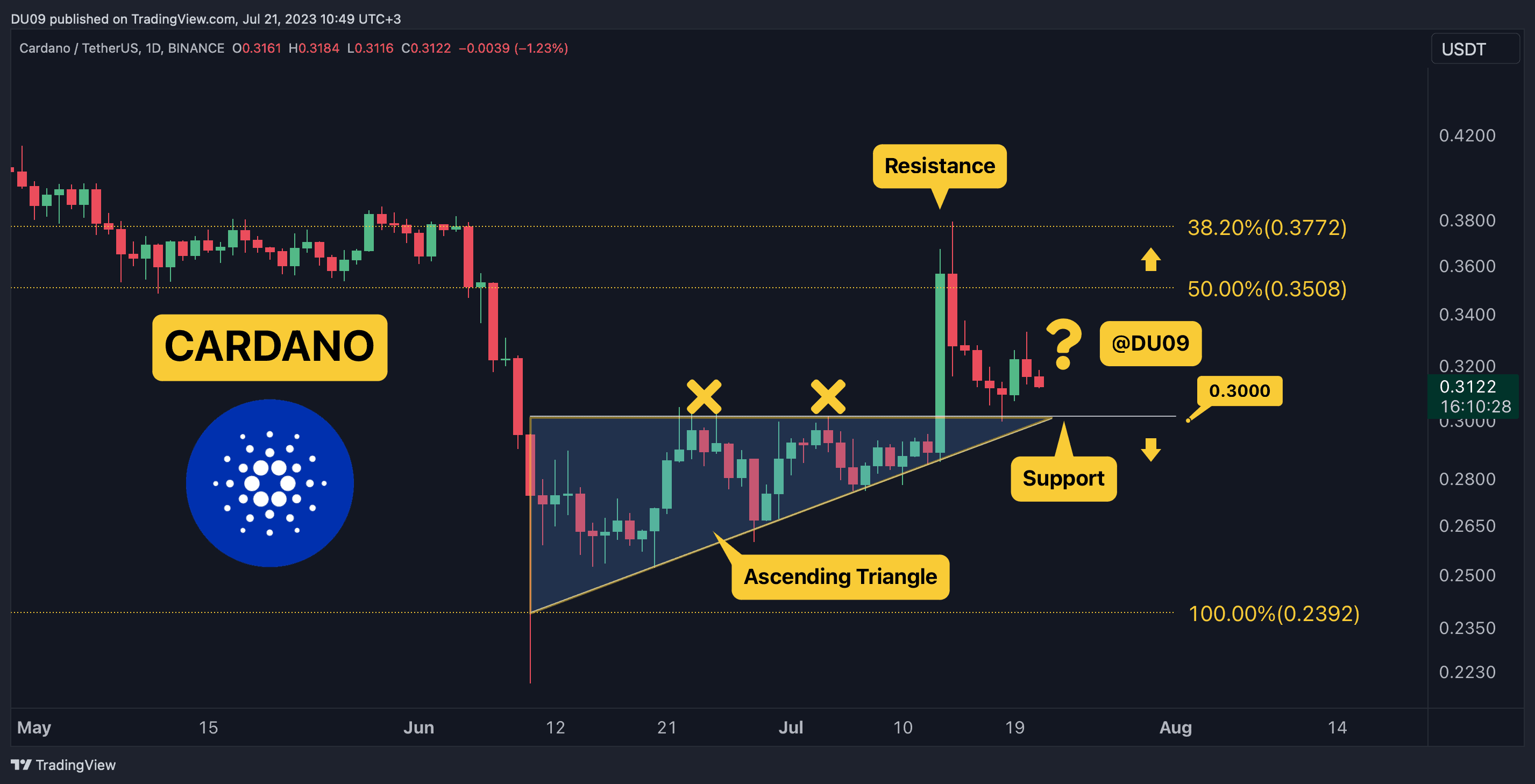

Crypto Price Analysis July-21: ETH, XRP, ADA, SOL, and MATIC

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Polygon.

