Crypto Thrives in War-Torn Ukraine and Sanctioned Russia: Chainalysis

Ukraine and Russia, ranked 6th and 7th in this year’s Global Crypto Adoption Index, stand out as key players in the global crypto economy.

According to the latest report by Chainalysis shared with CryptoPotato, Russia notably surged six spots compared to last year’s ranking. This feat comes amid the ongoing war and Russia’s intensifying sanctions. Meanwhile, Eastern Europe led the way with $182.44 billion in crypto inflows into Russia, while Ukraine followed with $106.1 billion.

Russia and Ukraine’s DeFi Growth

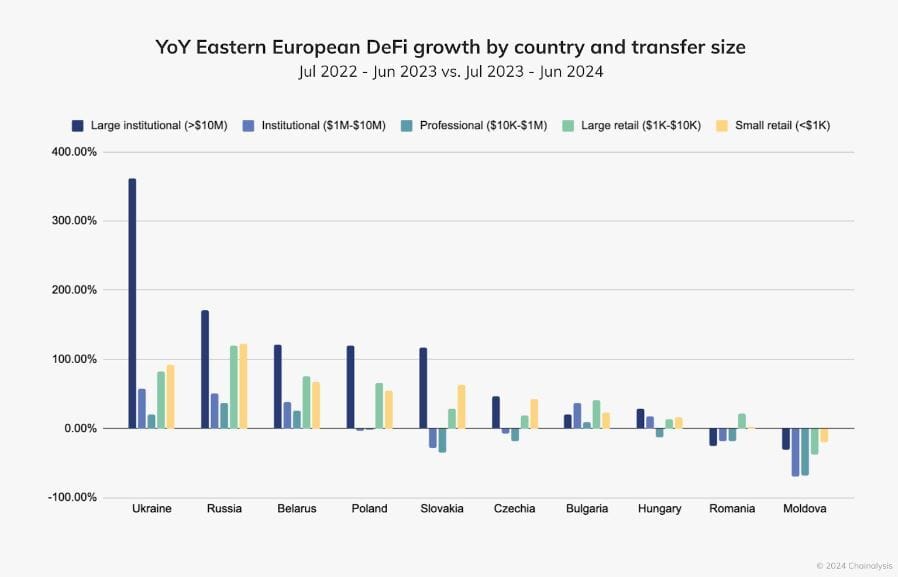

Chainalysis found decentralized exchanges (DEXes) across Eastern Europe experienced a significant rise in crypto inflows, led by Ukraine and Russia.

Regionwide, DEX platforms received approximately $149 billion in crypto, with Ukraine’s DEX inflows growing by more than 160% to $34.9 billion and Russia’s by over 173%, reaching $58.4 billion. DeFi lending services in Moldova, Hungary, and Czechia also saw substantial growth, receiving $11.29 billion in digital assets.

Over the past year, DeFi transaction sizes in Ukraine and Russia reveal two major trends. Ukraine saw a massive 361.49% rise in large institutional transactions, defined as those over $10 million. This cohort drove most of its DeFi activity.

Russia, along with Belarus, Poland, and Slovakia, also experienced notable growth in DeFi through large institutional transfers.

Ukraine, however, saw a significant uptick in large and small retail transactions, with growth of 82.29% and 91.99%, respectively. These smaller transactions suggest a grassroots crypto adoption, likely reflecting an effort by investors to use crypto for everyday spending as Ukraine navigates geopolitical challenges and inflation recovery.

Sanctions Fuel Growth in Russia’s No-KYC Crypto Platforms

Homegrown crypto services in Russia have risen steadily in popularity, with substantial inflows from both inside and outside the country. In fact, Chainalysis revealed that Web traffic to centralized exchanges has remained flat, but Russian-language no-KYC exchanges experienced a peak in activity last year and have since stabilized.

The increase is likely linked to sanctions on Russian banks, prompting locals to use these platforms to convert their fiat into cryptocurrency.

The post Crypto Thrives in War-Torn Ukraine and Sanctioned Russia: Chainalysis appeared first on CryptoPotato.