DeFi Unfazed by SEC’s Classification of Tokens as Securities

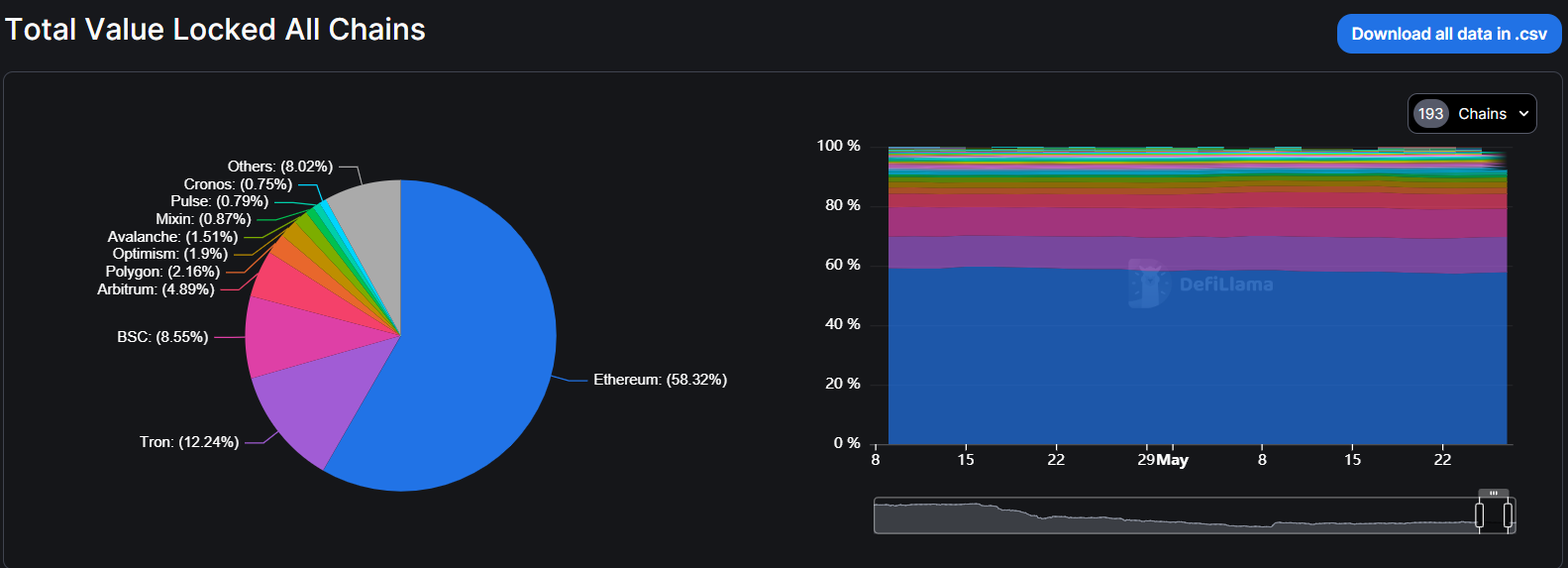

Value locked on decentralized finance (DeFi) applications operating on the blockchains of tokens alleged as securities in the recent filings made by the U.S Securities and Exchange Commission (SEC) remained mostly stable despite the ongoing drama.

The lack of sudden capital flight suggests positive sentiment among global market participants, despite falling prices. BNB coin (BNB) fell to six-month lows on Wednesday, while prices of Solana’s SOL, Cardano’s ADA, Polygon’s MATIC, and other tokens also tumbled.

In separate filings on Monday and Tuesday, the SEC charged Binance and Coinbase (COIN) with selling unlicensed securities in the country.

The charges came despite a lack of regulatory clarity from the regulator on whether crypto tokens can be considered securities. The SEC has not given any official legal definitions to token issuers and is yet to respond to a petition from Coinbase seeking clear rulemaking definitions.

DeFi avenues remain unfazed, at least as of Thursday. Data shows value locked on Cardano, Solana and BNB Chain networks fell just over 5% in the past week – in line with a broader market decline. These declines hovered at just over 1% on a monthly basis, the data show.

DeFi continues to be resilient

Some market observers opined that the lack of capital from DeFi applications was suggestive of the type of market participant that dominates the current climate.

“It’s been a long crypto winter and the majority of ‘tourists’ have already left the space,” shared Kyle Doane, trader at crypto investment firm Arca, in an email to CoinDesk. “The remaining participants are most likely more dedicated believers and thus less affected by the latest actions from the SEC.”

