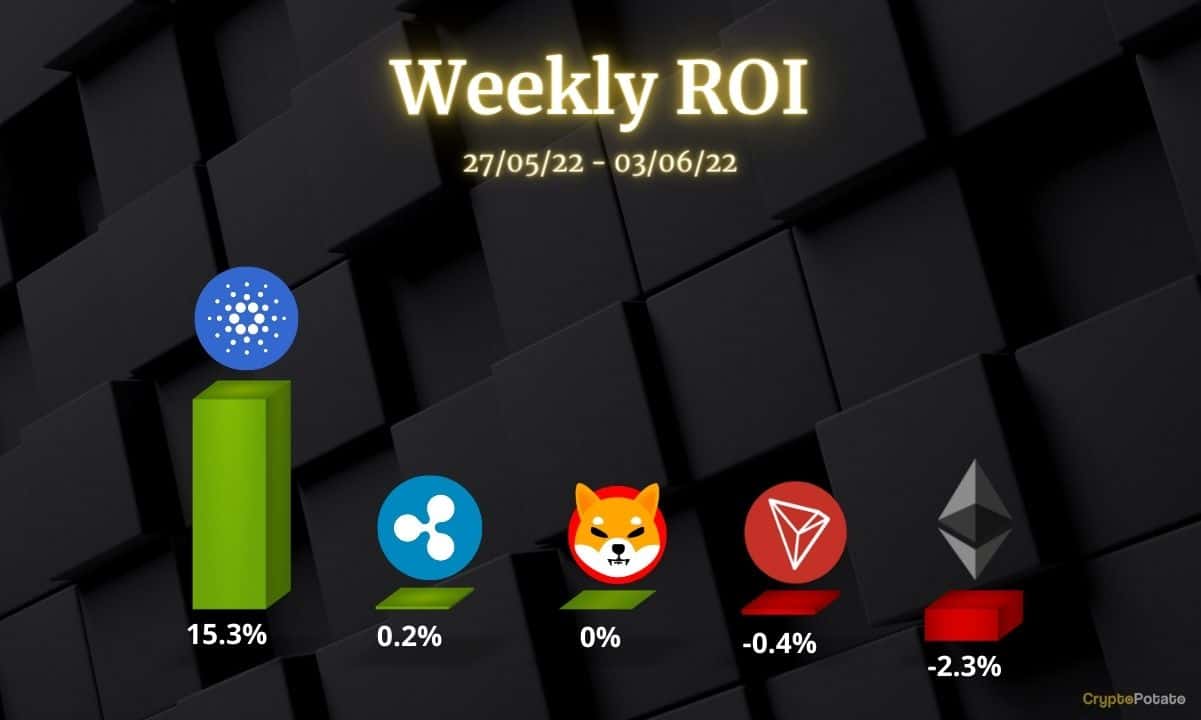

Crypto Price Analysis June-3: Ethereum, Ripple, Cardano, Tron, and Shiba Inu

This week, we take a closer look at Ethereum, Ripple, Cardano, Tron, and Shiba Inu.

