Decentralized Exchanges – (Not) the Future: Trading Volume Hit All-time Low

According to a report by the curated data platform Diar, decentralized exchanges has hit a new all-time low in January 2019 regarding USD traded value along with on-chain ETH transactions. The statistics show a decreasing volume even though the leading centralized cryptocurrency exchanges have introduced their DEX solutions.

The huge drop in volume

Data show that since June 2017 – when decentralized exchanges have appeared in the crypto space – a total of $8.9 billion had been traded on the on-chain services. Only last year accounted for over $7.1 billion.

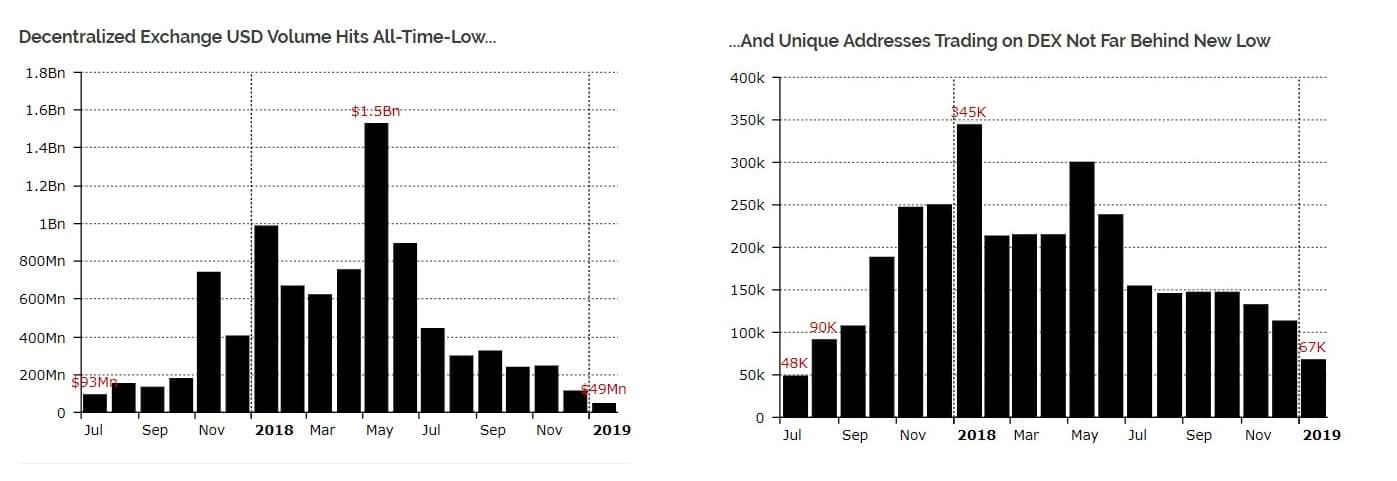

Despite last year’s all-time high trading volume, this number has dropped to only $49 million in January 2019. According to the data, this equates less than a tenth of the daily trading volume on Binance exchange.

Furthermore, January’s volume is just a little over half of the previous all-time low in July 2017 when DEXs were entirely new for the markets.

The amount of DEX-traded ETH has also dropped significantly – it’s about a third of January 2018’s volume. Ether trading was at its highest in May 2018 when decentralized exchange users traded over 2.3 million ETH. As of now, it has dropped to approximately 400,000 ETH.

The number of unique addresses trading on DEX has followed the drop in both the volume and ETH trading.

Although DEX addresses did not reach July 2017 all-time low of 48,000, they have approached it as only 67,000 unique addresses were trading on DEX this past month. Compared to the peak of 345,000 unique addresses recorded in January 2018, this number has fallen by over 80% in the matter of just a year.

Can the leading exchanges solve the DEX issue?

Despite the new all-time low trading volume, major cryptocurrency exchanges have previously shown interest in setting up their own DEX solutions. While Binance has already shown the demo of its decentralized exchange platform, OKEx Open Ledger DEX has launched along with Bithumb’s decentralized solution. Joining the others, Coinbase purchased Paradex last year.

According to the report, despite their efforts, the new DEX platforms by the major centralized exchanges did not solve the continuous decrease of the trading volume. Coinbase along with Binance and others did not manage to win over a significant percentage of traders from centralized platforms even though DEX fees are meager – or there are no fees at all.

Diar argues that the main reason for the volume decrease is the slow user experience infrastructure of DEX solutions that need deposits, withdrawals, and transaction gas fees from the users. While the fees can be low, DEX won’t gain popularity until the operators upgrade the current infrastructure.

The post Decentralized Exchanges – (Not) the Future: Trading Volume Hit All-time Low appeared first on CryptoPotato.