Crypto Price Analysis July-22: Ethereum, Ripple, Cardano, Solana, and Polygon

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Polygon.

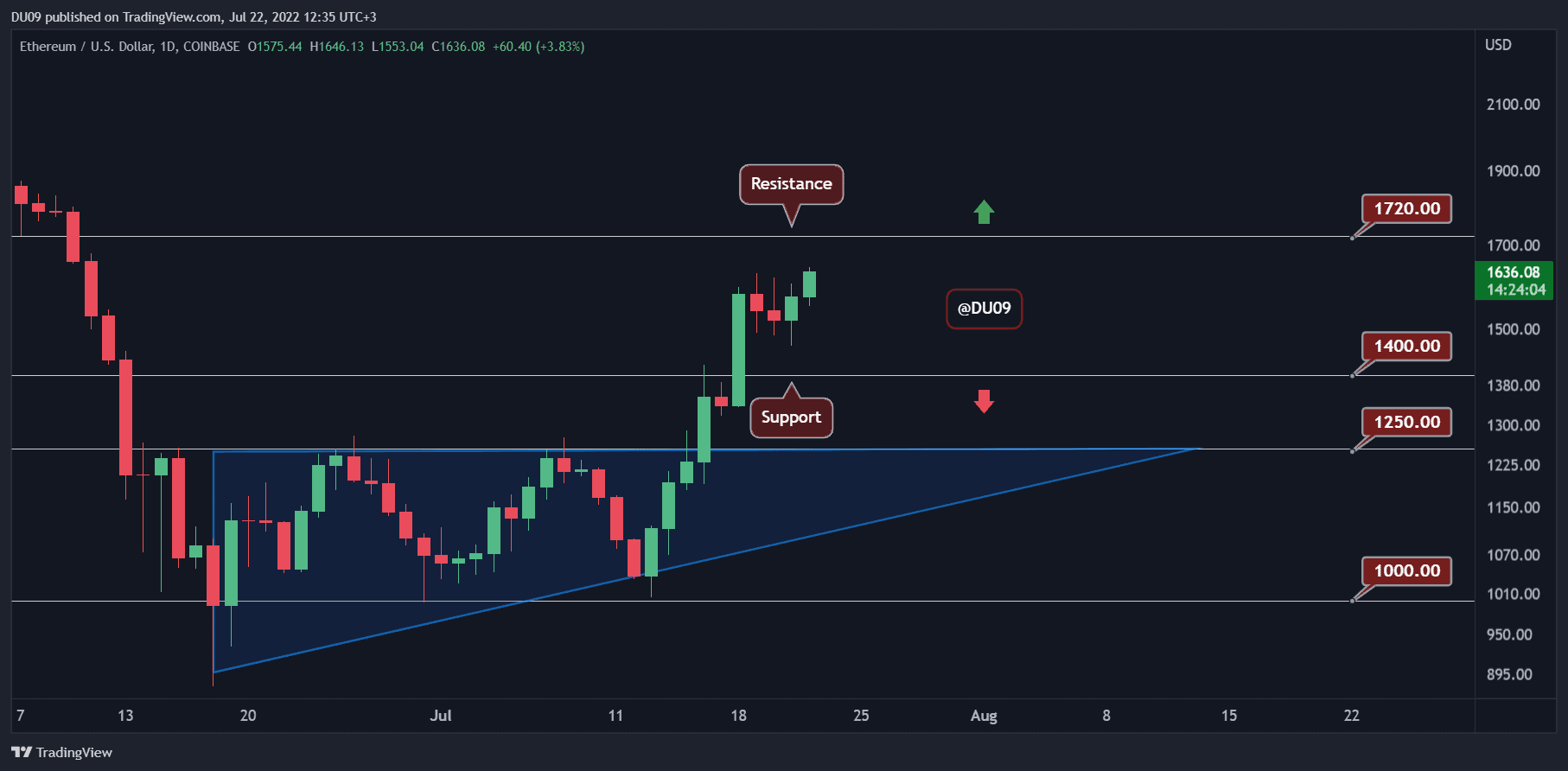

Ethereum (ETH)

