Crypto Price Analysis Dec-3: Ethereum, Binance Coin, Cardano, Solana, and Luna

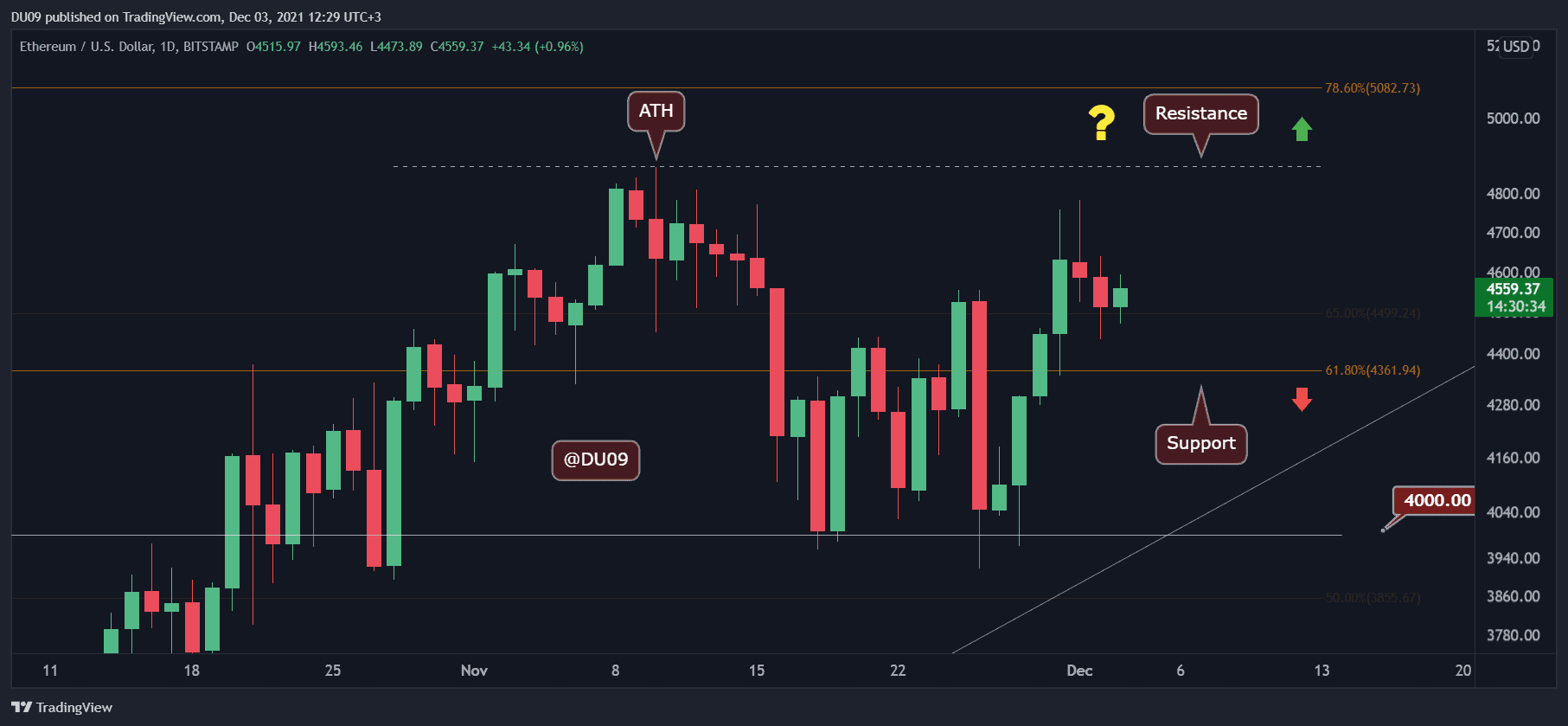

Ethereum (ETH)

Ethereum acted as a locomotive in the last seven days, pulling most of the altcoin market back on the uptrend after the $4,000 support held well. ETH broke above the key resistance at $4,350 and stopped just $80 from reaching the all-time high at $4,868.

Due to the high volatility, the price is very close to last week’s analysis, charting only a small 1% increase. Nevertheless, ETH outperformed Bitcoin and drew a lot of attention.

The key challenge now for ETH is to 1) sustain the price above the critical resistance-turned-support at $4,350 and 2) attempt a break above the all-time high at $4,868. If successful, this can lead the market to a significant uptrend. Either way, the month of December should be very exciting for market participants.

Binance Coin (BNB)

After falling under $600, BNB managed to make a quick recovery above this key level. Despite this, the price did not manage to make a higher high compared to the last weekly review and is at -2.3% in the past seven days.

