Déjà vu: Ethereum’s First Month of CME Futures Overwhelmingly Bearish

Futures contracts allow institutional investors to hedge against future price movements of an asset with the possibility of shorting them. Just like with Bitcoin, the Chicago Mercantile Exchange launched its products when Ethereum was trading on its way to an all-time high.

It is unsurprising then that the first month of trading futures has been bearish as the asset’s price has retraced heavily and those shorting it on CME would have been correct to do so.

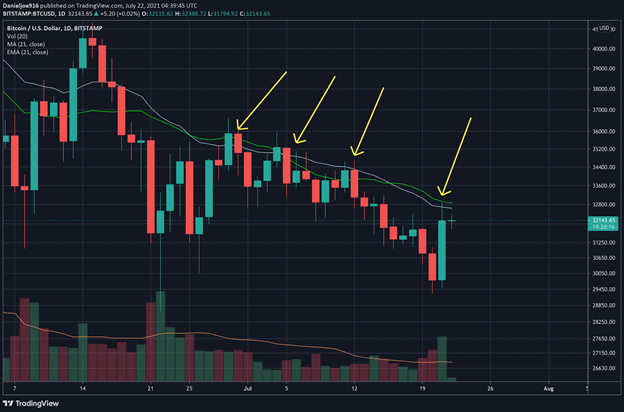

First month of CME trading for $eth ethereum pic.twitter.com/7xPO0Z4588

— frxresearch (@frxresearch) February 28, 2021

Déjà vu For Crypto Futures

CME launched its Ether futures on Feb. 8, and at the time the asset was trading at around $1,600. As reported by CryptoPotato at the time, a bearish reaction was expected.

Ethereum prices hit an all-time high of $2,050 on Feb. 21, but have corrected by 30% since then to today’s prices of around $1,450 – 10% lower than when the futures were launched.

ETH has underperformed BTC since the CME futures launch but a similar situation occurred with BTC, which underperformed ETH after its CME futures launch.

For #CME notes:

8 hours before CME’s first ETH 26 February 2021 expiration at 1600 UTC,

– Exchanges’ Feb futures expired at 0800 UTC

– Notable options expiry

– CME front month hit a -10% price limit, price reversed instantly and dumped at CME expiry

CME Feb closed -14.23%

— NeoButane (@NeoButane) February 26, 2021

When Bitcoin futures were first launched in December 2017, the asset hit an all-time high a week or so later then pulled back heavily resulting in a similar effect on futures markets. Exactly the same has happened with Ethereum a little over three years later.

Of course, BTC has recovered and entered a new bull market and the same will happen with Ethereum regardless of how deep this correction goes.

In terms of volumes, the CME is reporting its highest ever day as Feb. 23 with 2,092 contracts traded. That volume has slumped to around 749 contracts on Feb. 26.

Longer-term contracts are likely to be bullish as the rollout of ETH 2.0 and the growth of staking opportunities is likely to push ETH prices to new highs whilst alleviating those epic transaction cost issues.

Ethereum Price Outlook

Currently, Ethereum has gained 4% on the day but has declined almost 30% since its peak last weekend. The asset fell to a monthly low of $1,300 on Feb. 28 but has since recovered a little to trade back over $1,400 again at the time of press.

There is strong support at current levels so ETH needs to remain above it to maintain the current momentum. A fall below could see ETH settle at just over $1,200 but a sustained move higher would need to see resistance at $1,600 broken again.