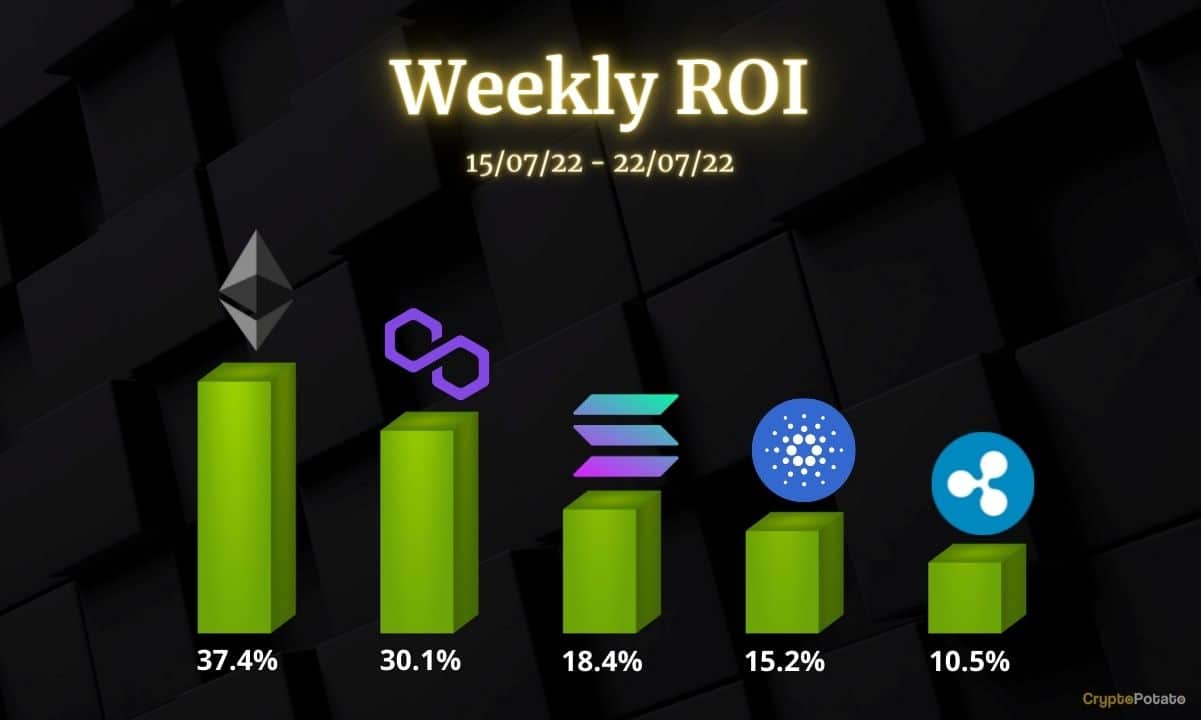

Ethereum had a fantastic rally after mid-July, increasing by 37.4% in the past seven days and since July 13th by over 60%, making it the best performer on our list. This is starting to make market participants wonder if the bear market is over, considering ETH is the second-largest cryptocurrency by market capitalization. While some speculate ETH already found its bottom, it is still too early to call it.

The current price action is bullish, and the next key resistance is found at $1,720. The support at $1,400 was not even re-tested because buyers are so eager to get exposure. This is another bullish sign that the market sentiment has changed this month. The question is if it will last.

Looking ahead, ETH is poised to test the key resistance at $1,720 and even rally towards $2,000 if it manages a successful breakout. The indicators on the daily timeframe remain bullish, and they do not appear overextended yet. The daily RSI will soon reach overbought conditions if this momentum maintains, so it’s imporstayo remain careful and not FOMO.

