DeFi Platform Celsius Hits $1 Billion in Cryptocurrency Deposits

Decentralized finance platform Celsius Network has crossed $1 billion in total cryptocurrency deposits.

Decentralized lending and borrowing platform Celsius Network has crossed $1 billion in total cryptocurrency deposits since its launch in 2018.

The platform claims that it returns 80% of its total revenue to its users and has so far paid $17 million as interest rewards to its community of cryptocurrency holders, of which, $12 million were in Bitcoin (BTC) and $3 million in its native CEL token.

Thriving through the pandemic

The growth of the platform in recent months has been considerable despite the coronavirus pandemic having an adverse effect on most businesses.

In March this year, Celsius CEO Alex Mashinsky claimed that their platform was the first major cryptocurrency lending platform that has turned profitable.

To further expand its user base, Celsius revealed last month that it was adding support for tokenized gold. The platform will also be adding other tokenized commodities in the future.

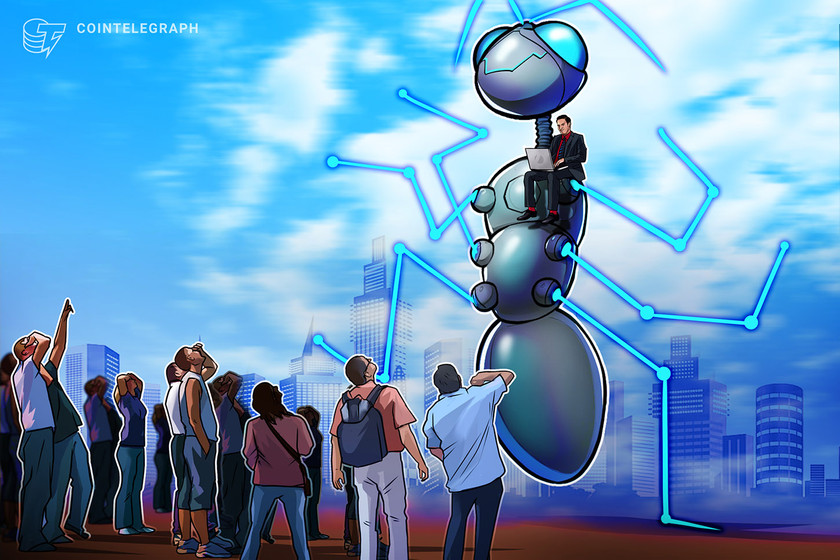

Unbanking with Celsius

As many blockchain and cryptocurrency projects focus on using the technology to bring banking services to the unbanked population, Celsius is working to unbank people and purportedly provide them a better alternative — one powered by cryptocurrency. Mashinsky said:

“We look forward to the day when billions of people leave the antiquated traditional banks behind and choose to unbank with Celsius. We proved we can bring the power back to the people.”

Mashinsky noted that the app was for individuals who were turned away from traditional finance “due to race, gender, credit score or job status” to earn more than they could otherwise through more accepted means.