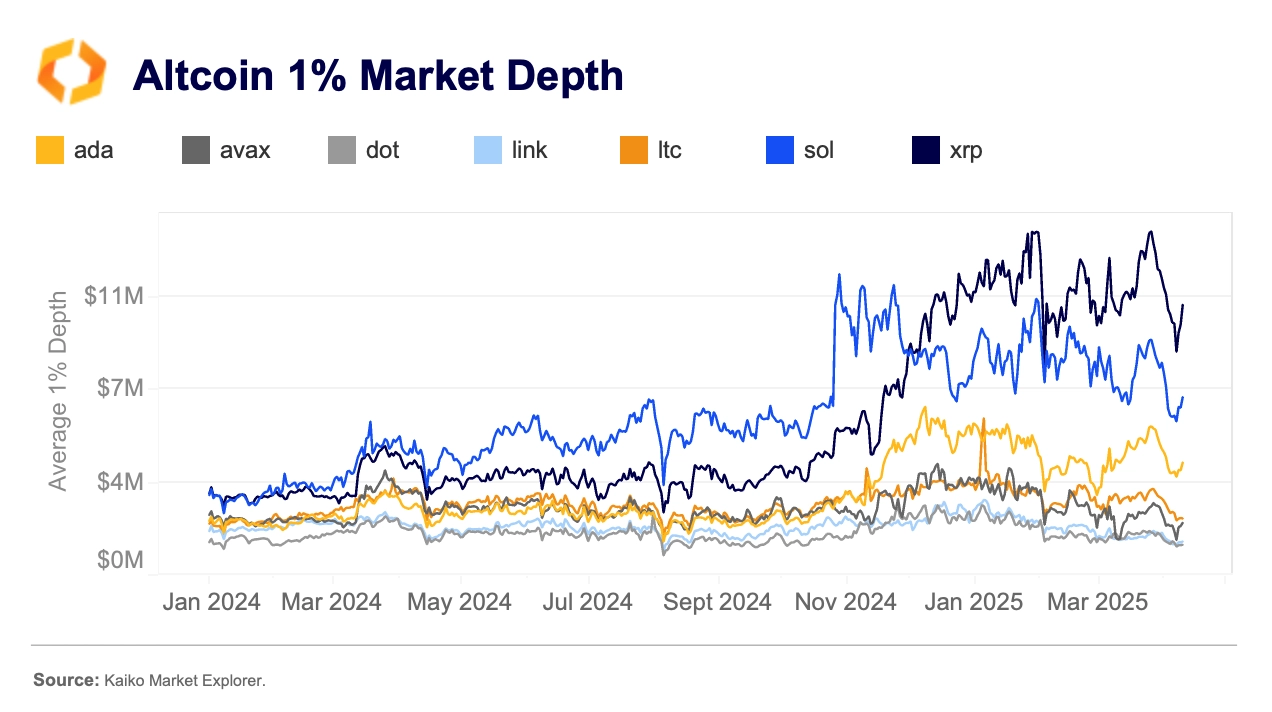

Kaiko’s recent market report highlighted the substantial liquidity of XRP and SOL, as they have “the highest average 1% market depth.” Both assets are among the front-runners for ETF applications.

XRP’s market depth exploded in late 2024, perhaps driven by the hopes of the political and regulatory changes in the US. It surpassed SOL and doubled that of ADA, which ranks third among the ETF seekers.

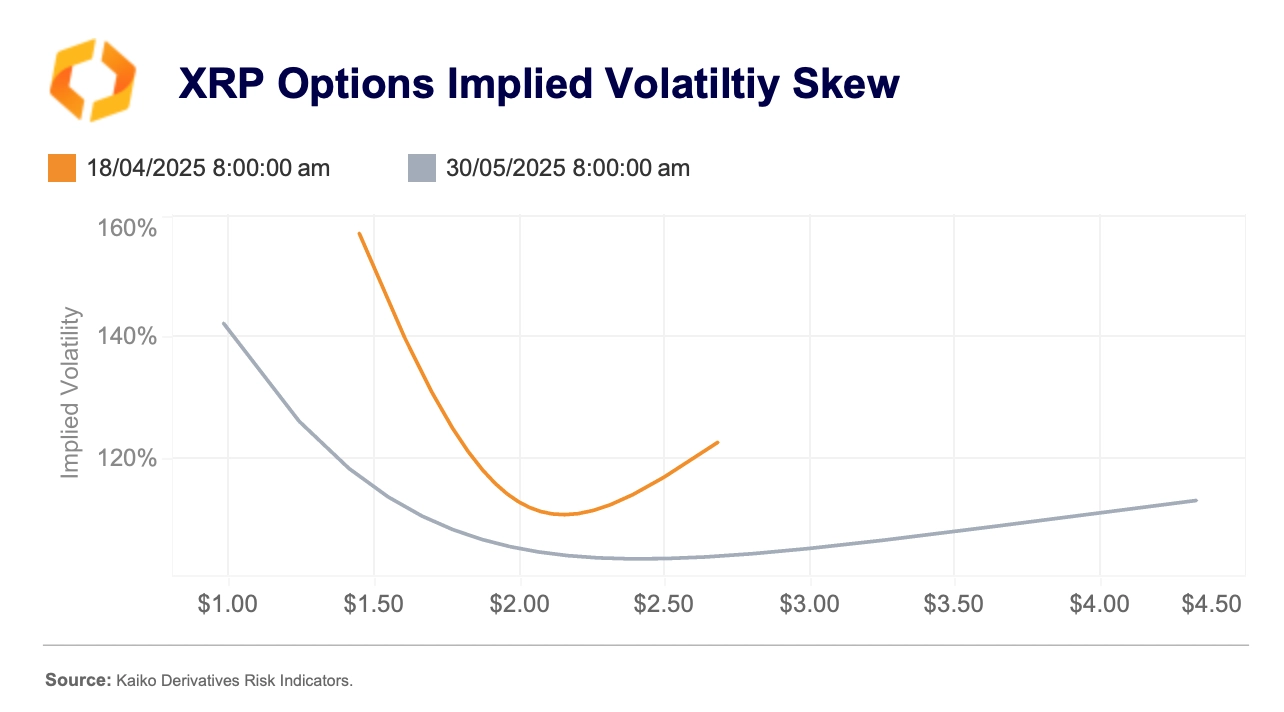

Despite the anticipation for an XRP ETF and all the major developments around Ripple as of late, which include a massive $1.2 billion prime broker acquisition, the options market on Deribit is “skewed bearish.”

Kaiko said that the volatility smile (a pattern of implied volatility for a number of options that have the same expiration date and underlying but different strike prices) for the April 18 expiration is “heavily to the left,” which signals “demand for downside protection.”

However, the report explained that the bearish outlook is “likely linked to broader market uncertainty at present due to macroeconomic concerns.”

The post Despite Ripple ETF Optimism, XRP Options Market Leans Bearish appeared first on CryptoPotato.