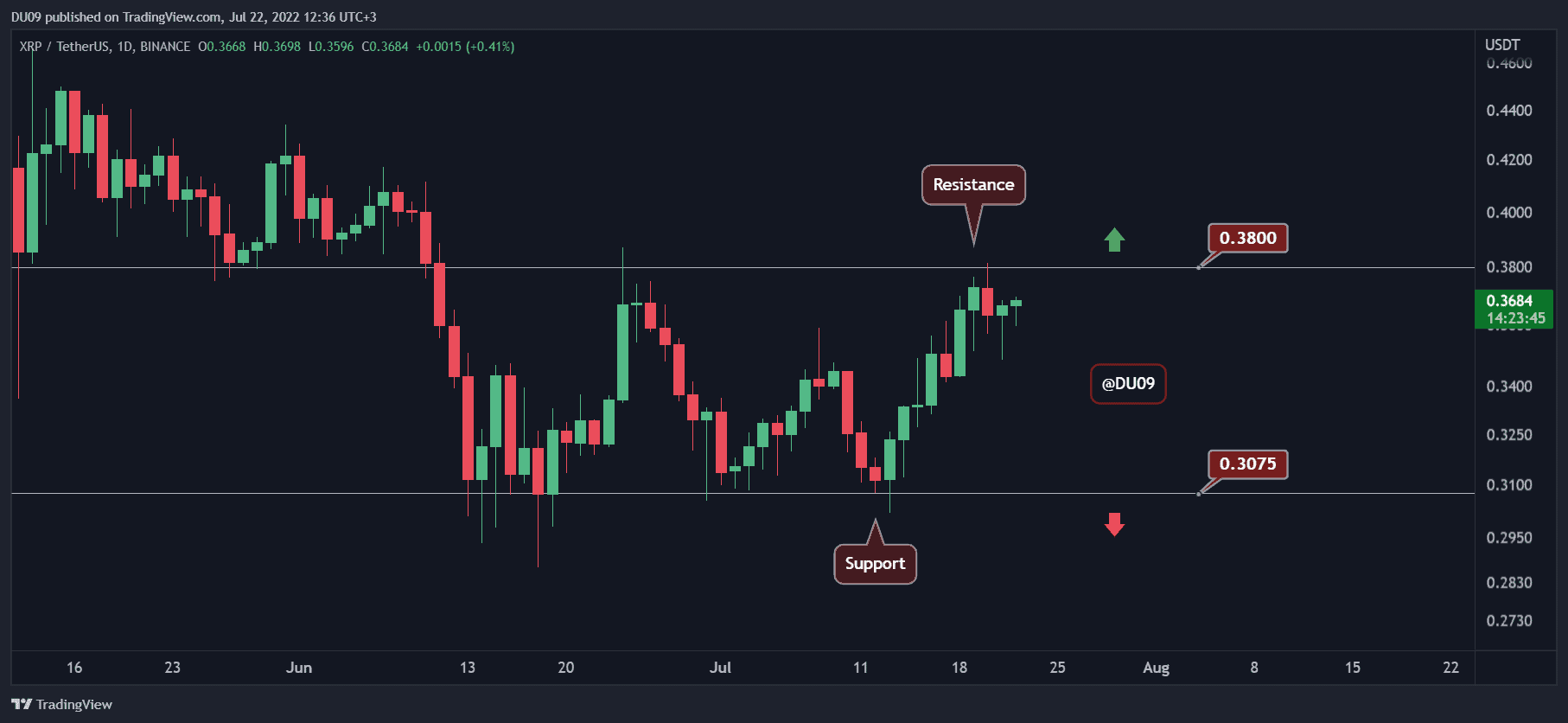

Ripple (XRP)

While Ripple saw a similar price action to ETH over the past week, the rally was less intense, with a 10.5% price increase in the past seven days. The cryptocurrency is now found at the critical resistance of $0.38. If buyers remain interested, then a breakout could follow.

The reason why XRP failed to rally stronger is that the price has been stuck in a range since June and whenever the macro trend is flat the bounces from support are less significant. Nevertheless, the outlook for XRP is positive, with the indicators giving a bullish bias.

Looking ahead, Ripple may attempt to break the key resistance at $0.38, which could unleash a more significant rally, maybe even towards half a dollar. That would put XRP back into the spotlight and allow it to regain some of the market share lost in the past.

