Crypto Sites Are Naming Fake Dispute Resolution Organizations: Canada’s Securities Regulator

The Canadian Securities Administrators (CSA), an umbrella organization of Canada’s provincial and territorial securities regulators, is warning investors about crypto companies that claim to be authorized by fictitious regulatory or dispute-resolution organizations.

“In an effort to appear legitimate, the purported trading service providers claim they are certified by a fictitious authority or that they are members of a dispute resolution organization,” the CSA said in a release.

The organizations named by the CSA include:

-

Financial Standard Commission FSC Canada

-

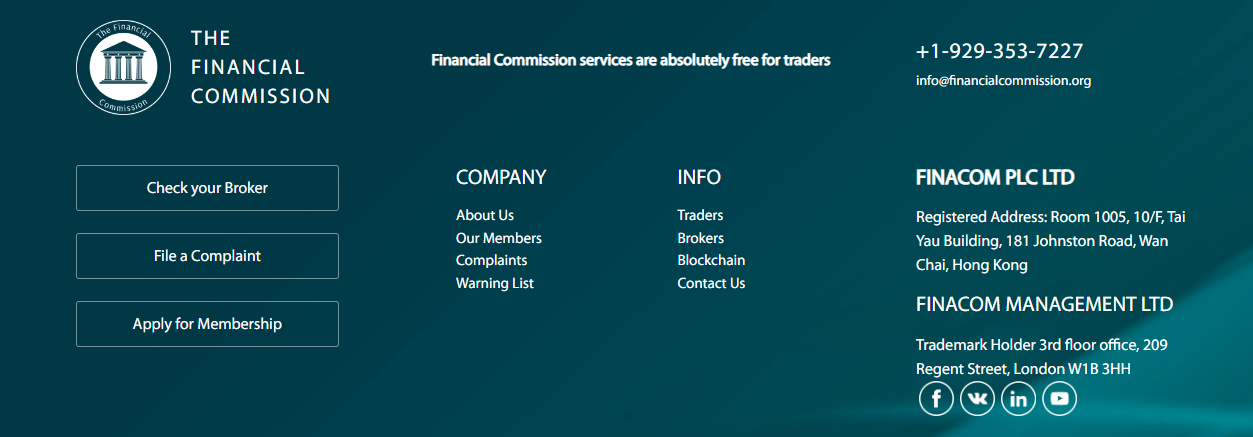

Financial Commission/Finacom PLC Ltd.

-

Blockchain Association

-

European Financial Services and Exchange Commission

-

Crypto Conduct Authority/Crypto Frugal Ltd. (Ireland)

-

Crypto Conduct Authority/Crypto Frugal Ltd. (U.K.)

-

International Regulatory & Brokerage E-markets

-

British Investment Commission/BIC PLC Ltd.

-

International Financial Market Supervisory Authority

-

Crypto Commission Authority/Crypto Commission Ltd.

The CSA did not provide any evidence of wrongdoing by the named groups, and did not immediately respond to a request for comment by CoinDesk.

Most of the groups don’t have any sort of web presence. One exception is The Financial Commission – operated by Finacom – which runs the Blockchain Association (not to be confused with the lobby group in Washington D.C.).

“Anyone considering using a crypto firm that claims to be certified or a member of a dispute resolution organization should try to independently verify that the referenced organization actually exists,” said the CSA in a statement.

On its website, the Financial Commission provides an address in Hong Kong’s Wan Chai district that’s commonly used to register companies and a phone number from a Brooklyn, New York, area code.

“We are a legitimate company and do not agree with the characterization of our business,” a spokesperson for the group told CoinDesk.

