Debt Of Nations: Bitcoin Is An Alternative To The Physical Hand Of Keynesian Economics

Fish are the last to discover water — and economists simply cannot see past the Keynesian theory that creates the problems they intend to solve.

Introduction

In 1776, Adam Smith published, “The Wealth of Nations” and, for the most part, the near 1,000-page document confused, perplexed or completely lost many readers in what some considered a wandering and often “off subject” digressive narrative. Some of the most brilliant thinkers see correlations where the masses do not.

Smith is considered to be to economics what Isaac Newton was to mathematics or physics (Diemer and Guillemin, 2011). In the end, Adam Smith’s 1776 work brought forth a debate between how to govern: exempli gratia, an invisible hand versus a physical hand. The debate continues today in regard to market manipulation, quantitative easing, the role of digital assets (bitcoin) and a definition of “real wealth.” This article explores these topics as well as reaches beyond prototypical financial or economic examples in an attempt to propose alternative solutions.

Disclaimer

“Laissez-faire” and even the notion of an “invisible hand” are phrases attributed to Adam Smith in some circles, but neither of the terms was coined by Smith in his writings (Dellemotte, 2009). There are peer-reviewed articles supporting these claims, on both sides, however, for the purposes of this document, Smith’s original works will be explored. Postscript narratives and adaptations of intent are not being applied.

This document assumes that the reader has a basic understanding of Keynesian (active State participation in markets, such as the U.S. Federal Reserve printing money and adjusting interest rates) and Austrian (allowing financial markets to correct naturally) economics.

Solutions Beyond Expertise

NASA has held open invitations where they present, openly and publicly, challenges that their engineers, scientists and program managers currently face; problems that they have yet to solve (Dunbar, 2022). When massive oil spills occur, chemists and scientists often scramble for solutions on how to limit damage and solve the problem (Leone, 2021). FBI cryptographers have posted ciphers they do not understand and cannot crack to public spaces asking for assistance (ABC News, 2011). As a result of this candor and humility, solutions from outsiders, with no direct experience in the fields, have been implemented by NASA, the FBI and oil spill recovery teams. One can only wonder what type of background or experience an “outsider” might have to be able to crack a cipher system that befuddled professionals for decades or a technical issue that bested NASA engineers.

In each scenario listed above, approaching a problem from a narrow, single-minded and often universally trained perspective hinders thought and potential solutions beyond a specialist’s scope. For example, when considering NASA and a “toilet problem” on a ship, should one naturally consult a plumber or is someone who understands vacuums a more appropriate place to start? When the Exxon Valdez oil spill occurred in 1989, the fact most forget is that the spill occurred in frigid arctic waters. As such, oil recovery techniques did not work as the oil itself became too thick for traditional recovery methods and equipment (History, 2018).

After years of failed attempts, in 2007 the Oil Spill Recovery Institute posted the years-old problem in an open forum. Who or where did the solution come from only a few months later? Contractors and concrete. John Davis, who had experience pouring concrete, knew of machinery that vibrated the material in order to keep it in a liquid form (Leone, 2021).

The vibrating machinery extended the working time for contractors when pouring the material as well as allowed the concrete to fill into small cracks and crevices, which were previously difficult or impossible to address. Similarly today, what do oil spill recovery teams use as oil dispersants when working with sensitive wildlife? Ingredients found in whipped cream, peanut butter and chocolate (American Chemical Society, 2012). Sometimes the solution to a problem isn’t what professors teach in a classroom based on previous knowledge. The most challenging issues exist outside academia, in the real world, and have yet to be solved. The InnoCentive website has a variety of unsolved challenges that experts seek assistance in cracking. Looking back in history, we’re reminded of the fact that brilliant, yet humble minds, sought expertise or insights from beyond themselves.

Economic Pilots

Adam Smith is known for “The Wealth of Nations” (1776), however, prior to that writing, he also penned, “The Theory of Moral Sentiments” (1759). In his earlier work, he addressed ethics, philosophy and psychology. Sir Issac Newton explored and had a profound correlation to economics (Hetherington, 1983). Copernicus, in the 1500s, recognized inflation and the challenges associated with an increased production of debased coinage (Taylor, 1955). These brilliant minds, while focused on current challenges, allowed their thoughts to wander and question beyond their immediate foci at times; their insights were unique to stagnant fields.