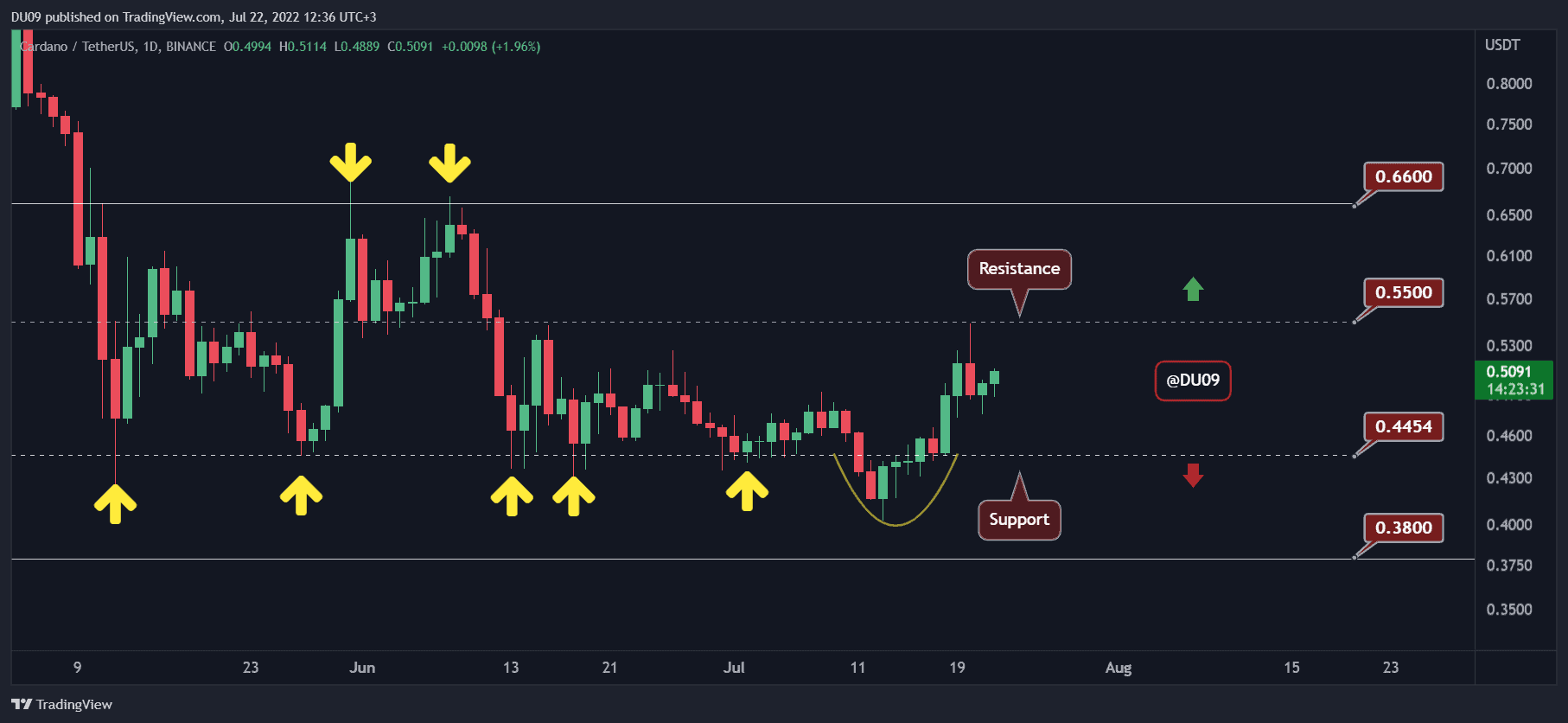

Cardano (ADA)

ADA has been a bit more successful than XRP, having reached a half-dollar valuation after a strong performance in the last seven days when the price increased by 15.2%. With another push from buyers, it could go even higher in the next few days.

The key resistance levels are found at $0.55 and $0.66. If ADA manages to break free from these levels, then the price could leave the current flat trend that has been ongoing since May and enter a significant rally.

It’s looking like ADA will challenge the key resistance levels in the coming week. For this reason, a test of the support at $0.45 is unlikely at this time. The indicators also give a bullish bias and buying volume looks solid.

Solana (SOL)

This past week, Solana had a major attempt to break above the ascending triangle represented in blue on the chart. Bears managed to reject it, but SOL still booked a strong performance in the last seven days and increased by 18%.

At the time of this article, the bulls are back in action pushing the price again above the $44 resistance. If successful, this could start another significant run for SOL.

If we look back at the historical price action for Solana, as soon as buyers take control, the price does not hesitate to rally hard. If the critical resistance falls, then the next target for SOL will be found at just under $60.

