Crypto Markets Shed $130 Billion as Bitcoin (BTC) Slumped to 9-Day Low (Market Watch)

Bitcoin took yet another turn for the worse in the past day or so as it dumped to its lowest price position in over a week of $58,100 earlier today.

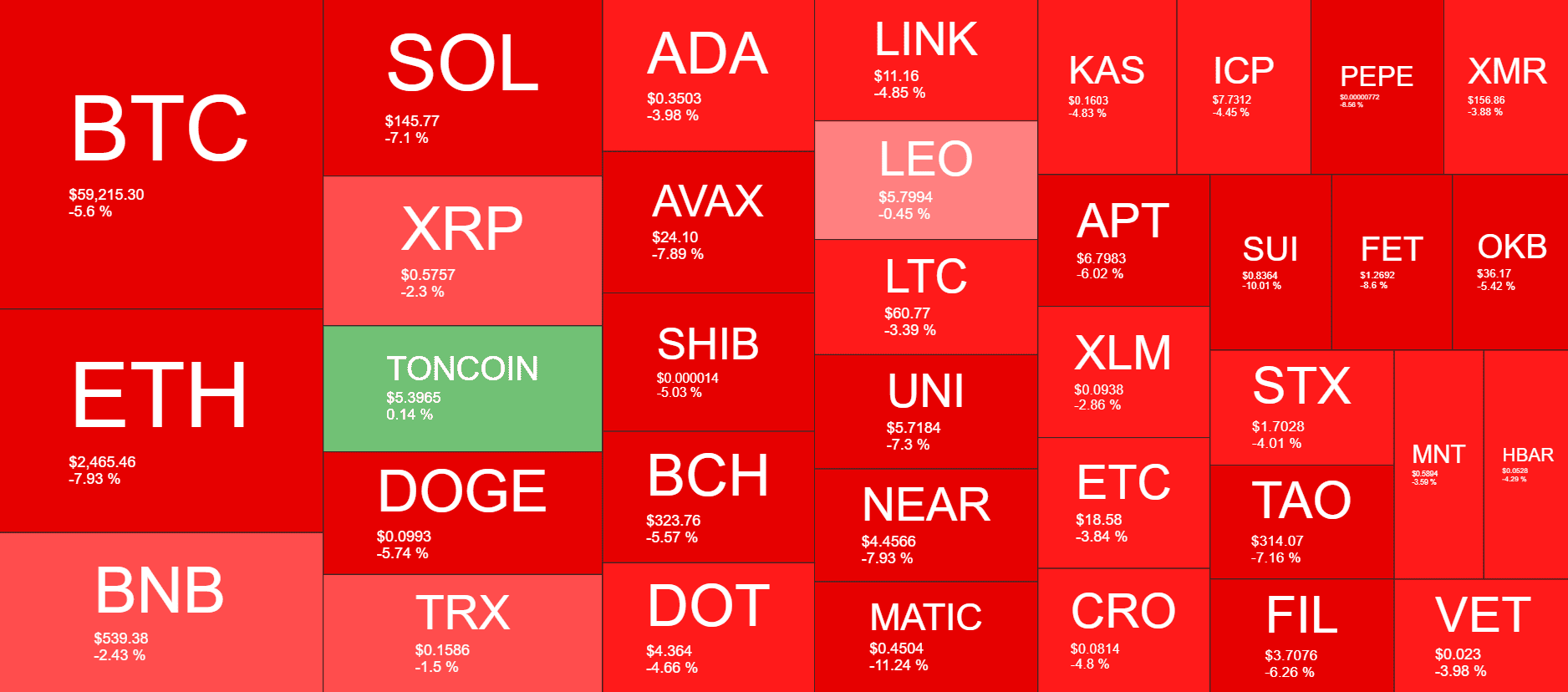

The altcoins are in no better shape, with ETH dumping by 8%, SOL by 7%, and DOGE by 6%.