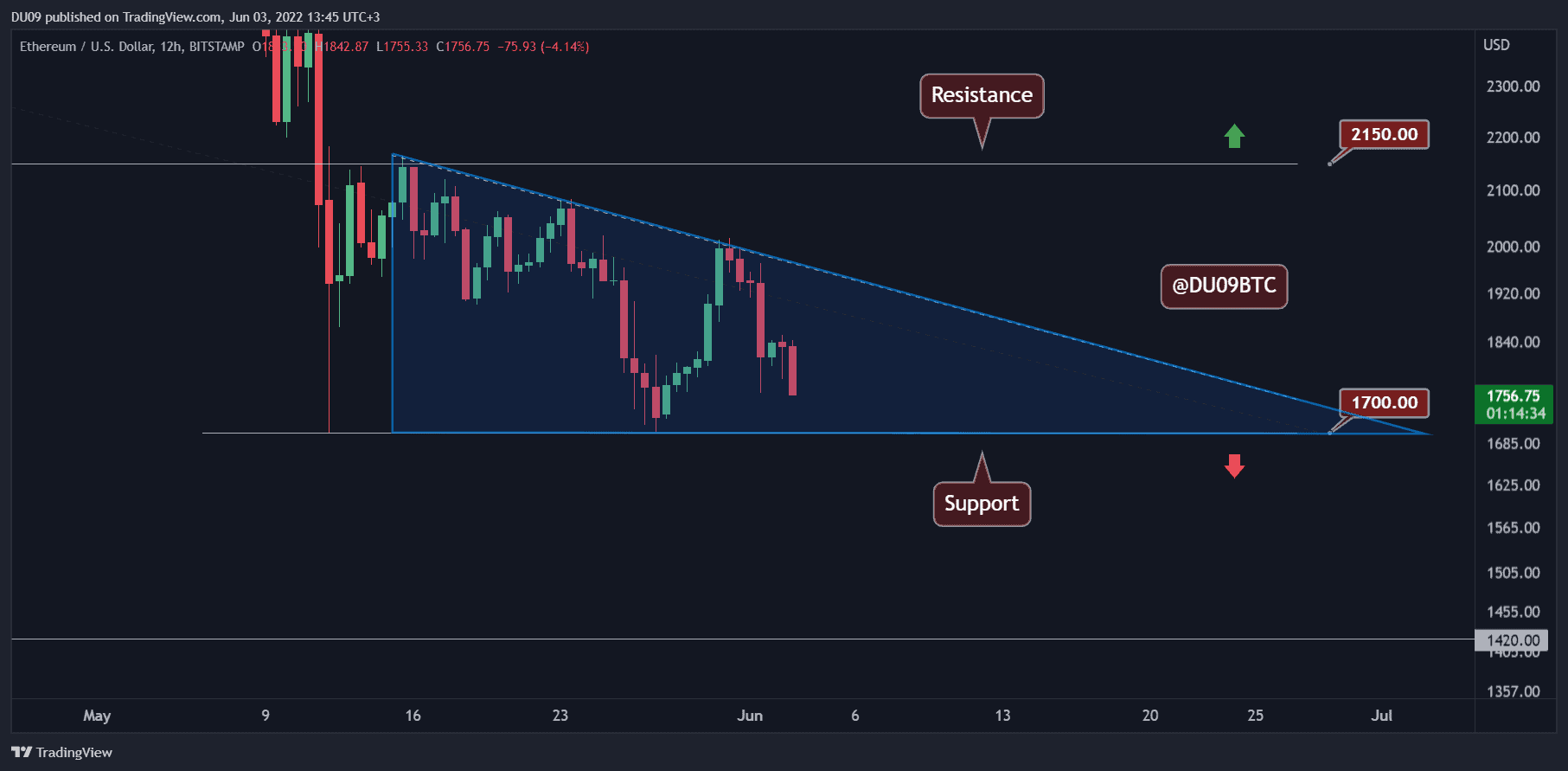

Ethereum (ETH)

During these past seven days, Ethereum has consolidated in a range between $2,000 and $1,700. For this reason, the price remained relatively flat compared to last week and registered a 2.3% loss. The cryptocurrency also appears to have formed a descending triangle (represented in blue in the below chart).

Should buyers be unable to defend the critical support at $1,700, then ETH will be more likely to drop to the next key level found at $1,450, which was also the all-time high from January 2018. Whenever a triangle is formed, the price will break away from this formation once it moves about 70% across the triangle, on average.

Looking ahead, Ethereum appears weak since it was unable to turn resistance levels into support and may break below the descending triangle. Buying pressure is also fading despite the bounce at the end of May, and this might embolden bears to take over.

