Crypto Traders Suffer Over $100M of Short Liquidations as Bitcoin Hits 3-Month High Over $31K

Cryptocurrency derivatives traders have endured over $150 million of liquidations over the past 24 hours as rapidly surging digital asset prices caught many market participants off-guard.

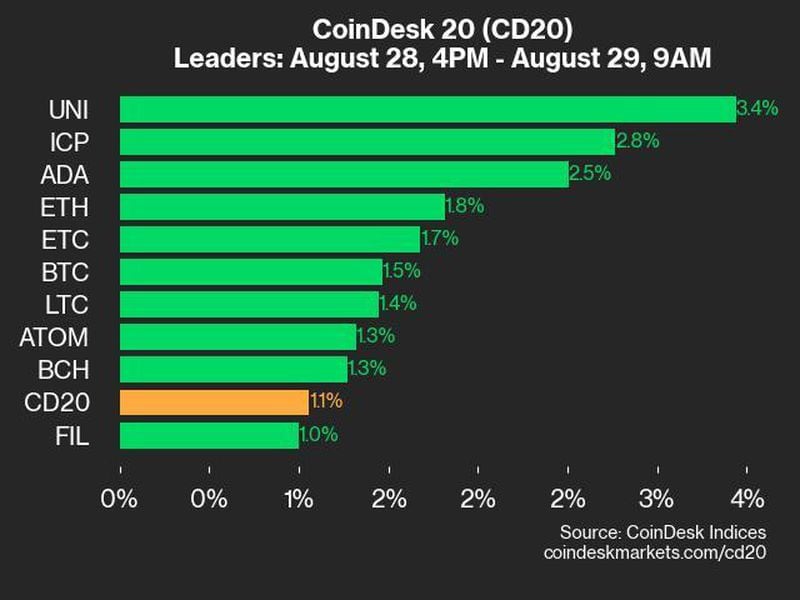

Most of the positions wiped out – worth some $110 million – were leveraged shorts, or traders who bet that prices would fall, CoinGlass data shows. This was the second-largest amount of short liquidations in any day since late August.

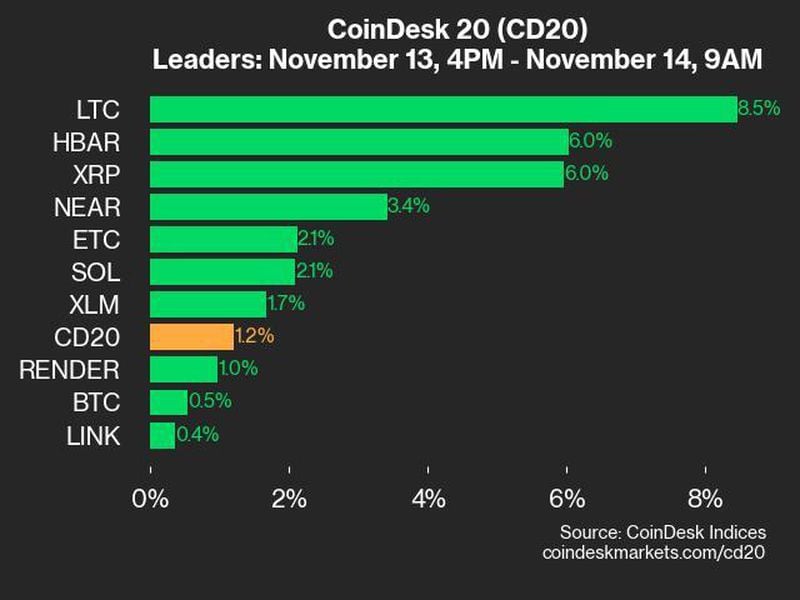

Bitcoin (BTC) traders were hit by $55 million of liquidations, predominantly those who shorted its price, followed by ether (ETH) traders’ roughly $29 million of liquidations, per CoinGlass. Chainlink (LINK) speculators also suffered over $9 million in liquidations as LINK hit its highest price since May 2022.

The liquidations occurred as bitcoin rallied 4% to surpass the $31,000 price level for the first time since July, extending its October advance. Most of the alternative cryptocurrencies, or altcoins, also soared, with Chainlink’s LINK, Polygon (MATIC) and Polkadot (DOT) posting 6% to 10% advances at one point.

Liquidations happen when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money down, or “margin,” because the trader fails to meet the margin requirements or doesn’t have enough funds to keep the position open.

Edited by Nick Baker.