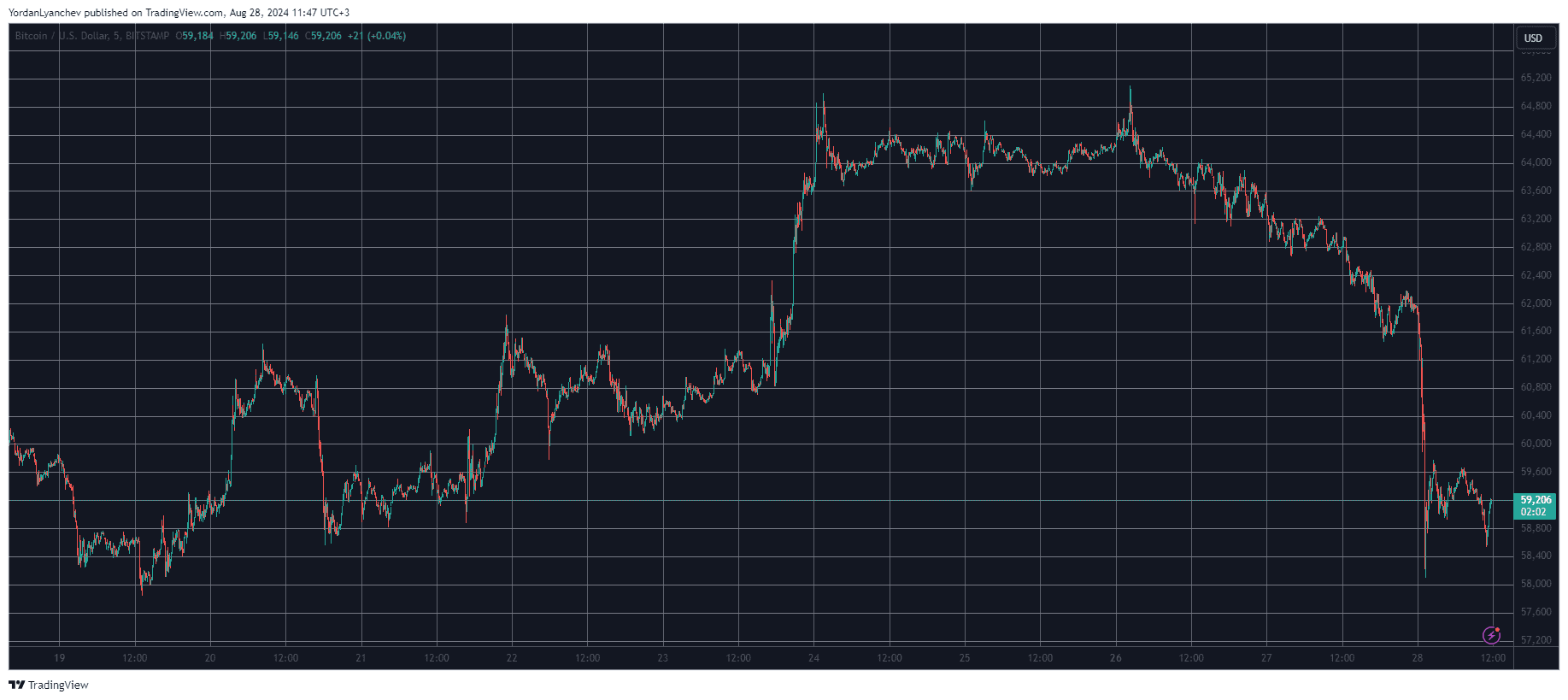

Bitcoin’s Nosedive

The primary cryptocurrency had a highly positive end to the previous business week, which was overall sluggish up until Friday. That’s when the positive developments on US soil, including the Fed Chair’s promise to cut the interest rate and RFK’s endorsement of Donald Trump, sent it flying by over four grand in less than a day.

As such, BTC peaked at just under $65,000 on Saturday. Although it retraced slightly on Sunday, it went back on the offensive on Monday morning and briefly exceeded $65,000 for the first time in three weeks.

However, that’s where the progress stopped and the asset started to lose traction. It had declined to around $63,000 by yesterday, but the bears took complete control and initiated a massive leg down in the past 12 hours.

More specifically, BTC slumped to a 9-day low of $58,100 (on Bitstamp), leaving over $320 million in liquidations and ETF experts puzzled. Despite recovering some ground and currently trading about a grand higher, BTC is still 5.5% down on the day and its market cap has declined to $1.170 trillion.

Alts See Nothing but Red

The landscape among the altcoins is no different. Ethereum is down by 8% and sits way below $2,500. SOL has plunged to $145 following a 7% daily correction. AVAX, SHIB, DOGE, BCH, UNI, and NEAR have charted similar losses.

As expected, the ever-volatile meme coin sector has been hit the most. You can check some of the massive losers here.

The cumulative market cap of all crypto assets is down to $2.170 trillion. This means that the metric has dumped by $130 billion since yesterday and more than $200 billion since Monday.

The post Crypto Markets Shed $130 Billion as Bitcoin (BTC) Slumped to 9-Day Low (Market Watch) appeared first on CryptoPotato.