DCG, Genesis Were the ‘Adults in the Room’ but Didn’t Behave Like It

My colleague, the intrepid reporter/editor Nik De recently wrote a column about how amateurish the crypto industry seems as details come to light from Sam Bankman-Fried’s ongoing criminal trial. To some extent you can almost, almost forgive the crooked dealings at SBF’s twinned exchange and trading shop businesses. After all, FTX and Alameda Research were managed by a close-knit crop of longtime friends of SBF, who all had limited experience in finance and who were guided, seemingly, by the genuine utilitarian desire to make the world a better place.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

Last week, during Alameda CEO Caroline Ellison’s multi-day testimony, she admitted guilt to sending Alameda’s business partners cooked books and running a longhaul scheme to defraud FTX investors and customers — including deceiving CoinDesk’s sister company Genesis, the lending subsidiary of Digital Currency Group. I’m not going to bite my tongue just because we share a parent organization. In Ellison’s testimony, Genesis — nominally a victim of SBF’s scheme — is an unsympathetic participant.

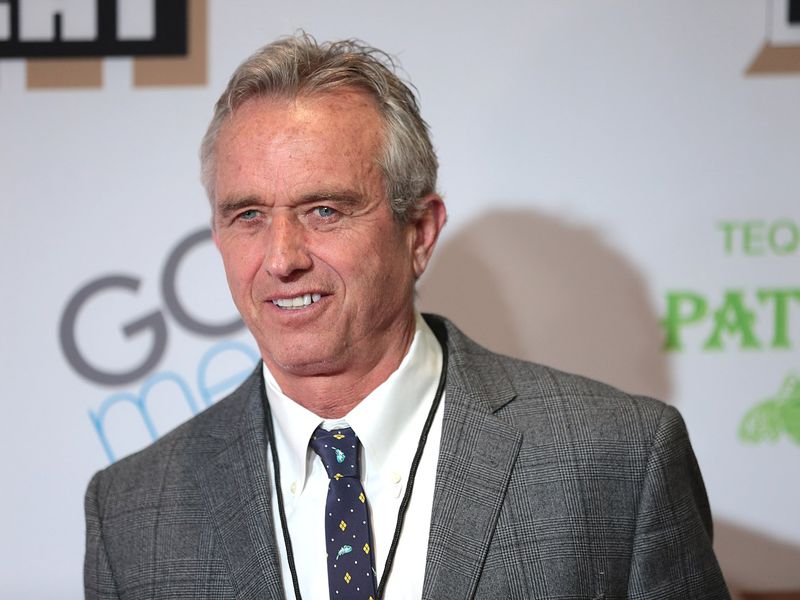

New York Attorney General Leticia James today filed lawsuits against Genesis and DCG, as well as their principal managers, ex-CEO of Genesis Michael Moro and DCG founder and Chief Executive Barry Silbert, accusing the firms of lying to customers, each other and the general public. It’s a complicated case involving another crypto exchange Gemini, century-old securities law and Gemini’s retail-focused crypto lending platform called “Earn.”

What’s painful about this particular lawsuit, apart from the familiar connection, is that this was supposed to be the big leagues of crypto. There was real money on the line (Earn customers are estimated to have lost upwards of $1 billion) and well-established firms involved. Before a unit of Genesis declared bankruptcy this year, the firm’s employees were widely considered to be “the adults in the room,” the people who knew business best.

At its height, DCG was compared to Standard Oil, a firm that grew oligarchically big. Only it turns out The State doesn’t need to dissemble Silbert’s empire — it tore itself apart.

The line between fraud and “rookie mistakes” is a prominent theme throughout the FTX story. SBF’s lawyer has described FTX’s misfit operation as a plane being built mid-flight. Ellison’s testimony spoke to the casual relationship Alameda had with Genesis, where it seemed routine to transact hundreds of millions of dollars over a Telegram chat. That level of insouciance speaks both to confidence gained through expertise and a basic error in judgment.

Of course, it was also a casual relationship established in trust — and allegedly, SBF and his cadres willingly violated that trust. To the extent that Genesis was deceived, it is a victim. However, Attorney General Leticia James is also accusing Genesis and DCG of trying to pull the wool over the eyes of the world. Genesis made what are in retrospect insane decisions — like facilitating a $1 billion swap of Do Kwon’s rickety stablecoin for bitcoin, and accepting the FTX casino token FTT as collateral for billions of dollars in loans — that show poor risk-management.

Where things cross the line, James might argue, is when Genesis and DCG tried to hide their losses and mismanagement. At the center of this is a $1.1 billion promissory note DCG made to Genesis, allegedly used to conceal the firm’s “true financial health.” At one point, Alameda accounted for 60% of Genesis’ loan book, a worrisome concentration of risk made worse by the loans being undersecured. Winklevoss-owned Gemini, also being sued by the Attorney General, knew as early as February 2021 that Genesis was risk-prone, yet entrusted its customers’ funds to Genesis to earn yield for the supposedly “low-risk” Earn program.

Is this amateur hour? Or what we would expect of boardroom-level financial dealings in a hot market? Where James’ might overcomplicate things in her lawsuit is by grouping together a number of firms — many of which are feuding publicly — and splitting a number of arrangements into “two distinct fraudulent schemes.” The “Gemini Scheme,” perpetrated by that legacy institution of crypto, lent money to a firm it supposedly knew it shouldn’t (Genesis), and misrepresented its own offerings (Earn).

The so-called “DCG Scheme” is of a different kind — an apparent attempt to conceal a “structural hole” of $1 billion at Genesis Capital. Despite being party to the case, for allegedly lying to customers, Gemini said the lawsuit vindicated its position that the firm was “lied to.” Lied and lied to isn’t far off as a description of the “greater fool theory” said to drive bull markets — where one “fool” buys an overpriced asset hoping sell it at a profit to an even “greater fool.”

In crypto, companies are often more intertwined and dependent than you would suspect, and, after a while, all of the schemes that brought down firms like Three Arrows Capital, Celsius Network and BlockFi begin to rhyme. Lied and lied to. Genesis’ hole appeared after the collapse of 3AC, itself brought down by the implosion of Do Kwon’s UST stablecoin.

However, there are real differences of kind and degree in the many business failings following crypto’s largest market run-up to date. Yet, if there is a single lesson to be learned through it all, it’s that even the experienced can fall prey to wishful thinking. And maturity is knowing how to handle it.