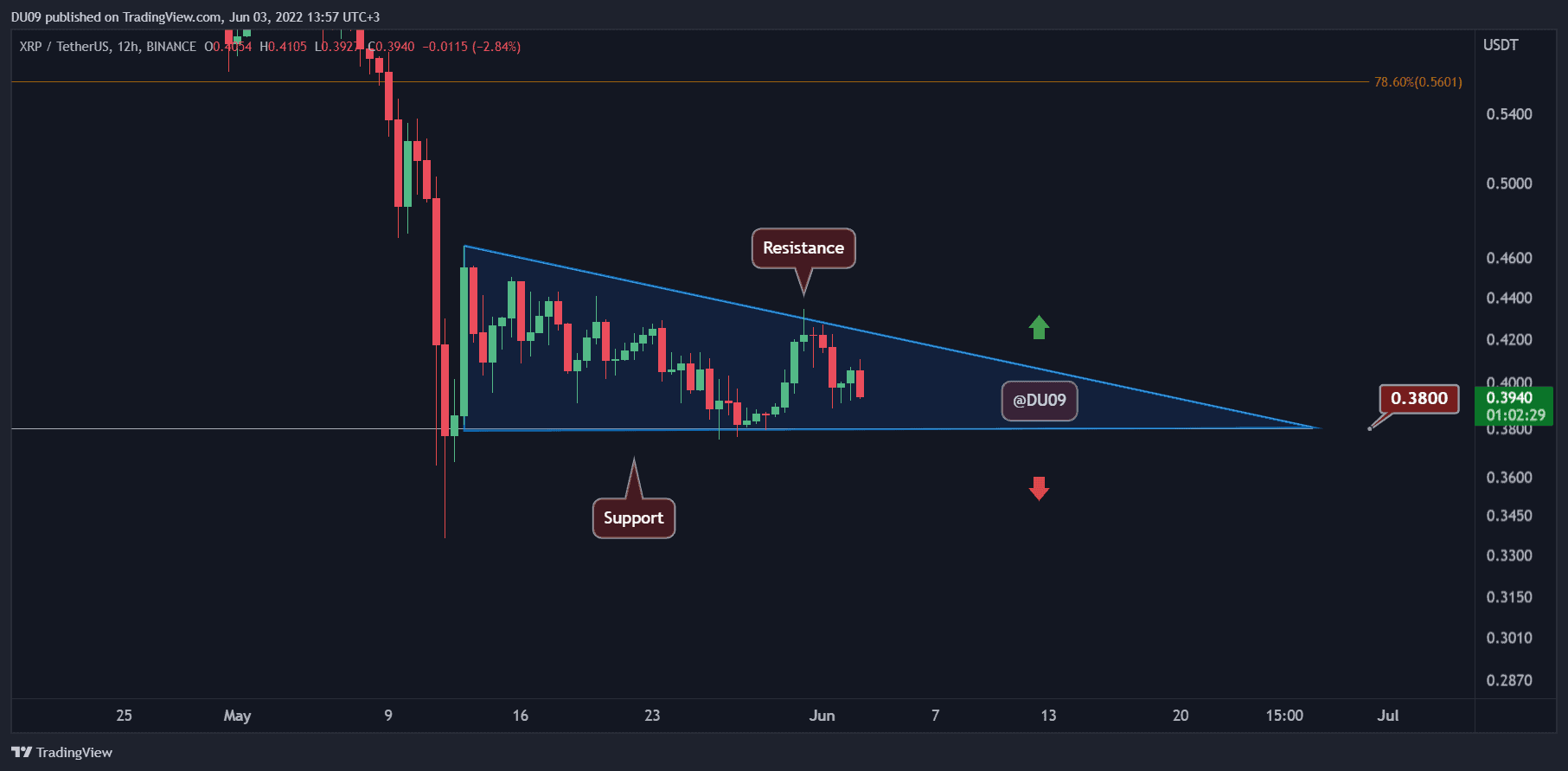

Ripple (XRP)

XRP’s price failed to rally and made a lower high. Because of that, the price action is currently bearish, as indicated by the descending triangle similar to ETH. The key support at $0.38 held well at the end of May but may be retested soon. Overall, in the past seven days, XRP’s price has remained relatively flat with no significant change.

The key resistance is found at $0.43, and in the coming week, XRP may attempt to break away from this triangle. It is too early to call for a direction, but the bull case is rather weak. The indicators on the daily timeframe and below are turning bearish again, which may lead to a breakdown if sellers are able to maintain the pressure.

If the key support is not defended well, then the cryptocurrency could fall lower and reach 30 cents in the coming weeks.

