DeFi Protocol Abracadabra Wants to Charge 200% Interest on Curve Founder’s $18M Loan

-

Abracadabra is proposing measures to protect from a bad debt situation stemming from an $18 million loan to Curve Finance founder Michael Egarov.

-

If passed, the protocol would automatically sell crv tokens to liquidate the position unless topped up with more collateral, putting selling pressure on an already stressed crv market.

As decentralized finance (DeFi) protocols scramble to protect themselves from the risks posed by a massive loan taken against crv (CRV) tokens, one platform is proposing an aggressive measure – raising interest rates on that loan exponentially to effectively liquidate the position.

Abracadabra Finance today floated a proposal that introduces sky-high interest rates on two specific pools it terms “cauldrons” that are made up of crv belonging to Curve Finance founder Michael Egarov.

Egarov has taken out $18 million from Abracadabra at a current rate of 18%. But Wednesday’s protocol seeks to increase this to 200% – effectively squeezing him out. The move seeks to reduce Abracadabra’s overall crv exposure to just $5 million worth of tokens.

“Given the current outstanding principal is $18M, the base rate would be 200%. At this interest rate, the loan would be fully covered within 6 months. As the principal is repaid, the base rate would decrease,” the proposal read.

The hike is not a total interest rate bump, but a gradual rate that starts at 200% and decreases as the loan is paid back by automatically selling crv tokens. Developers expect the loan to be paid back in six months with such a strategy, with all proceeds going to the Abracabadra treasury.

“We believe this solution will reduce negative externalities associated with such positions compared to a simple interest rate hike,” developers wrote in the proposal.

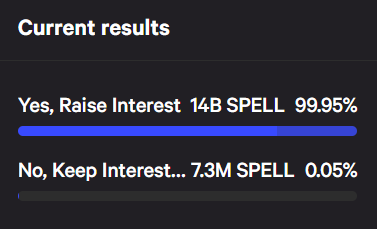

A staggering 99.95% of the Abracadabra community has voted in favor of the proposal as of Wednesday at 13:00 UTC, governance data shows.

Such concerns were earlier raised in a June post by community member “0xthespaniard,” who said that while the 18% interest charged on the large loan “meaningfully contributes” to the protocol’s profitability, the platform ultimately faces asymmetric downside risk.

“There are several indications that a liquidation would prove to be fatal to the Abracadabra protocol,” 0xthespaniard warned at the time. “According to Curve’s own DEX front-end, a 10M CRV swap (equivalent to approximately $6.7M at spot prices) is expected to cause a 30% price impact on Curve’s own DEX.”

“The gigabrains over at (risk management firm) Gauntlet conducted their own simulations and are estimating that the markets would struggle to support even a $6M liquidation,” he added. “It seems incredibly unlikely that Abracadabra would be able to liquidate the full CRV position without incurring significant amounts of bad debt.”

Curve Finance, a stablecoin swapping giant, suffered a Sunday exploit that drove down the price of the CRV token, putting a $168 million stash of founder Michael Egorov’s money at risk of being liquidated.

This created bearish sentiment for the tokens among traders alongside concerns that liquidated assets would have to be sold into a market where prices are already falling. The liquidation of such a large position could put pressure on other DeFi protocols because CRV is used as a trading pair and ballast in trading pools across the ecosystem.