Crypto’s Interest in Rates

It appears crypto investors have been enjoying time away from the trading desk during the late summer months.

With some exceptions (a flurry of excitement around potential bitcoin spot ETFs and trading enforcing upper and lower price support levels), they appear to be less focused on their holdings and more focused on other matters, including taking much-needed R&R.

Amid that relative calm, the U.S. Treasury has been busy at work in the fixed-income market borrowing more and more via bond issuance. This increase has been significant enough to prompt Fitch ratings to cut the U.S. debt rating from AAA, joining S&P’s move to the same AA+ level more than a decade ago. Amped up issuance may also have pushed yields on 2- and 10-year Treasuries up in relation to inflation-linked TIPS.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

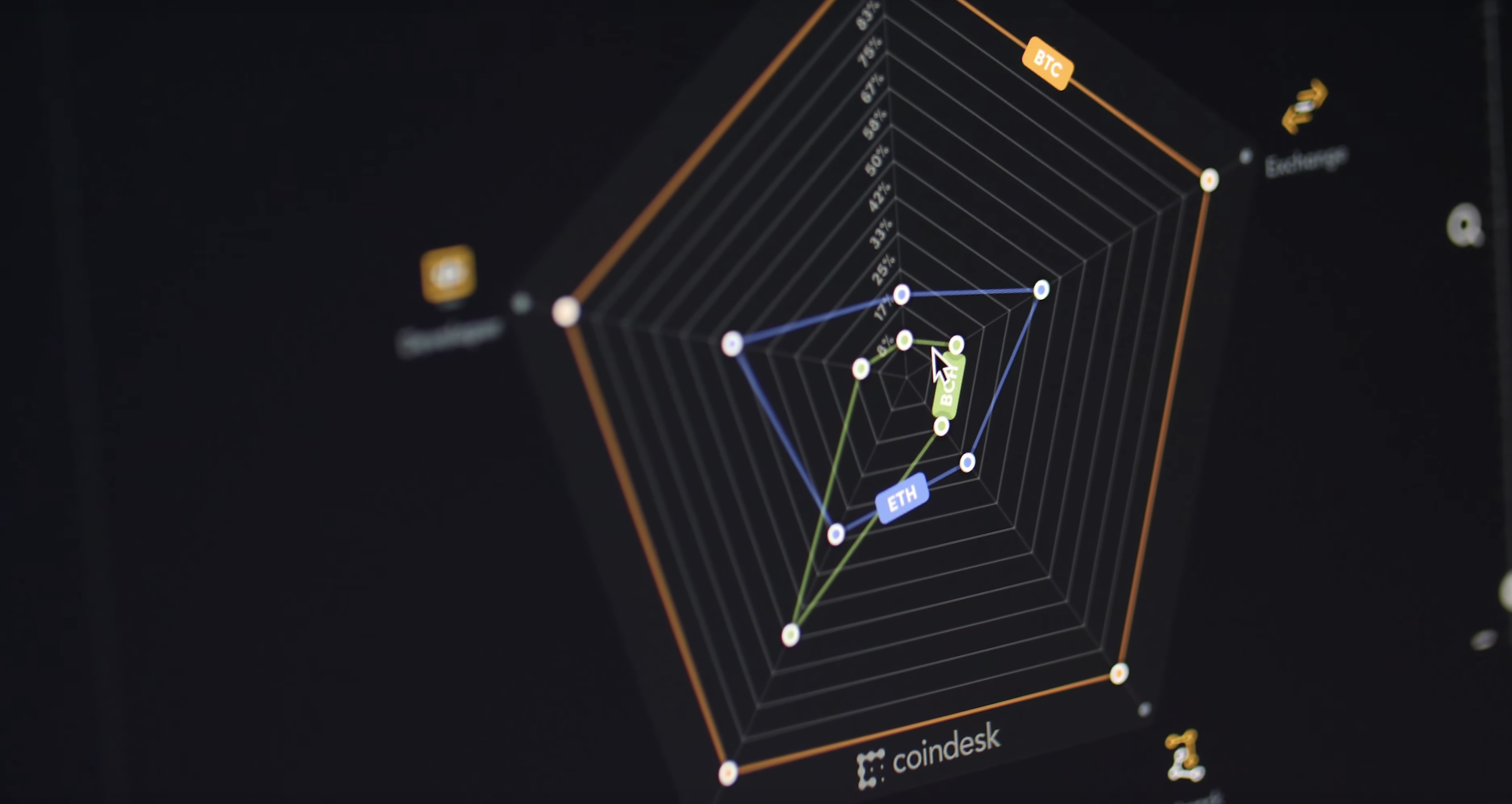

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ZCAVEQCYW5BZPASTGXU7T6AXVI.png)

Source: Federal Reserve Bank of St. Louis

Should this have nudged digital asset prices, too? How do interest rates impact crypto asset prices?

