Data Suggests Bitcoin Miners Have Capitulated, Bottom Is Close

The inflection point in every bitcoin bear market is capitulation, and the mining sector may have just reached its own trough of bearishness.

This is an opinion editorial by Zack Voell, a bitcoin mining and markets researcher.

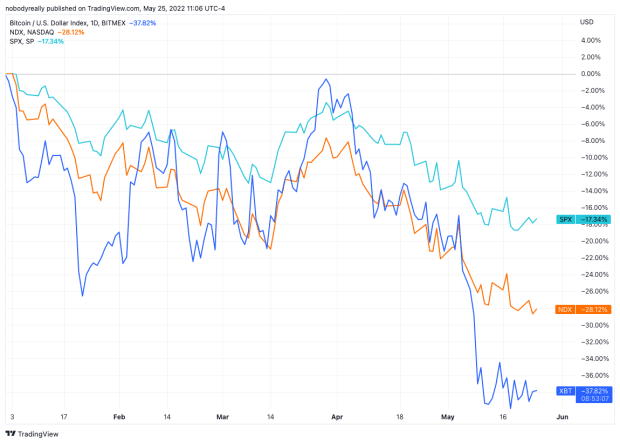

Bitcoin miners often suffer the brunt of bear market woes thanks to some of the industry’s highest capital expenditures, smallest margins and most unreliable infrastructure. Although the current bearish phase has been one of Bitcoin’s shallowest drawdowns, miners have suffered more than ever.

Layoffs, bankruptcies, lawsuits and other negative press have battered one of Bitcoin’s most prominent sectors. But every bear market eventually finds a bottom — the pain climaxes and things slowly begin to recover. A variety of data suggest mining has reached this point of its market cycle, which could offer a bit of optimism going into the new year.

This article is not intended to offer financial or investment advice of any kind. On the contrary, its intended purpose is data-driven analysis of the current state of the bitcoin mining sector in context of some exogenous and endogenous influences that could shape its near-term future.

Understanding Capitulation

Before diving into the data, it might help to understand what “capitulation” is. The term is commonly used in financial markets to reference an acute and often dramatic crescendo of fear or widespread surrender by investors or businesses during the throes of depressed market conditions. Basically, everyone says, “It’s over. We can’t take this anymore.” For mining, capitulation basically means the economics became so bad and operating margins are so thin that miners chose to quit or simply cannot operate anymore and are squeezed out of the market.

Wall Street Analysts Turn Bearish

One of the hallmark signs of miner capitulation (in this author’s opinion) at the current stage of the ongoing bear market is the full pivot from financial analysts who report on publicly-traded mining companies. For the past 12 months, these analysts have preached about the upside potential of bitcoin mining stocks. But now they are “pulling the plug.” This language was used by Chris Brendler of DA Davidson to describe his outlook on the mining sector. Since July, Brendler has said that the current market conditions were a good time to buy mining stocks, as reported by CoinDesk.

In December 2021, JPMorgan’s analyst Reginald Smith also wrote a memo that said one particular mining company — Iris Energy — has “more than 100% upside.” He also suggested the current stock price was at a “deep discount.” Shares of the company were trading around $14 at the time of the memo. No they’re trading below $2… an even deeper discount!

If Wall Street giving up on mining isn’t capitulation, then what is?

Bitcoin Hash Rate Starts Dropping

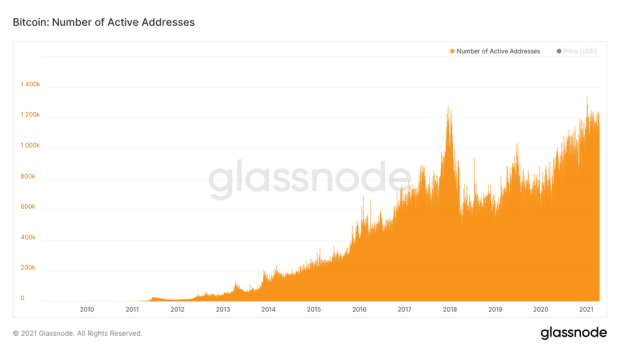

For the entirety of the bear market to date, the Bitcoin hash rate has steadily grown larger, forcing difficulty increase after increase on struggling miners. But that trend might be changing. In early December, the next adjustment is set to drop by almost 11% at the time of writing. This drop will be caused by hash rate falling, which is notably off its recent all-time highs and currently sitting near 240 exahashes per second (EH/s).

