DCG Fiasco Won’t Include Lots of Selling: Novogratz Comments on Crypto State

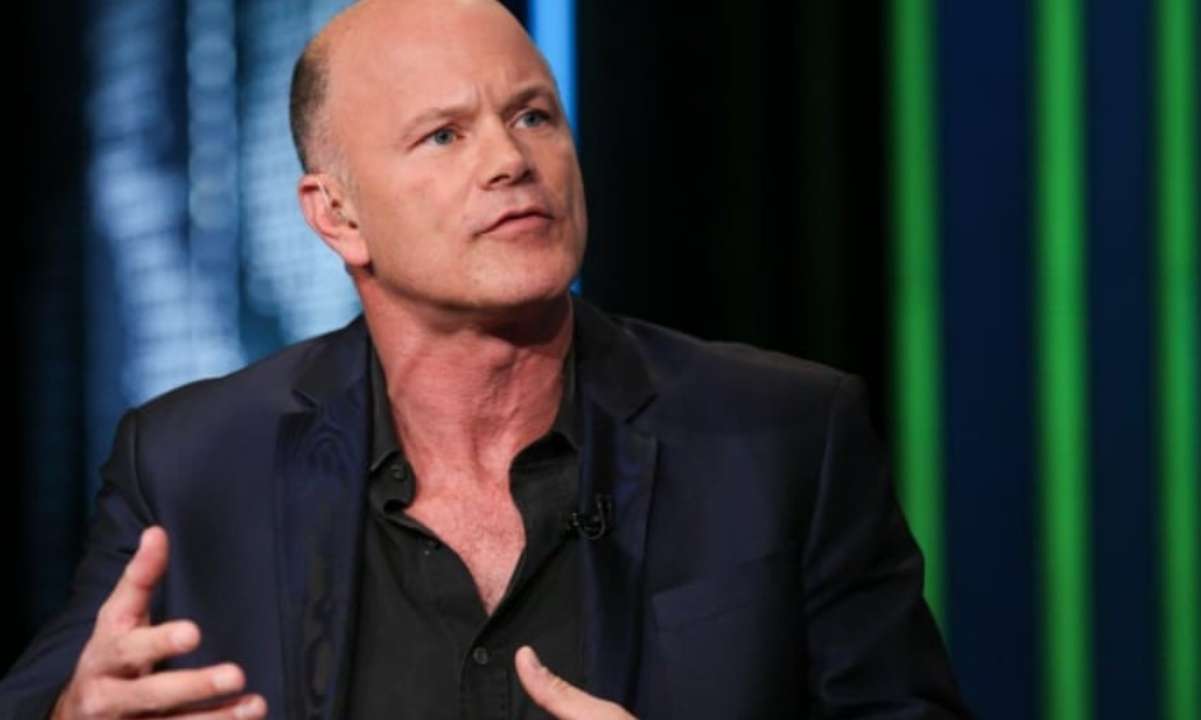

Crypto proponent and CEO of Galaxy Digital, Mike Novogratz, commented on the fiasco between two industry participants – Digital Currency Group (DCG) and Gemini – and how it will affect the entire market.

The American investor noted that although the issue “isn’t good news” for the industry, it won’t involve massive selling that will affect crypto prices as it plays out over the next quarter.

The DCG-Gemini Fiasco

Recall that the DCG debacle started in the wake of FTX’s insolvency in November 2022. Shortly after FTX filed for bankruptcy, Genesis halted users’ withdrawal, citing “extreme market dislocation and loss of industry confidence caused by the FTX implosion.”

The liquidity crunch also caused Genesis’ business partner Gemini to halt withdrawals from its lending platform. According to reports, Genesis owes Gemini Earn’s users over $900 million. Since then, problems have been piling up for Genesis and its parent company, DCG.

Earlier this week, Gemini co-founder Cameron Winklevoss wrote an open letter to the board of DCG, demanding its CEO Barry Silbert’s immediate removal for misleading statements about Genesis’s financial status.

Crypto Is in a Transition Period: Novogratz

Like many other crypto proponents, the Galaxy Digital CEO believes the bear market offers the industry an opportunity to heal and rebuild.

According to him, crypto and growth stocks experienced a “grand washout” last year, and multiple firms were hampered, leading to revenue shrinks.

Novogratz explained that the crypto market is neither in a good nor bad position as it is facing several experiences that have not been before. As a result, entities and individuals must cut costs to survive the period.

Firms Cutting Jobs Doing the Right Thing

Since the crypto crash in April, crypto companies have laid off thousands of employees to stay afloat. The job cut trend has continued into the new year, with firms like Coinbase going into a second round of layoffs.

While referring to Coinbase’s decision to slash its workforce again, Novogratz opined that the CEOs of firms that have made such a move are doing the right thing.

“2022 was a grand washout for growth stocks and for crypto and so anything associated with it…got hampered as many of the crypto stocks did. I think CEOs Brian at Coinbase and any rational CEOs are doing the right thing,” Novogratz said.

Novogratz noted that 2023 would be a year of survival and upturn as the market heals.

“The outlook for crypto is not horrible but it’s not great. We’ve got regulatory headwinds we didn’t have before, we’ve got time to heal and rebuild the narrative and so people are gonna cut costs and survive this transition period,” he stated.

The post DCG Fiasco Won’t Include Lots of Selling: Novogratz Comments on Crypto State appeared first on CryptoPotato.