Crypto Promoter and Failed Politician Michelle Bond Accused of Illegally Taking FTX Cash

-

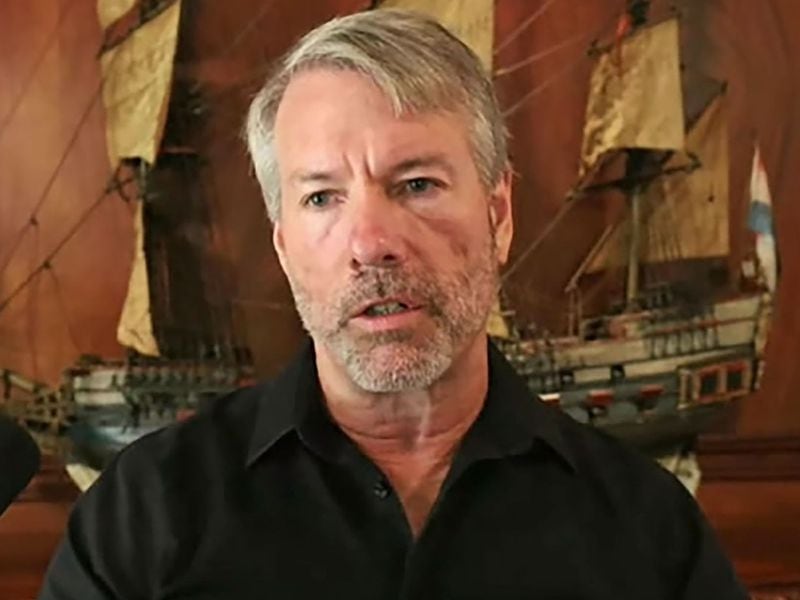

A once-prominent crypto advocate, Michelle Bond, has been indicted for taking illegal money from her former FTX executive boyfriend, Ryan Salame, to back her congressional campaign in 2022.

-

Bond, a former Securities and Exchange Commission lawyer, was the CEO of a crypto trade group in Washington.

Michelle Bond, who once ran a Washington-based crypto advocacy group and had served as a U.S. Securities and Exchange Commission lawyer, was indicted in federal court for taking illegal campaign contributions during her 2022 run for Congress, and court documents detail how a river of cash came through her former FTX executive boyfriend.

Bond was accused in an indictment unsealed on Thursday of several counts of illegal handling and acceptance of campaign donations, tied to former senior executive Ryan Salame. She was also said to have filed ethics documents on behalf of the campaign that made bogus claims about the source of her money.

A court clerk told CoinDesk that Bond was expected to be presented before a magistrate judge in Manhattan around 3 p.m. EDT on Thursday.

Salame wasn’t named in the court papers, but the description matches the ex-CEO of Bahamas-based FTX Digital Markets, who received a 7.5-year sentence in a plea deal that Salame now argues was supposed to protect Bond. Salame’s lawyers contend that his guilty plea for campaign finance violations and running an unlicensed money transmitting business was meant to halt the case against Bond. (A judge scheduled a hearing on this issue for next month.)

The indictment against Bond in the U.S. District Court for the Southern District of New York was dated earlier this week.

Bond, who has made a recent effort to return to commenting on crypto policy affairs, declined to comment through a representative. Salame didn’t immediately respond to a request for comment sent through his lawyers.

Salame and Bond have a child together, and the couple was often featured during Bond’s failed Republican campaign for a New York seat in the U.S. House of Representatives. The two sought to associate themselves at the time within the circles of former President Donald Trump, and she was endorsed by son Donald Trump Jr.

A self-funded candidate has to ensure under election rules that they are using their own money. Bond is accused of taking several payments in 2022, some of them in the hundreds of thousands of dollars.

“I just wanted to say thank you so much for paying that [consulting firm] invoice…really appreciate this, means a lot,” Bond texted to Salame in February 2022, according to the indictment.

He’s said to have responded, “If you’re thanking me for that. … the expenses on you actually running … going to get me so much love <3."

Her campaign raised more than $1.5 million, according to Federal Election Commission records, but the vast bulk of that allegedly came from Bond herself. The indictment argues virtually all of it originated as payments from Salame or FTX, which subsequently collapsed in one of the most consequential failures in the industry’s history. After some of the allegations emerged of an improper financial connection to FTX, Bond resigned as the CEO of the Association for Digital Asset Markets (ADAM).

Though she spent about the same as her Republican primary opponent and was backed by about $1.3 million in advertising paid for by the crypto industry, she managed to bring in less than 30% of the vote.

Edited by Nikhilesh De.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/www.coindesk.com/resizer/x37dWM_1ORxU2nCUG8EyVsmvF4Y=/arc-photo-coindesk/arc2-prod/public/3CZRUU6QWVDQ5PSXCNWHUB6CY4.png)