DeFi’s Curve Finance Is Branching Out to Polkadot

It costs a lot to swap assets on Ethereum. Curve Finance is building a version on Polkadot to enable a multi-chain future.

DeFi’s Curve Finance Is Branching Out to Polkadot

Curve Finance is making its way to another blockchain – Polkadot.

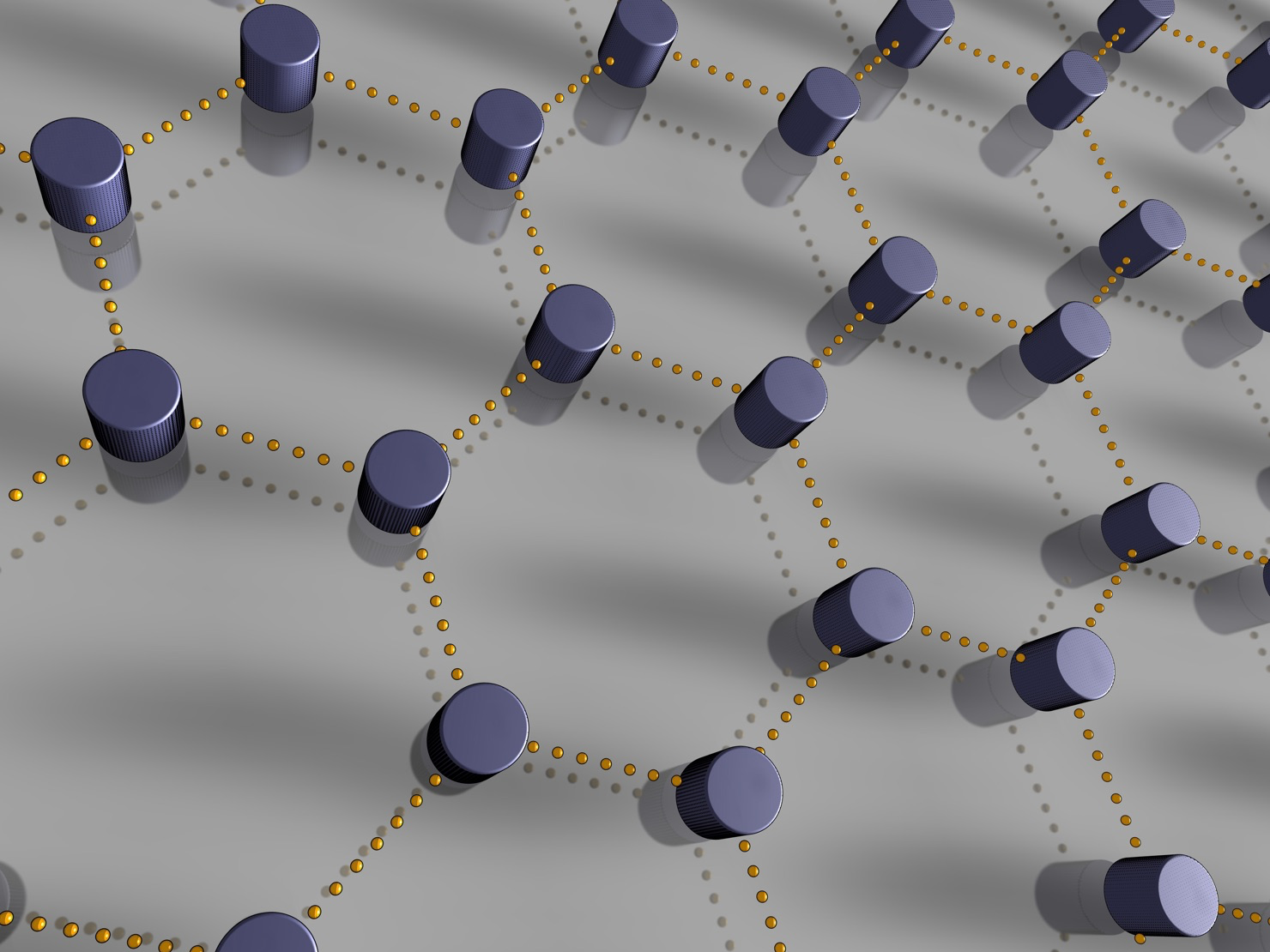

The decentralized finance (DeFi) money market is building a cross-chain implementation to run on the Polkadot parachain Equilibrium. Once implemented, the automated market maker (AMM) will exist on both Ethereum and Polkadot.

Curve Finance is one of the largest automated market makers (AMM) on Ethereum. The protocol enables low-slippage swaps of stablecoins such as tether (USDT), dai (DAI) and USDC. For example, Curve processed $400 million in volume in one day last month, according to CoinGecko.

“We’re excited to see the demand for stablecoin liquidity driving the technology to other chains,” Curve Finance CEO Michael Egorov said in a statement. “Deep liquidity is vital for adoption of new applications like Equilibrium, as well as for the adoption of new blockchains themselves.”

Fees, fees, fees

The cross-chain project comes as transaction fees continue to soar on Ethereum, the preeminent blockchain for DeFi. As CoinDesk reported, the average transaction fee broke north of $20 last week.

DeFi projects are now scrambling to address heightened fees, a factor that pushes out small investors from the young market. One such answer is rollups, a throughput solution that bundles transactions off-chain and then settles them on-chain in one lump. Curve Finance has been working on a rollup solution using zero-knowledge proofs and even has a live version.

Yet, many DeFi apps are placing bets on many horses – including other blockchains. For example, DeFi lending market Compound announced its new Compound Chain currently under development across a few networks.

“With Curve Finance running on our Polkadot parachain, we have a powerful tool for exchanging homogenous assets on Polkadot, whether they are DOT-based or not,” Equilibrium CEO Alex Melikhov said in a statement. “We stand to unlock some true cross-chain functionality.”