Deconstructing The Bitcoin Lending Landscape in 2021: How To Lend Wisely And Avoid Disaster

Juicy interest rates on lending platforms are attracting Bitcoiners who are looking to stack more sats. But the devil is in the details.

Bitcoiners have dreamed of lending and earning interest on their coins for over a decade. With companies such as BlockFi offering juicy 6 percent interest rates, has this dream finally come true? Or is this just a minefield, where you’re just one step away from disaster? Let’s peel back some of the layers of this onion to try to better understand today’s bitcoin lending landscape, so you can make a more informed decision before parting ways with your hard-earned sats in hopes of collecting more sats.

First, let’s review some fundamentals. All parties involved in a business deal should have a shared and equal understanding of what is expected to happen and the risks involved. Lending is just like any other business deal. If you loan me your bitcoin, you should expect me to tell you exactly what I will do with your money, what risks are involved, and what happens if I don’t repay you. It takes some time to work through the details, but that’s where the devil lies. Details matter.

Imagine I ask you to lend me 10 bitcoin. I should be able to tell you not only that I plan to use your money to buy a house, but I will also tell you exactly which house I will buy. This way, if I fail to repay the loan, you can place a lien (a legal claim) on the title of the property that was purchased with your money. This type of arrangement is typically called a mortgage or hypotheque. The title of the property is called collateral.

As a lender, you’re worried about the 10 bitcoin that you have loaned me. You want to be absolutely certain that you will be able to recover as many of your 10 bitcoin as possible if I stop repaying the loan. Because your 10 bitcoin are “in” the property, you’re worried about the value of the property — the value of the collateral. You’ll want to make sure I have insured the property, and that I maintain it. What if house prices fall 50 percent, and the property is now only estimated to be worth 5 BTC? If I defaulted on the loan and you tried to sell the property, now you would lose at least 5 BTC. So, if the market price of the property drops, you might require that I “post” or contribute more collateral, such as the title to my car or my boat.

Here’s an interesting wrinkle: many governments now formally consider bitcoin to be property in the same way they consider real estate to be property. The best evidence for this is the expectation that you report capital gains or losses on bitcoin transactions for tax purposes in the U.S., exactly as you would for real estate. Some governments go further, and want you to pay tax on the market value of your bitcoin holdings, as you would for real estate holdings. These tax treatments strongly assert and reinforce the idea that bitcoin, presumably a given set of UTXOs, is property.

Because bitcoin is property, it can be used as collateral. This means you can borrow against (or “mortgage”) your bitcoin rather quickly and at negligible cost, whereas it might take many weeks and quite a bit of money to be able to borrow against real estate. You can probably see how the pieces of this puzzle start to fit together now.

Now let’s switch gears and think through a way we can make very good profits without getting our hands dirty doing real work like plumbing or carpentry. Let’s imagine ourselves working as a trader at a bank or investment company. Our job is to make money consistently, and with no risk of loss due to price movements. Generally speaking, this type of “risk free” trade is called arbitrage. Let’s have a look at one arbitrage strategy, which is the cash and carry trade. Which is also sometimes called the basis trade.

Imagine you can buy a barrel of crude oil today from your neighbor Carl for $50 cash (this is the spot price). When you log into your brokerage account, you notice you can sell that barrel of oil for $60 one month from now. It costs $5 to store the barrel for one month. Your profit would be $5, so that’s 9 percent return in just four weeks, and there’s not much risk. You can make the same trade using bitcoin instead of crude oil, and your storage costs will be much cheaper. As I write this, the bitcoin futures contract for a month from now on CME Group is trading at approximately $58,950, while the spot price is approximately $57,170. If you buy one bitcoin now and immediately enter into a contract to sell it in a month, you’ll make a profit of $1,780, or 3 percent. Do that each month each month and $10,000 turns into $14,000 over the course of a year. The more money you can get into the trade, the more money it’s possible to make.

