Crypto Price Analysis & Overview November 27th: Bitcoin, Ethereum, Ripple, Chainlink & Stellar Lumens

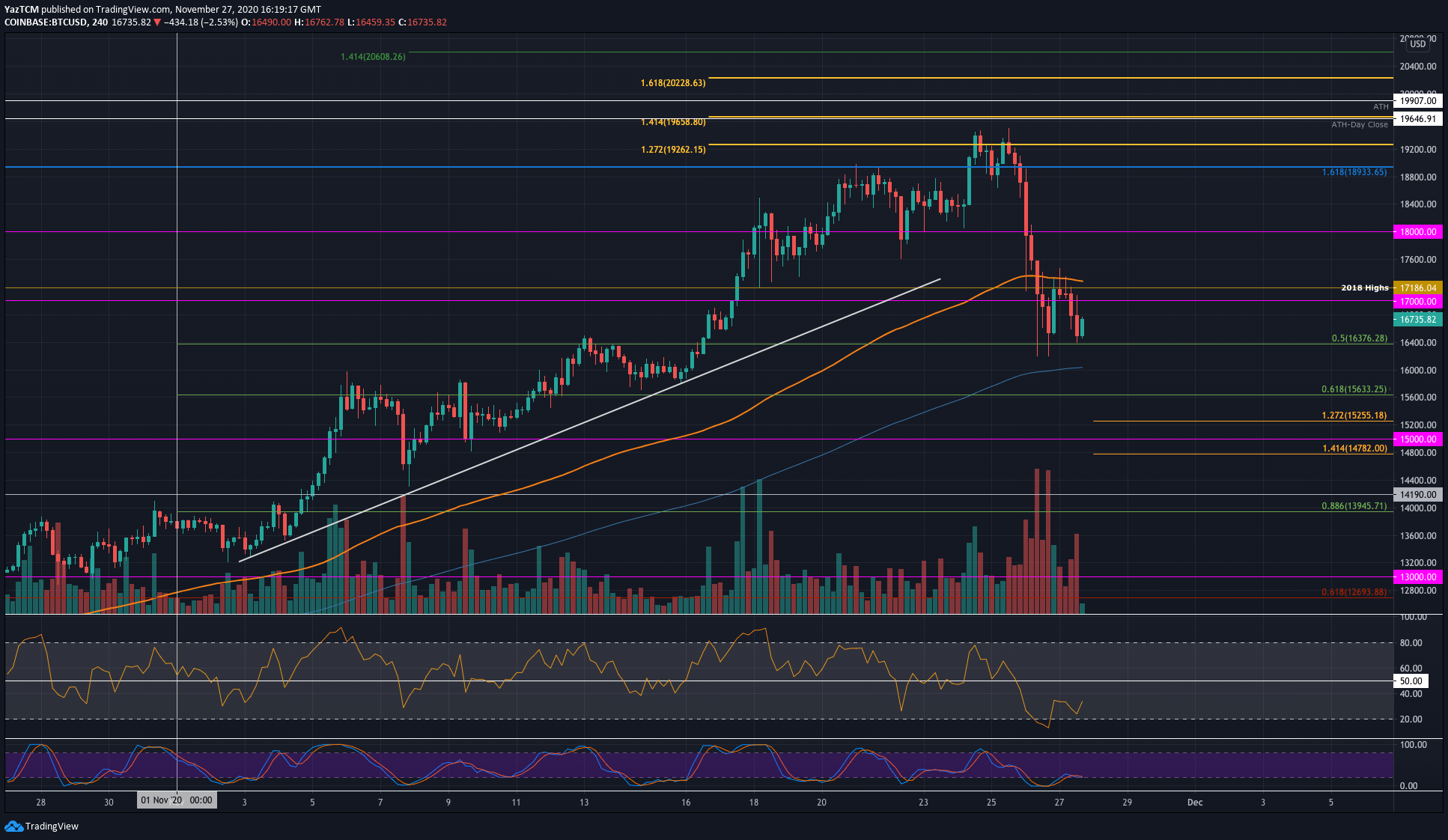

Bitcoin

Bitcoin saw a slight retracement from its bullish rally this week after dropping 6.3% over the past 7 days. The cryptocurrency started the week on a bullish footing as it climbed higher from $18,000 and reached as high as $19,500. Unfortunately, it could not close a daily candle above $19,265 (1.272 Fib Extension) during the week.

