Crypto Weekly Update – Bitcoin At $6K: Fidelity FOMO, BitFinex FUD, BTC Dominance Surges

The past week started with a correction but also marked with a sharp U-turn as Bitcoin continues to climb, taking the market with it (trading against the US Dollar). However, when looking at alternative coins in comparison to Bitcoin’s rise, we can clearly see them correcting as BTC dominance gains further momentum.

Following the year of 2018, which turned out to be “The year of the bear,” 2019 is shaping up to be in a mixed trend. Market uncertainty is being replaced with what seems to be a change in the overall trend, as it’s showing signs of recovery since February this year. Some altcoins such as Binance Coin (BNB), reached their all-time high (ATH) trading against Bitcoin as well as USD. Additionally, speculations are also rising when it comes to Binance opening the door for leveraged trading, which could attract great interest to risk-taking traders and add up more traction to the overall trading volume.

In addition, the IEO phenomenon which gained momentum in the first months of 2019 has seemingly calmed down following certain disappointments like the Ocean Protocol IEO event which was carried out on Bittrex exchange and saw its participants lose 80 percent of their initial investment value.

As it is almost always in this case, when looking for reasons for the recent volatility in Bitcoin’s price. However, if a reason must be pointed out, it could be attributed to Fidelity’s announcement that it will open its institutional trading gates for Bitcoin.

Fidelity’s announcement joins a long list of giant companies such as Facebook, Nike, Disney, and others, who are looking to fit into the innovative world of cryptocurrencies, each in their own way. Of course, news of the kind bring back the interest into the cryptocurrency market.

The Tether saga continues to cause problems for Bitfinex as a lot of traders abandoned the exchange and withdrew Bitcoin from the exchange. As a result, the larger wallets of one of the oldest cryptocurrency exchanges were shrunk with around 40% and Coinmarketcap exceeded the trading volume of the exchange and removed it from the Bitcoin price calculation.

It is also interesting to note that at the background of the rise of the cryptocurrency market, the stock market started the week in the red. It is still quite difficult to say whether there is a negative correlation between the markets, but according to the classic Bitcoin narrative, Bitcoin’s unique nature, as well as internal monetary policy, will provide a haven for investors who want to get away from the capital market in times of crisis. Therefore, a negative correlation could be assumed between the markets. Of course, this assumption is yet to be tested and it might soon get into a conclusion.

Market Data

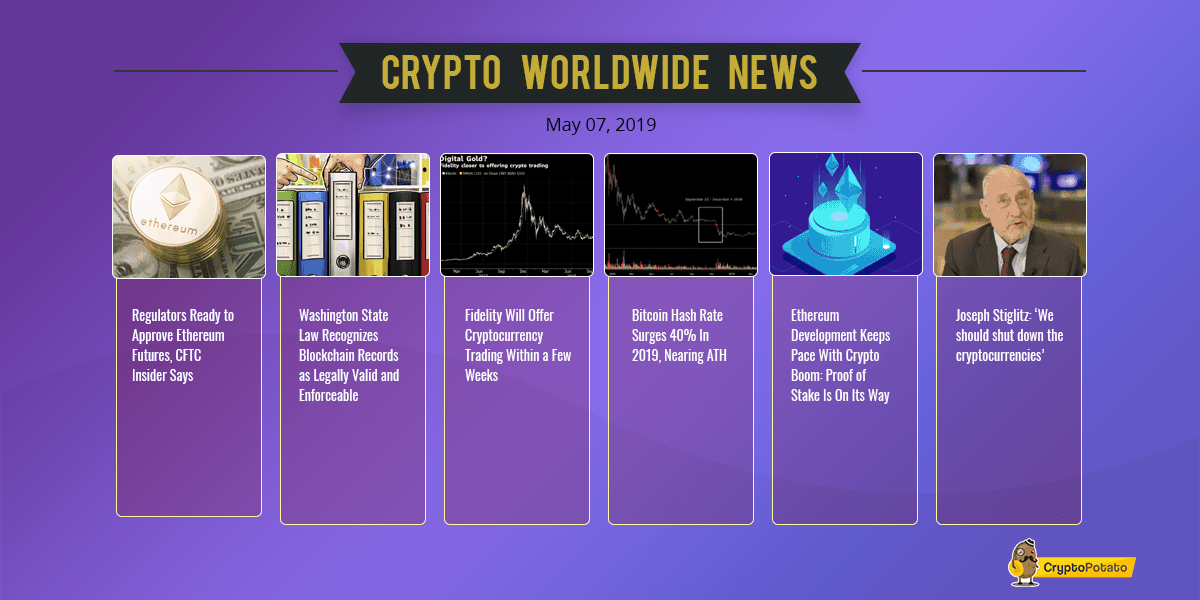

Crypto News

Regulators Ready to Approve Ethereum Futures, CFTC Insider Says. The US Commodities And Futures Trading Commission (CFTC) is willing to approve an ether futures contract should it be able to fulfill all the necessary regulatory requirements. This move might bring in additional institutional funding in the space.

Washington State Law Recognizes Blockchain Records as Legally Valid and Enforceable. Regulators in the state of Washington have passed a bill which protects and recognizes the legal status of electronic records which pertain to distributed ledgers such as blockchain. The document was signed into effect on April 26th.