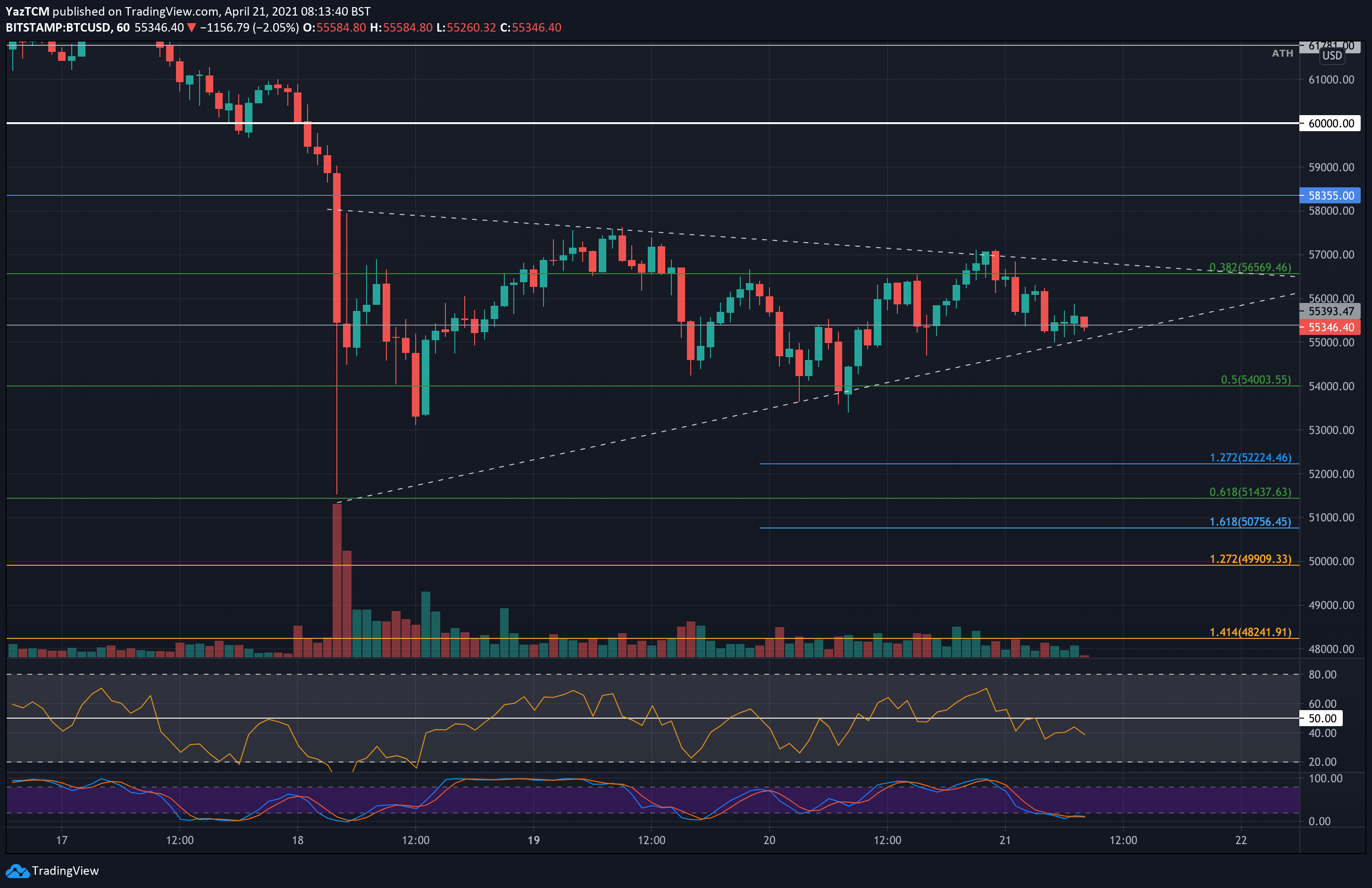

Ethereum (ETH)

Ethereum has shown indecision in the past week. This allowed sellers to take over the price action, which ended the week with a 5% loss. Despite this correction, the cryptocurrency remains above the key support at $1,820.

The current resistance is found at $2,000. ETH tried several times to turn this key level into support, but buyers were not strong enough, and the price fell under it every time.

Looking ahead, ETH seems likely to continue to range above the key support until the market forces push for a breakout. Considering that bears have the upper hand right now, do not exclude a possible test of the key support at $1,820.