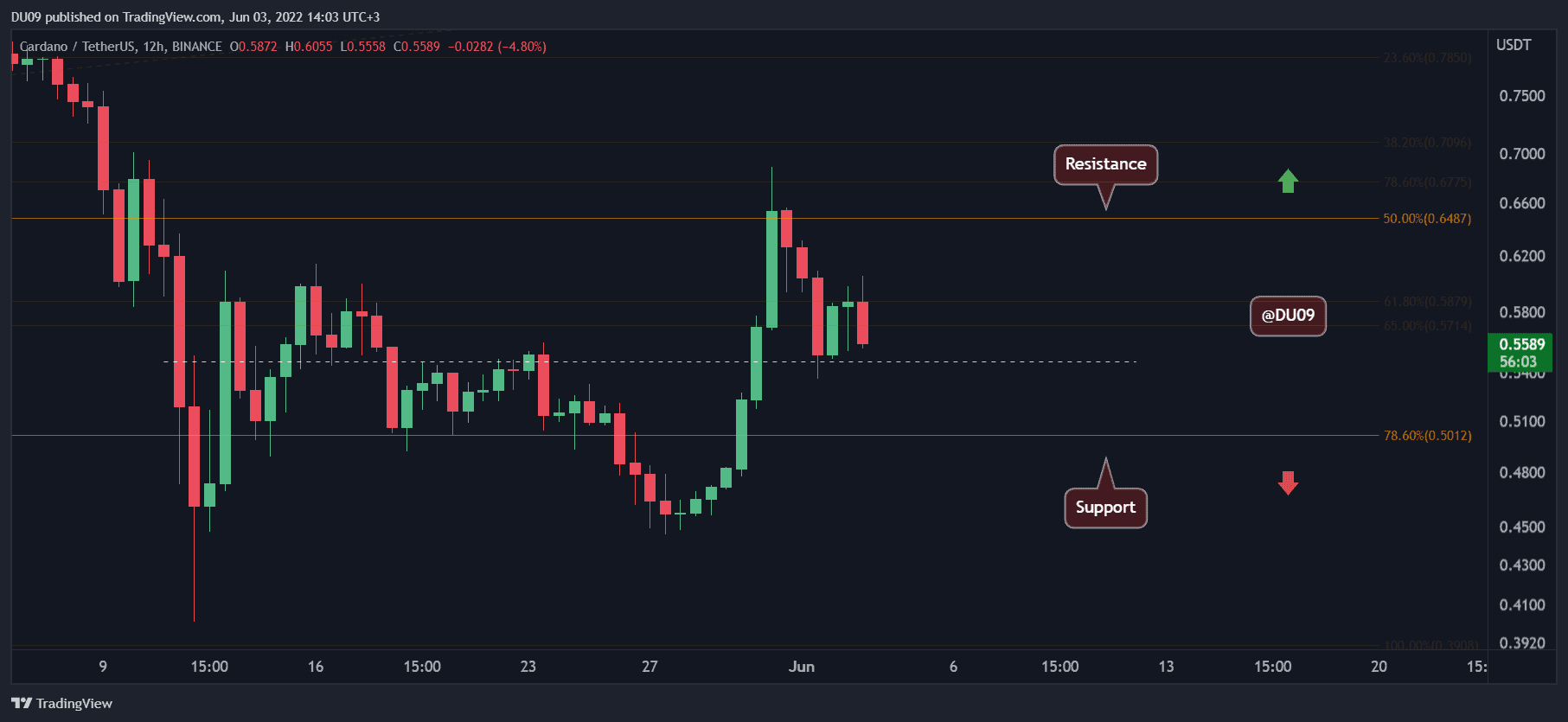

Cardano (ADA)

Cardano managed to consolidate above $0.55 this past week after making some significant gains in late May. This is somewhat bullish, but to gain more confidence, ADA has to move above the key resistance at $0.65 and turn it into support. Nevertheless, this cryptocurrency had a good week registering an increase of 16%.

Since the overall market appears to give some bearish signals on shorter timeframes, ADA could fall to the next key support at $0.50. The indicators on the 12-hour timeframe are also starting to lean bearish.

Looking ahead, ADA may have found a local bottom at $0.50, and it is crucial for buyers to defend this level at all costs. Any failure here would open the way for a significant loss in the future.

