Curve Debacle Triggers Transaction Frenzy, Sending Ethereum ‘MEV’ Rewards to Record High

-

Ethereum validators got an unexpected windfall from the surge in Maximal Extractable Value rewards, benefiting from their middleman position after news of an exploit on the decentralized exchange Curve triggered a frenzy of flows on the blockchain.

-

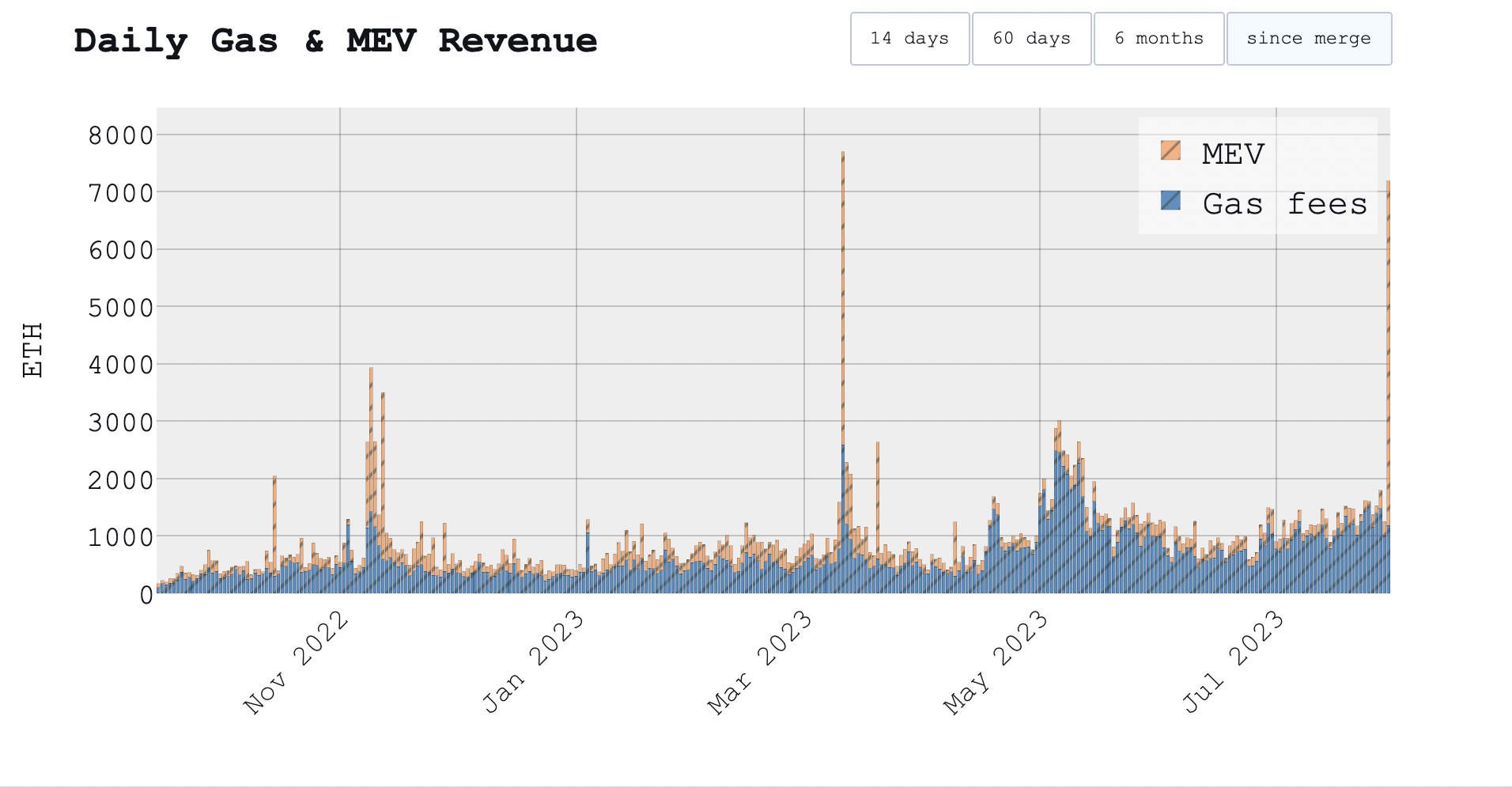

July 30 was the single most profitable day ever for MEV on Ethereum, bringing in 6,006 ETH (roughly $11 million) for validators.

Whenever a massive, sudden reallocation of money happens in the Ethereum blockchain ecosystem – it could be due to a hack, exploit, price scare, news headline – there’s a category of crypto middlemen who stand to benefit from the increased transaction flows.

And that appears to be happening now following Sunday’s exploit of one of the best-known decentralized exchanges, Curve Finance, leading to a dramatic increase in profits for the validators running the Ethereum blockchain.

As users yanked their money out of the decentralized exchange platform, ostensibly fearing that their crypto assets might be at risk, transactions and transaction fees spiked, in turn leading to a surge in a type of middleman profits known as Maximal Extractible Value (MEV). This extra profit, enjoyed by validators of the Ethereum blockchain, comes from the reordering or inserting of transactions within a data block. They are a key component of trading revenue on Ethereum, sometimes compared to arbitrage or front-running in traditional markets.

The hack of Curve, which drained over $50 million from key liquidity pools on the platform, sparked an exodus that pushed its “total value locked” or collateral down to $1.7 billion on Monday, from more than $3 billion on Sunday, according to data provider DeFiLlama.

The frenzy of transactions resulted in a total of 6,006.23 ETH (or roughly $11 million) in MEV rewards on July 30 being paid out to Ethereum validators. It was the most ever, according to researchers who track these profits.

Ethereum core developer Eric Conner shared in a tweet that slot 6,992,273 had the highest MEV of 584 ETH (roughly $1.09 million), followed by slot 6,993,342, which got 345 ETH, and then slot 6,992,050, with 247 ETH.

Validators on Ethereum earn MEV mainly through MEV-Boost, a middleware component innovated by research firm Flashbots that allows validators to request blocks from builders. MEV-Boost was introduced on Ethereum after the blockchain’s Merge last year, when Ethereum switched out its old proof-of-work consensus mechanism for proof-of-stake.

Toni Wahrstätter, an Ethereum researcher who created a leading MEV-Boost dashboard, told CoinDesk that “the value directed to validators and proposers has reached levels last seen during the USDC depegging event in March. Profits from transaction fees and MEV have even surpassed those recorded during the FTX collapse, which had a widespread effect on the markets.”

According to Wahrstätter’s dashboard, mevboost.pics, yesterday’s exploit saw the highest day for just MEV rewards.

But during the depeg of USDC on March 11, transaction fees were higher, which contributed to larger MEV opportunities.

“The split between MEV and transaction fees is not straightforward to determine,” Wahrstätter told CoinDesk. “We saw huge transaction fees so it was definitely as a result of the transaction fees spiking, which contributes to larger MEV too.”

“But yeah, when USDC depegged, the whole effect was even more pronounced,” Wahrstätter said.

Edited by Bradley Keoun.