DCG, Facing Competition From Bitcoin ETFs, Plans to Buy More Grayscale Bitcoin Trust

Digital Currency Group (CoinDesk’s parent company) is planning to hoover up up to a billion dollars worth of Grayscale Bitcoin Trust (GBTC), the company announced Wednesday.

-

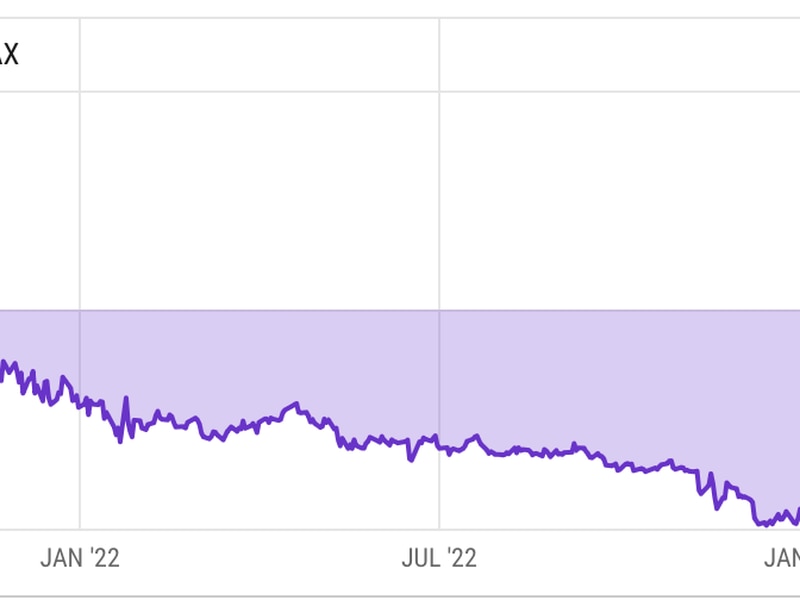

With subsidiary Grayscale’s flagship product facing sudden competition for brokerage accounts’ bitcoin dollars, the crypto conglomerate increased its GBTC buy range by $250 million. It said it has bought $388 million shares of GBTC so far.

-

The authorization comes as bitcoin-curious mainstream investors look beyond Grayscale for crypto exposure. On Tuesday, ProShares, a Wall Street fund shop, launched the first bitcoin-linked exchange-traded fund (ETF) in the U.S. It closed the day with $570 million in assets.

-

GBTC, meanwhile, ended Tuesday at a 16.55% discount relative to the price of bitcoin, after that figure hit a five-month low of 20.5% on Monday. It has its own plans to become an ETF, a conversion unlikely to happen any time soon.

Danny is a business reporter at CoinDesk.

Subscribe to The Node, our daily report on top news and ideas in crypto.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.