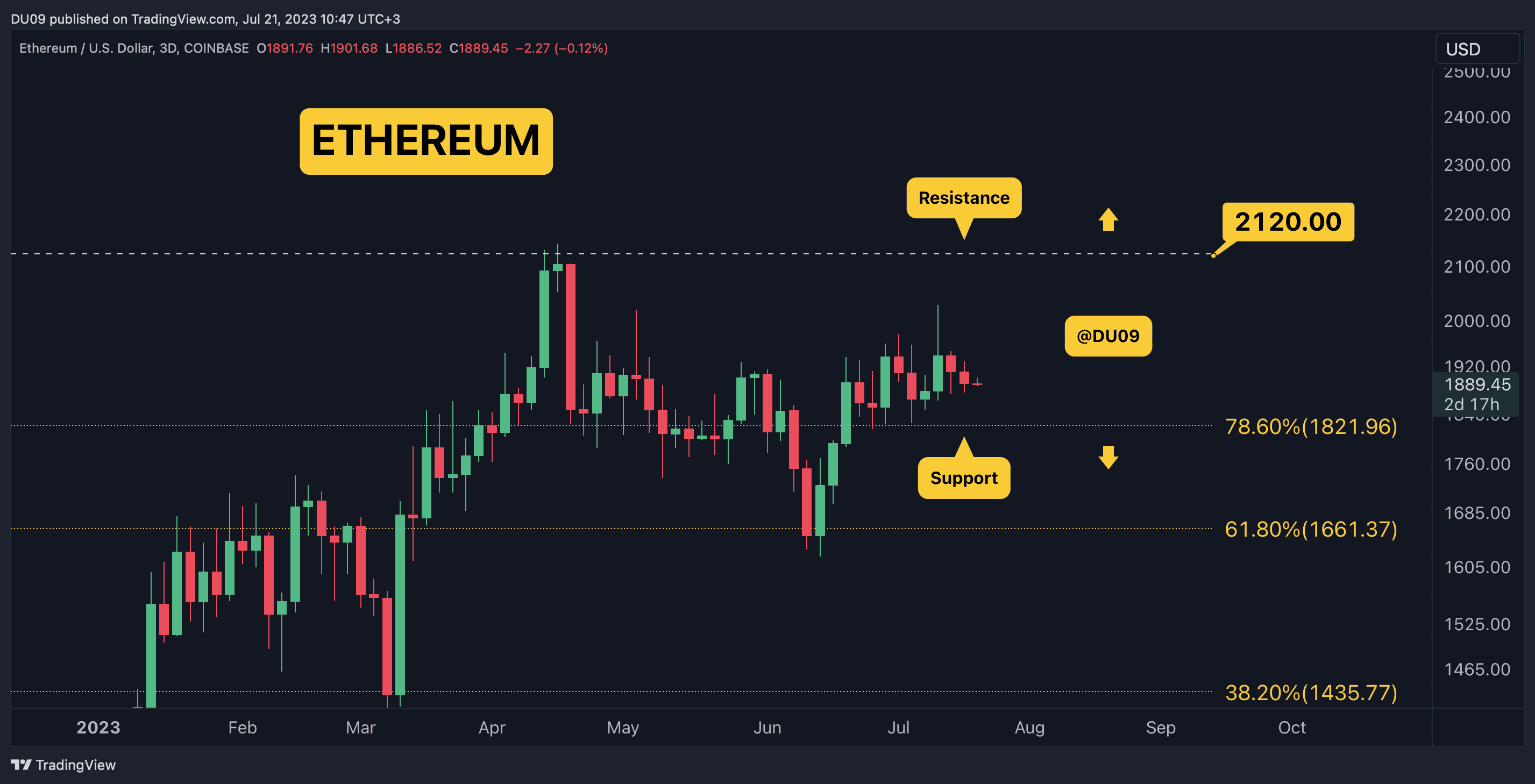

Ripple (XRP)

XRP has managed to maintain its most recent gains, booking a modest 3% loss as the price consolidates above the key support at $0.68. While most altcoins entered a deeper correction, XRP is holding quite well at current levels.

The key resistance is found at $0.93 cents, and so far, sellers did not allow the price to move above it. It is likely that the psychological level at $1 will attract a lot of sellers in the future looking to secure profits.

Looking ahead, XRP should be well positioned to hold above 68 cents as buyers prepare another attempt at breaking the key resistance.