Yesterday, Bitcoin dropped by a steep 10% to the $17,000 region. The decline continued today as BTC fell into the $16,375 support – provided by a .5 Fib Retracement.

Looking ahead, if the sellers push beneath $16,375, the first level of support is expected at $16,000. Beneath this, support lies at $15,633 (.618 Fib), $15,255, and $15,000.

On the other side, resistance is first expected at $17,185 (2018 Highs). Above this, resistance lies at $17,600, $18,000, $18,400, and $18,933. Above $19,000, resistance is found at $19,262, $19,500, $19,900 (ATH), and $20,000.

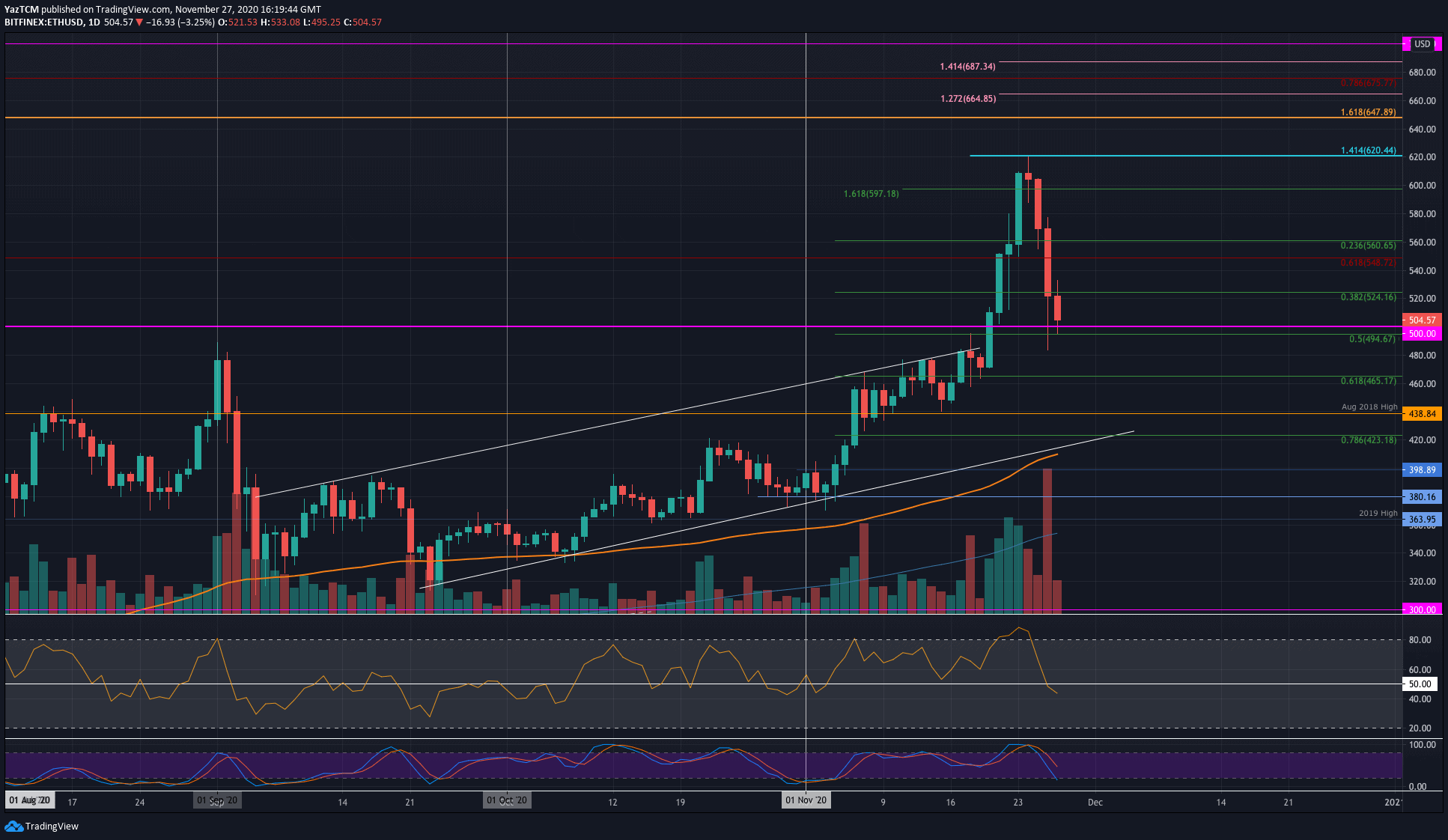

Ethereum

Despite dropping almost 20% over the past 4 days, Ethereum is still up by 6.8% over the week. The cryptocurrency was trading at the $470 level last Friday as it started to push higher. On Monday, it had penetrated above the $600 level to hit as high as $620 (1.414 Fib Extension) on Tuesday.

