Days After Elon Musk’s Bitcoin Bash: BTC Price Back to Levels Before Tesla’s $1.5B Buy

The honeymoon period between Tesla and Bitcoin may have ended as the latter’s price has returned to levels before the EV-maker entered the scene.

Despite the massive crash, though, several on-chain instruments suggest that long-term holders have refused to sell, while some larger whales may have used the opportunity to buy the dip.

Bitcoin Back to Pre-Tesla Price Levels

Elon Musk’s electric vehicle giant broke the internet in early February when it revealed that the firm had bought $1.5 billion worth of bitcoin in January. The cryptocurrency’s price reacted to the news immediately with a substantial pump from below $40,000 to $44,000.

In the following months, bitcoin kept climbing as its relationship with Tesla strengthened when the EV giant enabled BTC payments for its products.

Moreover, the company’s CEO, Elon Musk, was significantly more bullish on bitcoin after saying “it is a good thing” and regretted not purchasing years ago.

BTC’s value appreciation culminated two months after Telsa’s purchase when it peaked at $65,000. However, the positive relationship between the two came to a halt shortly after. The firm surprised the crypto community earlier in May when it disabled the bitcoin payments due to “environmental issues.” Musk broke the news on Twitter and has openly criticized the primary crypto since then.

Although the billionaire denied any speculations that Tesla had actually sold its bitcoins, the damage was already done. The asset’s price started tumbling and is down by roughly 40% since the peak and 31% since Tesla’s latest announcement.

Consequently, the drop towards (and below) $40,000 has completed the three-month price circle as the cryptocurrency is now down to levels last seen before the Tesla purchase.

Interestingly, the company’s decision to stop receiving BTC payments has, perhaps inadvertently erased its unrealized gains from the bitcoin investment, which was up by more than 50% at one point in just a few months.

Whales Buy the Dip?

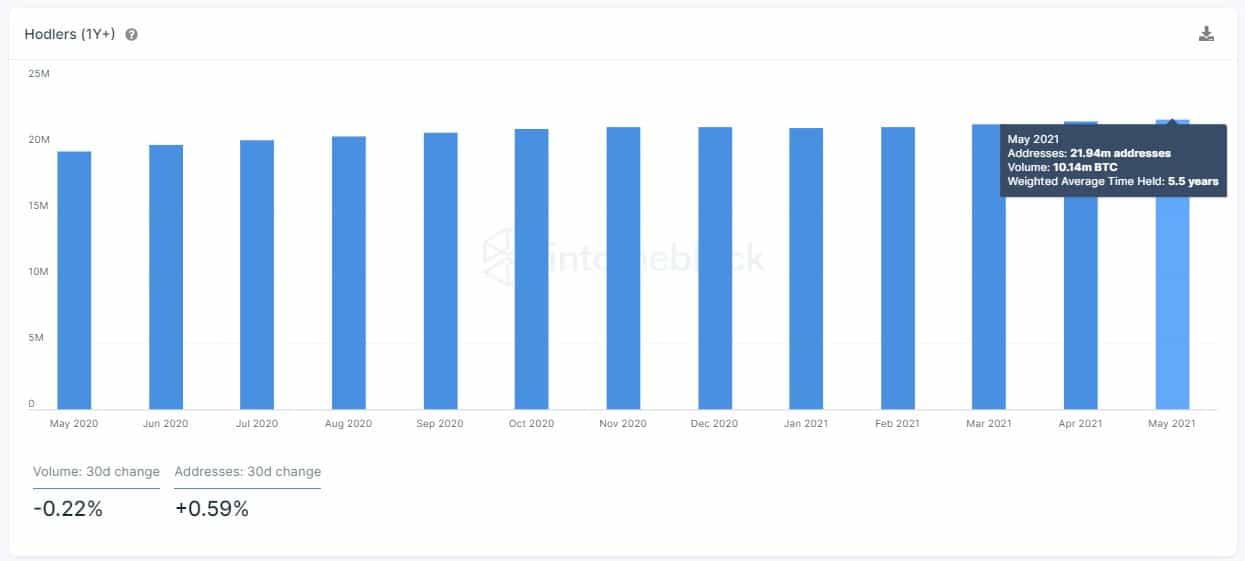

Ever since the market started to plummet, reports have repeatedly claimed that those who rushed to sell, even at a loss, were short-term holders. More recent data from IntoTheBlock confirms this narrative, indicating that the addresses who disposed of their coins were less than a year old.

In contrast, those who have been investing in the primary cryptocurrency for more than a year have either HODLed or accumulated more bitcoins.

As such, the analytics company concluded that the number of addresses holding bitcoin for more than a year had reached a monthly high.