“The tokens themselves being deemed securities have nothing to do with the viability of the underlying tech of DeFi and does not make the tokens/dApps any more or less valuable. These forces will likely only drive more financial activity to DeFi,” Doane added.

Martin Lee, an analyst at crypto analytics firm Nansen, shared the sentiment. “We’re not seeing any massive changes in number of users or transactions on Polygon, Solana and BNB Chain and they’ve largely remained within similar levels as they’ve been in the past month,” Lee said.

“Personal view is that until regulation is enforced and these tokens are officially classified as securities, it’s unlikely that we see a significant impact on the ecosystems,” he added.

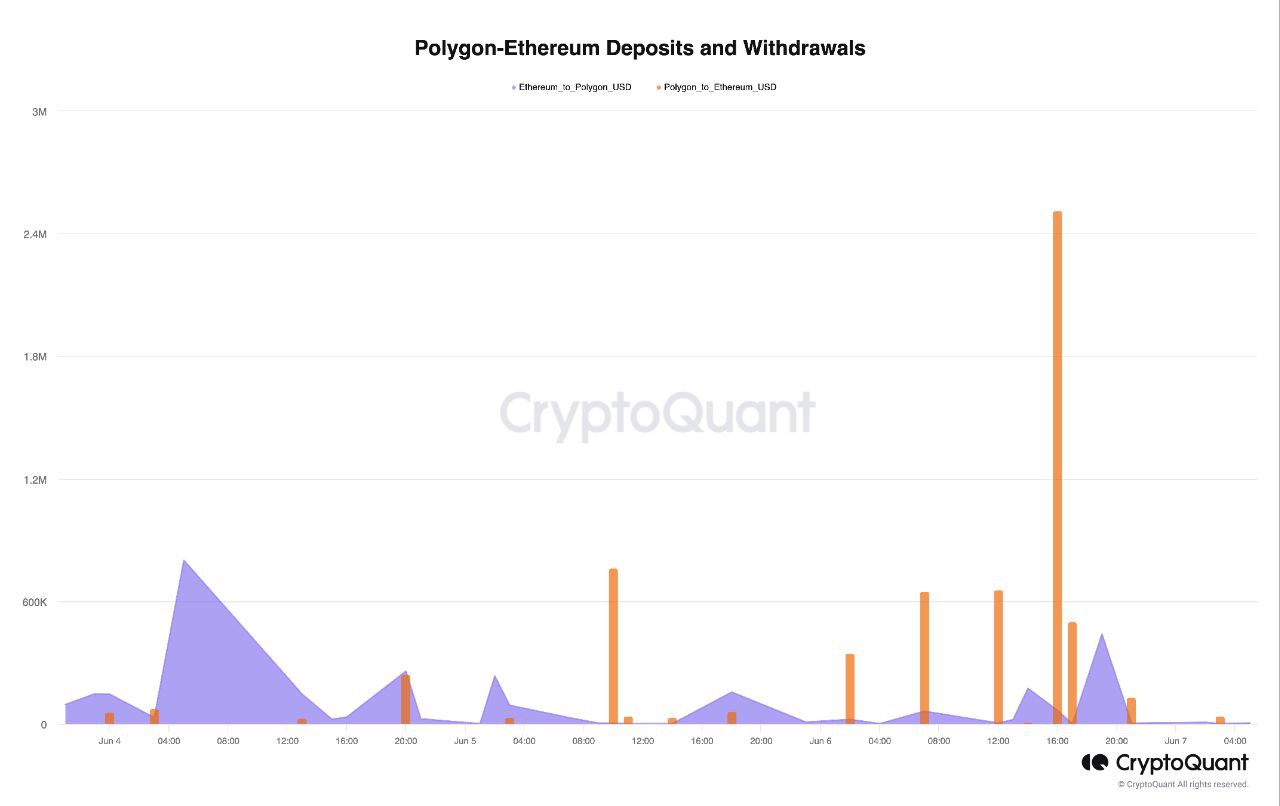

As such, while the Polygon network saw sudden withdrawals following the alleged classification of MATIC tokens as security in the U.S., the volumes remain muted based on a long-term analysis, shared Julio Moreno, head of research at analytics firm CryptoQuant.

“From the perspective of people withdrawing from Polygon network to Ethereum network there has been a spike after the SEC mentioned MATIC as a security, as the chart shows,” Moreno said, pointing to the $2.5 million in withdrawals on Tuesday.

“However, from a historical perspective, these withdrawal volumes remain low,” he added.

Edited by Parikshit Mishra.