This may be why Adam Smith produced nearly 1,000 pages of content in “The Wealth of Nations,” some of which confused readers; a nearly 70-page detour is one such example. This is also, perhaps, why Newton’s early experience building and repairing clocks and windmills may have helped shape his unique balance of mathematics, physics and physical inventions, such as his advances in optics.

The inverse may also be why the current state of U.S. Keynesian economists continue to pull the same lever expecting one outcome but triggering another. The analogy of a pilot was explained to me as a graduate student years ago and I’ll do my best to not butcher the eloquence.

Imagine Keynesian economists are pilots, they’ve been trained on every aspect of a plane. They understand what altimeter, airspeed, turn and bank, vertical speed, artificial horizon and heading indicators represent. These “economic pilots” understand that the thrust lever pushed this way increases the amount of fuel to the engine and the inverse reduces the fuel flow — faster, slower. Economists are not prepared for scenarios where they push the thrust lever and the plane transforms into a duck. The scenario is so far out of their perceived reality that the mere proposition is preposterous. This is why, in my opinion, observers of “experts” often hear phrases such as, “We couldn’t have anticipated this,” “This has never happened before,” or “That could never happen.”

Quantitative Easing, Concrete And Oil Spills

The selection of the 1989 Exxon Valdez disaster, which spanned decades, causing a tremendous amount of death and destruction, was not by accident; limitless global money printing (quantitative easing or QE) is a massive, pervasive and ever-increasing economic oil spill. Ironically, Federal Reserve chairs, treasury secretaries and Keynesian economists assume that, as a result of the habitual creation of currency, quarterly reviews and adjustments of interest rates, they are remedying economic challenges that current markets face. The reality that these economic experts are making the situation worse cannot enter their consciousness. Moreover, the economic thrust levers implemented illustrate the physical hand of government and a divergence of Smith’s proposition that markets work best when government’s leave them alone.

This is not to propose a laissez-faire approach to all economic interactions or to assume that an invisible hand is not warranted, at times, to protect intellectual or physical rights, but rather, that proactive economic measures might actually be doing more harm than good. Keynesian economists exist in a world where the concrete is continually in a liquid form; they never expect it to harden.

The challenge will become when QE reaches a breaking point; that is, when a “normal” crude oil spill goes beyond what is conceivable. When a tanker spills crude oil into an ocean, the maximum quantity of oil that could be spilt is whatever the capacity of the tanks were on the ships. This is a logical and rational assumption to the potential problem.

What happens when the tanker is habitually refilled and the flow never ends? The spill never stops. The crude oil pushed out into the environment will accumulate faster than any machinery designed to capture it. What lever can an economist pull then? A typical response in the crude oil world would be, “It would be impossible for a tanker to spill more crude oil than was on the ship.” In Keynesian economics, you can always print more. In Bitcoin, it is the opposite.

Economist Are Doctors, Not Midwives

For the years between 1840 and 1847, Vienna, Hungary, was home to the largest maternity hospital in the world. The hospital also disproportionately killed more newborn children and mothers than anywhere else in the world. The challenge Dr. Ignaz Semmelweis faced in 1846 was to attempt to address why the hospital ward, which was broken into two distinct clinics (doctors and midwives), had such a massive disparity in patient deaths? The clinic, which housed the doctors, had a maternal mortality rate of 98.4 per 1,000. The midwives clinic had a death rate of 36.2 per 1,000 (Loudon, 2013).

In the end, what was discovered was that the doctors had access to the morgue. Doctors and their apprentices would conduct autopsies, not wash their hands and then proceed to deliver babies in the maternity ward; the midwives did not have access to this part of the hospital and as such, “childbed fever” (more commonly known today as streptococcal infections) did not occur as frequently in the midwives ward. In an attempt to identify what was killing newborn children and women in a morgue, the doctors were perpetuating death with their own hands.

The reason the solution took nearly two decades to uncover? Because the doctors were the problem.