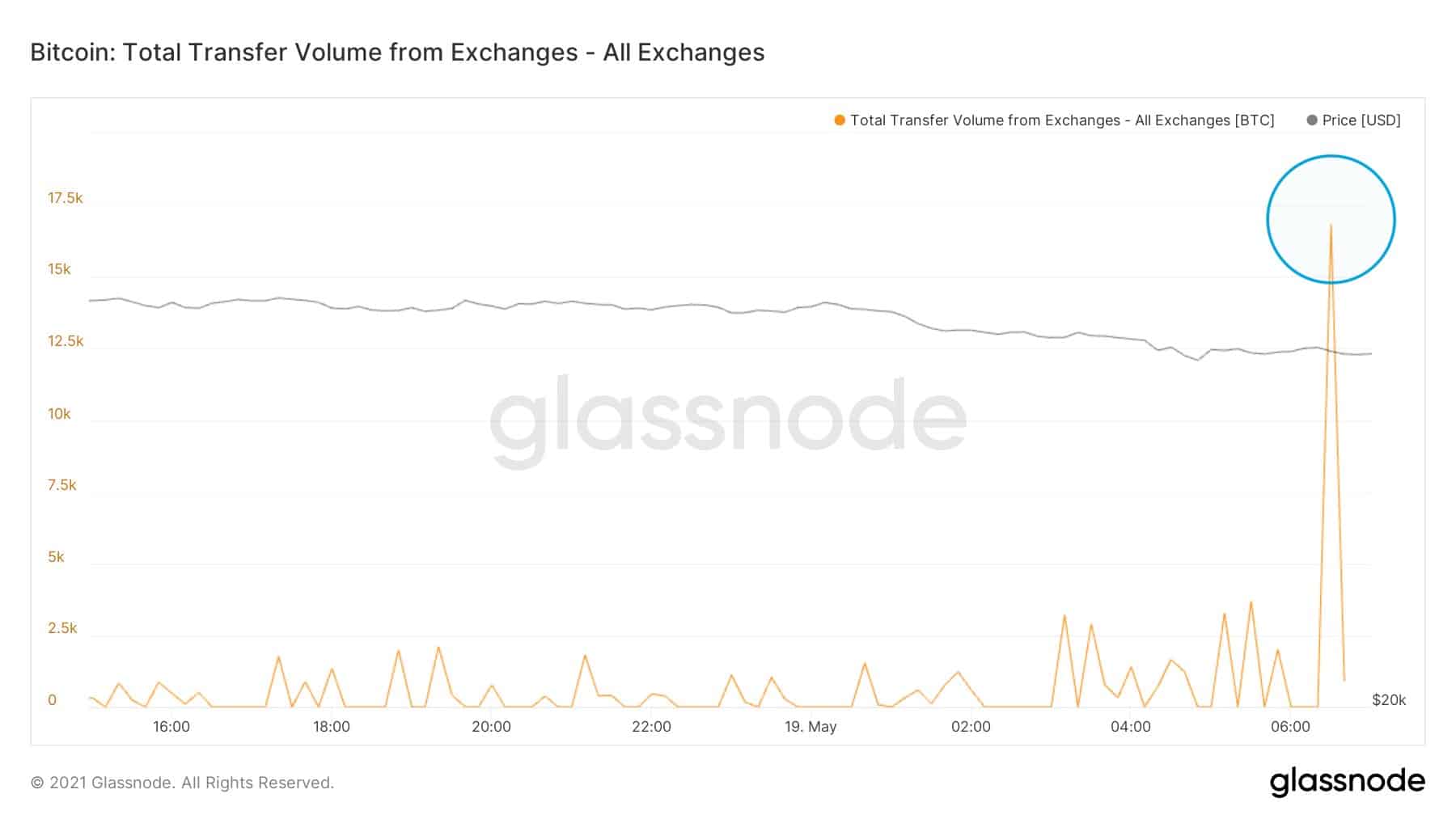

Further on-chain data suggested that whales have kept accumulating as 16,835 bitcoins were withdrawn from exchanges in a matter of minutes. In terms of the greenback, this substantial amount was worth more than 670 billion.

