DeFi Coins Exploding As Total Value Locked Eyes $35 Billion

The decentralized finance field continues expanding in all directions as the total value locked in various projects has tapped $35 billion. At the same time, numerous DeFi tokens have exploded in price in the past 24 hours, including an all-time high for Chainlink and double-digit pumps for Aave, Maker, Synthetix, Compound, and more.

Skyrocketing DeFi Tokens

The total crypto market cap marked a new all-time high today at over $1.170 trillion, and DeFi coins have attributed the most to these developments.

For starters, LINK, the native cryptocurrency of the most-widely used oracle network, Chainlink, registered a new all-time high of slightly over $27. This became possible after a 9% increase on a 24-hour scale. Furthermore, LINK is up by 120% since the start of the year when it traded at $12.

Aave, the native token of the decentralized lending platform going by the same name, has surged by 15% since yesterday to $520. Furthermore, the recently-rebranded coin is 85% up since Tuesday and almost 500% higher YTD.

Synthetix and Compound have gained 20% on a 24-hour scale to $22 and $533, respectively. On a weekly scale, though, Compound has added a whopping 116%.

Nevertheless, Maker and 0x have stolen the DeFi show. MKR has expanded by 75% in a day and 110% in a week to an all-time high of its own at $3,000. Just for reference, MKR traded at $560 at the start of 2021.

ZRX’s price has skyrocketed by 130% now to nearly $2. The asset is up by more than 225% in the past seven days and has neared its January 2018 ATH of $2.50.

Although Uniswap’s governance token, UNI, is slightly down since yesterday, it also recently reached a new price record of above $21.5.

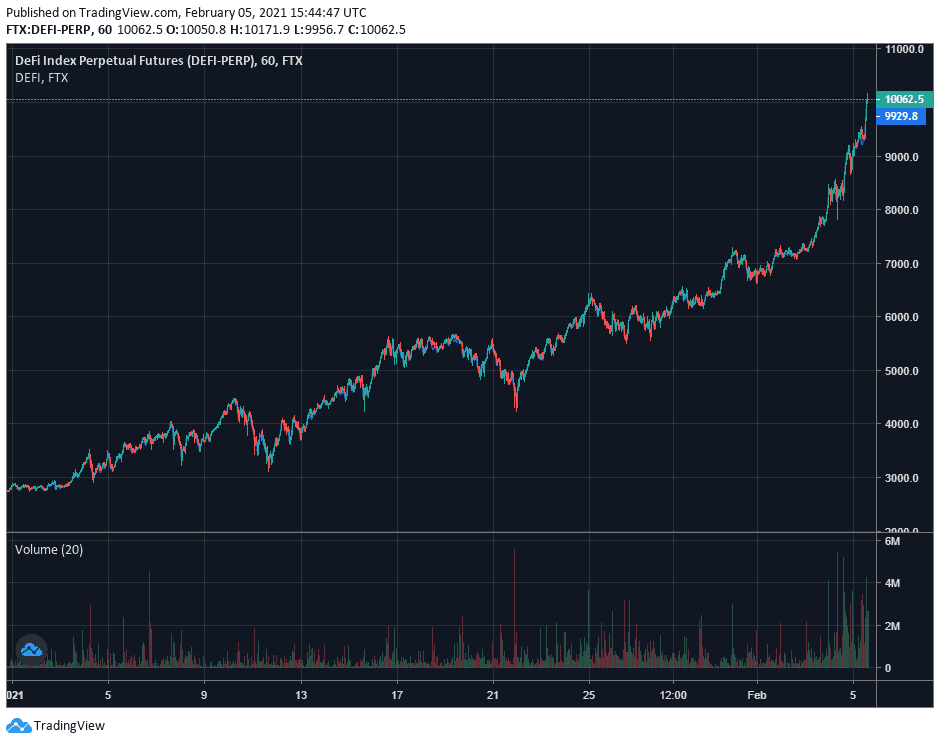

Ultimately, the DeFi-tracking index offered by the popular derivatives exchange FTX has expanded by more than three-fold since the start of the year to a new record above $10,000.

TVL Touches $35B

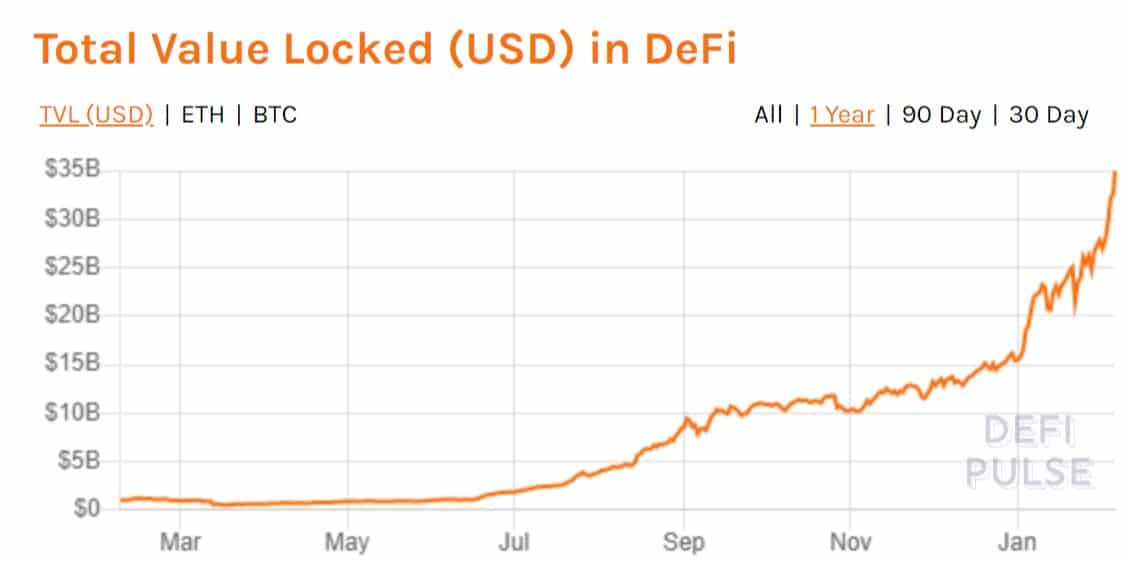

Simultaneously with the prices of DeFi tokens, the total value locked (TVL) in such projects has jumped to a new record of $35 billion.

As such, it has more than doubled since the beginning of 2020, when it was just shy of $15B. The TVL is a good example showing the growth of the DeFi sector in the past year. According to DeFipulse data, the total value locked had just breached $1 billion on this day last year.

Interestingly, the three leading projects accounting for the majority of the TVL are lending services. Namely, those are Maker with $6 billion locked, Aave with $5.76 billion, and Compound with $4 billion.

Three decentralized exchanges (DEX) follow – Uniswap $3.65 billion, Curve Finance $3.5 billion, and SushiSwap $3.1 billion.

It’s also worth noting that the growing engagement with DeFi projects has caused congestion for the underlying technology behind most of the field. As reported earlier, the average gas fees on the Ethereum network are at over $22 – a record high level.