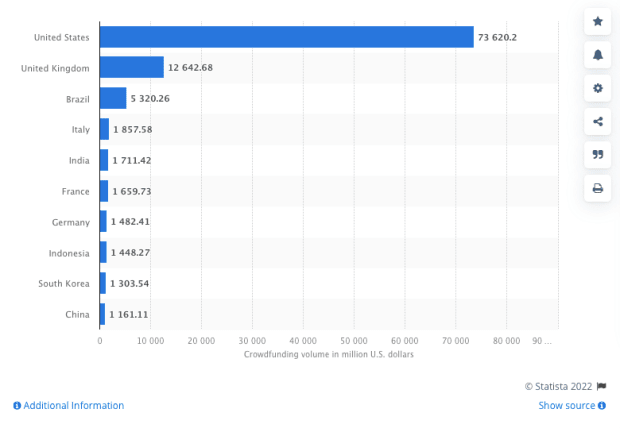

What’s the catch? You will need a lot of money to start off with. Where will you get all of this money? You need to convince someone to give it to you. Maybe you can start a company and issue equity, debt or a ridiculous token. And if you have to pay people for the use of this money (debt issuers do, equity and token issuers don’t), make sure to pay less in interest than you will earn on the trade.

There are endless variations of this trade, as the only thing that’s really required for the opportunity to appear is for a derivative to be priced differently from the spot price. For example, the Grayscale Bitcoin Trust issues shares, and that share price has been quite a bit higher than the bitcoin spot price. But if the share price trades more closely to spot price, or it falls below the spot price, then the profits from this particular carry trade will be reduced or will disappear entirely.

This particular carry trade disappearing does not imply that any particular professional trading firm that was making money from this trade is in any sort of financial distress. You should expect a professional firm to be able to begin another carry trade, such as the futures contract on CME. It shouldn’t be the case that a professional trading firm fails due to any one of these trades becoming unavailable for a long period of time. But you never know.

You’ve probably realized by now that you could do this trade yourself, but it will take a bit of effort. It makes sense that a professional firm like BlockFi engineers the trade, skims a bit off the top and then sends you the leftovers.

So, let’s return to the original question: Has the bitcoin lending dream become reality?