As long as BNB manages to hold above the support at $600, the price has a good chance to explore higher levels and even attempt a break of the all-time high at $692. The BNB indicators are not particularly bullish right now, with the daily MACD failing to complete a bullish cross yesterday. Should that happen later, then the chances for BNB to go higher will increase significantly.

Until then, BNB can continue to consolidate above $600. All eyes remain on the market leaders, Ethereum and Bitcoin, to set the tone in the coming week.

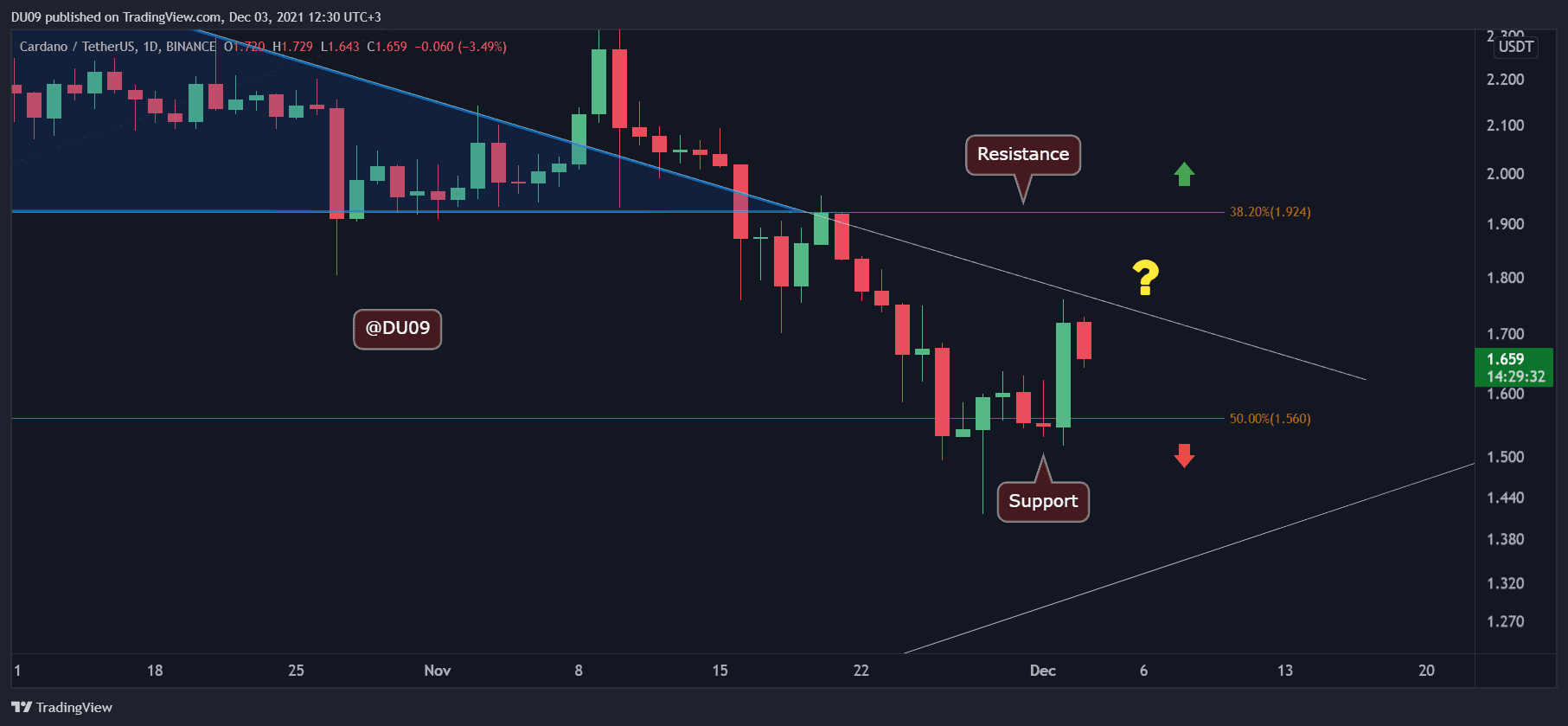

Cardano (ADA)

Volatility returned to ADA yesterday when the price increased by 10% in less than 4 hours. This is a welcome change after a poor performance in the previous weeks. On November 16th, ADA broke below the critical support at $1.9, and this level turned into an important resistance. Overall, in the past seven days, ADA’s price remained almost the same with a -1% difference.

For the cryptocurrency to reverse the downtrend, it has to break the resistance at $1.7 and $1.9, with the latter being the true test of this renewed volatility and momentum. Failure there might cause the price to remain under $1.9 for some time.

