Crypto Markets Shed $200 Billion on Russia-Ukraine Conflict (Market Watch)

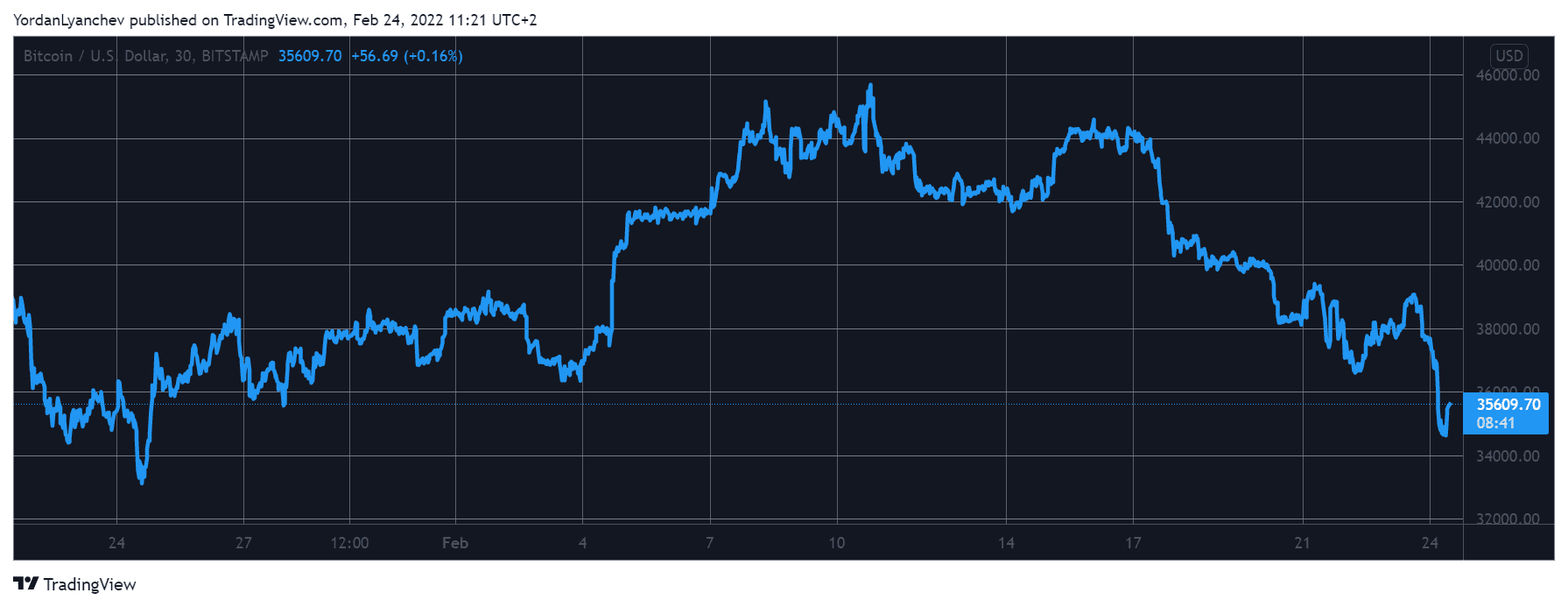

After yesterday’s brief recovery attempts, bitcoin nosedive once again following the conflict escalation between Russia and Ukraine and dumped to just over $34,000. Most altcoins suffered even more, with substantial double-digit losses evident from the majority.

Bitcoin Plummeted to a Monthly Low

All eyes are now on the rapidly escalating tension between Russia and Ukraine. Following several weeks of threats and so-called military trainings, the world’s largest country by landmass did what many expected was just a matter of time and launched an invasion, still labeled as a “special military operation.”

While reports showcase how Russian troops and military vehicles enter Ukraine through the border with Belarus, most financial markets went on a downfall.

Russian markets suffered the most, but their counterparts in Asia and Europe are also in the red. Futures contracts of the largest US stock market indexes have also turned negative.

Given bitcoin’s high correlation with the aforementioned lately, it’s no surprise that the asset also nosedived. BTC went from yesterday’s peak at around $39,000 to its lowest price position since late January at just over $34,000.

Despite recovering some ground since then and currently sitting above $35,500, BTC’s market cap has dropped below $700 billion.

Altcoins Bleed Out Hard

As it typically happens when bitcoin heads south, so do the altcoins. However, their daily losses are significantly more severe.

Ethereum, for example, slumped by more than 12% in a day and now sits below $2,400. Moreover, the second-largest cryptocurrency dipped to $2,200 earlier today.

Binance Coin is down by a similar percentage and struggles around $340. Ripple and Avalanche have declined by between 12% and 14%, while Solana and Terra by 8%.

Cardano is among the most substantial losers on a daily scale, with a 17% price dump. Polkadot (-16%), Dogecoin (-16%), Shiba Inu (-15%), CRO (-15%), and MATIC (-16%) follow.

More daily losses come from Convex Finance (-23%), ECOMI (-20%), Kadena (-19%), Curve DAO Token (-19%), Loopring (-19%), THETA Network (-19%), Enjin Coin (-19%), and many others.

The cumulative market cap of all crypto assets dumped by nearly $200 billion since yesterday’s peak and is now below $1.6 trillion.