Unfortunately, the BTC price drop caused ETH to head lower from there as it dropped into the $500 support level today. More specifically, the buyers bounced from the $495 support – provided by a .5 Fib Retracement.

Moving forward, if the sellers break beneath $500 again, the first level of support lies at $480. Under this, support lies at $465 (.618 Fib), $439 (August 2018 Highs), and $420 (.786 Fib).

Alternatively, the first level of resistance lies at $520. Above this, resistance lies at $550 (bearish .618 Fib), $580, $600, and $620 (1.414 Fib Extension).

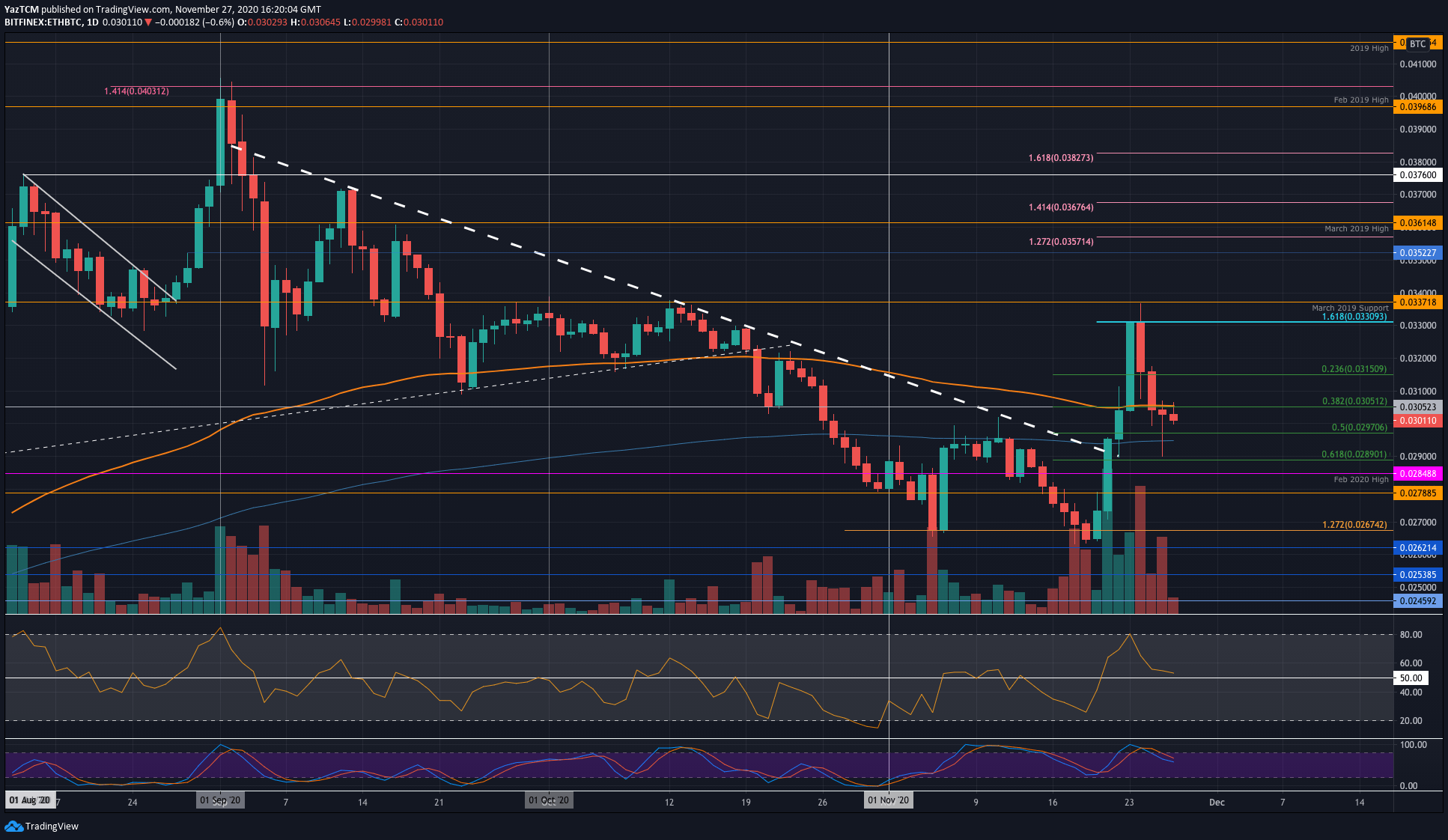

Against Bitcoin, Ethereum also managed to surge higher during the week. It pushed higher from 0.027 BTC last Friday and went on to break 0.03 BTC by Sunday. At the start of this week, ETH penetrated above the 100-days EMA to hit as high as 0.033 BTC (1.618 Fib Extension).

The coin spiked higher on Tuesday to reach 0.0337 BTC (March 2019 Support), but the sellers stepped in from there to push it lower. Yesterday, ETH fell beneath the 100-days EMA and is now trading at the 0.03 BTC support.

Looking ahead, if the sellers push lower, the first level of support lies at 0.0297 BTC (.5 Fib Retracement). Beneath this, support is found at 0.0289 BTC (.618 Fib), 0.0295 BTC (Feb 2020 highs), and 0.0278 BTC.

Alternatively, resistance is first expected at the 100-days EMA. Above this, resistance lies at 0.031 BTC, 0.032 BTC, and 0.033 BTC. Added resistance is then found at 0.0337 BTC, 0.034 BTC, and 0.035 BTC.