Looking ahead, there are some positive signs for ADA holders. The daily MACD painted a bullish cross, thanks to yesterday’s rally. If bulls can maintain this bullish momentum, ADA can finally return on the uptrend. The volume was significant, which is a sign of strength.

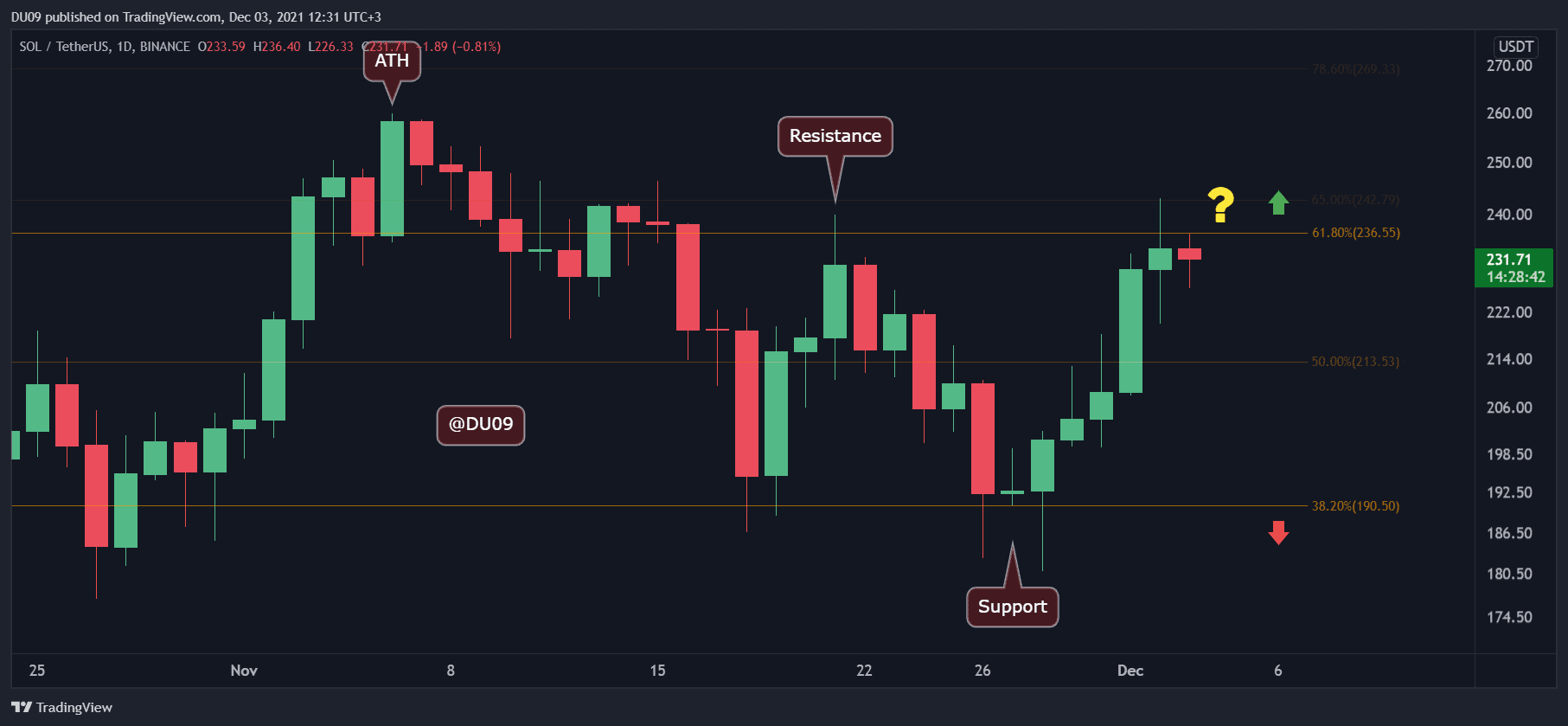

Solana (SOL)

SOL had a great week with a nice 13% increase after it successfully tested the $190 level as support. At the time of this post, the price is sitting just under the key resistance found at $236. It is unlikely this level will hold SOL under it for long because the bullish momentum is building up.

The MACD, on the daily timeframe completed a bullish cross, and this is a key bullish signal that SOL may be entering into a sustained rally. The first confirmation of this will come if the cryptocurrency breaks above the key resistance at $236. Volume has also increased in the past week, showing that bulls have the upper hand. It is important to see if bears will come in force at this resistance level because if they don’t, then bulls will continue on their march higher.

The all-time high for SOL is at $259.90, which is not far from the current price. If bears are unsuccessful to step in at $234, then the all-time high is their last line of defense before SOL re-enters price discovery.

