Crypto Trading Firm Auros Secures $17M Investment as It Recovers From FTX Woes

After FTX imploded, and as fear among market participants mounted about a full-blown insolvency crisis in crypto, lenders raced to recall outstanding loans to mitigate potential losses. With a significant chunk of funds locked up on FTX, Auros faced a sudden liquidity crunch to repay all of its desperate creditors.

Related Posts

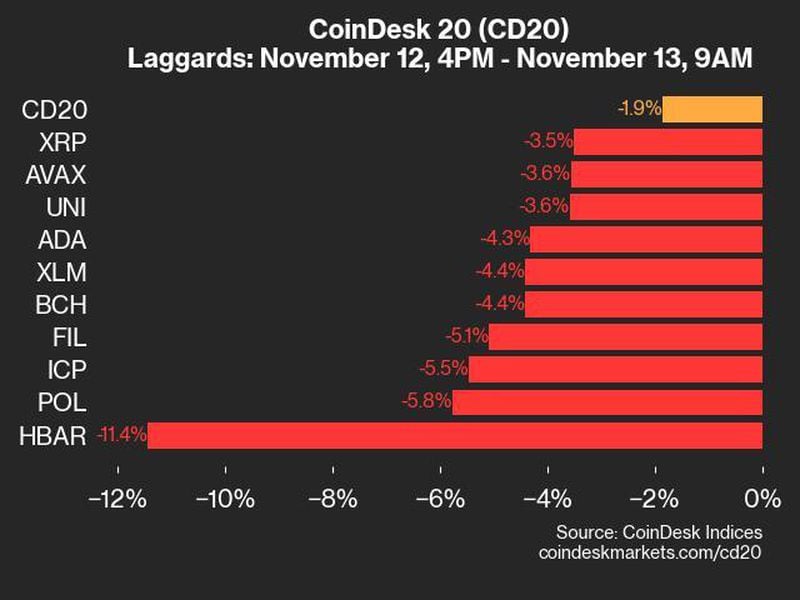

CoinDesk 20 Performance Update: HBAR Falls 11.4%, Leading Index Lower From Tuesday

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated . CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial

Social Engineering: A Plague on Crypto and Twitter, Unlikely to Stop

Social Engineering: A Plague on Crypto and Twitter, Unlikely to StopThe teenager arrested for allegedly masterminding the recent Twitter hack comes from a community that’s been targeting crypto users for years. The group’s attacks have one big thing in common: They take advantage of human fallibility rather than code vulnerability. These so-called social engineering attacks…

Swiss Wholesale CBDC Trial Shows ‘Feasibility’ for Central Bank Money on Distributed Ledger, BIS Says

Dec 3, 2020 at 4:55 p.m. UTCSwiss Wholesale CBDC Trial Shows ‘Feasibility’ for Central Bank Money on Distributed Ledger, BIS SaysAn under-the-wraps Swiss trial testing how central bank money can be linked to financial markets built on distributed ledger technology (DLT) yielded positive results, the Bank for International Settlements (BIS) announced Thursday. Launched by the Swiss…

Distilling the Tornado Cash and Samourai Suits

There was a lot of news last week, but maybe the biggest news came Wednesday when the U.S. Department of Justice arrested two co-founders of Samourai Wallet, a bitcoin wallet that offered mixing services. The arrest ramps up the federal government's efforts to tamp down on what it sees as money laundering enabled by privacy