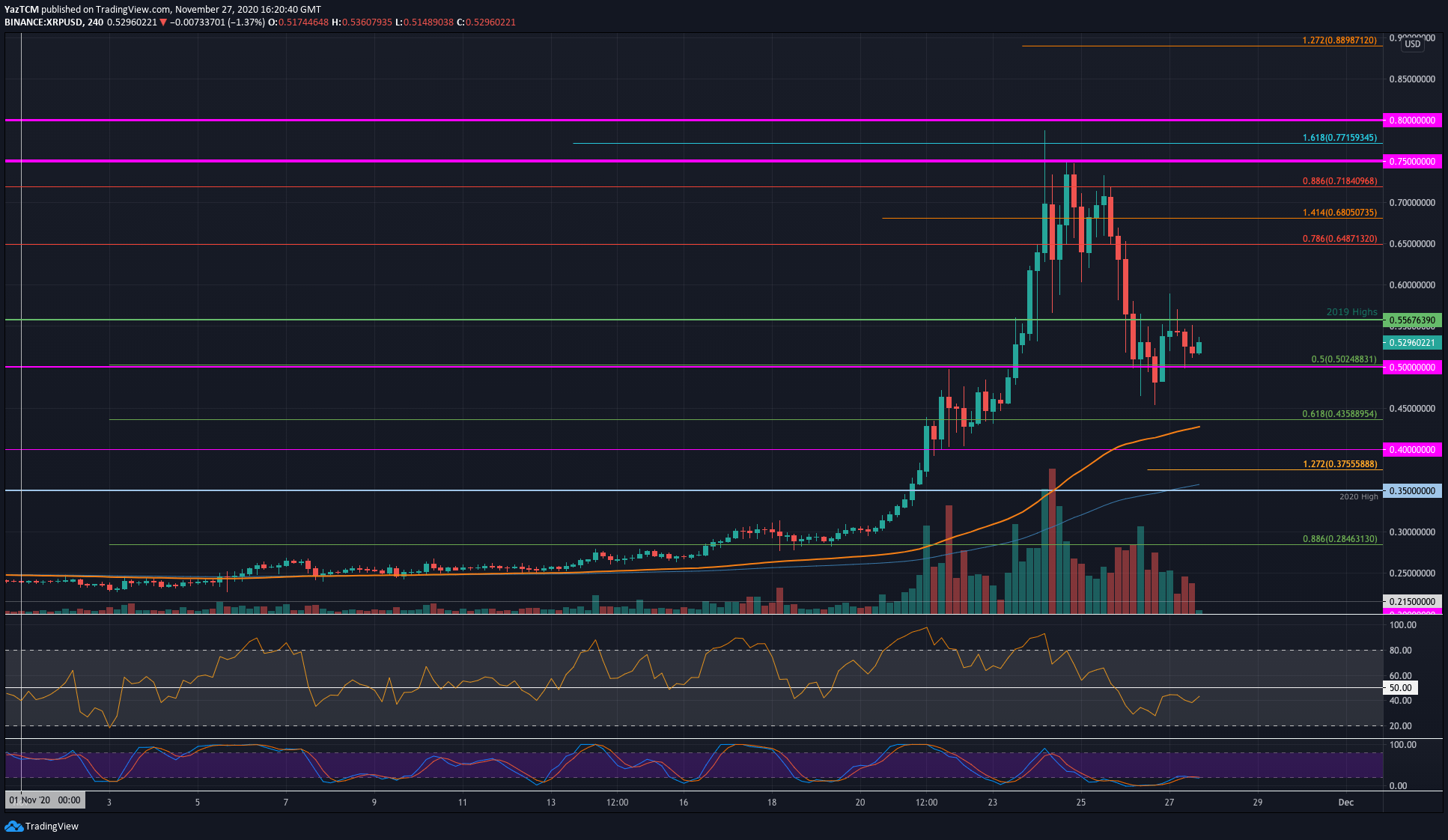

Ripple

Ripple outperformed the entire top 10 this week after it exploded by a strong 75% to hit the current $0.53 level. Last Friday, the cryptocurrency was trading at the $0.3 level. From there, it surged higher throughout the week as it broke above $0.5 to reach as high as $0.75 on Tuesday.

It was unable to break the resistance at $0.75 and rolled over from there. The coin went on to drop into the support at the $0.5 level and is now trading at $0.53.

Moving forward, if the buyers push higher again, the first level of resistance lies at $0.556. Above this, resistance lies at $0.6, $0.65 (bearish .786 Fib), $0.68 (1.414 Fib extension), and $0.817 (bearish .886 Fib). This is followed by resistance at $0.75, $0.77, and $0.8.

On the other side, if the sellers push lower, the first level of support lies at $0.5. Beneath this, support lies at $0.45, $0.435 (.618 Fib), $0.4, and $0.35 (.2020 highs).

