Despite BTC Losing $16K in Days, Crypto Community’s Bitcoin Positivity at 2021 Peak: Analysis

The cryptocurrency community has shown the highest optimism levels towards bitcoin in the past few days after the asset lost over $16,000 of value.

At the same time, the popular fear and greed index has gone into an “extreme fear” territory.

Crypto Investors Optimistic on Bitcoin?

Ever since the primary cryptocurrency reached its latest all-time high in mid-April of $65,000, it has failed to sustain its 2020/2021 bull run. Just the opposite, the asset started to gradually retrace and was stuck beneath $60,000 for a while.

The bears intensified their grip on BTC last week after Tesla and Elon Musk announced that users could no longer use bitcoin to purchase the company’s electric vehicles.

BTC traded above $58,000, but it plummeted by $16,000 in a matter of days to a three-month low of $42,000. Such developments typically cause massive disruptions among investors. Some reports outlined that short-term holders have disposed of their coins, even selling at a loss.

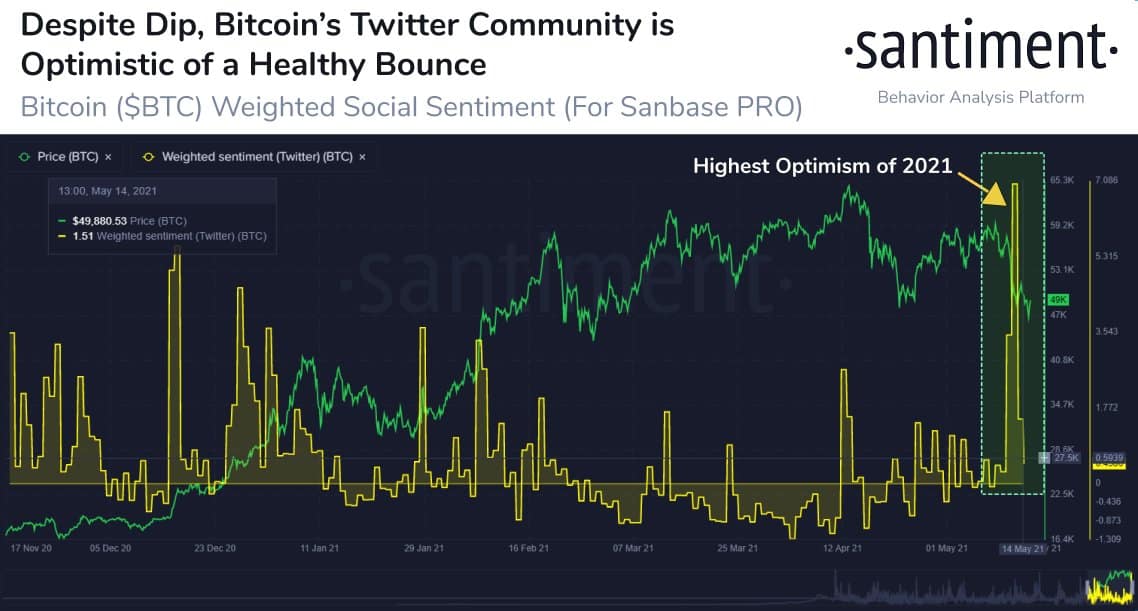

However, the majority of the community has apparently regarded this correction as a rather favorable event. At least, this is what the analytics company Santiment said.

“Bitcoin is currently getting the highest level of positive sentiment of the year after this dip, with many traders viewing low $40,000 BTC as an opportunity.”

The metric relies on aggregated comments regarding bitcoin on Twitter and the general perception of commentators.

Nevertheless, Santiment warned that the “best opportunity to buy the dip is when this optimism dies down from the crowd.”

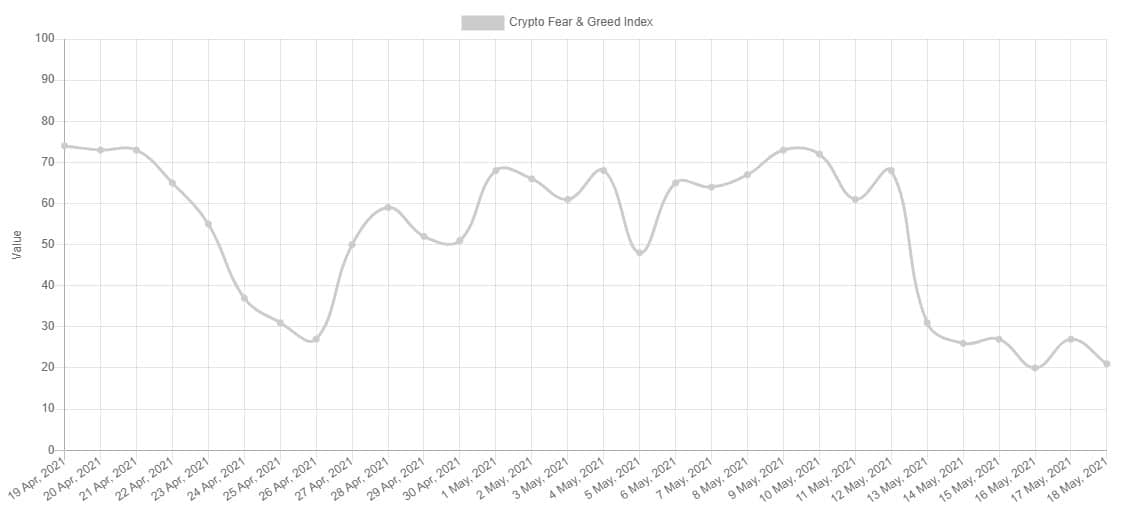

Fear and Greed Disagrees

The Fear and Greed Index is another metric providing the investors’ general sentiment on the crypto space. It calculates various types of data, including social media interactions, volatility, volume, and surveys. Consequently, it determines whether the mood is positive or negative.

The results range between 0 (extreme fear) and 100 (extreme greed). Its performance is usually highly correlated with bitcoin’s price movements.

As such, it has gone deep into a state of “extreme fear” since last week. However, history shows that when the metric goes to the hilt in either direction, the price usually heads in the other shortly after.

For instance, the last time it went to “extreme fear” in late April after a sizeable drop, bitcoin went on a tear and added roughly $10,000 in two days.