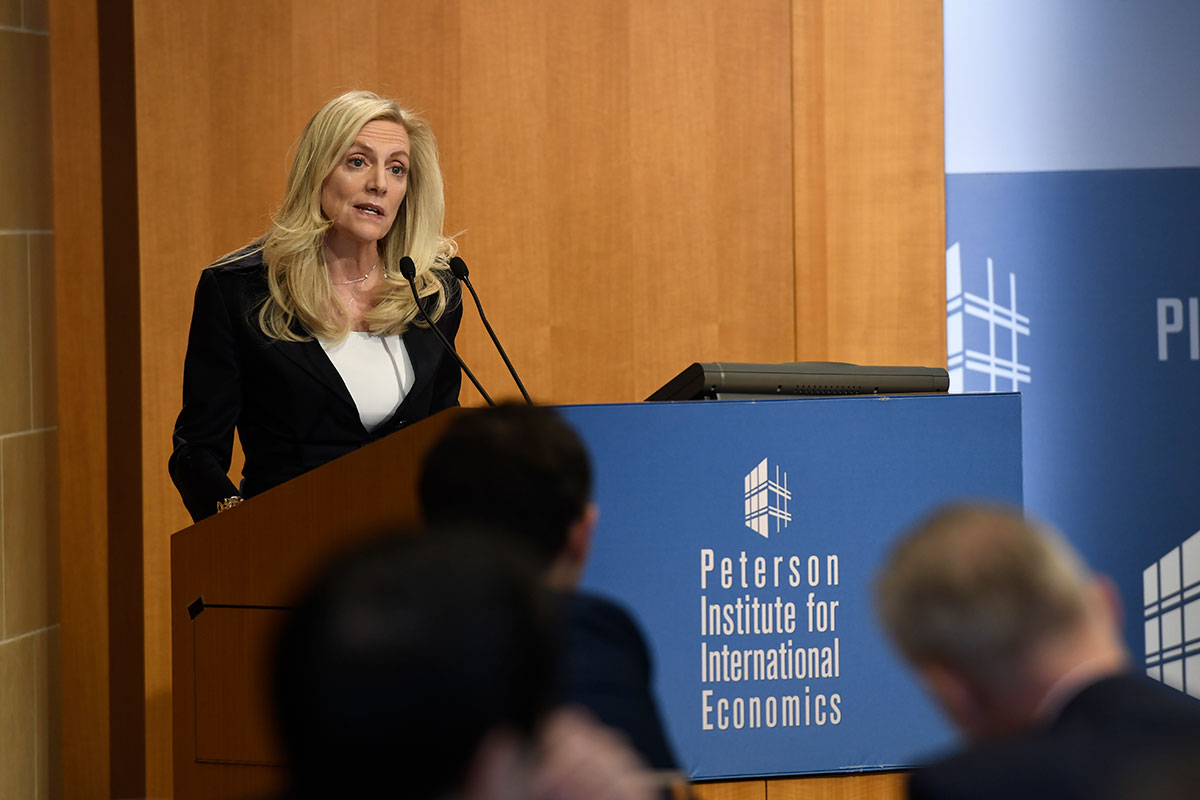

The Federal Reserve Is Experimenting With a Digital Dollar

Aug 13, 2020 at 20:09 UTCUpdated Aug 13, 2020 at 20:49 UTCFederal Reserve Board Governor Lael Brainard said the U.S. central bank has been experimenting with a digital dollar. (Federal Reserve/Wikimedia Commons)The Federal Reserve Is Experimenting With a Digital DollarThe U.S. Federal Reserve is actively investigating distributed ledger technologies and how they might be used…

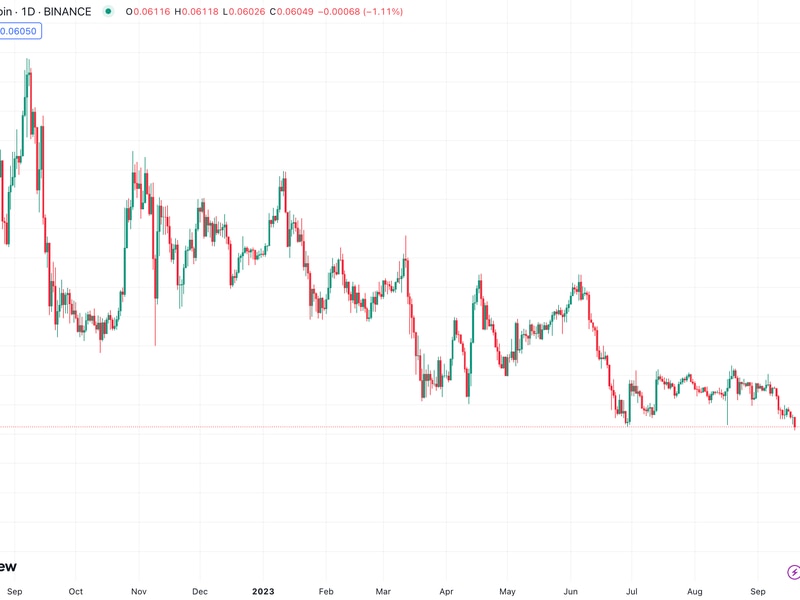

Bitcoin Enters Historically Strong Quarter With 3% Price Gain

Bitcoin Enters Historically Strong Quarter With 3% Price GainViewHistorical data suggests bitcoin could put in a positive performance in the second quarter. Bitcoin is currently trapped in a pennant pattern on the daily chart. A breakout will likely yield a rally toward $8,000. A pennant breakdown would put the bears in a commanding position and…

Bitcoin Zero-Knowledge Rollup Citrea Raises $2.7M in Seed Funding

Zero-knowledge rollups – a technology usually associated with scaling the Ethereum blockchain – are now coming to Bitcoin.Chainway Labs went public earlier this month with the news that it was building what it says will be the first zero-knowledge rollup for Bitcoin: Citrea. On Wednesday, the company disclosed to CoinDesk that it had raised $2.7

Binance Stops Support for Bitcoin NFTs Citing ‘Streamlining’ of Offered Products

Trading volume for NFTs is at multi-year lows.Bitcoin NFTs caused widespread network congestion in December.Binance users will not be eligible for future Bitcoin NFT airdrops.10:03Consensus 2023: Spotlight on Ordinals05:33New Project Bitcoin Stamps Renews Debate Over Bitcoin NFTs07:10Ordinals NFTs Could Make Stacks’ STX a Multibillion-Dollar Token: Matrixport01:40Matrixport Researcher on STX Token's Rapid Growth Amid Ordinals InterestCryptocurrency