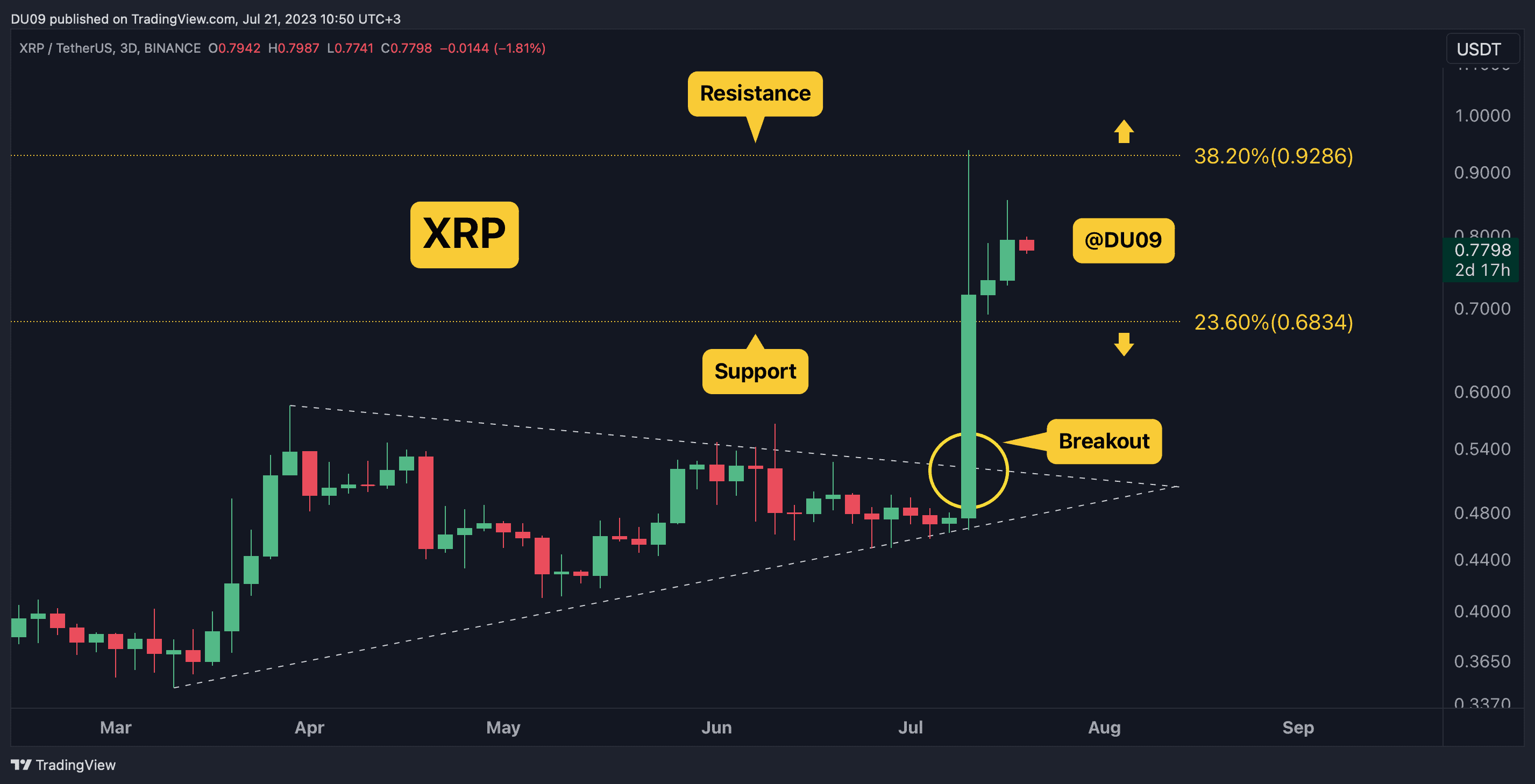

Cardano (ADA)

In contrast to XRP, ADA has failed to retain most of its gains, and the price retraced nearly in full to the key support at 30 cents. In the process, it lost 10% of its valuation in the past week.

With buyers unable to push higher, they are left to defend the key support. This shows weakness in the price action, and there is little hope that ADA can make any significant moves at this time. The current resistance is at 35 cents.

Looking ahead, ADA has lost its bullish momentum. Buyers will have to wait for another opportunity until they attempt another move to reach the key targets at 35 and 38 cents.