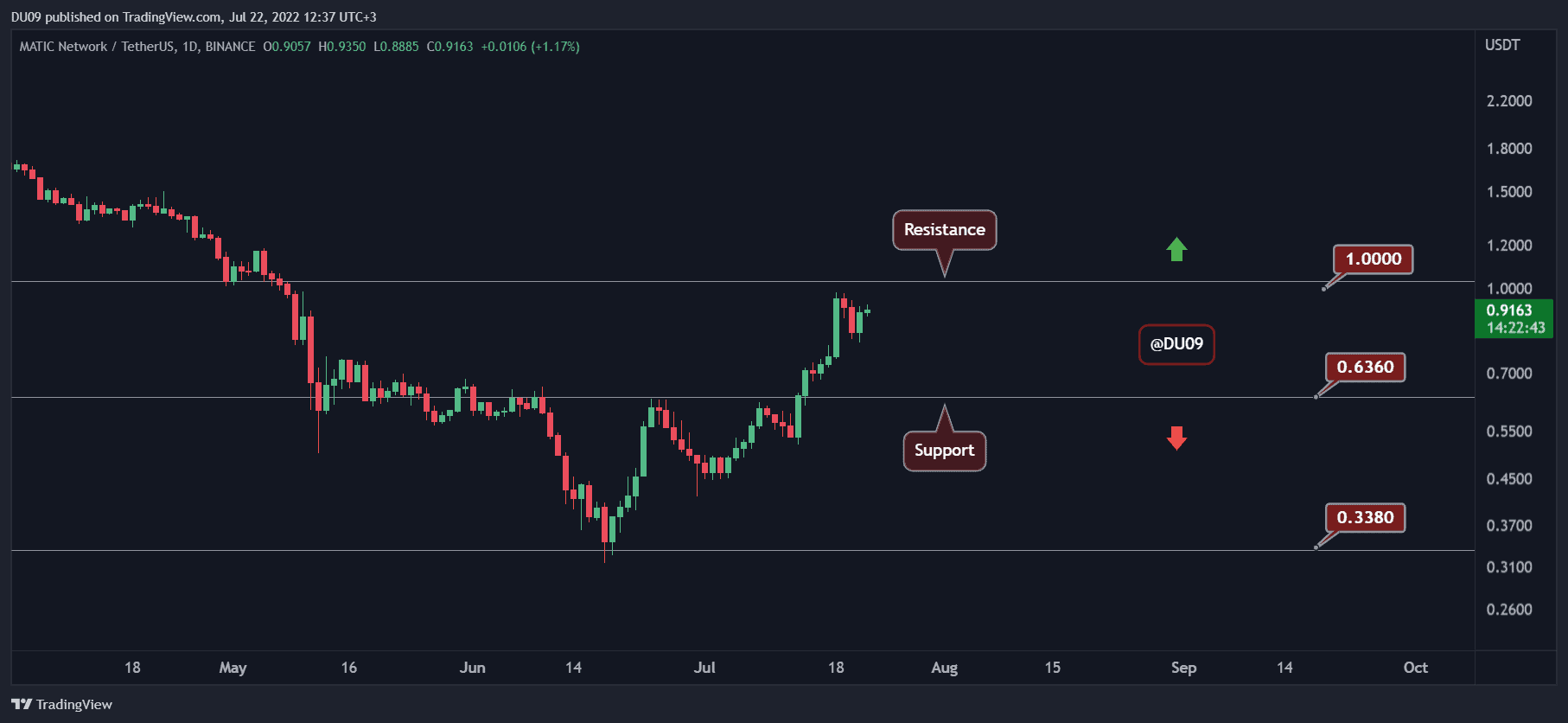

Polygon (MATIC)

MATIC is challenging Ethereum for the first spot in our list after it increased by 30% in the past seven days. Moreover, since the price hit a bottom at 31 cents, MATIC rallied by over 200%, reaching nearly $1 yesterday. This is an impressive rally and one of the most significant moves in the market.

However, buyers need to be on guard, because the bears may come in strong at the key resistance found at $1 which is also a psychological level. Buyers from earlier may decide to take profit here, which could cut back the current bullish momentum.

Looking ahead, MATIC is looking well positioned to continue on its rally, but a clean break of the key resistance is needed. Otherwise, the price could fall back to the support at $0.64.