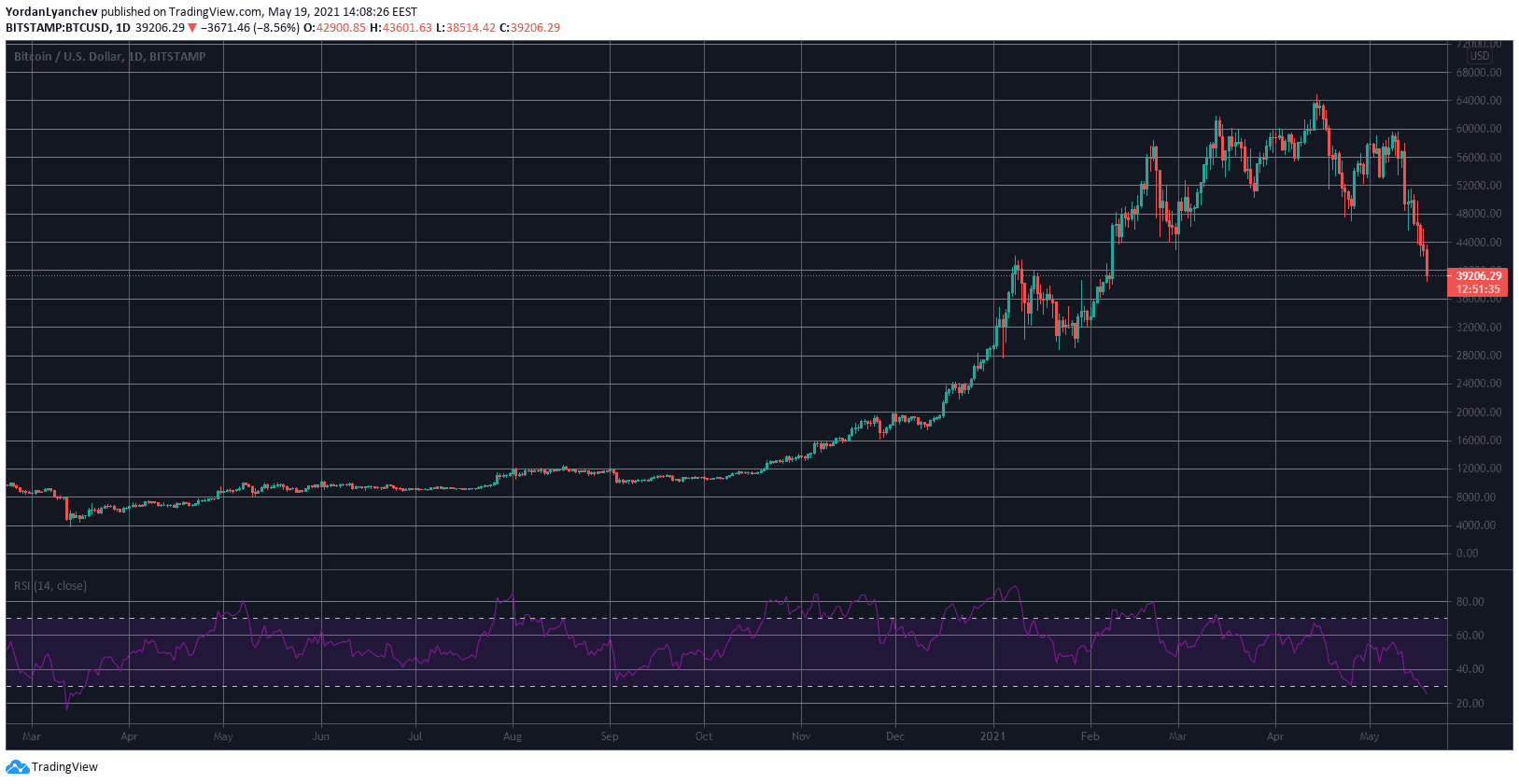

RSI Oversold for the First Time since Black Thursday

The Relative Strength Index (RSI) is a popular metric working as a momentum oscillator measuring the speed and change of price movements. It ranges between 0 and 100, and a level above 70 is considered overbought, while under 30 is oversold. Once it goes in either extreme, it could potentially indicate a trend reversal.

For instance, BTC’s RSI was well above 80 in late January 2021 – shortly before the asset retraced by 20% in days. Now, though, the metric has plummeted to its most oversold state since the Black Thursday market crash in mid-March 2020.

CryptoPotato reached out to The Wolf Of All Street (Scott Melker), who outlined RSI’s current stance on Twitter. Commenting on the most recent developments and Musk’s statements, Melser said, “Bitcoin is stronger than a single tweet from a temperamental billionaire.”

While Melker said it’s too early to make any predictions as the correction is still ongoing, he believes there were multiple market top indicators even before Musk’s U-turn.

“Signs of irrational euphoria and top signals were everywhere, from Tom Brady’s laser eyes to worthless knockoff dog coins pulling massive moves because of TikTok traders. This usually leads to a massive flush of retail and a transition from greed to fear.

Bitcoin has been here before and will be here again. The fact that Tesla decided not to sell cars in Bitcoin when practically nobody would actually buy a car with Bitcoin is not the reason for this drop – it’s just another narrative.”