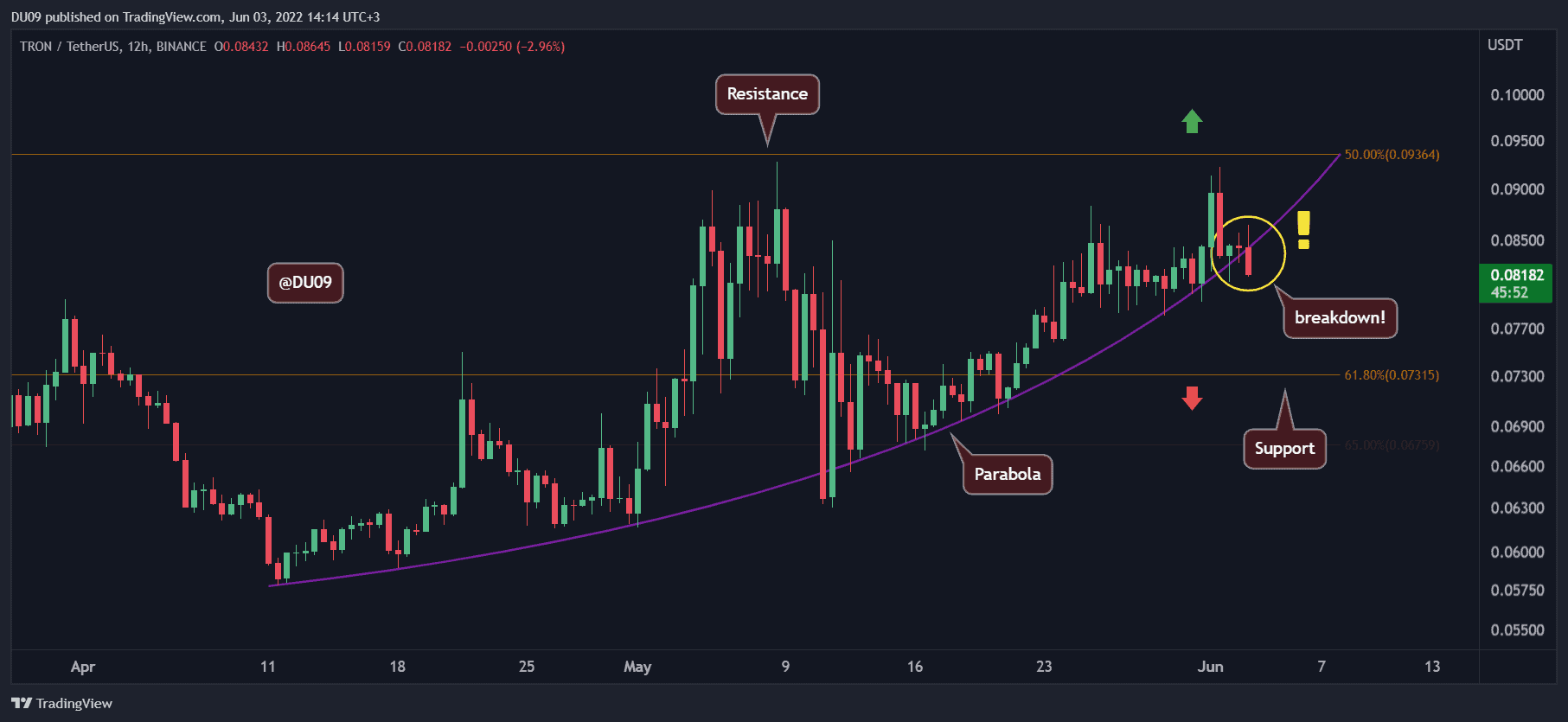

Tron (TRX)

Tron’s uptrend and parabola have been broken. This is a major bearish signal. Moreover, the indicators on the daily and lower timeframes are turning bearish. At the time of this post, the price registered barely any change compared to seven days ago, but this may quickly change if this leads to a significant correction.

The next key support level for Tron will be found at 7 cents. The current resistance at just under 9 cents has so far rejected any attempts for the price to break away. With the parabola broken, it seems rather unlikely for TRX to test this resistance any time soon.

Looking ahead, Tron appears to have entered a cooldown period with bears dominating the chart. The bias based on this price action leans negative and will only be revisited once TRX finds support again.