Fidelity Will Offer Cryptocurrency Trading Within a Few Weeks. Prominent asset manager Fidelity will reportedly offer cryptocurrency trading within a few weeks. According to a previous email of a company spokeswoman, their service offering is focused on Bitcoin.

Bitcoin Hash Rate Surges 40% In 2019, Nearing ATH. Bitcoin’s hash rate has increased by about 40 percent since the beginning of 2019 and is about 6 percent away from its all-time high. The surge followed the recent spike in Bitcoin’s price, which continues to grow steadily.

Ethereum Development Keeps Pace With Crypto Boom: Proof of Stake Is On Its Way. Vitalik Buterin has said that Ethereum’s transitioning towards a Proof of Stake (PoS) algorithm will be closing in, as Phase Zero could be finalized as soon as June. However, there are two more phases to the so-called Serenity integration, which have to follow.

Joseph Stiglitz: ‘We should shut down the cryptocurrencies’. Nobel-Prize winning economist Joseph Stiglitz has said that cryptocurrencies should be shut down. His main concerns hide behind the fact that virtual assets can enable illicit activities by making money transactions a lot less transparent.

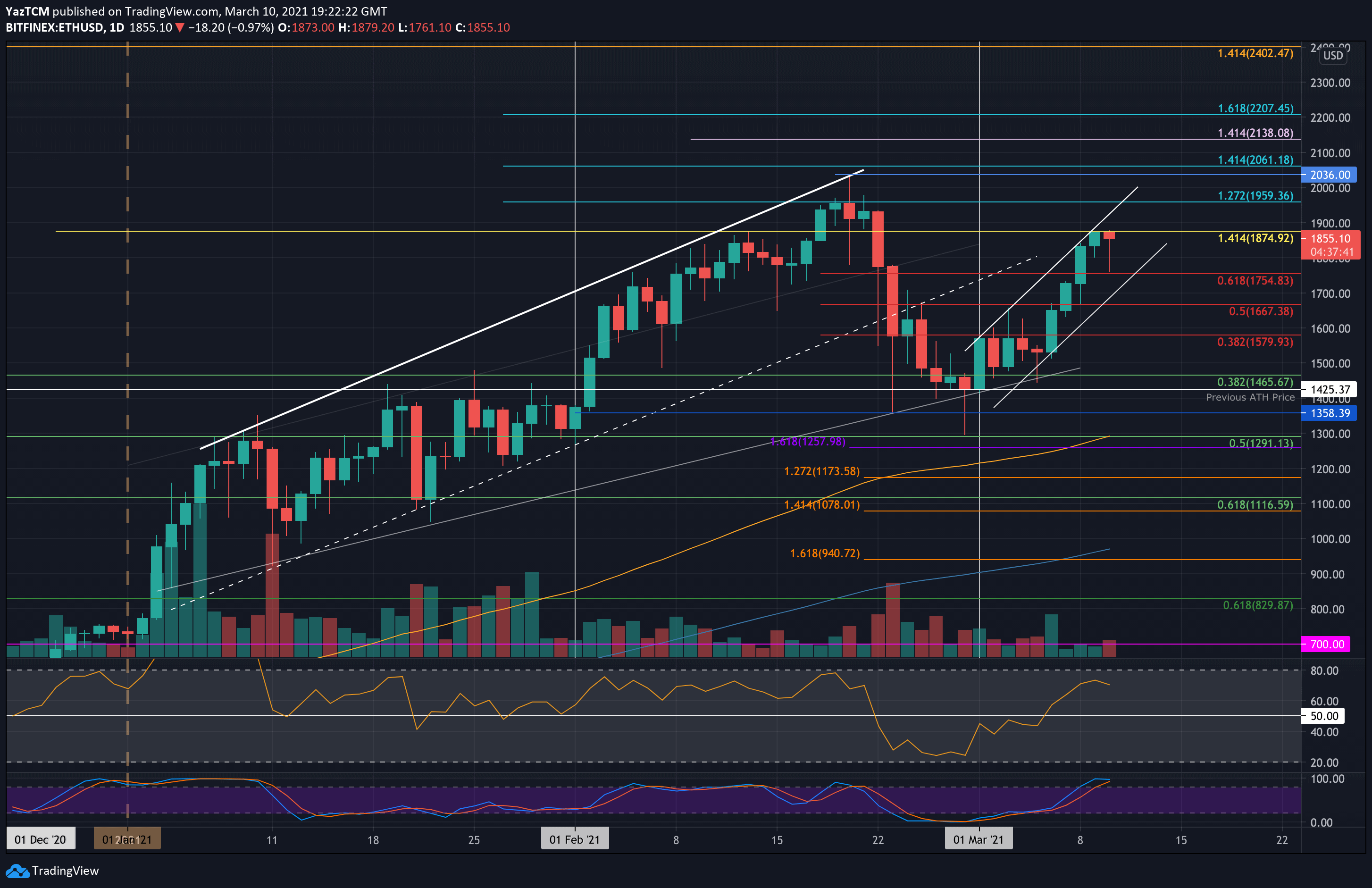

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple and IOTA – click here for the full price analysis.

The post Crypto Weekly Update – Bitcoin At $6K: Fidelity FOMO, BitFinex FUD, BTC Dominance Surges appeared first on CryptoPotato.