Crypto Summer and ‘Banana Zone’ Altseason After BTC Halving: Raoul Pal

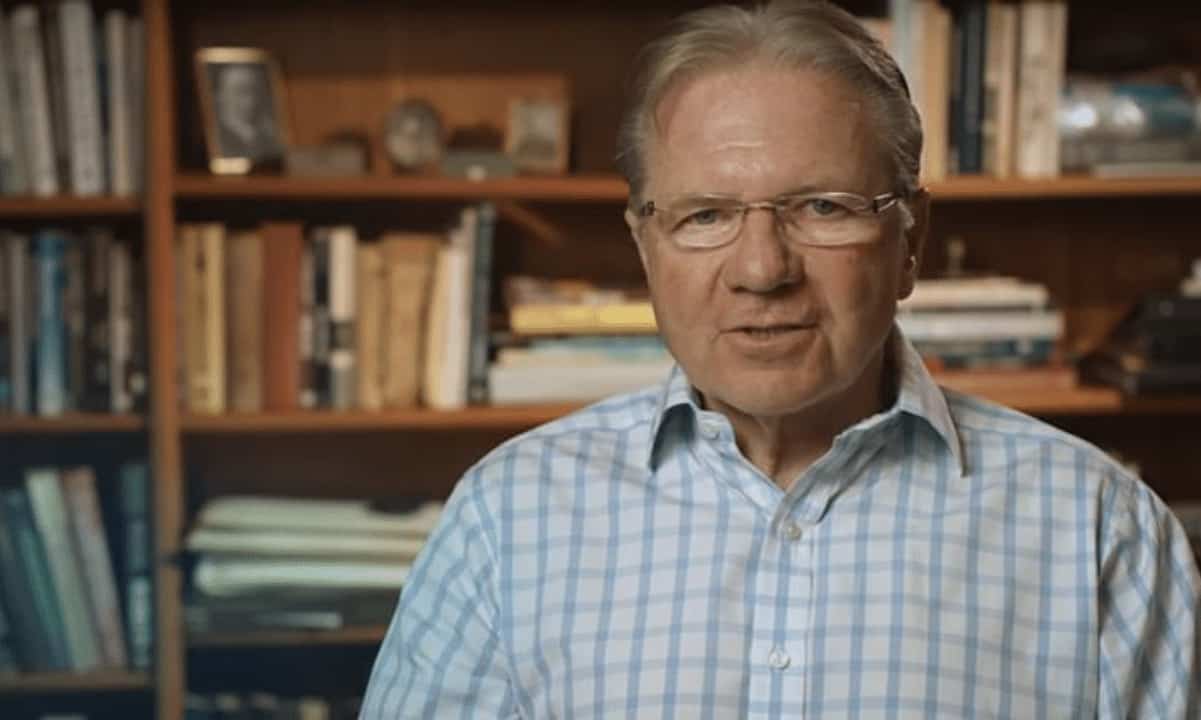

CEO and co-founder of Real Vision Group and Global Macro Investor Raoul Pal said macro and crypto summer has already started in a post on X on March 25.

The prediction is part of his ‘Everything Code’ thesis that explains market movements due to macroeconomic influences.

It is all driven by liquidity, which bottomed at the end of 2022, he said before adding that “macro summer and fall are all about liquidity rising,” and liquidity should rise “all the way into the end of 2025.”

What is Macro/Crypto Summer and why does it matter?

Well, macro summer has started, its the part of The Everything Code cycle where the ISM picks up (GDP growth)…. 1/ pic.twitter.com/L5KbhCUqh8

— Raoul Pal (@RaoulGMI) March 24, 2024

‘Banana Zone’ Altseason

Assets such as tech stocks and cryptocurrencies perform well during this period.

“Crypto summer has started and fully develops post-halving… it’s all the same ‘Everything Code’ cycle,”

He added that the “bigger game” is the altseason or “Banana Zone,” he said, presumably in reference to the massive gains and parabolic price charts for some altcoins.

“But the bigger game is yet to be played out as Alt season arrives and we fully enter the Banana Zone. The Banana Zone cometh and it is a huge wealth-generating machine.”

Pal’s “Everything Code” thesis, which he publicized in 2023 as the culmination of everything he has worked on since 2005, argues that today’s asset prices are primarily driven by central bank monetary policies and debt levels rather than traditional company fundamentals or economic growth.

High government debt levels globally require central banks to print money via quantitative easing (QE) to make interest payments, and this creates a cycle where more QE is needed every 3-4 years as debt rolls over.

This leads to the debasing of fiat currency, causing asset prices to be bid up, irrespective of company performance or valuations. Tech and crypto usually outperform in this environment as their growth potential offsets the debasing effects of QE.

Moreover, central banks are trapped in this “Everything Code” by larger demographic forces like slowing population growth, which reduces GDP growth and increases QE requirements to service escalating debts, argues Pal.

“The work we have done on the ‘Everything Code’ in Global Macro Investor has been central to my investing strategy and got us max long tech and crypto in Dec. 2022,” he stated.

Bitcoin Still Dominates

Raoul Pal is not the only investor predicting a big altseason ahead. Crypto investor “Alejandro” told his 106,000 X followers that the altseaon will come in the next two to four months.

We are in pre altseason.

ALTSEASON will come in 2-4 months, not before.

We also reached the 59 RSI level. Last time we reached this level, #Bitcoin dominance starts trending down pic.twitter.com/5pVQtlqDVr

— Alejandro₿TC (@Alejandro_XBT) March 23, 2024

Currently, Bitcoin still dominates, with a market share of 53.4%, according to TradingView. Only when this dips back to the mid-40% level, as it did during the last cycle, will the altseason really be in full swing.

The post Crypto Summer and ‘Banana Zone’ Altseason After BTC Halving: Raoul Pal appeared first on CryptoPotato.