Crypto OTC Volumes on Wintermute Soared 400% in 2023

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

In a new report from Wintermute, the market maker and liquidity provider, said that its over-the-counter (OTC) volume was up 400% throughout the year as volumes moved off-exchanges.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RIE36CU5OBAYDDMTIPNP5FM2JE.png)

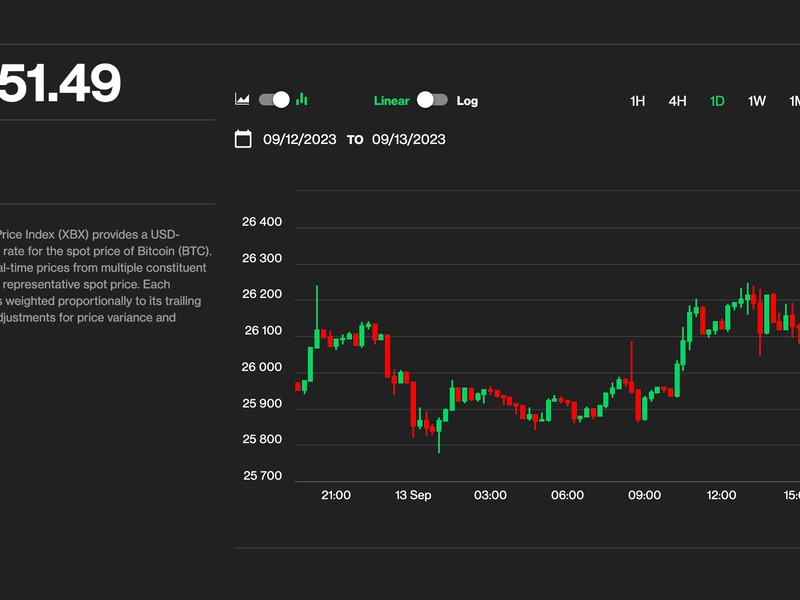

Wintermute said that during the first half of 2023, its OTC trading volume decreased, while the number of individual trades remained stable. In the second half of the year, however, the number of unique trades grew sixfold to 29 million while weekly OTC volume hit $2 billion.

“The developments in the space at the end of 2022 left the whole industry facing a challenging outlook. Markets slowed down, liquidity dried up, and we observed volumes starting to shift from exchanges to OTC,” Evgeny Gaevoy, CEO and Co-Founder of Wintermute Group, said in the report.

Liquidity in cryptocurrency trading refers to how easily large orders can be executed without significantly affecting the market price. Without sufficient liquidity, making large trades is more likely to alter prices.

A lack of liquidity has been a persistent challenge for exchanges throughout 2023, which has led many large institutional traders to move over to OTC desks.

Even as bitcoin rallied by over 150% through the year, the market was still plagued by the ‘Alameda Gap’ in liquidity, CoinDesk reported.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/WMVKAUZ5T5B5PDVJJ3PFOHOUII.jpeg)

Binance, the world’s largest crypto exchange, had a particularly challenging time with liquidity, as the liquidity available in its order book dropped by 25% in November, compounded by its $4 billion settlement with U.S. authorities and the subsequent resignation of its CEO Changpeng ‘CZ’ Zhao.

Edited by Parikshit Mishra.