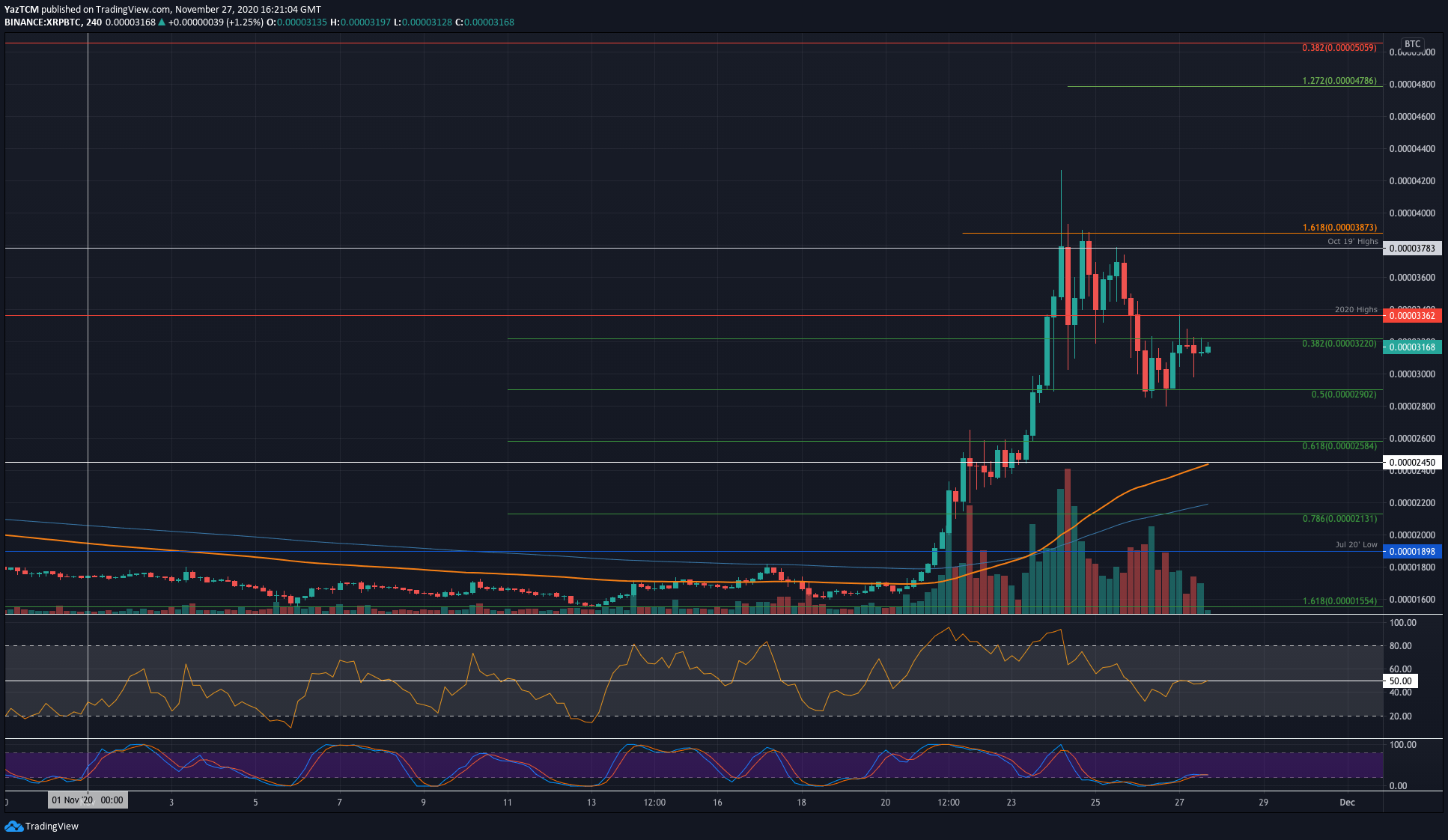

XRP also performed extremely well against Bitcoin. The coin was trading beneath the 1800 SAT level last Friday as it started to push higher. It managed to reach the October 2019 highs at 3785 SAT during the week but could not continue further above here.

From there, XRP headed lower until support was found at 2900 SAT, which is provided by the .5 Fib Retracement level. It has since bounced higher to trade at 3170 SAT.

Looking ahead, if the buyers push higher, the first level of resistance lies at 3360 SAT (Feb 2020 High). Above this, resistance lies at 3600 SAT, 3785 SAT, and 4000 SAT.

On the other side, the first level of support lies at 3000 SAT. Beneath this, support lies at 2900 SAT (.5 Fib), 2800 SAT, 2600 SAT(.618 Fib), and 2450 SAT.

Chainlink

Chainlink suffered a steep 10.8% price drop this week as the cryptocurrency dropped into the $12.15 level today. The coin is trading within an ascending price channel, and it hit the upper boundary of this channel during the week.

Unfortunately, LINK was unable to close a daily candle above the $15.66 resistance – provided by a bearish .786 Fib Retracement – and it rolled over from here. The coin is now trading at the lower boundary of the rising price channel.

Looking ahead, if the sellers break beneath the channel, the first level of support lies at $11.50. Beneath this, support lies at $10.50, $10.00, $9.80, and $9.15.

On the other side, the first level of resistance lies at $13.86 (bearish .618 Fib). Following this, resistance is located at $15, $15.66 (bearish .786 Fib), $16, and $16.73 (bearish .886 Fib).