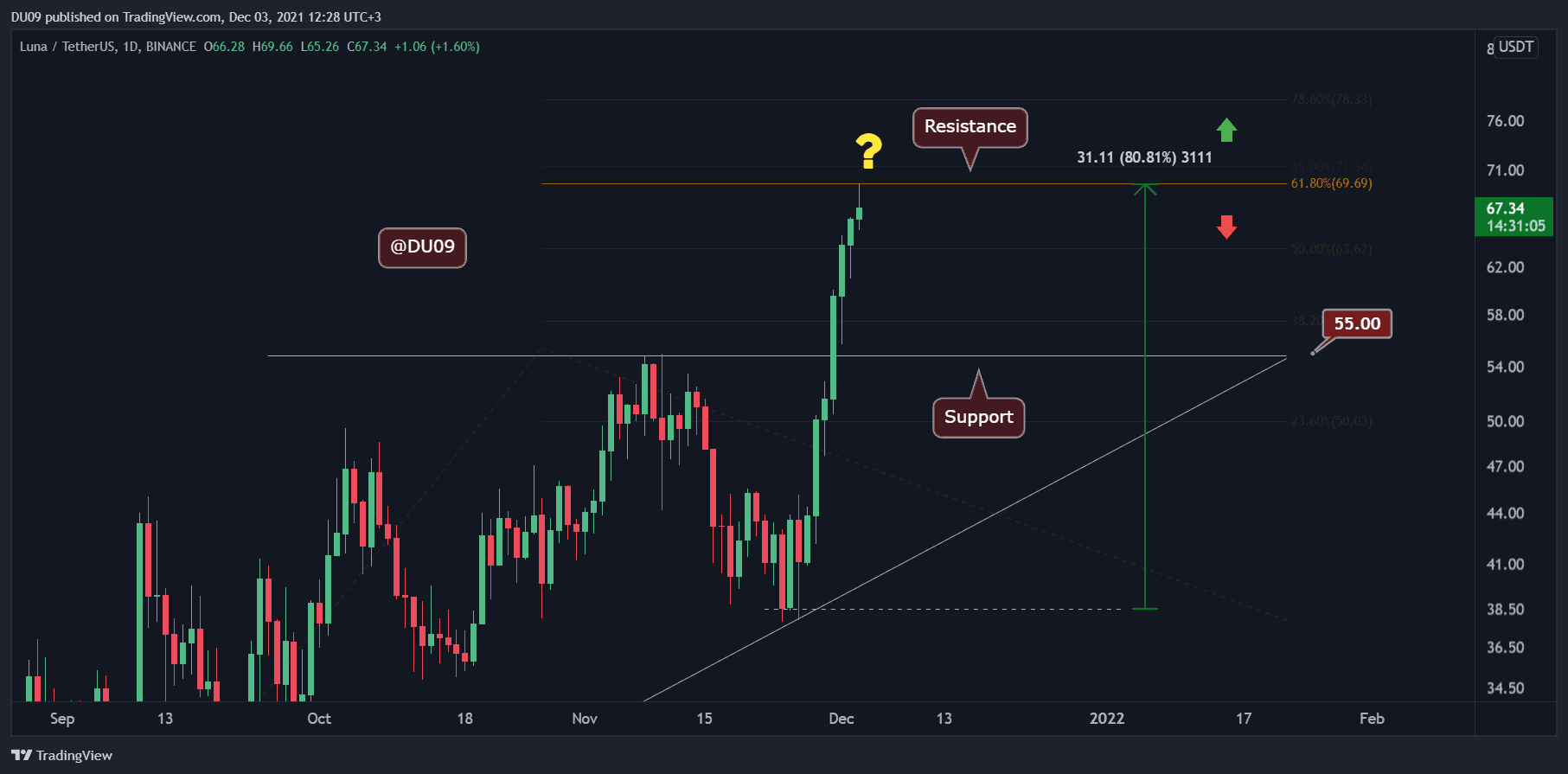

Luna

The strongest performer this week, Luna, increased by 53%. This is a testament to the fundamentals behind this push, with TerraUSD stablecoin reaching $7.8 billion in market cap at the time of this post. On November 1st, the market cap was $2.8 billion. More Luna tokens need to be burned to increase the market supply of TerraUSD. This creates demand for Luna, and it reduces its circulating supply. Taken together, this exercises a significant buy pressure on the token.

With that said, Luna made a new all-time high today and reached $69.66, the highest price on record. This level is likely to act as resistance as on lower timeframes like 4 hours, the RSI shows a bearish divergence. A short pullback would not be surprising as the bulls rest before the next rally. On larger timeframes, Luna’s indicators remain extremely bullish. However, it is always best to be cautious during extremes.

Looking ahead, Luna has great support at $55. Should it enter a correction in the future, these levels should be well defended by bulls.