Normally a dip in hash rate and difficulty would not be too significant. But seven of the past nine difficulty adjustments have been positive. And in context of the incessant hash rate growth and subsequent hash price collapse, the apparent trend reversal for hash rate is notable. Some miners appear to be throwing in the metaphorical towel and taking their machines offline. Discussing the hash rate and difficulty on Twitter in context of whether miners were capitulating, Foundry Senior Vice President Kevin Zhang simply replied, “Yes.”

Bitcoin Miners Are Re-Accumulating

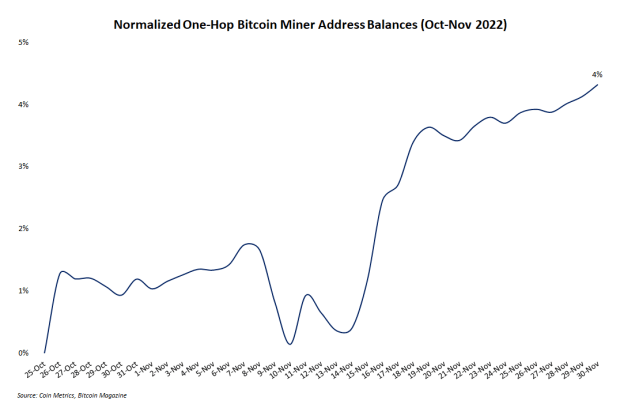

Generating fear, uncertainty and doubt (FUD) around on-chain movements of bitcoin from miner addresses is a popular pastime for Twitter influencers. And observing miner balances can be helpful. Current data shows notably larger balances compared to just a month ago. In short, net selling activity by miners appears to have subsided and their stockpiles of bitcoin are on the rise again.

Bitcoin mining address balances have seen small reductions over the past year. But the line chart below shows data that indicate a trend reversal is beginning. One-hop miner balances have increased by over 3%, or roughly 85,000 BTC since early October. Perhaps miners decided it’s time to HODL again.

Miner Outflows Spiked And Fell

One other piece of on-chain data that fuels mining FUD is outflows — the activity of miner addresses moving coins from those addresses to some other location. In mid-November, these outflows spiked to their highest level since June, which could indicate that fear and panic in the market has affected at least a few miners. Not surprisingly, the spike in outflows occurred at the same time as the collapse of FTX and its subsequent fallout were making headlines.

It should be noted that any inferences from on-chain data like outflows are informed guesstimates at best. Bitcoin network data is a useful tool for contextualizing certain market events, but it is far from infallible or un-manipulatable. But miners are notoriously bad at timing markets, and the timing of this sudden spike in coin movements could reasonably suggest some panicking miners. In the following week, however, outflows fell back to normal levels and have remained there as of the time of this writing.

Did miners panic near the market bottom? Very possibly.

Bitcoin Mining In 2023

Assuming the above analysis is correct and capitulation has occurred, the market will not immediately recover. As the dust settles and survivors emerge, the process of building and scaling more mining infrastructure will be as slow, expensive and tedious as ever. Winners are built in the bear market, and after some of the largest mining companies have sold bitcoin balances down to nearly zero and even sold significant amounts of mining hardware in desperate attempts to stay operational, all that’s left is survival or bankruptcy.

Of course, things could always get worse overnight. But this article suggests the weak and panicked have been squeezed out, and the time for recovery is here. Now is the time to be optimistic, not bearish.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.