Decentralizing IP Addresses With Bitcoin Helps Distribute The Internet

If they choose to, IANA could use Bitcoin to create a decentralized database for IP address distribution, unless they go down the path of tokenization.

This is an opinion editorial by Moustafa Amin, a technology leader with more than 20 years of professional experience across large organizations, service providers and telecom companies.

“Bitcoin Not Blockchain”

If you’re a frequent reader of Bitcoin Magazine or if you’re a Bitcoin enthusiast in general, you might have seen this motto. I came across it numerous times and I agree with it 100%.

Sometimes there could be a minor exception, for instance when the scope is constrained, the context is private and there is no need for tokenization but in most cases, it’s always wise to stick to bitcoin.

Let’s analyze an imaginary case study around IP addresses using a “traffic light” analogy — yellow, red and green.

IP Addresses

I assume that the readers are or at least familiar with how data communications occur across the internet based on the IP protocol (TCP/IP if we want to be technically accurate). The more technological readers may be aware of internet protocol (IP) addresses, like IPv4 and IPv6.

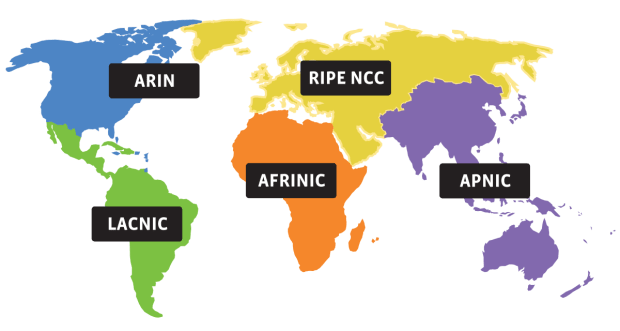

Try to Google “Who controls IP addresses?” You’ll promptly get “IANA: the Internet Assigned Numbers Authority.” IANA is the top authority behind IP address allocation and assignment. There are five different regional internet registries (RIR) with jurisdiction under the IANA.

As a matter of fact, as an individual or a normal internet user you cannot request IP addresses directly from IANA or one of the five RIRs, but only from internet service providers, such as the services offered by mobile or telecom operators.

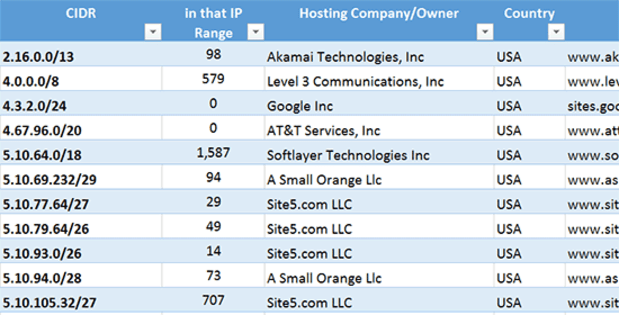

From this architecture, you can imagine a central database of IP addresses held and maintained by IANA.

Let us assume that one day IANA decides to launch a blockchain version of its IP addresses database, wouldn’t that be a legitimate project? The answer depends on their approach and their intention for doing so.

Before we proceed, let us agree on a couple of points:

- The term blockchain doesn’t always refer to the underlying technology of Bitcoin as invented (or discovered) by Satoshi Nakamoto. Instead, it has become a marketing term that is widely used by vendors as a buzzword to describe their products in either private or public contexts.

- Even with a decentralized version of the IP addresses database, the IP addresses will always remain in IANA’s custody. These resources will never be handed over to the public community.

The Yellow Path

If IANA cares about the integrity, safety and security of their current centralized IP addresses database and wants to make it decentralized over a blockchain by having separate identical copies of the database held in geographically dispersed regions for decentralization and redundancy, they’d look for a solution that will be a mix of decentralized storage (IPFS for example) and private blockchain (cloud-based or open-source). This could be compared to AWS blockchain, Hyperledger, Multichain, etc.

In this case, each regional RIR will be responsible for some nodes that run this private blockchain. Each node will send and receive updates over the blockchain while storing an identical always-updated copy of the IP addresses database.

No token will be required in this solution, and the whole solution will be maintained by nodes falling under either the jurisdiction of IANA or the RIR. As a matter of fact, IANA can pause, stop, restart, truncate or even delete parts of this private blockchain at their will.

Basically, this case is not different from the current situation where IANA can change or even delete parts of the IP addresses database of their centralized database (if they want to). I am not saying they would, but they could.

This path is labeled “yellow” because it could be acceptable as it doesn’t represent any risk to outsiders, i.e., there are no investors who put up money for tokens.

The Red Path

What if IANA decides to launch their blockchain version of IP addresses as a smart contract dApp — using some platform like Ethereum, or even as a separate public blockchain — and tokenizes the whole thing and maybe runs crowdfunding events to distribute these tokens? I won’t waste your valuable time discussing this scenario any further: This would make it no different from the other 20,000 useless altcoins out there!

The Green Path

What if IANA is intelligent enough to keep their IP addresses database truly decentralized over the only really decentralized blockchain — Bitcoin — and allowing payment in sats? A possible option could be an application built on top of Bitcoin or the Lightning Network and integrated with a distributed off-chain storage.

The distributed storage will store the actual IP addresses along with their respective owners. This would happen off-chain to avoid overwhelming the Bitcoin network, but the indexes to the database entries could be stored on chain.

To counteract Bitcoin’s pseudonymity, customers (providers or operators) will still be required to provide identification information for complete ownership of their IP addresses. Unfortunately, this would be in full compliance with know-your-customer laws (KYC) for online surveillance, as you might guess.

Regardless of the abundance of IP addresses, they are limited by nature, meaning that IANA cannot mint or create new addresses out of thin air.

Quick fact: there are slightly less than 4.3 billion IPv4 addresses that were all sold (depletion of IPv4 addresses started back in 2011), while there are 340 trillion, trillion, trillion IPv6 addresses — an insanely huge number so that the minimum IPv6 address allocation is divided by 32 to be equal to the number of all IPv4 addresses out there.

As all transactions will be permanently stored over the ledger, IANA can’t mess around and resell the same chunk of IP addresses to another owner. This is named an “IP address block,” not to be confused with Bitcoin blocks.

The Ideal Path

What if we replace the controlled and surveilled IP addresses with new internet addresses that are based on Bitcoin? These addresses will inherit all Bitcoin’s features, i.e., they will be purely decentralized, secure, future-proof, robust, anonymous, unhackable, controlled by no single authority and many more.

Is it just a dream? For now. If this could be true we would be changing the internet as we know it.

This is a guest post by Moustafa Amin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.