In economics, some economists are the problem. The challenge is that the field, as a whole, purports itself as the solution. Keynesian economists have textbook answers to textbook theoretical problems. The QE crude oil continues to spill, replenish and spill again and again; and an economic plane is starting to grow feathers.

Solutions And Recommendations

Adam Smith, Newton, NASA, oil spills, maternity wards and now Bitcoin. Quite the plane that has turned into a duck is it not? How could open-source software solve a problem that thousands of years of war, theorists, gold, currency, economists, scientists, presidents, dictators, political parties and the printing press could not solve? Because the solution was outside the experts. Similar to NASA, the FBI, the Oil Spill Recovery Institute or a hospital in Vienna during the 1800s, some economic problems require noneconomic solutions.

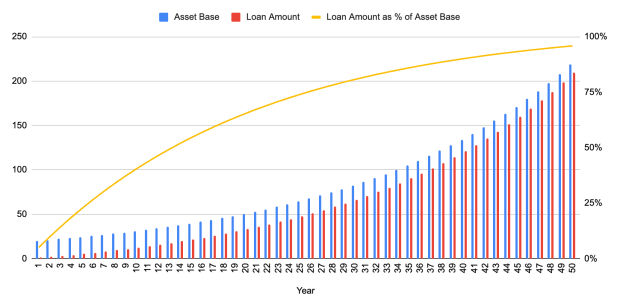

Bitcoin, with a dwindling and finite available future supply of 21 million, with every single unit being divisible into 100 million pieces, an ever-decreasing mining reward, and ever-increasing difficulty in mining, is the inverse of current Keynesian thought leaders — perhaps this is a good thing.

Adam Smith spent an exorbitant amount of time focused on the division of labor, defining true wealth, addressing technology, speaking on advancements to increase efficiency and introducing concepts such as gross domestic product (GDP). The focus was that wealth was created when exchange (trade) occurred freely, openly and regularly.

Old wealth was, at the time, perceived to be stored in gold and silver, but Smith proposed that true wealth was in the exchange of goods and services. As such, governments were to step aside and not choose winners and losers during this process, but rather, to provide a level playing field where the best could compete and thrive.

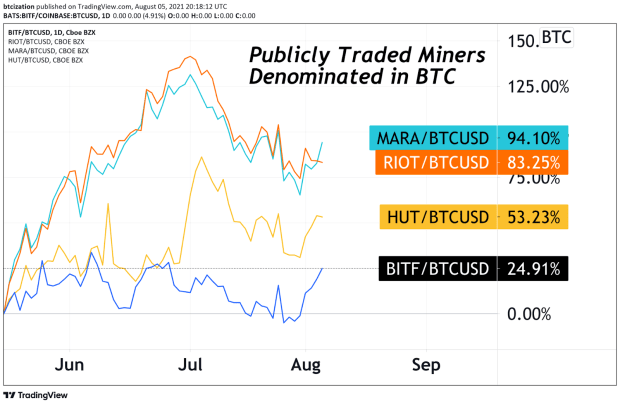

Bitcoin has already bested 10,000 protocols attempting to dethrone it, none have prevailed. The challenge for economists will be to consider what blindspots their traditional training has created and to consider that the challenges they face are not the same as those faced by their predecessors. Training that historians recognize when they zoom out and a glaring issue economists may be misinterpreting. From one perspective, perhaps Keynesian economics is just another protocol that Bitcoin will eventually dethrone.

The Keynesian economic-industrial complex is a multifaceted system of systems. The amount of careers that hinge upon the survival of the ecosystem is not a frivolous figure. Federal Reserve chairs, International Monetary Fund (IMF) leadership and global figureheads rely on a heavy-handed approach to global finance; their careers and livelihood require mass adoption and acceptance. The system created by Keynes was one out of necessity, a necessity to provide a career path for elites to trek. Elites who provide no social capital whatsoever. Dentists make toothaches go away, plumbers stop leaks, musicians create songs that make us feel a particular way and bakers make bread we can eat. What tangible or intangible good do Keynesian economists provide to the world?