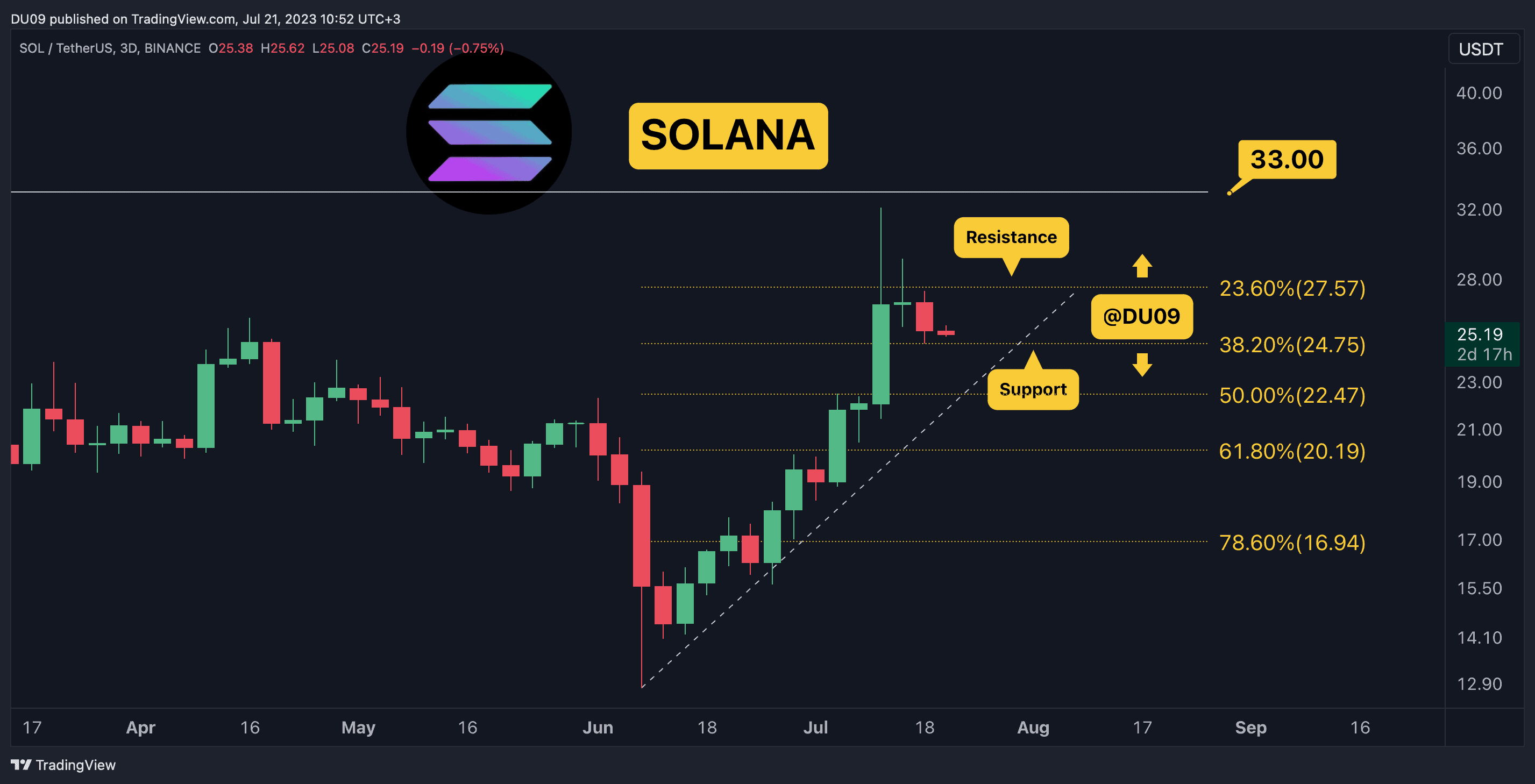

Solana (SOL)

Solana has entered a corrective period, booking a 10% loss this past week. This is not so concerning so long the price manages to hold above the key support at $25.

The current resistance levels are found at $28 and $33. SOL will have to break above these levels if the price is to continue its uptrend. Considering the price already doubled since June, it seems unlikely for the bulls will manage this in the short term.

Looking ahead, this cryptocurrency should focus on consolidating most of its recent gains and defend the key support level. This will allow it to create a strong base for a continuation of the uptrend.