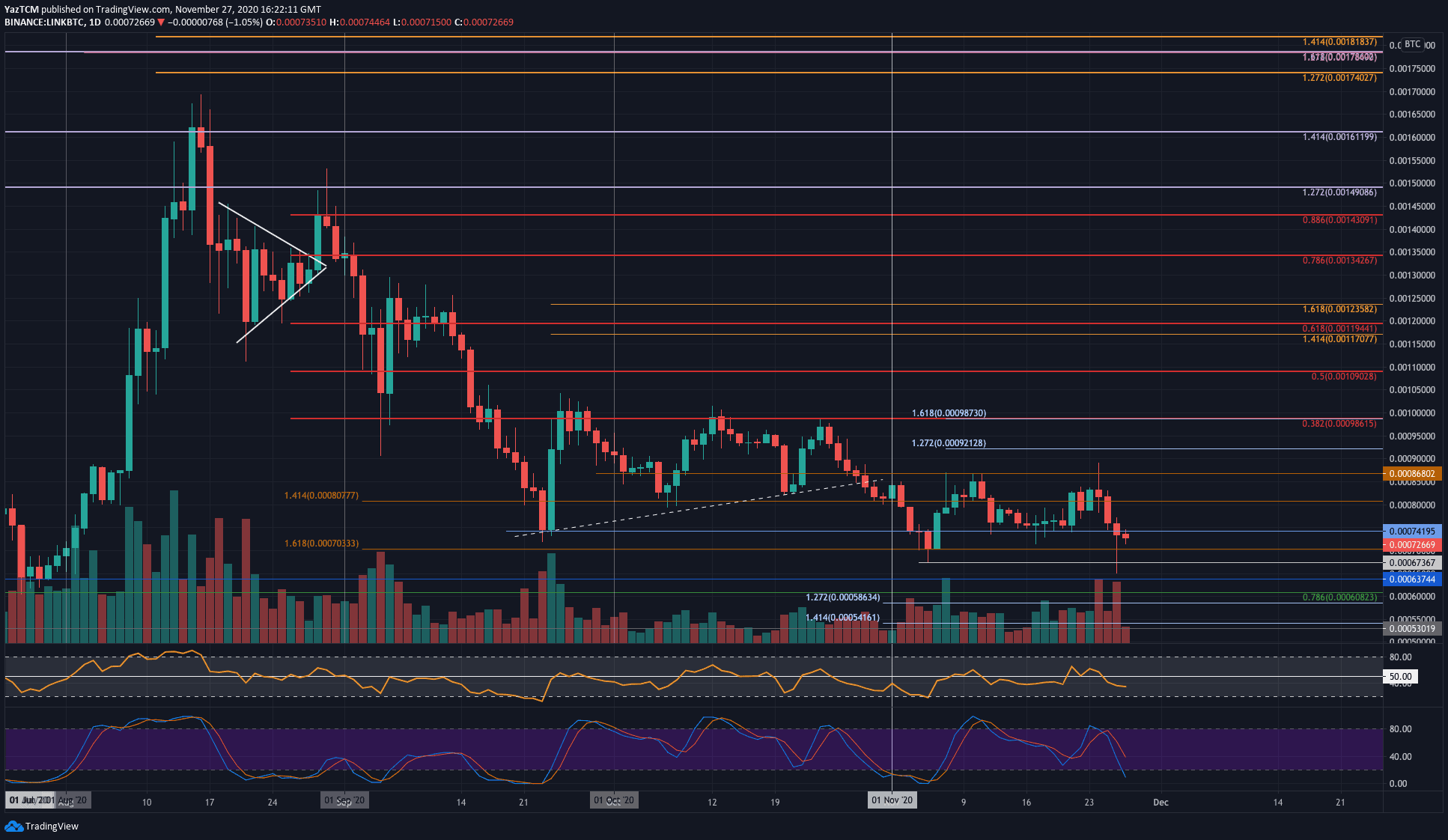

LINK has been struggling greatly against Bitcoin over the past few months. It has pretty much been trapped between 86,800 SAT and 67,400 SAT throughout the entire period of November and must break this range to dictate the market’s next direction.

It is currently trading closer to the lower boundary of this range as it sits at 72,700 SAT.

Moving forward, if the sellers push lower, the first level of support lies at 70,000 SAT. Beneath this, support is found at 67,400 SAT, 63,750 SAT, 60,000 SAT (.786 Fib), and 58,600 SAT.

Alternatively,resistance is found at 74,200 SAT, 80,000 SAT, 85,000 SAT, and 86,800 SAT. Added resistance can be found at 92,130 SAT, 98,615 SAT (bearish .382 Fib), and 100,000 SAT.