The challenges that Keynesian economists attempt to solve, the crises they work to minimize, and the speeches they give after collapsing currencies, could have been avoided if they hadn’t interfered with the system in the first place. The world does not need them or their systems, but until civilizations realize this, the masses are under their control. What if the solution to the problem is a system without centralized control?

One problem with Bitcoin is that the protocol rewards actual work. From the proof-of-work model at the start to the mom-and-pop pizza shop purchasing satoshis with excess capital at the end of each month. The protocol exists outside any need for interference, moreover, the Bitcoin ecosystem has no CEO, no chair, no policy stance on this or that, and no political leaning. In fact, the protocol isn’t even money, it’s just information that massive amounts of people, who seek an alternative to current systems, have chosen to put value into. This is not insignifiant.

The autonomy of the Bitcoin protocol and a seismic shift in perceived “value” must be terrifying for a group of thinkers who believe they are smarter than 99% of the population, so much so, that an entire system has been designed to control and regulate systems and people that do not need interference.

The United States is 245 years old; the Federal Reserve is just over 100 years old. The United States can exist without the Federal Reserve, but the Federal Reserve cannot exist without the United States. Which is the parasite? For those on the fence, consider Bitcoin.

Acceptance may never come for many economists; their livelihood depends on Keynesian models to not only exist but to be center stage. Moreover, their personal financial existence hinges on a rejection of new ideas. The humbling reality will occur when conversations of dovishness or hawkishness are no longer relevant.

Continue to endlessly print currency; continue to ignore the signs of inequality; and continue to put aside thought leaders from outside finance as well as their creative solutions. Keynesians do not realize that they are the oil spill; they are doctors in the 1800s killing newborns and mothers with their own hands; and they are the pilots with planes about to turn into ducks.

References

ABC News. (2011). FBI: Help Us Crack This Code and Solve a Murder Case. ABC News. Retrieved January 2, 2022, from https://abcnews.go.com/US/fbi-seeks-public-cryptic-code-1999-st-louis/story?id=13256467&page=1.

American Chemical Society. (2012). New Oil Spill Dispersant Made From Ingredients in Peanut Butter, Chocolate, Ice Cream. Retrieved January 13, 2022, from https://www.acs.org/content/acs/en/pressroom/newsreleases/2012/august/new-oil-spill-dispersant-made-from-ingredients-in-peanut-butter-chocolate-ice-cream.html.

Dellemotte, J. (2009). “Adam Smith’s ‘Invisible Hand’: Refuting the Conventional Wisdom.” L’Économie politique, 44, 28–41. https://doi.org/10.3917/leco.044.0028.

Diemer, A., and Guillemin, H. (2011). “Political Economy in the Mirror of Physics: Adam Smith and Isaac Newton.” Revue d’histoire des sciences, 64, 5–26. https://doi.org/10.3917/rhs.641.0005.

Dunbar, B. (2021, May 17). Flagship Initiatives. NASA. Retrieved January 15, 2022, from https://www.nasa.gov/open/open-source-development.html.

Hetherington, N. S. (1983). “Isaac Newton’s Influence on Adam Smith’s Natural Laws in Economics.” Journal of the History of Ideas, 44(3), 497–505. https://doi.org/10.2307/2709178.

History.com Editors. (2018, March 9). “Exxon Valdez Oil Spill.” History.com. Retrieved January 14, 2022, from https://www.history.com/topics/1980s/exxon-valdez-oil-spill.

Leone, L. (2021). “Solver Stories: John Davis.” InnoCentive Blog. Retrieved January 5, 2022, from https://blog.innocentive.com/solver-stories-john-davis.

Loudon, I. (2013). “Ignaz Phillip Semmelweis’ Studies of Death in Childbirth.” Journal of the Royal Society of Medicine, 106(11), 461–463. https://doi.org/10.1177/0141076813507844.

Smith, A., and Canaan, E. (2003). The Wealth of Nations. New York, NY: Bantam Classic.

Taylor, J. (1955). “Copernicus on the Evils of Inflation and the Establishment of a Sound Currency.” Journal of the History of Ideas, 16(4), 540–547. https://doi.org/10.2307/2707509.

This is a guest post by Dr. Riste Simnjanovski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.