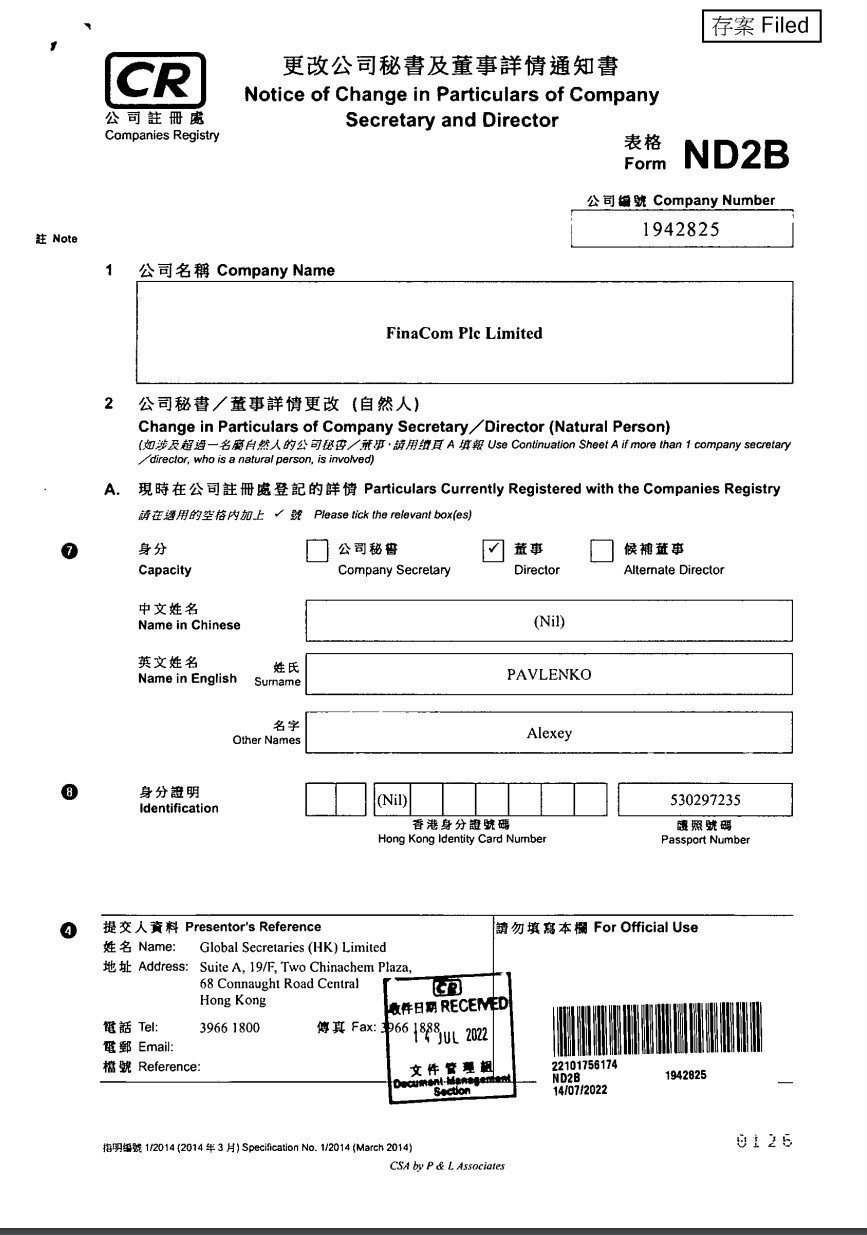

Filings from Hong Kong’s corporate registry show it’s registered to Alexey Pavlenko, who is listed on the website as a board member of the organization. Pavlenko is also listed as a director for the firm’s U.K entity.

The Financial Commission’s Blockchain Association unit also rejected the CSA’s characterization.

“We do not agree with the information in the CSA’s notice and believe the regulator made a mistake,” Chief Operating Officer Nikolai Isayev said in an email to CoinDesk. “We have already engaged legal counsel in Canada and preparing a submission to CSA to remove this designation. We expect this issue to be resolved soon.”

The group has had a handful of members over the years, but has not provided any services in the last two years and is currently in a dormant state, he said.

The majority of the members of the Financial Commission are foreign currency trading brokerages. The only notable blockchain company is YouHolder, a centralized yield platform.

YouHolder did not respond to a request for comment from CoinDesk.

UPDATE (June 21, 09:35 UTC): Adds response from Blockchain Association in 10th paragraph.

Edited by Sheldon Reback.