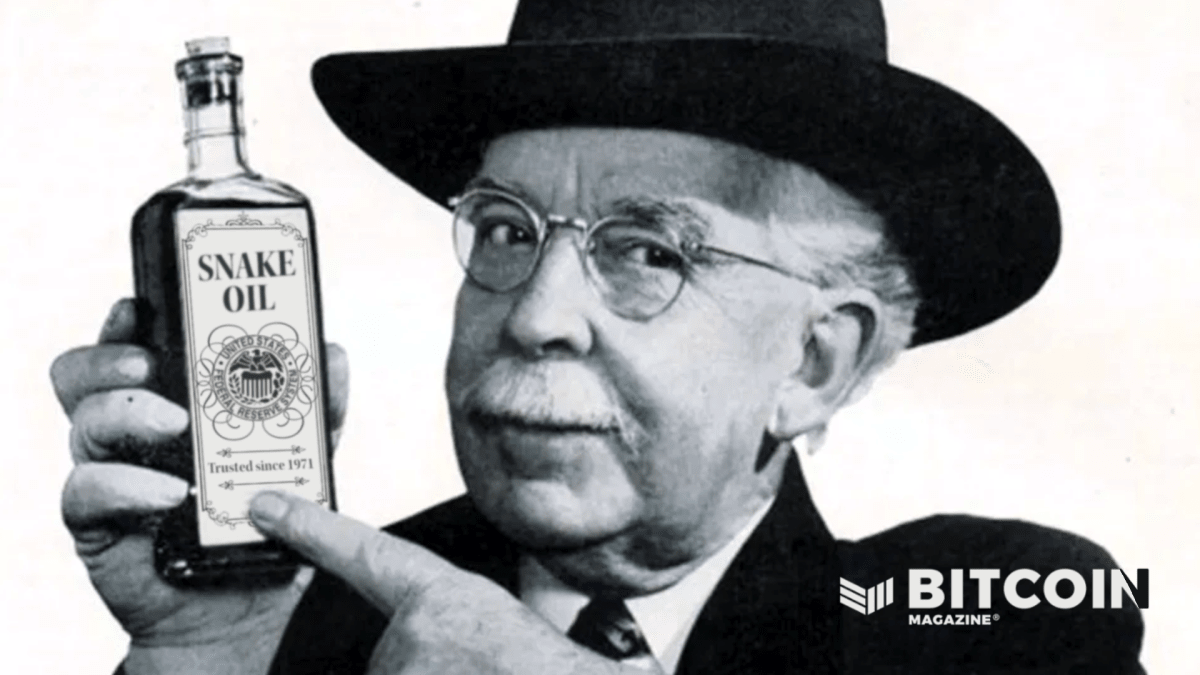

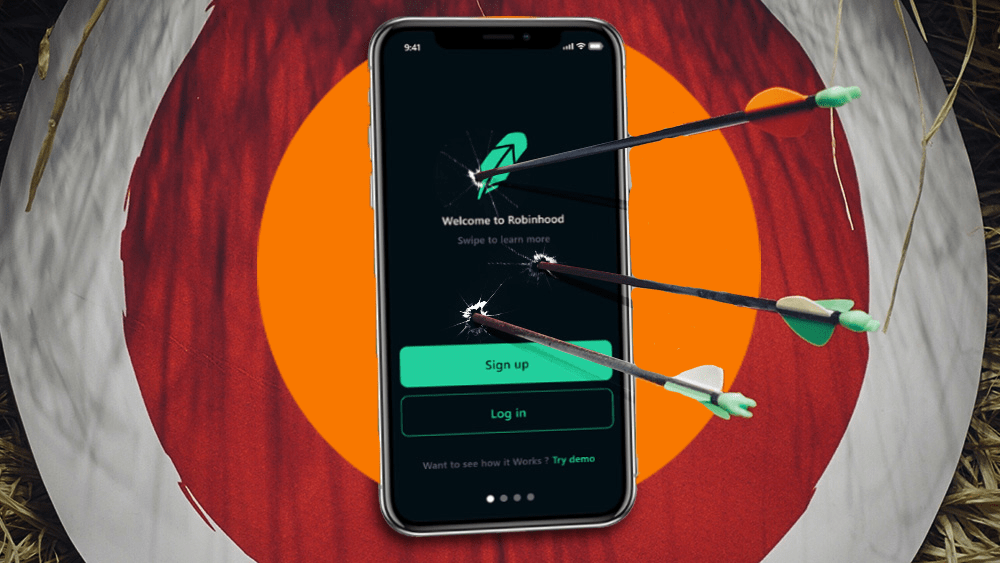

What most people believe today to be “lending” bitcoin in order to earn interest is not actually lending. To use BlockFi as an example: legally, you’re giving away your property, and BlockFi has no obligation to give it back. The directors of that company have not posted their personal homes, cars or boats (since their latest fundraising success, it’s now probably yachts and private jets) with you as collateral. In fact, you probably don’t even know who the directors of that company are.

What’s especially confusing is many of these platform operators use the word “lending” quite liberally in their marketing materials and on their websites. They might even promote that they are regulated. But this only means they are allowed to offer loans to the public. It does not mean you are lending to the company, even though this might be slyly implied.

The bottom line is this: today’s popular “lending” platforms are not what you might think they are. There is a strong asymmetry of information and power in these relationships, and the deck is stacked against you. You’re making a handshake agreement with anons running a pseudo-hedge fund, tossing them some of your savings and hoping for the best. So far, things seem to be working out. But past performance is no guarantee of future results. BTC-e and Mt. Gox kept their promises, until they didn’t. Bear Sterns, Long Term Capital Management and countless others kept their promises until they didn’t.

There is good reason that banks are so strict when it comes to lending: they don’t want to lose money. With bitcoin, you are your own bank. You should be just as strict in evaluating credit worthiness and demanding borrowers of your bitcoin to post collateral (even if it is additional bitcoin collateral), and make sure you have an enforceable contract before ever making a loan to a private person or a company.

This is a guest post by Justin Smith. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.