Changes in rates can indirectly affect the price of bitcoin (BTC), although the relationship between these markets is complex and influenced by various factors, including:

-

Opportunity cost: Bitcoin and other proof-of-work cryptocurrencies that don’t provide holders what amounts to interest payments can become more alluring to investors when conventional interest rates are low. This allure and demand can push up their prices in a low-yield environment. And the opposite can happen in moments like now when conventional interest rates are relatively high. This effect of interest rates (“cost of cash”) can be slightly offset with proof-of-stake digital assets like Ethereum’s ether (ETH), which do offer a rate of interest from staking activities to secure the network. Crypto is intrinsically global, so rates of interest across the world need to be taken into consideration.

-

Risk sentiment: Changes in rates can influence overall market sentiment. When central banks raise them to cool down an overheating economy or combat inflation, it can signal a more restrictive monetary policy and a desire to slow economic growth, potentially damping risk appetite (“animal spirits”) in financial markets. In such circumstances, investors may move away from riskier assets like growth stocks and digital assets, including bitcoin, toward safe haven assets that typically pay interest. While very much related to the opportunity cost of capital, sentiment is slightly distinct as it relates to the overall mood of the market.

-

Inflation expectations: Interest rates are often adjusted by central banks in response to inflation expectations. If central banks raise rates to combat rising inflation, it can erode the purchasing power of fiat currencies like the U.S. dollar. In such cases, some investors may turn to bitcoin as a store of value, viewing it as a hedge against inflation, which can drive up its price. However, if the inflation-fighting credibility of the central bank remains intact with inflation expectations well anchored, this can result in bitcoin prices falling due to the increase in interest rates (i.e. adding to the opportunity cost of not being in short term treasury bills).

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/R4U3HYLASZBNTKUGR54VWN5WD4.png)

Source: St. Louis Fed, CoinDesk Indices

To answer whether or not bitcoin has been impacting by the recent moves higher in interest rates, I ran a quick rolling regression analysis on the recent bitcoin price history against interest rates (both the 2-year US Treasury yield and the 10-year inflation adjusted real interest rate) and the EUR/USD spot exchange rate to correct for moves in the U.S. dollar. From the results (see figure above), it appears that current bitcoin prices reflect the move up in nominal and real interest rates.

– Todd Groth, CFA, head of research at CoinDesk Indices

Takeaways

From CoinDesk Deputy Editor-in-Chief Nick Baker, here is some news worth reading:

-

REAL STUFF: So much of the FTX saga concerns bewildering questions about what was actually real there. How much money did clients have? Where did it go? Etc. On the other hand, a bankruptcy restructuring is all about being super tangible for stuff, searching beneath the proverbial couch cushions to figure out how much stuff there really is and what’s it worth. FTX’s bankruptcy overseers released an illuminating report this week listing about $7 billion of assets, including cash, cryptocurrencies and real estate. That includes $1.16 billion of SOL, the token behind the Solana project that Sam Bankman-Fried supported. There have been worries in the aftermath that FTX is about to dump a bunch of crypto – to cash out – spooking some investors. There is not, however, actually evidence that’s about the occur, raising the question of whether any swoon in prices will be short-lived.

-

DEMOCRAT’S DISLIKE: At a hearing this week, a key Senate Democrat, Ohio’s Sherrod Brown, made clear he dislikes crypto. He also praised the Securities and Exchange Commission’s application of current laws to crack down on the industry. “I’m glad the SEC is using its tools to crack down on abuse and enforce the law,” Brown said. This has implications for any legislative movement to give the industry the clarity it yearns for since Brown runs the Senate Banking Committee, and could signal that crypto could remain a partisan issue in the U.S. presidential race (Democrats opposed and Republicans supportive).

-

ETHER TRUST: The Grayscale Bitcoin Trust (GBTC) has for a long time traded at a price way below the value of the BTC it holds, though that discount has narrowed as GBTC’s odds of being converted into a more-appealing ETF have improved. But another Grayscale product, the Grayscale Ethereum Trust (ETHE), is seeing similar movement as companies apply to ilst ether ETFs. “The market is weighing higher odds that Grayscale will be able to convert its ETHE product into an ETF following the push from traditional finance giants into the space,” said IntoTheBlock’s Lucas Outumuro.

Edited by Nick Baker.