Crypto Rails Should Bring Efficiency Gains to the $7T-a-Day TradFi FX Market

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Todd Groth is Head of Index Research at CoinDesk Indices. . He has over 10 years of experience involving systematic multi-asset risk premia and alternative investment strategies.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Crypto prices are wobbling amid Silvergate Bank’s woes and the U.S. government’s regulation-by-enforcement campaign. But I’m looking past that, thinking about the likely future collision of crypto and the legacy plumbing of finance and markets. How will they interact? What efficiencies will result from deploying the best of both worlds? What happens to existing over-the-counter and private markets? What real-world assets will shift to on-chain trading?

A recent paper from Uniswap Labs, the decentralized-finance (DeFi) titan, and stablecoin giant Circle previews that future.

The authors studied the first six months of trading on a Uniswap liquidity pool that contains USD coin (USDC) and euro coin (EUROC). (It launched in July.) More than $120 million traded through the automated market maker (AMM), which provided liquidity 24/7 without a hiccup during the depths of crypto winter.

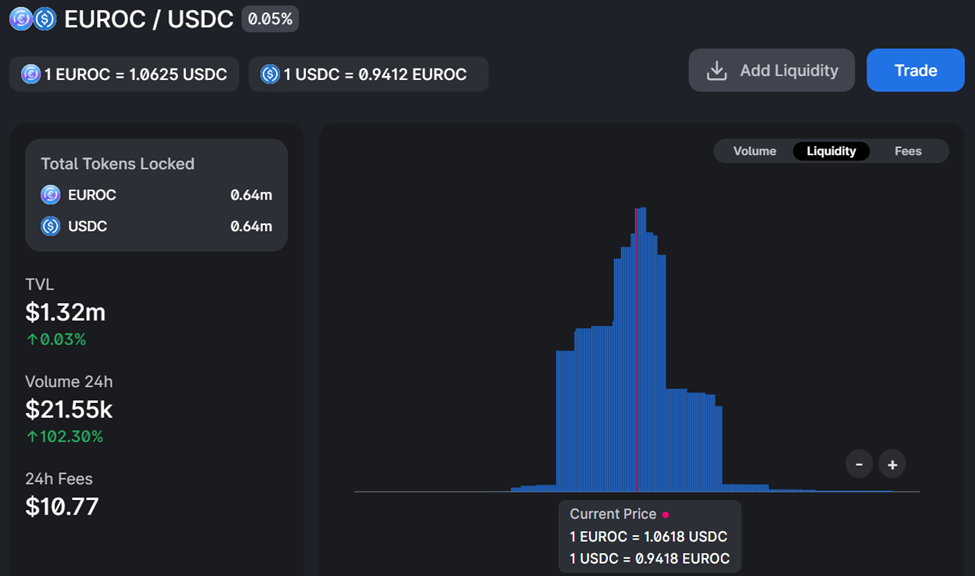

The Uniswap EUROC/USDC liquidity pool on March 5. (Uniswap)

Sure, there’s only $1.32 million in total value locked (TVL). But something significant is afoot here as two fiat-backed stablecoins get swapped efficiently and without fanfare on chain.

The traditional currency market is something like a $7-trillion-a-day, mostly over-the-counter business. It’s opaque and complex. There’s no official prices. And an estimated one-third of all volume (about $2 trillion daily) has settlement risk, according to a 2022 Bank for International Settlements survey.

Meanwhile, this USDC/EUROC pool completed transactions on a public ledger, and did it really efficiently. During the study period, prices stuck within a few basis points of the conventional EUR/USD exchange rate. There was weekend liquidity, a time when the traditional FX spot market goes dark. And there were fewer intermediaries and their associated fees and frictions. Automation worked.

“DeFi can reduce remittance costs by as much as 80 percent relative to banks and money transmitters relying on traditional payment systems,” the study authors wrote. That amounts to “a gain of around $30 billion per year going to households” most reliant on remittance payments from families across borders, they added.

While a lowly USDC/EUROC stablecoin liquidity pool might seem like a rather mundane example of crypto in action, it points to the numerous benefits, increased efficiencies of a blockchain future. Don’t overlook that amid the day-to-day of crypto price action.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

Todd Groth is Head of Index Research at CoinDesk Indices. . He has over 10 years of experience involving systematic multi-asset risk premia and alternative investment strategies.