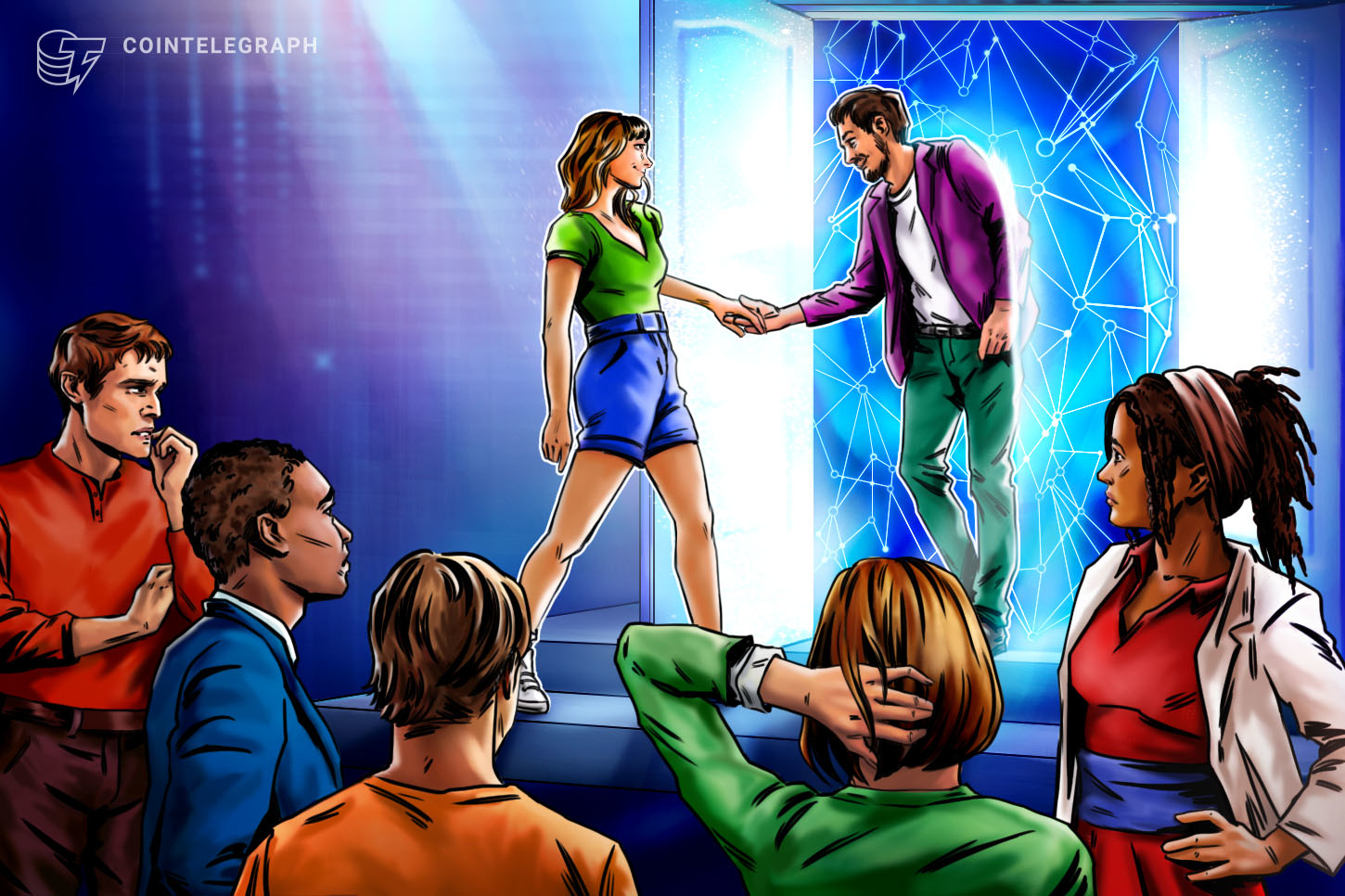

Dutch crypto derivatives exchange Deribit launched a block trading solution in partnership with American trading communication platform Paradigm.

World’s first block trading tool for crypto derivatives

The institutional block trading solution is reportedly the first one of its kind offered by a crypto-derivatives exchange, the firms said in a press release shared with Cointelegraph on Aug. 22.

The new block trading solution intends to enable institutions to directly negotiate crypto-derivative trades via chat on Paradigm, while agreed information is automatically directed to Deribit for execution and clearing.

What are block trades?

Block trades are privately negotiated transactions in futures or options, or spreads and combinations of the two, that exceed certain minimum quantity thresholds. Once traders agree on a price, these transactions are submitted to the exchange for execution and clearing.

By introducing the new tool, Deribit and Paradigm want to eliminate any execution risk associated with the order book when institutional traders privately negotiated large trades via Telegram or Skype and then manually coordinated execution on Deribit.

John Jansen, co-founder and CEO of Deribit, pointed out that benefits for institutions are further emphasized when trading options. According to Jansen, options traders can now create a portfolio of put and call options in different variations and trade them by blocks, adding futures at the same time, instead of negotiating and trading options one at a time.

He added:

“The ability to negotiate deals privately and execute them automatically on Deribit platform but outside of the order book is a crucial step in onboarding institutional traders. You remove the risk of front running and offer institutions the ability to trade significant amounts without moving the markets and with a counterparty of their choosing.”

Traders will have access to block trades in Bitcoin (BTC) or Ether (ETH)-backed futures and options, including spreads and combinations of the two products.