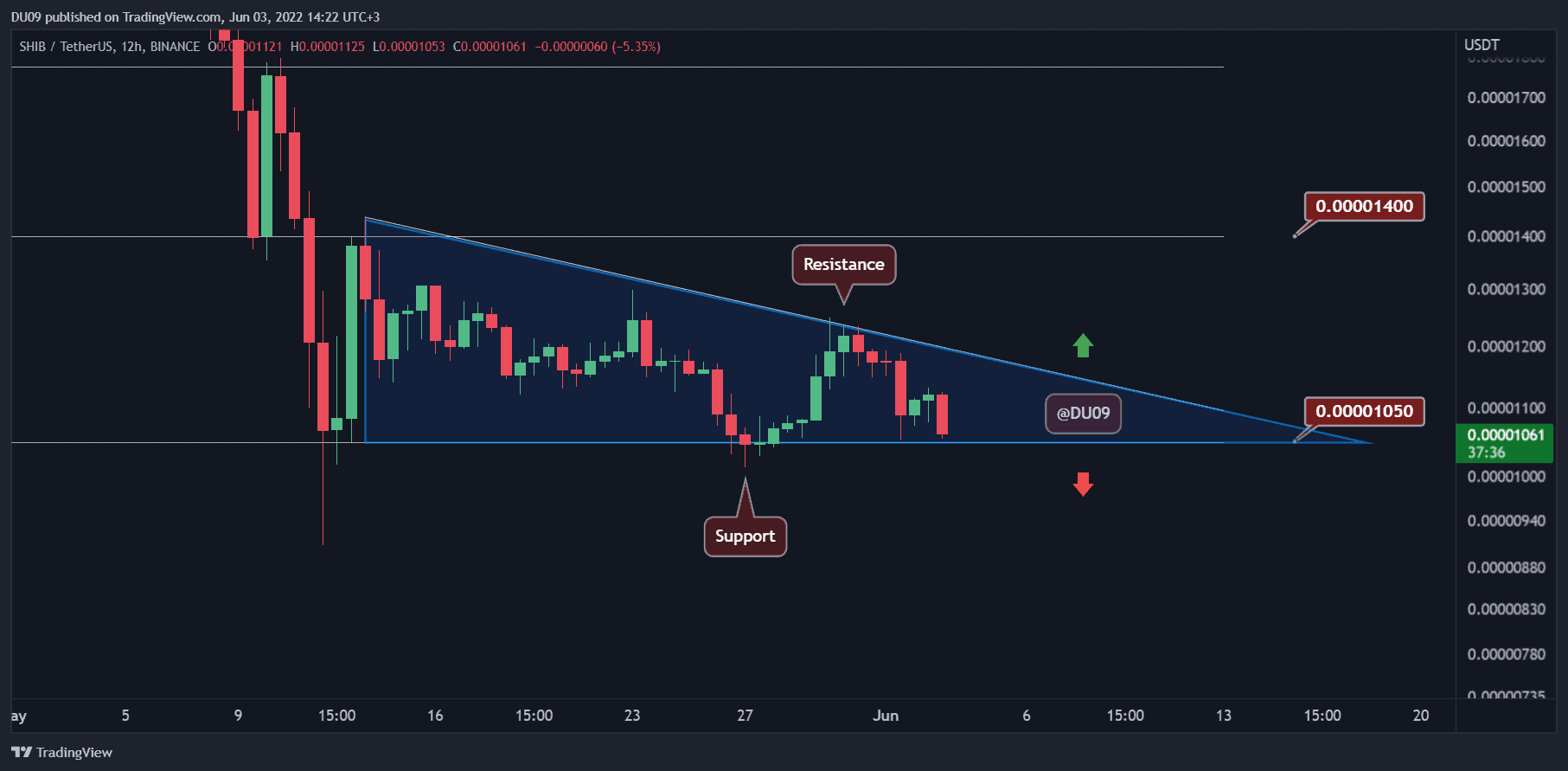

Shiba Inu (SHIB)

Shiba Inu has returned to the key support level at $0.000010 after an attempted rally at the end of May. This failure to sustain a higher price is bearish and if sellers maintain their pressure, SHIB may fall even lower. In the past seven days, the price of SHIB has remained flat.

This price action calls for caution, and a bullish rally in SHIB seems unlikely at this point. The indicators on the daily timeframe and below are turning bearish. Therefore, bulls will likely have a difficult time in the next couple of days.

So far, SHIB has lost almost 90% of its price since the all-time high. It could continue to fall even lower before sentiment changes.