DeFi Token YFI Is Now Worth More than a Bitcoin

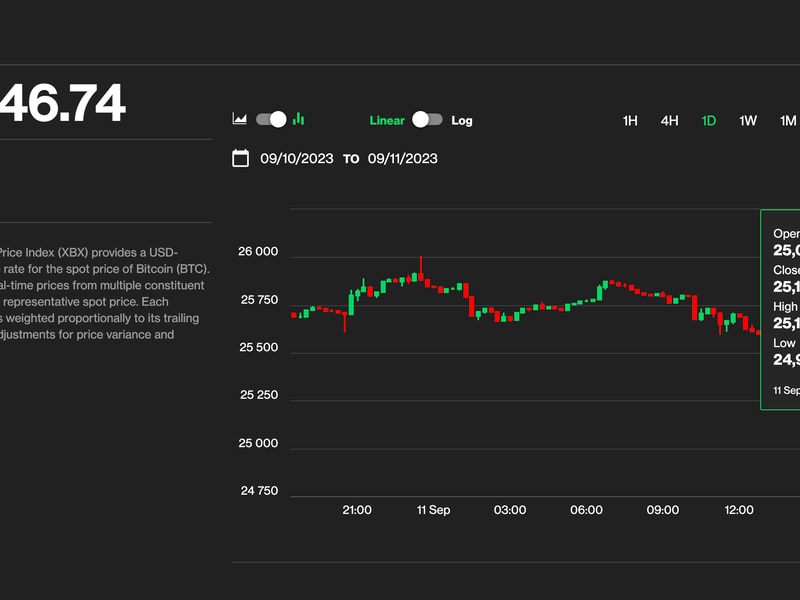

YFI price action in the past 24 hours (CoinGecko)

As bitcoin continues to falter, a token from the booming DeFi sector has, for the first time, taken over to become the market’s most valuable cryptocurrency.

- yEarn.finance’s governance token (YFI) has surged 35% in the past 24 hours and is currently trading at nearly $13,500, according to CoinGecko data.

- In comparison, after hitting a yearly-high earlier this week, bitcoin has now fallen back down to just under $11,800 – possibly in response to a strengthening dollar.

- This is the first time bitcoin has ever been superseded by an alternative cryptocurrency.

- YFI only launched four weeks ago – initially trading at just $32; it surged $400 as CoinDesk went to press.

- Investors deposit select digital assets into yEarn, which then automatically executes various DeFi trading strategies with ROIs of up to 95% – the platform takes 5% of the yield as commission.

- Total value locked (TVL) in yEarn stood at $9.3 million on July 18 but boomed to $600 million by Tuesday. At press time, TVL stood at $675 million, according to DeFi Pulse.

- As a governance token, YFI can be staked to give holders a vote on the protocol’s direction. It can also be farmed like many other DeFi tokens.

- But only 30,000 YFIs were created, meaning that despite the price surge its market cap currently sits at just under $400 million – a fraction of bitcoin’s goliath $218 billion cap.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.