Stellar Lumens

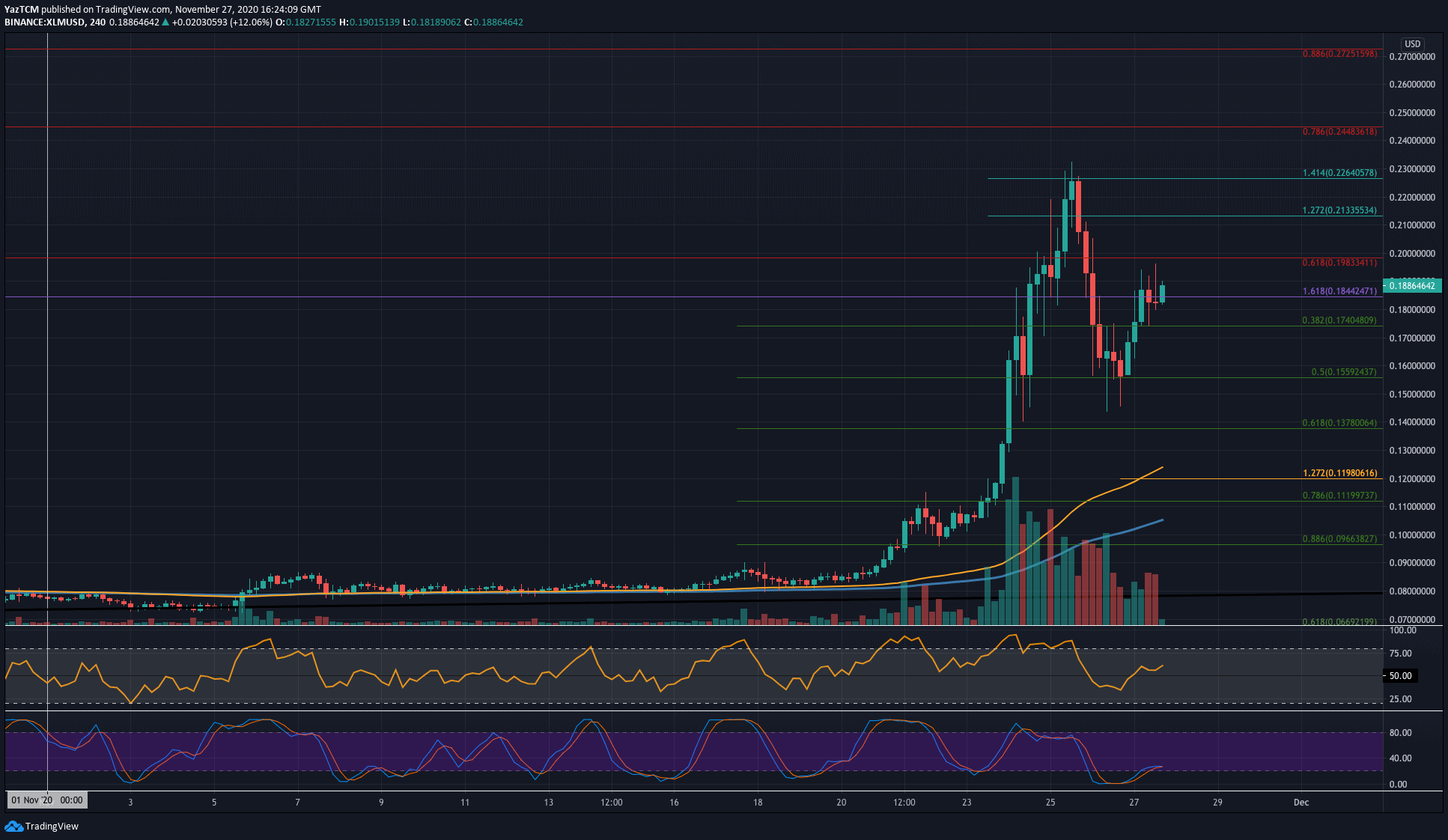

Stellar Lumens is the highest performing cryptocurrency on this list this week after it managed to surge by 125%. The coin is closely correlated to XRP, so when XRP started to surge higher this week – so did XLM.

XLM was trading at around $0.08 last Friday as it started to climb higher. It broke above $0.11 to explode higher and reach the $0.226 resistance (1.414 Fib Extension) on Tuesday. Unfortunately, it did not manage to close a daily candle above the $0.198 level (bearish .618 Fib) during the week.

It since rolled over from $0.226 to reach the support at $0.155 (.5 Fib). It has rebounded from here to trade at $0.188 today.

Looking ahead, if the buyers push higher, the first level of resistance is expected at $0.198 (bearish .618 Fib). Above $0.2, resistance lies at $0.213 (1.272 Fib Extension), $0.226 (1.414 Fib Extension), $0.24, and $0.244 (bearish .786 Fib Retracement).

On the other side, the first level of support lies at $0.18. Beneath this, support lies at $0.174 (.382 Fib), $0.17, and $0.155 (.5 Fib).

The situation is similar for XLM against Bitcoin. Last Friday, the coin bounced higher from the 450 SAT level and managed to push as high as 1200 SAT during the week. So far, it has struggled to close a daily candle above the 1050 SAT level, but it has climbed by around 15% today to trade at 1130 SAT and it looks like it should close higher than 1050 SAT.

Moving forward, the first level of resistance lies at 1145 SAT (bearish .382 Fib). Above this, resistance lies at 1200 SAT, 1300 SAT (bearish .5 Fib), 1350 SAT, and 1460 SAT (bearish .618 Fib).

On the other side, support lies at 1050 SAT, 1000 SAT, 950 SAT, and 900 SAT.