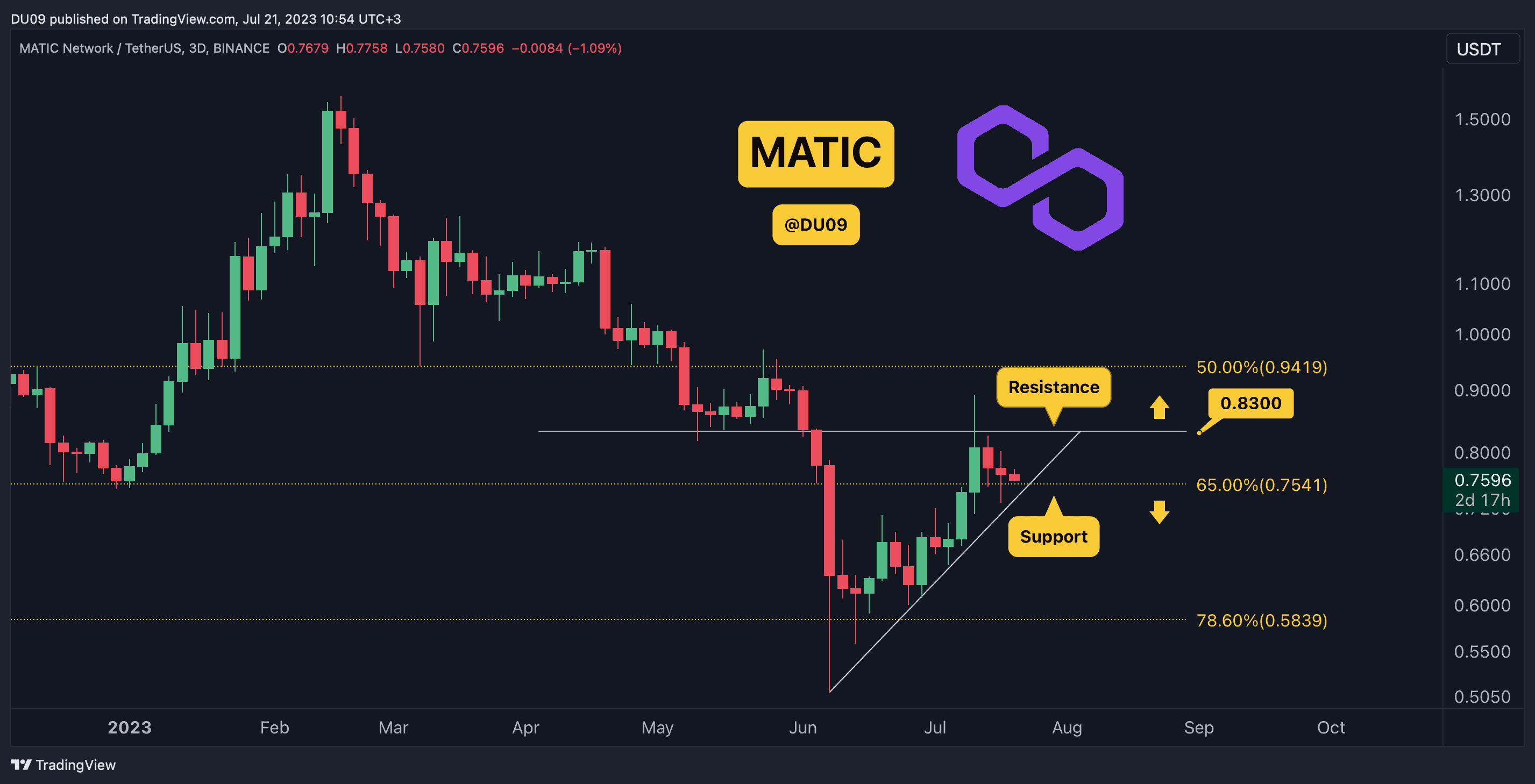

Polygon (MATIC)

MATIC is also found in a correction after a spike in the price took it to 90 cents. The current support is at 75 cents, and the price is slowly approaching this key level after losing 9% of its valuation this past week.

Such a correction is to be expected, considering that MATIC was at 50 cents in June. Any sharp increase in the price is usually followed by a pullback.

Looking ahead, if this cryptocurrency holds at 75 cents, then the uptrend will remain intact and allow buyers to try again to break the resistance at 90 cents. However, such price action will also depend on the overall market, which has to turn bullish to allow for this.

The post Crypto Price Analysis July-21: ETH, XRP, ADA, SOL, and MATIC appeared first on CryptoPotato.